South Africa's Coalition Faces Down Tax Increase

Table of Contents

The Proposed Tax Increase: Details and Rationale

The proposed tax increase aimed to address South Africa's persistent budget deficit and fund crucial social programs and infrastructure development. Specific proposals included:

- A 2% increase in Value Added Tax (VAT), raising it to 17%.

- A progressive increase in personal income tax, impacting higher earners most significantly.

- An increase in corporate tax rates, potentially impacting foreign investment.

The government's rationale emphasized the need for increased revenue generation to finance essential services like healthcare, education, and infrastructure projects vital for economic growth. However, critics argued that the tax increase would stifle economic activity, leading to decreased investment, reduced consumer spending, and ultimately, higher inflation. The potential economic impact was a major point of contention throughout the debate, with economists offering differing projections.

The Coalition's Response and Internal Divisions

South Africa's coalition government is inherently complex, comprising various parties with sometimes conflicting agendas. The proposed tax increase exposed deep internal divisions within the coalition.

- Some parties, particularly those representing the working class, vehemently opposed the tax increase, fearing the impact on already struggling citizens.

- Other parties, more aligned with business interests, were more open to the tax hike, viewing it as necessary for fiscal stability.

- This led to intense political negotiation and horse-trading, with key political figures like [Name of prominent political figure] and [Name of another prominent figure] taking opposing stances.

- The coalition's response involved a series of closed-door meetings, public statements, and ultimately, a significant degree of compromise to avoid a complete collapse of the governing alliance.

The Role of Opposition Parties

Opposition parties played a significant role in shaping the debate and influencing the outcome of the parliamentary vote.

- They actively campaigned against the tax increase, highlighting its potential negative consequences for the economy and everyday citizens.

- Their strategies included public rallies, media appearances, and vigorous parliamentary debate.

- Public opinion, fueled by media coverage emphasizing the potential burden on taxpayers, played a crucial role in galvanizing opposition to the tax increase. Negative public sentiment put significant pressure on the coalition government.

The Parliamentary Vote and its Aftermath

The parliamentary vote on the tax increase was highly anticipated and closely watched. The legislative process included numerous debates, amendments, and ultimately, a dramatic showdown on the floor of parliament.

- The final vote resulted in the defeat of the proposed tax increase, with a close margin of [Insert margin if available].

- The immediate reactions from political parties were varied, with the opposition parties celebrating a victory while some coalition partners expressed disappointment but ultimately accepted the outcome.

- Short-term consequences include uncertainty in the financial markets and a renewed focus on finding alternative ways to address South Africa's budget deficit. Long-term consequences are still unfolding and will depend on the government's subsequent fiscal policies.

Long-Term Economic Implications of Defeating the Tax Increase

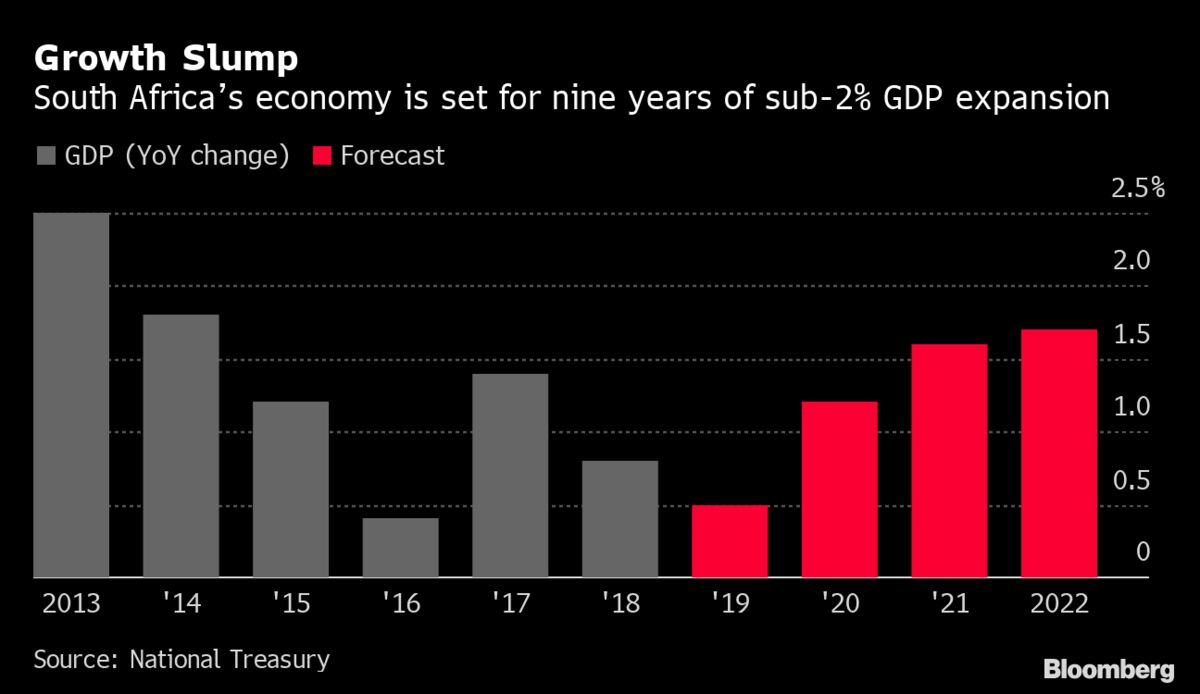

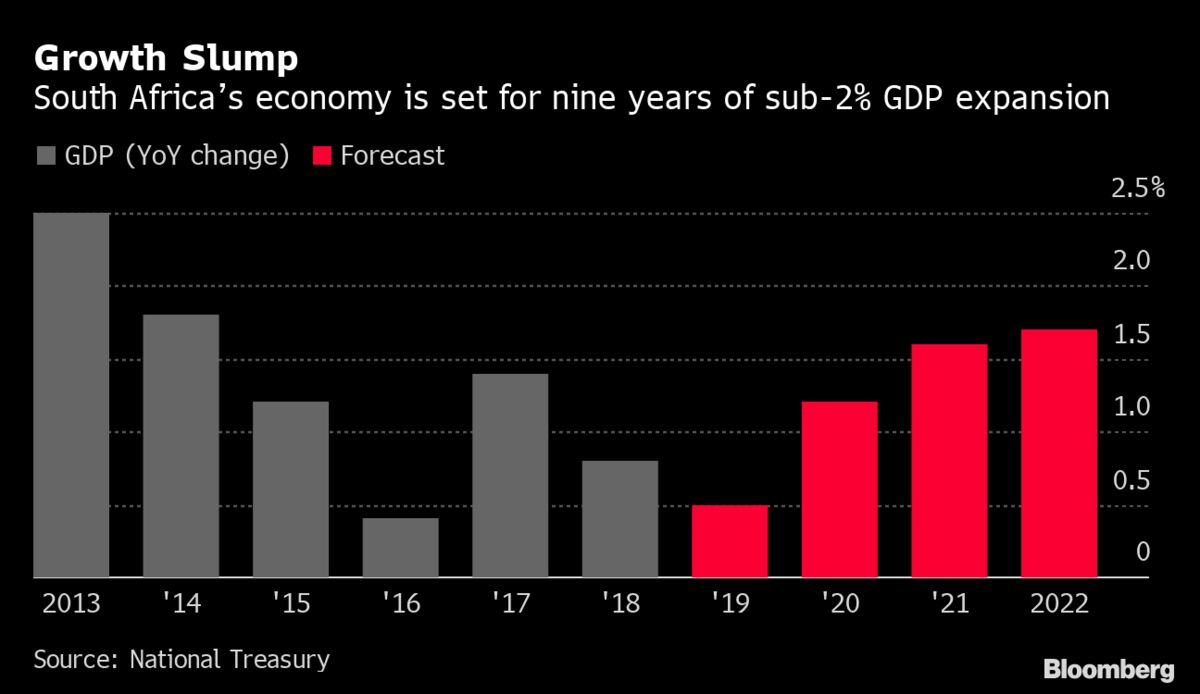

The defeat of the tax increase raises significant questions about South Africa's fiscal sustainability.

- The government will now need to explore alternative strategies to address the budget deficit, potentially through spending cuts or innovative revenue-generating measures.

- The impact on social programs and infrastructure investment remains uncertain, potentially leading to delays or reductions in funding.

- South Africa's economic trajectory in the coming years will depend greatly on how effectively the government navigates this challenge and implements effective alternative solutions.

Conclusion

This article examined the intense political battle surrounding the proposed tax increase in South Africa. The coalition government's successful opposition to the tax hike highlights the fragility of political alliances and the complexities of governing in a diverse nation. The long-term economic implications of this decision remain to be seen, necessitating continued monitoring and debate. The question remains: was this a genuine victory for the South African people, or merely a short-term political win with potentially significant long-term economic consequences?

Call to Action: Stay informed about the ongoing developments in South Africa's political and economic landscape. Follow our updates for further analysis on the implications of this significant decision regarding South Africa's coalition government's handling of the proposed tax increase and its impact on the country's future. Understanding the intricacies of South Africa's coalition politics and its impact on taxation is vital for every concerned citizen.

Featured Posts

-

Carnaval Jorge Mateus E Felipe Amorim Garantem Festa No Primeiro Dia

Apr 25, 2025

Carnaval Jorge Mateus E Felipe Amorim Garantem Festa No Primeiro Dia

Apr 25, 2025 -

Ridley Scotts Dope Thief Brian Tyree Henry And Wagner Moura Steal The Show

Apr 25, 2025

Ridley Scotts Dope Thief Brian Tyree Henry And Wagner Moura Steal The Show

Apr 25, 2025 -

2025 Nfl Draft Ashton Jeanty To The Chicago Bears The Buzz Heats Up

Apr 25, 2025

2025 Nfl Draft Ashton Jeanty To The Chicago Bears The Buzz Heats Up

Apr 25, 2025 -

Planning Your Stagecoach 2025 Trip What You Need To Know

Apr 25, 2025

Planning Your Stagecoach 2025 Trip What You Need To Know

Apr 25, 2025 -

Denver Broncos Super Bowl Potential Hinges On Ashton Jeantys Performance

Apr 25, 2025

Denver Broncos Super Bowl Potential Hinges On Ashton Jeantys Performance

Apr 25, 2025

Latest Posts

-

Did Chris Paul Harrison Barnes And Julian Champagnie Play Every Spurs Game This Season

Apr 30, 2025

Did Chris Paul Harrison Barnes And Julian Champagnie Play Every Spurs Game This Season

Apr 30, 2025 -

Evrobasket 2024 Sedlacek O Dolasku Jokica I Jovica

Apr 30, 2025

Evrobasket 2024 Sedlacek O Dolasku Jokica I Jovica

Apr 30, 2025 -

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

Apr 30, 2025

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

Apr 30, 2025 -

Sedlacek O Mogucem Sastavu Reprezentacije Za Evrobasket

Apr 30, 2025

Sedlacek O Mogucem Sastavu Reprezentacije Za Evrobasket

Apr 30, 2025 -

Jokic I Jovic Na Evrobasketu Sedlacekev Pogled Na Situaciju

Apr 30, 2025

Jokic I Jovic Na Evrobasketu Sedlacekev Pogled Na Situaciju

Apr 30, 2025