Smart Shopping For Budget-Conscious Consumers

Table of Contents

Planning & Budgeting for Smart Shopping

Before embarking on any shopping spree, solid planning and budgeting are essential components of smart shopping. This ensures you're spending consciously and avoiding unnecessary expenses.

Creating a Realistic Budget

Understanding where your money goes is the first step towards effective budgeting. Tracking your expenses, even for a short period, reveals spending patterns and areas for potential savings.

- Use budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital offer user-friendly interfaces to track spending and create budgets.

- Categorize your spending: Divide your expenses into categories like groceries, transportation, entertainment, and clothing to identify spending hotspots.

- Identify areas for reduction: Analyze your spending categories and pinpoint areas where you can cut back without significantly impacting your lifestyle.

The 50/30/20 budgeting rule is a helpful guideline: allocate 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Applying this rule to your shopping habits can dramatically improve your financial health.

Prioritizing Needs vs. Wants

Differentiating between needs and wants is crucial for smart shopping. Needs are essential for survival or well-being, while wants are non-essential desires.

- Create a shopping list based on needs: Before heading to the store, meticulously list only the items you truly need.

- Delay gratification for wants: Resist the urge for immediate gratification. Waiting allows you to assess whether you truly need the item. A waiting period of 24-48 hours often helps curb impulse buys.

- Utilize waiting periods to curb impulse buys: Before purchasing non-essential items, wait a predetermined period (e.g., a week). This allows time for reflection and often eliminates impulsive purchases.

For example, groceries are a need, while that new pair of shoes is a want. Similarly, a new phone might be a need if your old one is broken, but upgrading to the latest model is a want.

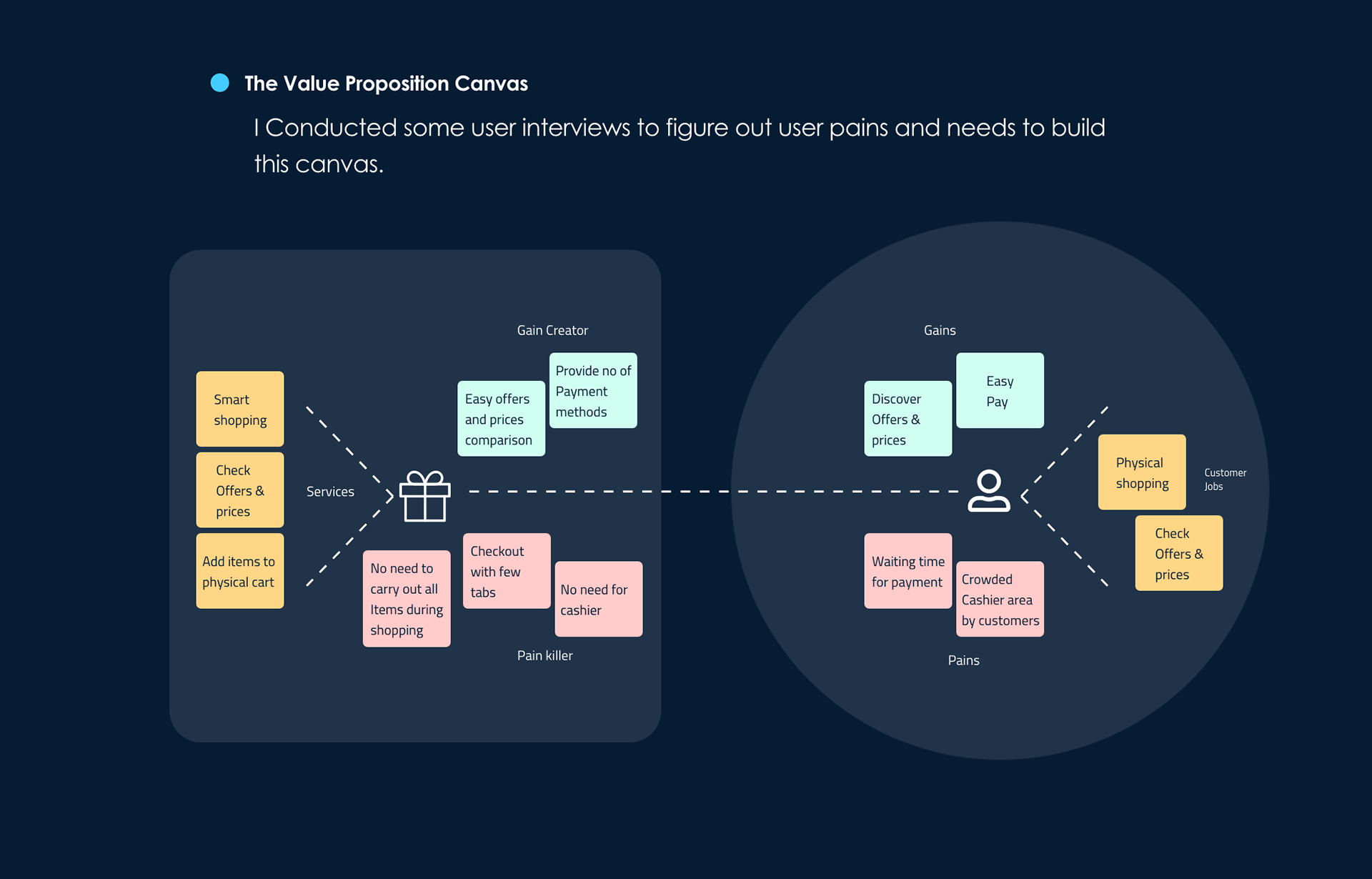

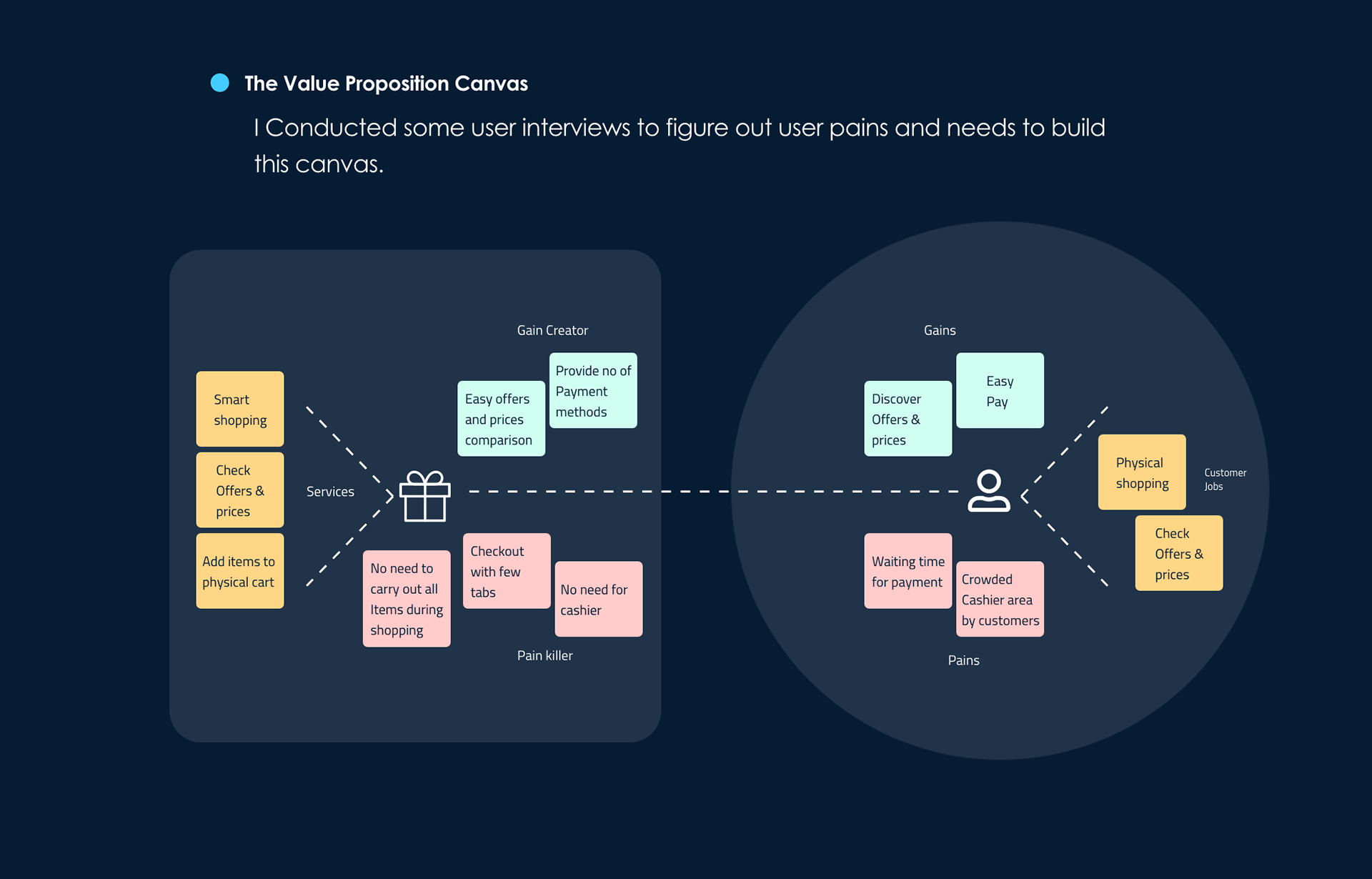

Mastering the Art of Comparison Shopping

Comparison shopping is a cornerstone of smart shopping, ensuring you get the best value for your money.

Utilizing Price Comparison Websites

Price comparison websites and apps save you time and money by aggregating prices from various retailers.

- Popular price comparison websites and apps: Google Shopping, PriceGrabber, and Honey are excellent tools to compare prices across different vendors.

- Check shipping costs and return policies: Factor in shipping costs and thoroughly examine return policies before making a purchase. Free shipping might be offset by higher prices.

- Specific examples of savings: Comparing prices on electronics, books, or clothing can reveal substantial differences, often amounting to significant savings over time.

Leveraging Coupons and Discounts

Coupons and discounts can significantly reduce your spending. Actively seeking these opportunities is a smart shopping essential.

- Utilize coupon apps: Apps like Coupons.com, RetailMeNot, and Groupon offer a wide range of coupons and deals.

- Sign up for email newsletters: Many retailers offer exclusive discounts and promotions to their email subscribers.

- Look for in-store promotions and sales: Check for flyers, in-store displays, and weekly advertisements for deals.

Stacking coupons—combining manufacturer coupons with store coupons—can maximize your savings. Loyalty programs and reward points are further strategies to reduce the final price.

Smart Shopping Strategies for Specific Purchases

Applying smart shopping principles to specific purchases yields even greater savings.

Grocery Shopping on a Budget

Grocery shopping is a major expense. Strategic planning drastically reduces your grocery bill.

- Create a weekly meal plan: Plan your meals for the week, then create a shopping list based on those meals, minimizing impulse buys.

- Compare unit prices: Don’t solely focus on the total price; compare unit prices (price per ounce, pound, etc.) to find the best value.

- Shop the perimeter of the store: Fresh produce, meat, and dairy are usually located around the edges of the store, while processed foods are typically found in the aisles.

- Utilize grocery store apps for savings: Many grocery store apps offer digital coupons, loyalty rewards, and personalized deals.

Buying in bulk can be cost-effective for certain items with long shelf lives, but it’s important to avoid overbuying items that might spoil before you consume them.

Saving Money on Clothing and Accessories

Clothing and accessories can quickly drain your budget. Smart shopping here involves strategic purchasing.

- Shop consignment stores: Consignment and thrift stores offer gently used clothing and accessories at drastically reduced prices.

- Utilize online marketplaces: Platforms like eBay, Poshmark, and ThredUp provide access to secondhand clothing at discounted rates.

- Wait for seasonal sales: Major sales events offer significant discounts on clothing and accessories.

- Focus on classic styles: Investing in versatile, timeless pieces reduces the need for frequent purchases.

Buying secondhand clothing also has significant environmental benefits, reducing textile waste and promoting sustainability.

Avoiding Impulse Purchases & Debt

Impulse purchases are a common pitfall. Understanding their psychology and taking preventative measures is critical.

The Psychology of Impulse Buying

Impulse buying often stems from emotional triggers, such as stress, boredom, or social pressure.

- Unsubscribe from tempting emails: Reduce exposure to tempting advertisements by unsubscribing from retailers’ email lists.

- Leave credit cards at home: Shopping with cash limits spending to the amount you have available.

- Practice mindful shopping: Before purchasing, ask yourself if you truly need the item and if it aligns with your budget and values.

- Use a waiting period before making large purchases: Give yourself time to consider a purchase before committing, allowing rational thought to override impulse.

Delaying gratification is a powerful tool to curb impulsive spending. The short-term satisfaction of a purchase often pales in comparison to the long-term benefit of saving money.

Managing Credit Card Debt

Credit card debt can rapidly accumulate, hindering your financial progress. Responsible credit card use is essential for smart shopping.

- Pay bills on time: Paying bills on time avoids late fees and maintains a good credit score.

- Avoid unnecessary debt: Only use credit cards for purchases you can afford to repay immediately.

- Utilize balance transfer options carefully: Balance transfer cards can help consolidate debt and lower interest rates, but read the terms carefully.

High-interest debt can severely impact your financial well-being. Understanding the consequences of debt and developing financial literacy are crucial for smart shopping and long-term financial health.

Conclusion

Smart shopping is a multifaceted skill requiring planning, comparison, and mindful spending. By creating a realistic budget, prioritizing needs over wants, utilizing price comparison tools and coupons, and avoiding impulse purchases, you can significantly improve your financial well-being. Consistent application of these smart shopping habits leads to long-term savings and increased financial security. Start practicing these smart shopping strategies today and transform your spending habits! Become a smart shopper and achieve your financial goals!

Featured Posts

-

Netflixs The Four Seasons Colman Domingo And The Oscar Nomination Story

May 06, 2025

Netflixs The Four Seasons Colman Domingo And The Oscar Nomination Story

May 06, 2025 -

Spike Lees Endorsement Elevates Sinner Impact On Films Reception

May 06, 2025

Spike Lees Endorsement Elevates Sinner Impact On Films Reception

May 06, 2025 -

Watch The 2025 Met Gala Live Streaming Options For Latin America Mexico And The U S

May 06, 2025

Watch The 2025 Met Gala Live Streaming Options For Latin America Mexico And The U S

May 06, 2025 -

Australian Election Potential Market Upswing For Assets

May 06, 2025

Australian Election Potential Market Upswing For Assets

May 06, 2025 -

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Relationship

May 06, 2025

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Relationship

May 06, 2025