Spotify's Q[Quarter] Earnings: 12% Subscriber Growth Outperforms Expectations (SPOT)

![Spotify's Q[Quarter] Earnings: 12% Subscriber Growth Outperforms Expectations (SPOT) Spotify's Q[Quarter] Earnings: 12% Subscriber Growth Outperforms Expectations (SPOT)](https://ideatankforkids.com/image/spotifys-q-quarter-earnings-12-subscriber-growth-outperforms-expectations-spot.jpeg)

Table of Contents

Strong Premium Subscriber Growth Fuels Positive Earnings

Exceeding Analyst Expectations

Spotify's Q3 results showcased robust growth in premium subscribers, defying predictions and setting a positive tone for the earnings report. The company added [Insert Exact Number] premium subscribers, representing a [Insert Percentage]% year-over-year increase and surpassing analyst consensus estimates of [Insert Analyst Estimate]. This impressive figure demonstrates the sustained appeal of Spotify's platform and its ability to attract and retain users globally.

- Exact figures for premium subscriber growth: [Insert Exact Number] new premium subscribers.

- Comparison to previous quarter's growth: Compared to Q2's [Insert Q2 Growth Percentage]% growth, Q3's performance represents a [Insert Comparison, e.g., significant acceleration/modest increase] in user acquisition.

- Geographic regions showing the strongest growth: [Mention specific regions, e.g., Latin America, Asia-Pacific] saw particularly strong growth, indicating the success of Spotify's international expansion strategies.

- Factors contributing to the growth: This growth can be attributed to several factors, including the introduction of new features like [Mention new features], targeted marketing campaigns focusing on [Mention target demographics/campaigns], and the continued expansion into new geographic markets.

Revenue Performance and Key Financial Metrics

Overall Revenue Growth and Breakdown

Spotify's Q3 revenue demonstrated strong overall growth, driven by both premium subscriptions and advertising. Total revenue reached [Insert Total Revenue Figure], representing a [Insert Percentage]% increase year-over-year. This positive trajectory reflects a healthy balance between its core subscription model and its growing advertising business.

- Total revenue figures: [Insert Total Revenue Figure]

- Premium subscription revenue figures: [Insert Premium Subscription Revenue Figure]

- Advertising revenue figures: [Insert Advertising Revenue Figure]

- Gross profit margins and any significant changes: Gross profit margins stood at [Insert Gross Profit Margin Percentage], showcasing [Insert Analysis of Margin Change, e.g., healthy profitability/a slight decrease compared to the previous quarter].

Podcast Performance and Strategic Initiatives

Podcast Listener Growth and Monetization

Spotify's investment in podcasts continues to yield positive results. While precise listener numbers weren't explicitly stated in the report, [Insert available data or qualitative assessment from the report regarding podcast growth]. The company's strategic partnerships with prominent podcast creators and its focus on podcast advertising are contributing to its growth in this segment.

- Number of podcast listeners (if available): [Insert Data if available, otherwise, mention qualitative improvements]

- Key partnerships or acquisitions impacting podcast growth: [Mention key partnerships or acquisitions, e.g., exclusive deals with popular podcasters].

- Successes and challenges in podcast advertising revenue: [Discuss the success of podcast advertising and any challenges, e.g., competition in the podcast advertising market].

Future Outlook and Investment Implications for SPOT Stock

Management's Guidance and Market Predictions

Spotify's management provided optimistic guidance for the coming quarters, projecting [Insert projected subscriber growth] in premium subscribers. The market reacted positively to the Q3 earnings, with SPOT stock experiencing a [Insert Percentage]% increase following the announcement. However, analysts hold varying opinions on future performance, with some expressing caution regarding [mention potential challenges, e.g., competition from other streaming services].

- Management's projected subscriber growth for the next quarter(s): [Insert Management's Projection]

- Impact of the earnings report on SPOT stock price: [Insert Impact and Percentage change]

- Analyst ratings and price targets for SPOT stock: [Summarize Analyst Ratings and price targets]

- Potential risks and challenges facing Spotify's future growth: [Mention potential risks like increased competition, regulatory challenges, etc.]

Conclusion

Spotify's Q3 2023 earnings report paints a picture of robust growth and a positive outlook for the company. The impressive 12% increase in premium subscribers, exceeding analyst expectations, fueled strong revenue growth and a positive market response. While challenges remain in the competitive streaming landscape, Spotify's strategic initiatives in podcasts and its continued focus on user experience suggest a promising future. The strong Q3 performance solidifies Spotify's position and provides a positive outlook for SPOT stock in the near term. Stay informed about future Spotify earnings reports and SPOT stock performance by following the company's news and financial market updates.

![Spotify's Q[Quarter] Earnings: 12% Subscriber Growth Outperforms Expectations (SPOT) Spotify's Q[Quarter] Earnings: 12% Subscriber Growth Outperforms Expectations (SPOT)](https://ideatankforkids.com/image/spotifys-q-quarter-earnings-12-subscriber-growth-outperforms-expectations-spot.jpeg)

Featured Posts

-

Exploring Black History Through Yates Insights From Dr Jessica Johnson

Apr 30, 2025

Exploring Black History Through Yates Insights From Dr Jessica Johnson

Apr 30, 2025 -

Na Sveti Valentin Iva Ekimova Podkrepya Dscherya Si Na Kontsert

Apr 30, 2025

Na Sveti Valentin Iva Ekimova Podkrepya Dscherya Si Na Kontsert

Apr 30, 2025 -

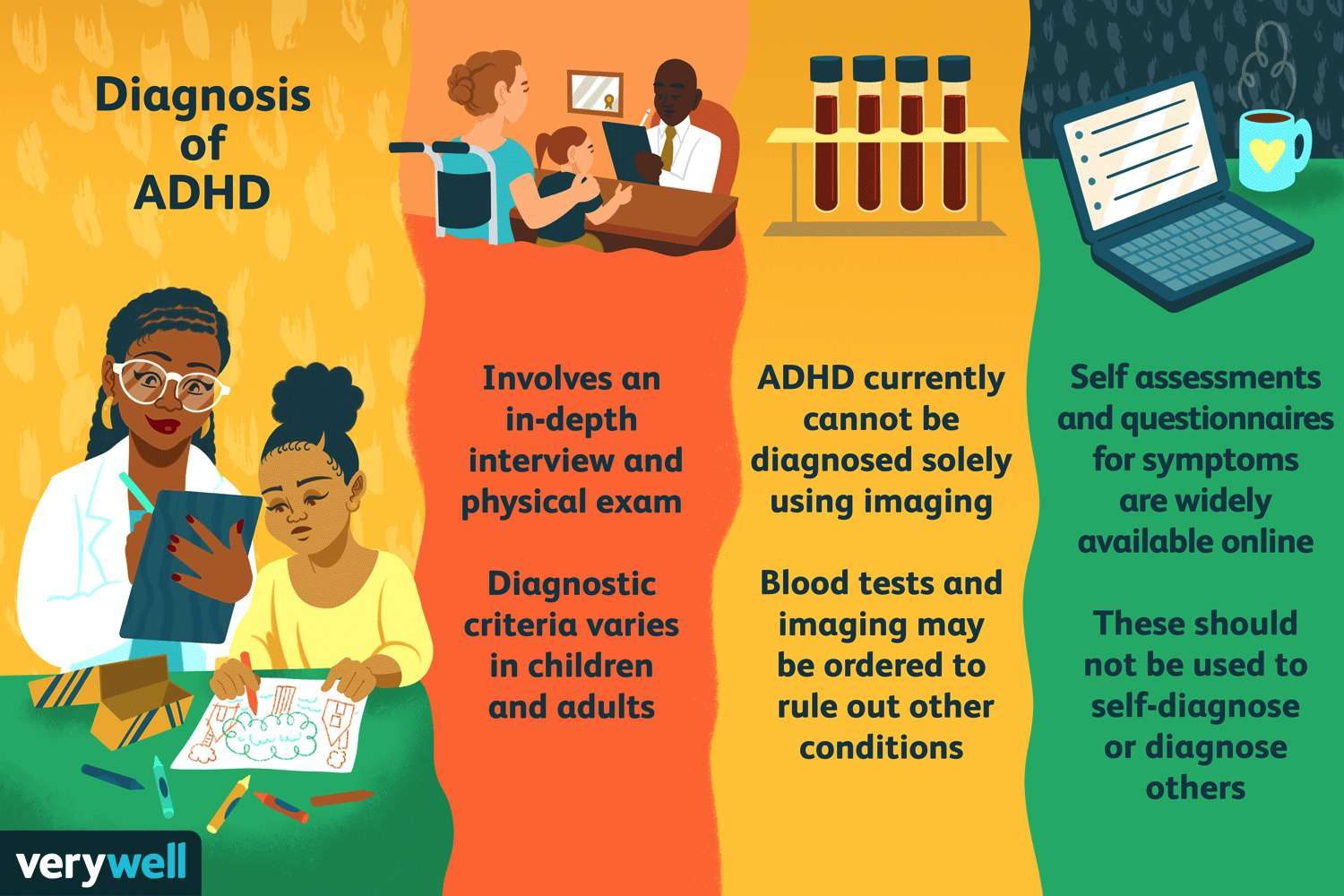

Adult Adhd Diagnosis Treatment And Support Resources

Apr 30, 2025

Adult Adhd Diagnosis Treatment And Support Resources

Apr 30, 2025 -

Duolingo And Ai The Future Of Contract Work

Apr 30, 2025

Duolingo And Ai The Future Of Contract Work

Apr 30, 2025 -

Hollywoods Double Strike What It Means For The Film Industry

Apr 30, 2025

Hollywoods Double Strike What It Means For The Film Industry

Apr 30, 2025

Latest Posts

-

Thaco Cup 2025 Lich Thi Dau Chinh Thuc Vong Chung Ket Hap Dan

Apr 30, 2025

Thaco Cup 2025 Lich Thi Dau Chinh Thuc Vong Chung Ket Hap Dan

Apr 30, 2025 -

La Flaminia Conquista La Seconda Posizione Analisi Della Rimonta

Apr 30, 2025

La Flaminia Conquista La Seconda Posizione Analisi Della Rimonta

Apr 30, 2025 -

Vong Chung Ket Tnsv Thaco Cup 2025 Xem Truc Tiep O Dau Va Khi Nao

Apr 30, 2025

Vong Chung Ket Tnsv Thaco Cup 2025 Xem Truc Tiep O Dau Va Khi Nao

Apr 30, 2025 -

Incredibile Rimonta Della Flaminia Ora E Seconda

Apr 30, 2025

Incredibile Rimonta Della Flaminia Ora E Seconda

Apr 30, 2025 -

Lich Thi Dau Thaco Cup 2025 Cap Nhat Thong Tin Tran Dau Vong Chung Ket

Apr 30, 2025

Lich Thi Dau Thaco Cup 2025 Cap Nhat Thong Tin Tran Dau Vong Chung Ket

Apr 30, 2025