Slowing Growth Forces SSE To Cut £3 Billion From Spending Budget

Table of Contents

The Scale of SSE's Spending Cuts and Their Impact on Projects

The £3 billion reduction in SSE's spending plans represents a dramatic shift in the company's investment strategy. This cut affects various crucial projects across the energy value chain. While exact figures for each area aren't publicly available, it's understood that significant portions have been allocated to reducing planned capital expenditure.

-

Renewable Energy Investments: A substantial percentage of the cuts likely impacts renewable energy projects. This could mean a reduction in planned investments in offshore wind farms, potentially delaying the expansion of renewable energy capacity in the UK. This reduction in SSE investment in renewables directly impacts the nation's commitment to its net-zero targets.

-

Grid Infrastructure Upgrades: Essential upgrades to the UK's national grid are also likely to be affected. These upgrades are crucial for integrating increasing amounts of renewable energy into the system, so delays caused by infrastructure spending cuts could impact the stability and reliability of the energy supply.

-

Smart Meter Rollout: The ambitious rollout of smart meters across the UK, a crucial element in improving energy efficiency and customer engagement, could experience significant delays due to these SSE spending cuts.

These cuts have the potential to lead to significant job losses within SSE and across its supply chain. The delays in crucial energy projects further risk pushing back the UK's timetable for achieving its renewable energy targets.

Reasons Behind SSE's Decision to Reduce Spending

The decision to implement such drastic SSE spending cuts stems from a confluence of challenging macroeconomic factors:

-

Inflationary Pressures: Soaring inflation has significantly increased the cost of materials, labor, and other inputs required for energy projects. This makes it more expensive to execute planned investments, forcing companies to re-evaluate their budgets.

-

Rising Interest Rates: Higher interest rates increase the cost of borrowing, making it more expensive for companies like SSE to finance large-scale infrastructure projects. This increase in financing costs has made many planned projects financially unviable.

-

Government Policy Uncertainty: Changes and uncertainty in government energy policies add another layer of complexity to investment decisions. The lack of clarity about future regulations and support schemes can make long-term investment planning challenging.

-

Slowing Economic Growth: The overall slowing economic growth significantly impacts the energy market's demand and investment outlook, further contributing to the necessity for these SSE spending cuts.

The Long-Term Implications of SSE's Spending Cuts

The long-term implications of these cuts extend beyond SSE itself. The reduction in investment could have significant consequences:

-

Energy Security: Delays in renewable energy projects and grid upgrades could compromise the UK's energy security, making the country more reliant on volatile fossil fuel markets.

-

Renewable Energy Targets: The cuts could jeopardize the UK's ambitious renewable energy targets, potentially delaying the transition to a low-carbon energy system.

-

Consumer Prices: While initially designed to manage costs, the potential for future price increases remains, as some projects offer long-term cost savings. Delays in infrastructure improvements, for example, could lead to increased energy prices for consumers in the long term.

Analyst Reactions and Market Response to the SSE Spending Cuts

Financial analysts have reacted with a mix of concern and understanding to the SSE spending cuts. Many acknowledge the challenging macroeconomic environment and the difficult choices faced by energy companies. The market response has been largely negative, with SSE's share price experiencing a downturn following the announcement. This reflects investor concerns about the potential long-term impact of the reduced investment on the company's future profitability and growth prospects. The broader impact on the energy sector is uncertainty among investors concerning other energy companies' future investment plans.

Conclusion: Analyzing the Impact of SSE Spending Cuts

The £3 billion reduction in SSE spending represents a significant development with far-reaching implications. Driven by inflation, rising interest rates, policy uncertainty, and slowing growth, these cuts risk delaying crucial energy projects, impacting the UK's energy security, and potentially affecting consumer prices. The market's negative reaction underscores the gravity of this situation. While necessary in the short term, these cuts pose challenges to the UK’s long-term energy goals and its transition to a low-carbon future.

Stay updated on the latest news concerning SSE spending cuts and their impact on the energy industry. Share this article to raise awareness of this critical issue and its potential consequences.

Featured Posts

-

Public Reaction To Annie Kilners Posts Regarding Kyle Walker

May 24, 2025

Public Reaction To Annie Kilners Posts Regarding Kyle Walker

May 24, 2025 -

Apple Stock Q2 Earnings Preview And Potential Price Movement

May 24, 2025

Apple Stock Q2 Earnings Preview And Potential Price Movement

May 24, 2025 -

Is Sean Penns Support For Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025

Is Sean Penns Support For Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025 -

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025 -

Pre Owned Porsche 911 S T Pts Riviera Blue Detailed Specifications

May 24, 2025

Pre Owned Porsche 911 S T Pts Riviera Blue Detailed Specifications

May 24, 2025

Latest Posts

-

Tulsa King Season 3 Kevin Pollaks Role And Potential Conflict With Sylvester Stallone

May 24, 2025

Tulsa King Season 3 Kevin Pollaks Role And Potential Conflict With Sylvester Stallone

May 24, 2025 -

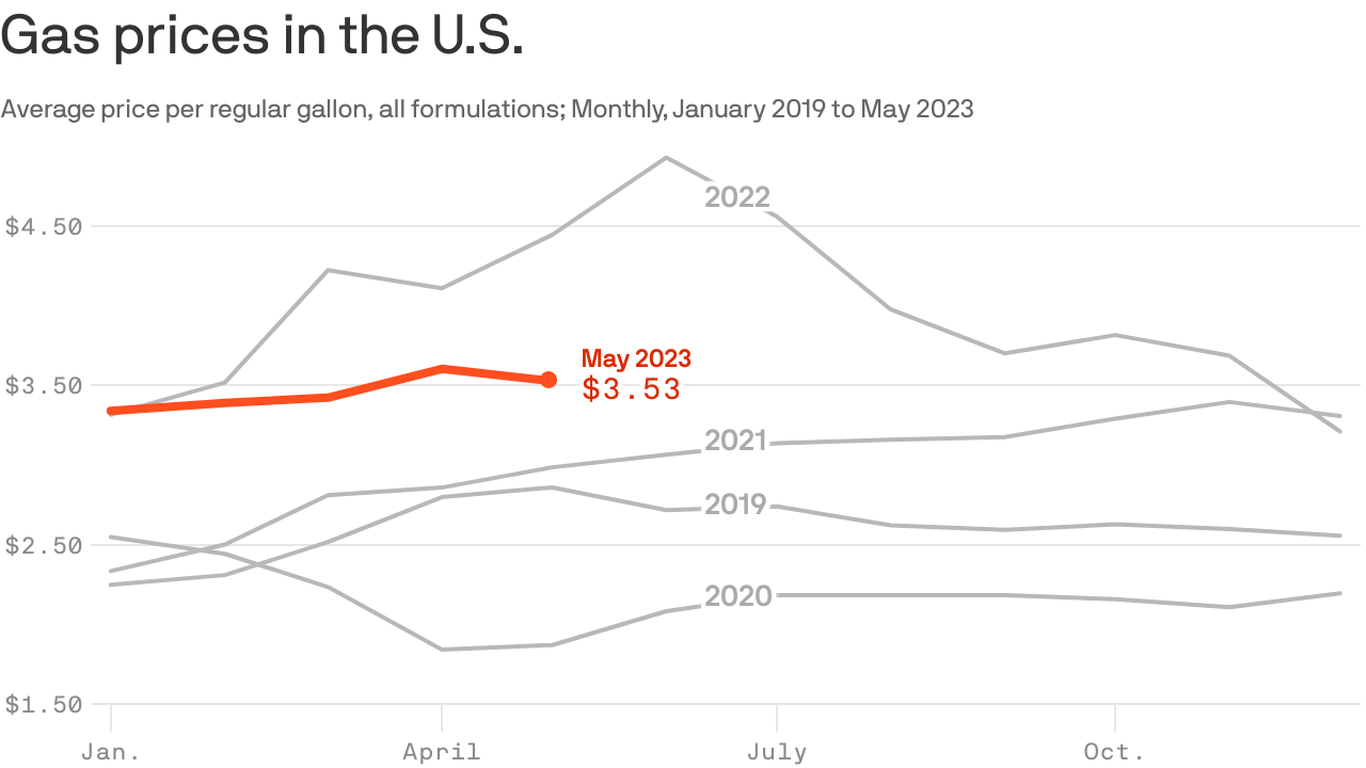

Memorial Day Gas Prices Expected To Be Historically Low

May 24, 2025

Memorial Day Gas Prices Expected To Be Historically Low

May 24, 2025 -

Lowest Memorial Day Gas Prices In Years

May 24, 2025

Lowest Memorial Day Gas Prices In Years

May 24, 2025 -

Bull Riding Faith And Film Neal Mc Donough Discusses The Last Rodeo

May 24, 2025

Bull Riding Faith And Film Neal Mc Donough Discusses The Last Rodeo

May 24, 2025 -

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025