Smart Spending On A Budget: Affordable Products That Deliver Value

Table of Contents

Prioritizing Needs vs. Wants

Understanding the difference between essential purchases and impulse buys is crucial for budget-conscious consumers. Effective budget management hinges on this distinction. Let's break down how to prioritize your spending.

Identifying Your Essential Needs

Focus on necessities like food, shelter, transportation, and healthcare. These are the foundational elements of a comfortable life, and a well-structured budget prioritizes them.

- Track your spending: For a month, meticulously record every expense. This provides a clear picture of where your money is going. Many free budgeting apps can simplify this process.

- Utilize budgeting apps: Numerous apps categorize expenses, track progress towards goals, and even offer personalized financial advice. Mint, YNAB (You Need A Budget), and Personal Capital are popular choices.

- Create a "needs" vs. "wants" list: This visual representation helps clarify your spending habits and identify areas for potential savings. Be honest with yourself about what truly constitutes a "need."

Differentiating Wants from Needs

Learning to delay gratification is key to avoiding impulse buys. Analyze your spending habits to spot unnecessary expenses and cultivate mindful consumption.

- Ask yourself: Is it necessary or a desire? Before making any purchase, pause and honestly assess its necessity. Many "wants" can be delayed or eliminated entirely.

- The 24-hour rule: Wait a full day before making any non-essential purchase. This cooling-off period often reveals impulsive decisions.

- The "one in, one out" rule: For possessions, this principle helps prevent clutter and overspending. Before buying something new, get rid of something similar.

Finding Affordable, High-Quality Alternatives

Many budget-friendly products offer comparable functionality to their more expensive counterparts. Smart shopping involves finding these hidden gems.

Utilizing Comparison Shopping Tools

Explore online resources and price comparison websites to find the best deals. Don't settle for the first price you see!

- Browser extensions: Several browser extensions automatically compare prices across different retailers as you shop online.

- Read product reviews: Reviews offer valuable insights into product quality, durability, and overall customer satisfaction. Pay close attention to comments on longevity and performance.

- Refurbished or open-box products: These often offer significant savings while retaining much of the original product's functionality. Just ensure you understand the warranty and condition.

Leveraging Sales and Discounts

Take advantage of seasonal sales, promotional offers, and discount codes to maximize your savings. These opportunities can dramatically reduce the cost of many items.

- Email newsletters: Sign up for email newsletters from your favorite stores to receive alerts about sales and exclusive offers.

- Coupon websites and apps: Numerous websites and apps specialize in aggregating coupons and discount codes. RetailMeNot and Coupons.com are popular examples.

- Major sales events: Plan your larger purchases around sales events like Black Friday or Cyber Monday for potentially substantial discounts.

Investing in Durable and Long-Lasting Products

While the initial cost might be higher, investing in durable products often saves money in the long run by reducing the need for frequent replacements. It's a form of smart, long-term budgeting.

Researching Product Longevity

Look for products with long warranties or a reputation for durability before making a purchase. Don't underestimate the value of quality.

- Read reviews focusing on lifespan: Pay close attention to user reviews that discuss the product's durability and how long it lasted.

- Check for independent reviews and ratings: Look beyond manufacturer claims and seek out objective assessments from reputable sources like Consumer Reports.

- Consider the total cost of ownership: Account for potential repair costs and maintenance over the product's lifespan when making your decision.

Prioritizing Quality over Quantity

Instead of buying many inexpensive items, it's often more cost-effective to invest in fewer, high-quality items. This approach minimizes waste and maximizes value.

- Build a quality wardrobe: Focus on a few durable, versatile items rather than numerous trendy pieces that quickly wear out.

- Invest in quality tools and appliances: High-quality tools and appliances often last much longer, reducing the need for replacements and saving money in the long run.

- Consider the environmental impact: Opt for sustainable and ethically sourced products whenever possible; this often translates to higher quality and longer life.

Conclusion

Smart spending on a budget is achievable with careful planning and strategic choices. By prioritizing your needs, finding affordable alternatives, and investing in durable products, you can significantly improve your financial well-being without compromising your quality of life. Remember to continuously evaluate your spending habits and refine your strategies. Embrace the power of smart spending and unlock the potential for financial freedom! Start implementing these tips today and experience the benefits of affordable products that deliver value.

Featured Posts

-

Constitutional Oath And Trumps I Dont Know Response

May 06, 2025

Constitutional Oath And Trumps I Dont Know Response

May 06, 2025 -

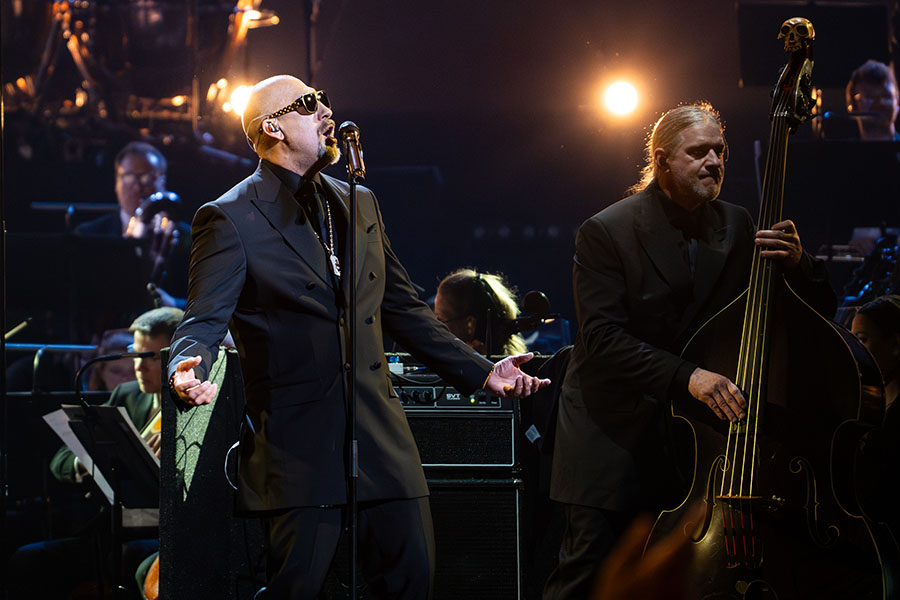

Diana Ross 1973 Royal Albert Hall Concert Setlist Review And History

May 06, 2025

Diana Ross 1973 Royal Albert Hall Concert Setlist Review And History

May 06, 2025 -

Fin De Saison Pour Popovich Le Futur Des Spurs

May 06, 2025

Fin De Saison Pour Popovich Le Futur Des Spurs

May 06, 2025 -

Tracee Ellis Rosss Family Tree Exploring Her Famous Relatives

May 06, 2025

Tracee Ellis Rosss Family Tree Exploring Her Famous Relatives

May 06, 2025 -

Patrick Schwarzenegger Nude Father Arnold Schwarzenegger Weighs In

May 06, 2025

Patrick Schwarzenegger Nude Father Arnold Schwarzenegger Weighs In

May 06, 2025