SMFG's Potential Investment In Yes Bank: A Deep Dive

Table of Contents

SMFG's Strategic Interests in India

SMFG, a global financial giant, has been steadily increasing its presence in Asia. Its "India expansion" strategy reflects a keen interest in capitalizing on the country's rapid economic growth and burgeoning financial market. The "SMFG India strategy" likely prioritizes diversification and securing a larger share of the Asian market expansion. An investment in Yes Bank could be a significant step towards achieving these goals.

The potential benefits for SMFG are substantial:

- Increased market access in a high-growth region: India's expanding economy presents a vast untapped market for financial services.

- Diversification of investment portfolio, reducing risk: Investing in a different geographical market reduces reliance on existing markets, mitigating overall risk.

- Potential synergies with existing SMFG operations in India: SMFG may find opportunities to integrate Yes Bank's operations with its existing Indian ventures, creating operational efficiencies.

- Acquisition of valuable assets and customer base: Yes Bank, despite its challenges, still boasts a significant customer base and a substantial network of branches across India.

Yes Bank's Current Financial Status and Needs

Yes Bank has faced significant challenges in recent years, undergoing a period of "Yes Bank restructuring" and striving for "Yes Bank recovery." While the bank has undertaken steps to improve its financial health, it still needs substantial capital infusion to strengthen its balance sheet and regain investor confidence within the "Indian banking sector".

Key aspects of Yes Bank's current financial standing include:

- Analysis of Yes Bank's Non-Performing Assets (NPAs): Reducing NPAs remains a crucial aspect of Yes Bank's recovery.

- Discussion of its capital adequacy ratio: Improving the capital adequacy ratio is essential to meet regulatory requirements and bolster investor confidence.

- Overview of its recent performance and growth trajectory: Analyzing past performance helps determine the bank's future potential.

- Explanation of the need for external investment: External investment is crucial for recapitalization and future growth.

Potential Terms and Structure of the Investment

The "investment structure" of SMFG's potential investment in Yes Bank could take various forms, including an "equity stake," "debt financing," or a strategic partnership. An "equity stake" might involve SMFG acquiring a significant percentage of Yes Bank's shares, potentially influencing its management and strategic direction. A strategic partnership could involve collaboration on specific products or services.

Several key aspects of the potential transaction remain speculative:

- Potential equity stake percentage for SMFG: The size of the stake will significantly impact SMFG's influence on Yes Bank's operations.

- Expected impact on Yes Bank's share price: The announcement could lead to significant volatility in Yes Bank's stock price.

- Potential changes in Yes Bank's board composition: SMFG's involvement may lead to changes in Yes Bank's board of directors.

- Anticipated regulatory approvals needed: Securing necessary approvals from Indian regulatory bodies will be crucial for the transaction's success.

Market Reactions and Analysis

The news of SMFG's potential investment will undoubtedly trigger significant "market impact." "Stock market analysis" will be crucial to understand the investor response. The "investor sentiment" will depend on the perceived success of the deal and its implications for the long-term stability of Yes Bank.

Analyzing market reactions involves considering:

- Potential impact on Yes Bank's stock price: The share price will likely experience volatility depending on the deal's specifics.

- Reactions from other investors and stakeholders: Reactions from other shareholders, creditors, and industry players will shape the overall narrative.

- Analysis of the competitive landscape within the Indian banking sector: The investment could shift the competitive balance within the Indian banking sector.

- Potential long-term effects on the Indian economy: The deal could have broader implications for the Indian economy's financial stability.

Risks and Challenges Associated with the Investment

Despite the potential benefits, "investment risks" exist. "Financial challenges" for Yes Bank might persist, and integration issues between SMFG and Yes Bank could hinder the expected synergies. "Regulatory hurdles" in India's complex financial regulatory environment pose significant challenges.

Key challenges and risks include:

- Potential regulatory obstacles in India: Navigating the Indian regulatory framework can be complex and time-consuming.

- Challenges in integrating Yes Bank's operations with SMFG: Integrating two organizations with different cultures and operational styles can be difficult.

- Risks associated with the Indian economic environment: Macroeconomic factors in India could affect the success of the investment.

- Potential cultural and operational differences between the two organizations: Overcoming cultural and operational differences is vital for a successful integration.

Conclusion: Assessing SMFG's Potential Investment in Yes Bank

SMFG's potential investment in Yes Bank presents a complex interplay of opportunities and challenges. While the investment could significantly benefit both organizations and contribute to the stability of the Indian financial market, risks associated with integration, regulatory hurdles, and the broader Indian economic environment need careful consideration. The ultimate success of this potential "SMFG's potential investment in Yes Bank" will depend on effective management of these risks and a strategic approach to integrating the two entities.

Stay tuned for further updates on this potentially transformative investment and continue your research into the evolving landscape of the Indian banking sector.

Featured Posts

-

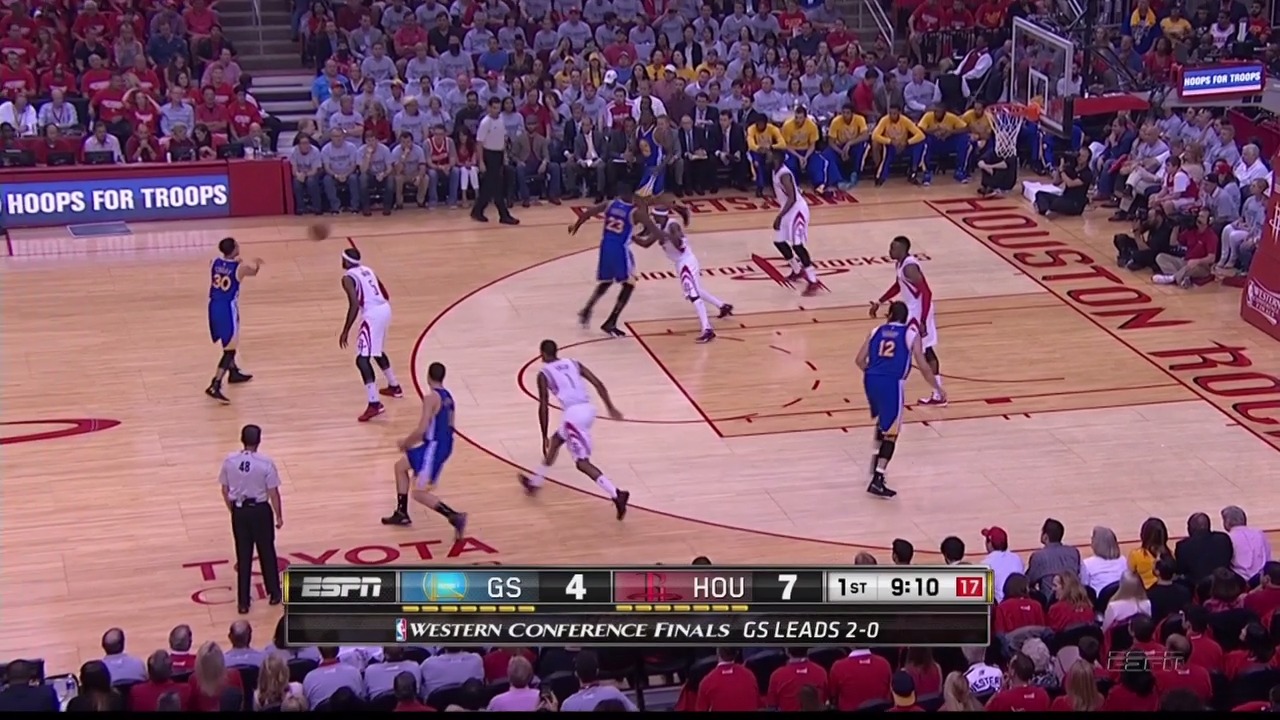

Warriors Unified Message Sets Stage For Rockets Playoff Battle

May 07, 2025

Warriors Unified Message Sets Stage For Rockets Playoff Battle

May 07, 2025 -

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 07, 2025

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 07, 2025 -

Sister Exposes Family Rift Zendayas Absence During Cancer Fight

May 07, 2025

Sister Exposes Family Rift Zendayas Absence During Cancer Fight

May 07, 2025 -

Isabela Merced As Dina In The Last Of Us Season 2 Character Explained

May 07, 2025

Isabela Merced As Dina In The Last Of Us Season 2 Character Explained

May 07, 2025 -

Jenna Ortega A Rejtett Inspiracio

May 07, 2025

Jenna Ortega A Rejtett Inspiracio

May 07, 2025

Latest Posts

-

Inter Milan Midfielder Piotr Zielinski Faces Weeks Out With Calf Problem

May 08, 2025

Inter Milan Midfielder Piotr Zielinski Faces Weeks Out With Calf Problem

May 08, 2025 -

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025 -

Inter Milans Sommer Out Thumb Injury Jeopardizes Key Fixtures

May 08, 2025

Inter Milans Sommer Out Thumb Injury Jeopardizes Key Fixtures

May 08, 2025 -

Zielinskis Calf Injury Weeks On The Sidelines For Inter Milan

May 08, 2025

Zielinskis Calf Injury Weeks On The Sidelines For Inter Milan

May 08, 2025 -

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025