Social Media Sentiment And Economic Forecasting: The Case Of Recession Indicators

Table of Contents

1. Measuring Social Media Sentiment for Economic Indicators

This section details the methods used to gather and analyze social media data for economic forecasting purposes. Effectively leveraging social media requires a robust methodology.

Data Sources and Collection Methods

Various platforms offer valuable data. Twitter, with its real-time updates and vast user base, is a common choice. Facebook provides insights into user demographics and group discussions. Reddit, with its numerous subreddits dedicated to finance and economics, also offers a rich source of information. Data scraping techniques, employing APIs (Application Programming Interfaces) like the Twitter API or Facebook Graph API, are crucial for collecting this data. However, ethical considerations and compliance with platform terms of service are paramount.

- Tools: Tools like Python libraries (Tweepy for Twitter, Facebook SDK) and specialized sentiment analysis platforms simplify data collection and processing.

- Challenges: Data bias is inherent; certain demographics may over-represent their views. Noise from irrelevant tweets or posts needs careful filtering. Rate limits imposed by APIs can also constrain data acquisition.

Sentiment Analysis Techniques

Sentiment analysis algorithms categorize text as positive, negative, or neutral. Methods include:

-

Lexicon-based approaches: These use pre-defined dictionaries of words and their associated sentiment scores. They are simple to implement but can struggle with nuanced language.

-

Machine learning techniques: Algorithms like Naive Bayes, Support Vector Machines (SVMs), and Recurrent Neural Networks (RNNs) learn from labeled data to classify sentiment. These methods are more sophisticated and can adapt to evolving language.

-

Examples: VADER (Valence Aware Dictionary and sEntiment Reasoner) is a popular lexicon-based tool. Models trained on large datasets, such as those available through Google Cloud Natural Language API, provide highly accurate results.

Identifying Relevant Keywords and Hashtags

Selecting the right keywords and hashtags is critical. Focusing on terms reflecting economic anxieties and consumer confidence amplifies relevant signals.

- Examples: Keywords like "layoffs," "job cuts," "inflation," "recession," "unemployment," and "financial crisis" directly signal economic uncertainty. Hashtags like #economicdownturn or #inflation can further refine the search.

- Filtering Noise: Techniques like removing irrelevant hashtags or filtering out spam accounts are crucial for accurate analysis.

2. Social Media Sentiment as a Leading Indicator of Recessions

This section analyzes the predictive power of social media sentiment in relation to traditional economic indicators.

Correlation with Traditional Economic Indicators

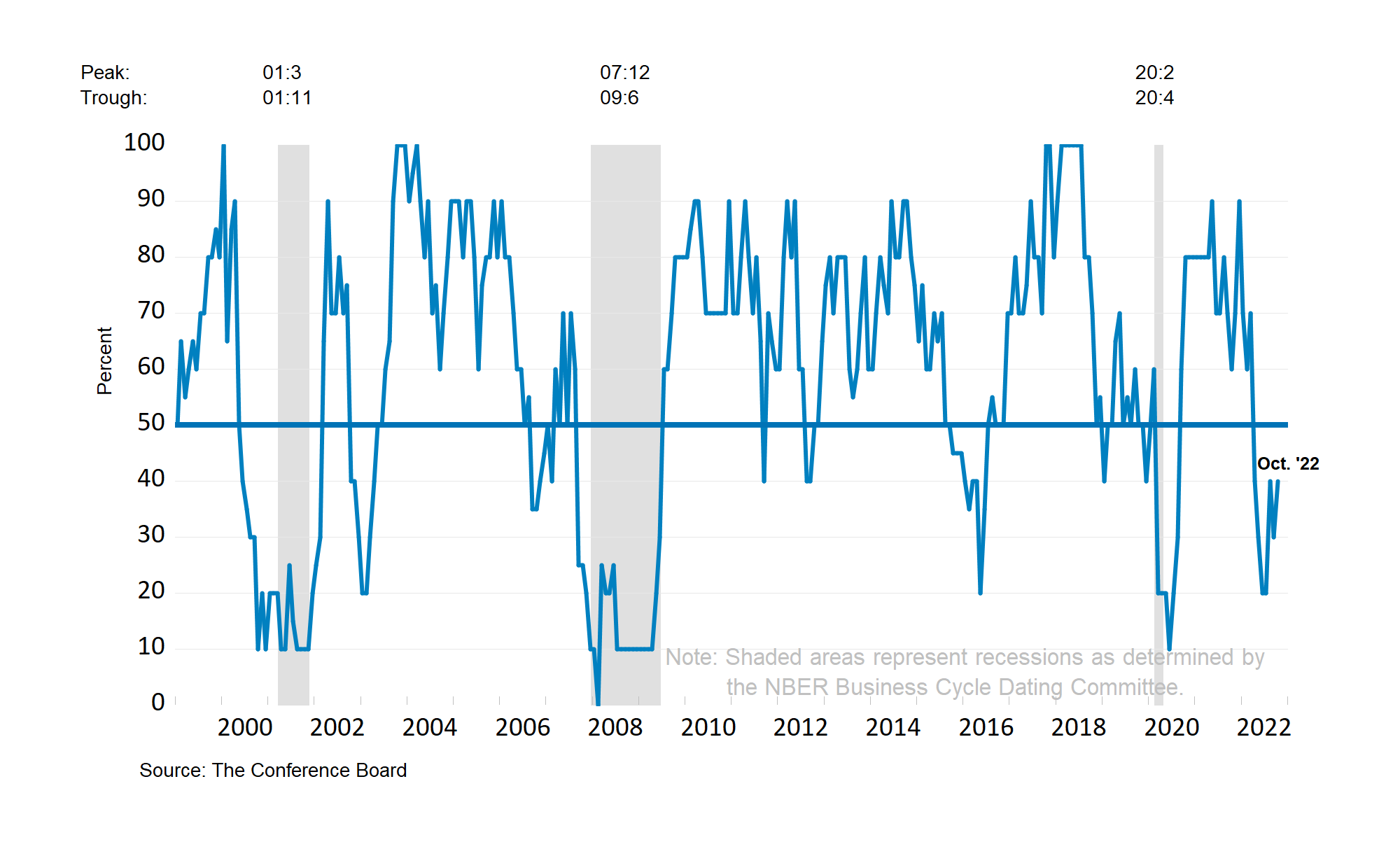

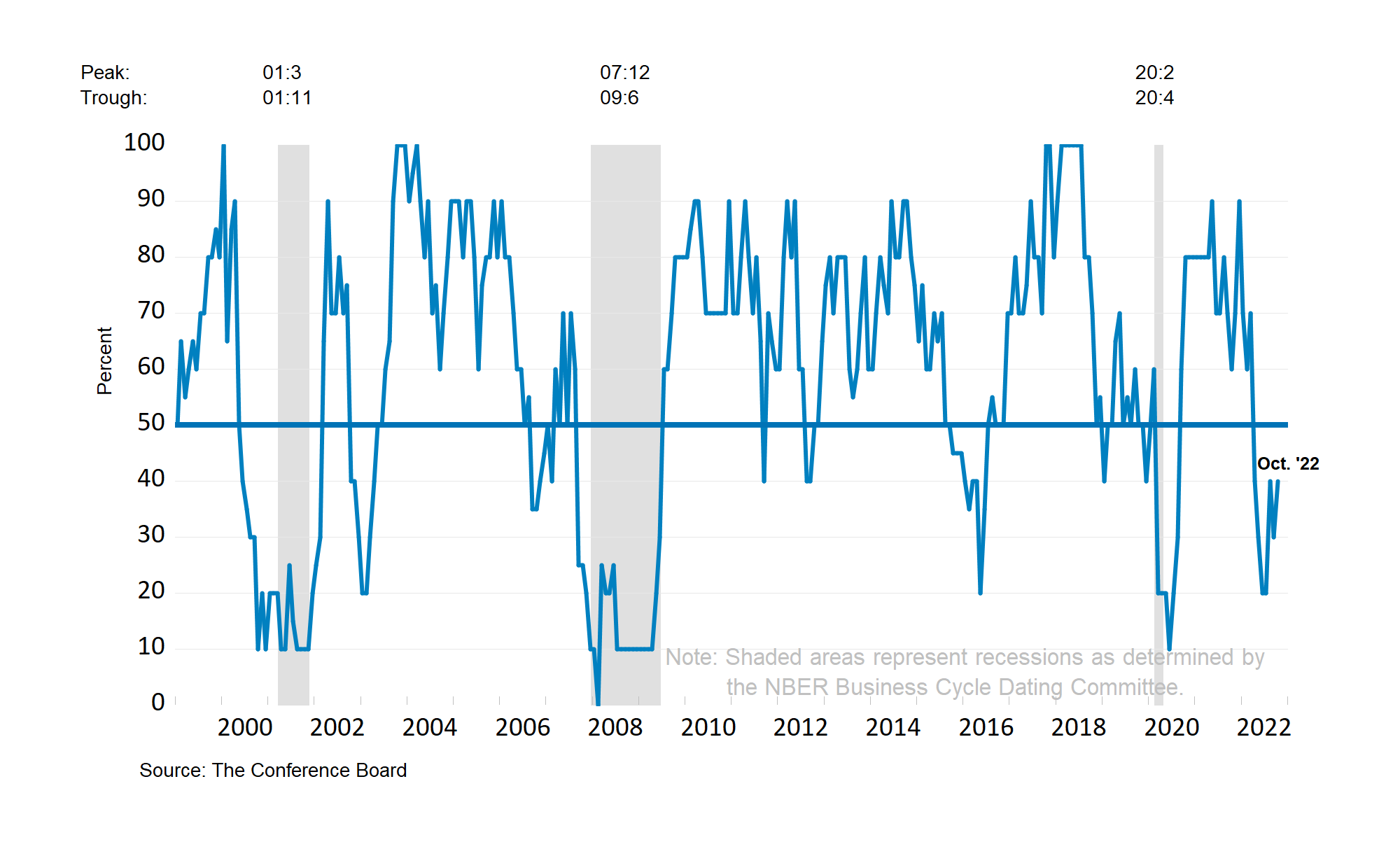

Studies show a strong correlation between negative social media sentiment and traditional recession indicators.

- Statistical Evidence: Graphs showcasing the inverse relationship between positive sentiment and GDP growth, or the positive correlation between negative sentiment and rising unemployment rates, provide compelling evidence. A lead-lag relationship, where sentiment shifts precede economic changes, further validates its predictive capacity.

- Lead-Lag Relationship: Negative sentiment often precedes actual economic downturns, suggesting its potential as an early warning system.

Case Studies of Successful Predictions

Several instances demonstrate the predictive power of social media sentiment analysis.

- Examples: Research papers analyzing social media data during past recessions often highlight the predictive accuracy of sentiment analysis models. (Cite specific studies and provide links.)

- Methodology: These studies usually involve comparing sentiment scores with lagging indicators to determine the lead-lag relationship and predictive accuracy.

Limitations and Challenges of Using Social Media Data

While promising, social media data has limitations.

- Fake News and Bots: The presence of fake news and bot-generated content can skew sentiment analysis results.

- Cultural and Regional Differences: Sentiment expressed on social media varies across cultures and regions, complicating generalizations.

- Data Bias: Social media users aren't a representative sample of the entire population, limiting generalizability.

3. Improving the Accuracy of Economic Forecasts Using Social Media Sentiment

This section explores methods to enhance the accuracy of economic predictions using social media.

Combining Social Media Data with Traditional Methods

Integrating social media data with traditional economic forecasting models enhances their accuracy.

- Benefits: Social media data adds a layer of real-time sentiment, providing insights into consumer confidence and economic expectations that traditional indicators may miss.

- Integration: Sentiment scores can be incorporated as additional variables in econometric models, improving predictive power.

Advanced Techniques for Sentiment Analysis

Advancements in NLP and machine learning are crucial.

- Deep Learning: Deep learning models, such as recurrent neural networks (RNNs) and transformers, can capture complex contextual information in text, improving sentiment analysis accuracy.

- Sentiment Classification Models: Advanced models can identify subtle nuances in sentiment, going beyond simple positive/negative classifications.

- Emotion Detection: Detecting specific emotions (fear, anger, anxiety) provides richer insights into economic anxieties.

The Role of Big Data and AI in Economic Forecasting

Big data and AI are essential for processing and interpreting the sheer volume of social media data.

- Computational Challenges: Processing vast datasets requires powerful computing resources and efficient algorithms.

- Cloud Computing: Cloud computing platforms offer the scalability needed to handle the computational demands of social media data analysis.

3. Conclusion

Social media sentiment analysis offers a valuable, albeit imperfect, tool for economic forecasting, particularly regarding recession indicators. While limitations exist, such as the influence of fake news and the challenges of cross-cultural comparisons, the correlation between negative sentiment and economic downturns is undeniable. Future research should focus on improving data cleaning techniques, developing more sophisticated sentiment analysis models, and refining methods for integrating social media data with traditional economic indicators. By understanding the nuances of social media sentiment and economic forecasting, you can gain a powerful edge in predicting market trends and mitigating risks. Start exploring the possibilities of using social media sentiment analysis today!

Featured Posts

-

The Appeal Of Rather Be Alone Exploring Leon Thomas And Halle Baileys Hit Song

May 06, 2025

The Appeal Of Rather Be Alone Exploring Leon Thomas And Halle Baileys Hit Song

May 06, 2025 -

Fans Go Wild Ayo Edebiri Embraces The Rom Com Genre

May 06, 2025

Fans Go Wild Ayo Edebiri Embraces The Rom Com Genre

May 06, 2025 -

Arnold Schwarzenegger Weighs In On Son Patricks Nude Scenes

May 06, 2025

Arnold Schwarzenegger Weighs In On Son Patricks Nude Scenes

May 06, 2025 -

Samuel L Jacksons 10 Year Old Narration Spike Lees Super Bowl Recognition

May 06, 2025

Samuel L Jacksons 10 Year Old Narration Spike Lees Super Bowl Recognition

May 06, 2025 -

Astdaft Sbayk Ly Frst Lnmw Snaet Alaflam Alsewdyt

May 06, 2025

Astdaft Sbayk Ly Frst Lnmw Snaet Alaflam Alsewdyt

May 06, 2025