Significant Spending Reduction At SSE: £3 Billion Cut Explained

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

The decision to slash £3 billion from SSE's spending reflects a confluence of factors impacting the energy sector. This cost reduction strategy is a response to a complex interplay of economic pressures and strategic shifts within the company. The key drivers can be summarized as follows:

-

Increased Regulatory Pressure and Compliance Costs: The energy industry faces increasingly stringent regulations, demanding significant investments in compliance measures and infrastructure upgrades. These rising costs have undoubtedly contributed to the need for budget cuts. The cost of meeting these regulatory demands is substantial and is a factor influencing many energy companies’ financial strategies.

-

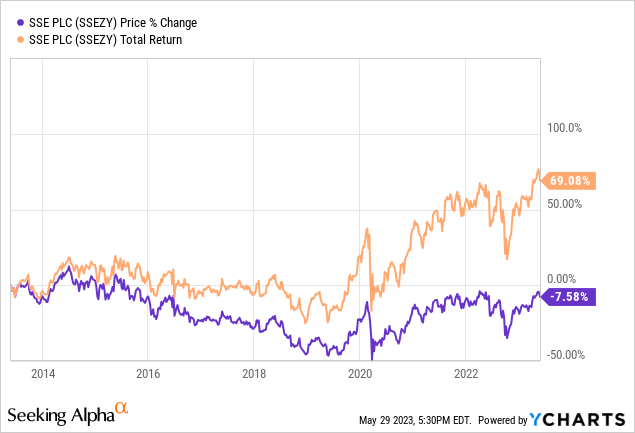

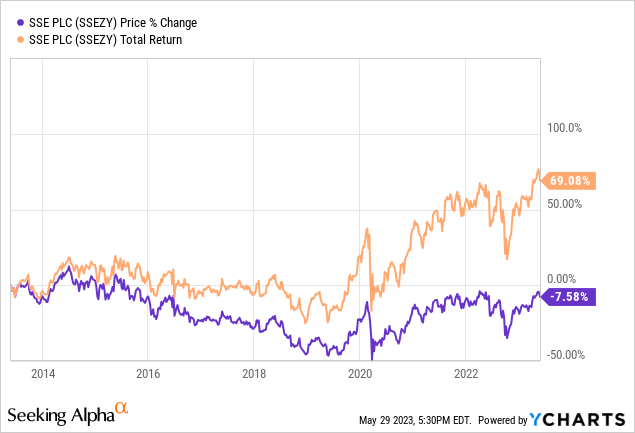

Need to Improve Profitability and Shareholder Returns: In the face of fluctuating energy prices and increased competition, SSE needs to demonstrate strong profitability to maintain investor confidence and deliver attractive shareholder returns. Cost reduction is a key element in enhancing margins and boosting the bottom line. This is a crucial aspect of any publicly traded company's long-term success.

-

Shifting Focus to Renewable Energy Investments: SSE is actively transitioning towards a more sustainable energy portfolio, investing heavily in renewable energy sources like wind and solar power. This strategic shift necessitates a reallocation of resources, potentially leading to cuts in less profitable or less sustainable areas of the business. This reflects a wider industry trend towards greener energy solutions.

-

Impact of the Global Energy Crisis and Rising Inflation: The global energy crisis and soaring inflation have significantly impacted SSE's operating environment, putting pressure on costs and margins. The cost-cutting measures are a necessary response to navigate this challenging economic climate. Rising inflation particularly impacts operational expenses and supply chain costs.

Specific Areas Affected by the Spending Cuts

The £3 billion reduction isn't evenly distributed across SSE's operations. Certain areas have experienced more substantial cuts than others. These include:

-

Capital Expenditure on Specific Energy Projects: The most significant cuts are likely to be seen in capital expenditure on projects related to fossil fuels. SSE is prioritising investments in renewable energy, meaning less funding will be allocated to traditional energy sources. For example, we might see a reduction in planned investments in aging coal or gas plants.

-

Operational Expenses: Cost-cutting measures will likely impact operational expenses, potentially affecting areas such as staffing levels, marketing budgets, and administrative costs. While specific figures haven't been publicly released, we can expect efficiencies and streamlining across these departments. This could include reductions in non-essential travel and other operational expenses.

-

Research and Development Budgets: While SSE continues its commitment to innovation in renewable energy technologies, certain research and development projects in less strategically important areas may experience budget reductions. This careful allocation of R&D resources is common during periods of financial constraint.

Impact of the Spending Cuts on SSE's Future

The £3 billion spending reduction will have both short-term and long-term implications for SSE.

-

Improved Financial Performance and Increased Profitability: The immediate effect is expected to be an improvement in financial performance, leading to increased profitability and potentially higher dividend payouts for shareholders. However, this positive impact needs to be balanced against other potential consequences.

-

Potential Job Losses and Impact on Employee Morale: Cost-cutting measures may unfortunately lead to job losses. This will undoubtedly impact employee morale and may require careful management to mitigate negative effects. Employee retention and retraining programs will be crucial.

-

Impact on SSE's Ability to Invest in Renewable Energy Projects: While the shift to renewable energy is a priority, the budget cuts might temporarily limit the pace of investment in some projects. This will require careful prioritization to balance cost reduction with long-term strategic goals.

-

Changes to the Company's Strategic Direction and Long-Term Goals: The spending cuts will inevitably force SSE to re-evaluate its strategic direction and long-term goals. This could lead to a sharper focus on core businesses and a more streamlined operational structure.

Comparison with Other Energy Companies' Cost-Cutting Measures

Many energy companies globally are undertaking cost-cutting measures to adapt to the changing energy landscape and economic conditions. While SSE's £3 billion reduction is significant, it's important to contextualize it within the broader industry trends. Further research is needed to compare the specifics of SSE's cost reduction strategy to those of competitors like Centrica or BP to determine whether the scale and scope of SSE's cuts are typical or unusually drastic. This comparative analysis will provide further insight into the financial health of the sector as a whole.

Understanding SSE's £3 Billion Spending Reduction – A Call to Action

SSE's £3 billion spending cut represents a significant strategic shift driven by regulatory pressures, the need for improved profitability, a transition to renewable energy, and the challenging global economic climate. The cost reduction impacts several areas of the company's operations, from capital expenditure to operational expenses and research and development. While the short-term benefits include improved financial performance, potential long-term consequences include job losses and impacts on renewable energy investment. To remain informed about the ongoing ramifications of this substantial cost-cutting initiative and SSE's future investment strategies, follow SSE's official announcements and stay updated with reputable financial news sources covering the energy sector. Understanding SSE's cost-cutting measures and its impact on the company's financial performance is vital for anyone interested in the UK energy market.

Featured Posts

-

Flash Flood Warning Texas North Central Texas Under Downpour Threat

May 26, 2025

Flash Flood Warning Texas North Central Texas Under Downpour Threat

May 26, 2025 -

Pennsylvania Facing Flash Flooding Thursday Morning Update

May 26, 2025

Pennsylvania Facing Flash Flooding Thursday Morning Update

May 26, 2025 -

Info Lengkap Jadwal Siaran Moto Gp Argentina 2025 Di Trans7

May 26, 2025

Info Lengkap Jadwal Siaran Moto Gp Argentina 2025 Di Trans7

May 26, 2025 -

Presidential Seals Luxury Watches And Marriott Afterparties Investigating A High Stakes Event

May 26, 2025

Presidential Seals Luxury Watches And Marriott Afterparties Investigating A High Stakes Event

May 26, 2025 -

The Fourth Decade How F1 Drivers Fare After Turning 40

May 26, 2025

The Fourth Decade How F1 Drivers Fare After Turning 40

May 26, 2025