Skepticism In Shipping Industry Following Trump's Houthi Truce Announcement

Table of Contents

Heightened Geopolitical Risk and its Impact on Shipping

Years of conflict in Yemen have created a volatile environment for the shipping industry, significantly increasing the risk of attacks on shipping vessels transiting the Red Sea and the strategically important Bab el-Mandeb strait. This geopolitical instability directly impacts several key areas:

-

Increased War Risk Insurance Premiums: The elevated risk translates to higher war risk insurance premiums for cargo ships and tankers navigating these waters. This added cost significantly impacts shipping costs and overall profitability for businesses.

-

Potential for Vessel Seizures: The threat of vessel seizure by warring factions remains a substantial concern, leading to significant financial losses and operational disruptions. This risk is further amplified by the lack of clear maritime security in the region.

-

Supply Chain Disruptions: Port closures, delays, and rerouting due to conflict cause widespread supply chain disruptions. Businesses relying on seaborne trade for importing and exporting goods face unpredictable delays and increased costs. This uncertainty affects global supply chains far beyond the immediate region.

-

Continued Threat of Houthi Attacks: Even with a declared truce, the potential for continued Houthi attacks casts a long shadow of doubt on the reliability of any promised peace. The history of broken agreements fuels this skepticism.

Industry Reactions and Cautious Optimism

The response from the shipping industry to the Houthi truce announcement has been one of cautious optimism, tempered by years of experience with broken promises and ongoing conflict.

-

Shipping Companies' Measured Response: Many major shipping companies have publicly expressed their cautious optimism. However, they emphasize the need for concrete, verifiable evidence of lasting peace before making any significant changes to their risk assessments or operational strategies.

-

Logistics Providers' Contingency Planning: Logistics providers are closely monitoring the situation and developing contingency plans to mitigate potential disruptions. These plans often involve diversifying shipping routes and securing alternative transportation modes.

-

Analysts' Warnings Against Premature Celebrations: Industry analysts strongly advise against premature celebrations and urge a wait-and-see approach. They warn that rushing to alter trade routes or insurance policies based on an unproven truce could be financially devastating.

-

Due Diligence Remains Crucial: Detailed due diligence and robust risk assessments remain crucial for shipping companies operating in the Red Sea. Companies must continually evaluate the evolving geopolitical landscape and adapt their strategies accordingly.

The Economic Stakes: Trade and Global Supply Chains

The Red Sea is a vital artery for global trade, handling a massive volume of oil tankers and container ships. Any disruption to this crucial waterway has far-reaching economic consequences:

-

Impact on Commodity Prices: Disruptions to oil and other commodity shipments through the Red Sea can cause significant price fluctuations, impacting businesses and consumers worldwide.

-

Global Supply Chain Resilience: The vulnerability of this key shipping lane highlights the fragility of global supply chains. Prolonged conflict significantly reduces supply chain resilience.

-

Economic Consequences of Conflict: The economic consequences of a protracted conflict in Yemen are devastating, not only for the Yemeni people but also for businesses and economies globally that rely on trade through the Red Sea.

-

Potential for Economic Growth: Conversely, a lasting peace could unlock considerable economic potential for the region, strengthening global supply chain resilience and fostering economic growth.

Verification and Enforcement Challenges

The success of the Houthi truce hinges on several key factors relating to verification and enforcement:

-

Effective Monitoring Mechanisms: Robust and impartial monitoring mechanisms are required to track compliance from all parties involved in the conflict.

-

Independent Verification: Independent verification of compliance by all parties involved is crucial to build trust and confidence in the truce agreement. The lack of transparency could undermine the agreement.

-

International Community Involvement: The active involvement of the international community, especially the UN, is essential to oversee the truce and ensure its effective implementation. Their presence helps to deter violations.

-

Challenges in Conflict Zones: The significant challenges associated with monitoring compliance within a conflict zone, such as limited access and security risks, could lead to renewed violence, potentially jeopardizing the fragile peace.

Conclusion

The announcement of a Houthi truce has elicited a mixed reaction within the shipping industry. While a lasting peace offers the potential to reduce geopolitical risks and restore stability to vital Red Sea shipping lanes, substantial skepticism persists. The industry will closely monitor the situation, awaiting concrete evidence of lasting peace and effective verification mechanisms before making significant changes to their risk assessments and operational strategies. The economic stakes are extremely high, demanding continued vigilance and robust risk management strategies from all stakeholders. The future of shipping in this crucial region depends entirely on the success – or failure – of the Houthi truce. Continued monitoring of the Houthi truce developments is essential for all players in the global shipping industry.

Featured Posts

-

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025 -

The Death Of Americas First Openly Nonbinary Person Examining The Circumstances

May 10, 2025

The Death Of Americas First Openly Nonbinary Person Examining The Circumstances

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports After Trump Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports After Trump Order

May 10, 2025 -

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025 -

Understanding Figmas Ai Driven Competitive Edge

May 10, 2025

Understanding Figmas Ai Driven Competitive Edge

May 10, 2025

Latest Posts

-

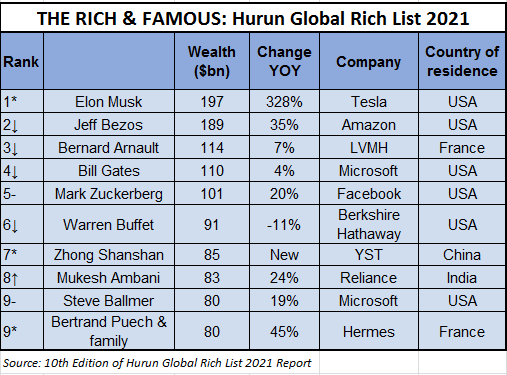

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

Tesla Stock Boost Sends Elon Musks Fortune Skyrocketing

May 10, 2025

Tesla Stock Boost Sends Elon Musks Fortune Skyrocketing

May 10, 2025 -

Hurun Global Rich List 2025 Analysis Of Elon Musks Reduced Net Worth And Continued Dominance

May 10, 2025

Hurun Global Rich List 2025 Analysis Of Elon Musks Reduced Net Worth And Continued Dominance

May 10, 2025 -

Elon Musks Wealth Soars Tesla Stock Surge After Doge Departure

May 10, 2025

Elon Musks Wealth Soars Tesla Stock Surge After Doge Departure

May 10, 2025 -

2025 Hurun Global Rich List Elon Musk Retains Top Spot Despite 100 Billion Loss

May 10, 2025

2025 Hurun Global Rich List Elon Musk Retains Top Spot Despite 100 Billion Loss

May 10, 2025