Spring Budget Update: Public Concerns And Government Plans

Table of Contents

The Spring Budget announcement always generates significant public interest and debate. This year is no different, with various sectors expressing concerns about specific areas. This article delves into the key public anxieties surrounding the latest budget and examines the government's plans to address them. We'll analyze the proposed measures and their potential impact on the economy and individual citizens. Understanding the Spring Budget's implications is crucial for everyone.

Cost of Living Crisis: Public Anxiety and Government Response

The cost of living crisis remains a dominant public concern. Soaring inflation is impacting household budgets across the nation, leading to widespread anxiety and uncertainty.

Rising Inflation and its Impact

The current inflation rate, hovering around [insert current inflation rate and source], is significantly impacting household finances. This translates into substantial increases in the cost of essential goods and services.

- Increased energy costs: Energy bills have skyrocketed, leaving many families struggling to afford heating and electricity.

- Grocery price hikes: The price of everyday groceries has risen sharply, forcing families to make difficult choices about their food consumption.

- Impact on low-income families: Low-income families are disproportionately affected, facing difficult decisions between essentials like food, heating, and transportation.

- Mortgage rate increases: Rising interest rates are making mortgages more expensive, adding further strain on household budgets.

Government Measures to Combat Inflation

The government has announced several measures to combat inflation and alleviate the cost of living crisis. However, the effectiveness of these measures remains a subject of ongoing debate.

- Tax cuts: Targeted tax cuts aim to provide some financial relief to households. However, the extent of this relief is debated.

- Subsidies: Energy bill subsidies and other targeted support programs are designed to help vulnerable groups cope with rising costs. The long-term sustainability of these subsidies needs further scrutiny.

- Support for vulnerable groups: Specific support programs are designed for low-income families, pensioners, and other vulnerable groups. The accessibility and efficacy of these programs are key issues.

- Investment in renewable energy: Increased investment in renewable energy aims to reduce reliance on volatile global energy markets in the long term. This is a long-term strategy with potentially delayed impact.

Taxation Changes and Their Public Perception

The Spring Budget included several significant tax changes, sparking considerable public discussion and debate.

Changes to Income Tax, Corporation Tax, and VAT

The government has announced [specific changes to income tax, e.g., changes to tax brackets, thresholds]. [Specific changes to corporation tax, e.g., increase or decrease in rates]. [Specific changes to VAT, e.g., changes to rates on specific goods or services]. The impact of these changes varies significantly across different income groups and business sectors.

- Specific tax rate changes: Detail the precise changes to tax rates and their effective dates.

- Impact on businesses: Explain how corporation tax changes affect businesses of different sizes and industries.

- Impact on individuals: Detail how income tax changes will affect individuals across different income levels.

- Potential loopholes: Identify any potential loopholes or unintended consequences of the tax changes.

Public Response and Debate

Public reaction to the tax changes has been mixed. Media outlets have offered varied interpretations, with economists and commentators presenting diverse perspectives. Public surveys reflect a range of opinions, highlighting the complexity of the issue.

- Positive and negative feedback: Summarize the positive and negative feedback received on the tax changes.

- Arguments for and against the changes: Outline the key arguments for and against the tax changes.

- Predictions of economic impact: Analyze the predicted economic impact based on expert opinions and forecasts.

Healthcare and Public Services Funding

Funding for healthcare and other public services is another key area of public concern. The Spring Budget allocates specific funds to these sectors, but whether these allocations are sufficient remains a point of contention.

Funding Allocations and Public Needs

The budget allocates [specific amount] to healthcare and [specific amount] to other public services. These figures, compared to previous years and public demand, raise questions about their sufficiency to meet the growing needs of the population.

- Funding increases/decreases: Compare the current funding levels to previous years, highlighting any increases or decreases.

- Specific programs affected: Identify specific programs that are impacted by the funding changes.

- Potential impact on waiting times: Analyze how the funding changes may affect waiting times for healthcare and other services.

- Impact on service quality: Discuss the potential impact on the quality of services provided.

Addressing Public Concerns about NHS and Social Care

Public concerns regarding the NHS and social care are significant. These concerns include staff shortages, lengthy waiting lists, and access to quality care. The budget's response to these concerns needs careful evaluation.

- Staff shortages: Analyze the extent of staff shortages and the budget's measures to address them.

- Waiting lists: Examine the length of waiting lists and the potential impact of the funding changes.

- Access to care: Evaluate the budget's impact on access to healthcare and social care services.

- Quality of care: Assess the potential impact of the funding changes on the quality of care provided.

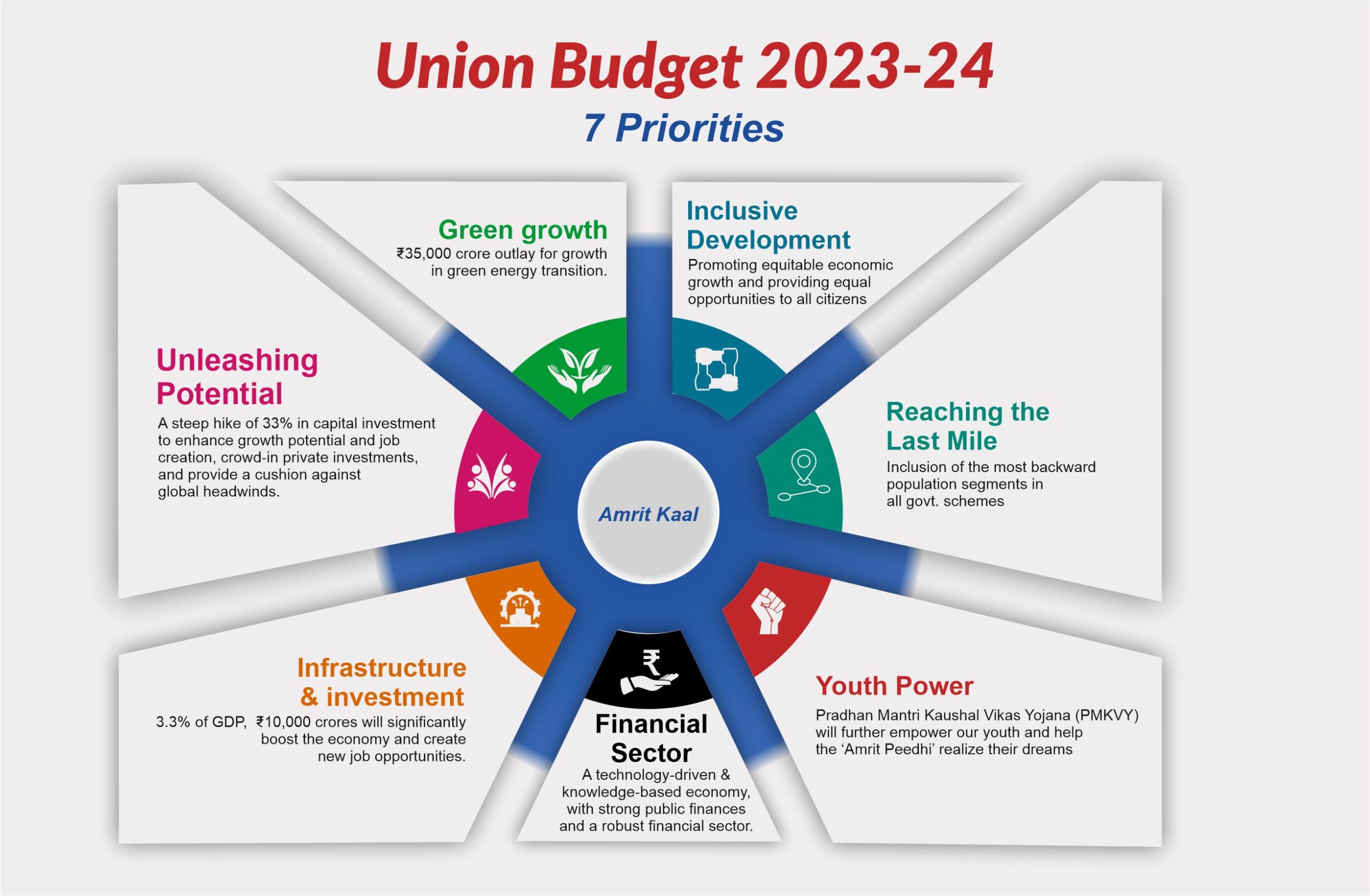

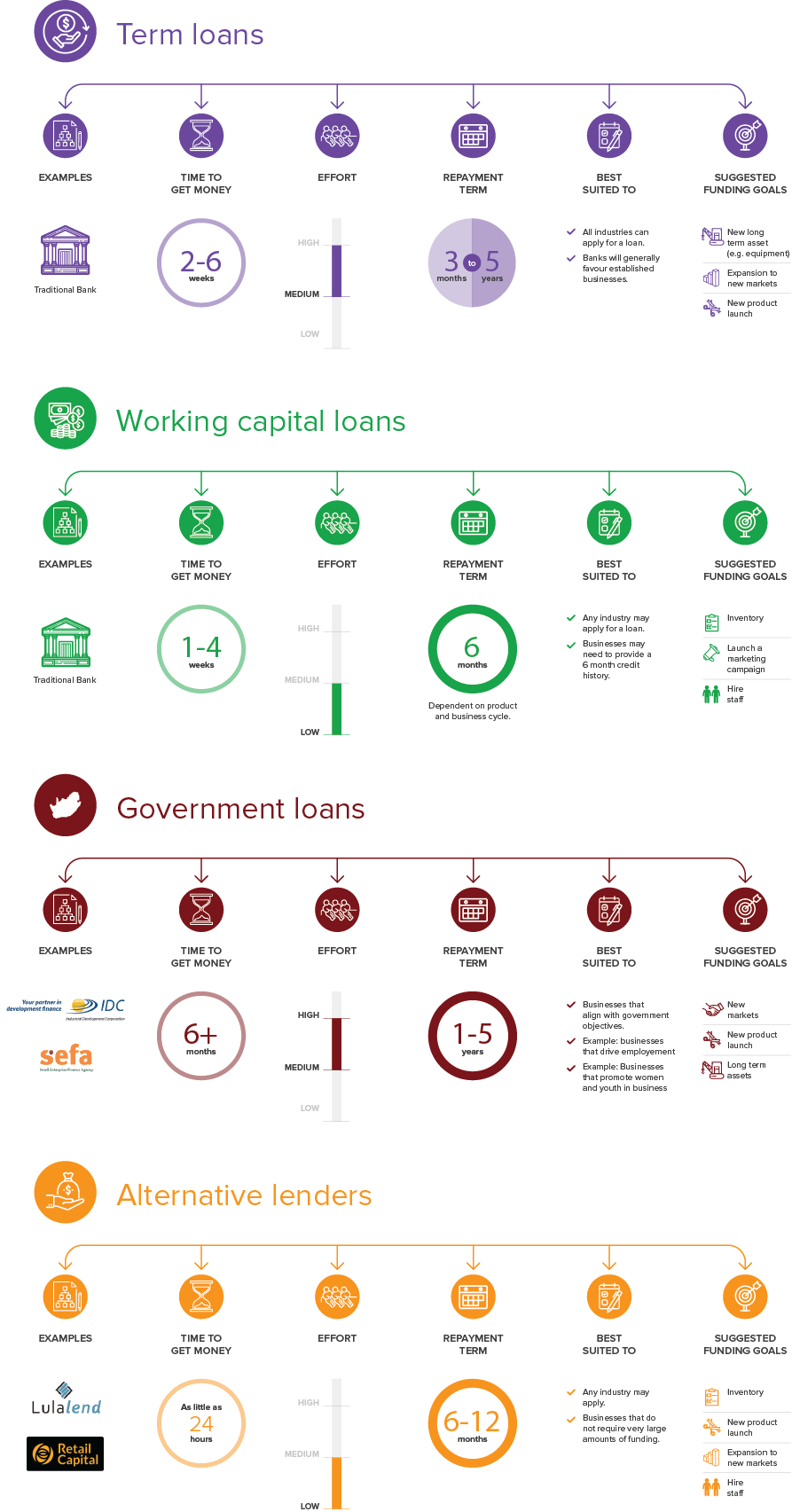

Investment in Infrastructure and Green Initiatives

The Spring Budget outlines investments in infrastructure projects and green initiatives, reflecting the government's long-term economic and environmental goals.

Government Spending on Infrastructure Projects

Significant investment is planned for various infrastructure projects.

- Specific projects: List specific infrastructure projects included in the budget, such as road improvements, transport upgrades, and broadband expansion.

- Estimated costs: Provide the estimated costs for each major infrastructure project.

- Timeline: Indicate the projected timelines for the completion of these projects.

- Projected job creation: Estimate the number of jobs expected to be created through these projects.

Commitments to Green Energy and Sustainability

The budget includes commitments to green energy and environmental sustainability. These commitments are crucial for meeting long-term environmental targets.

- Investment in renewable energy: Detail the level of investment in renewable energy sources.

- Targets for emissions reduction: Outline the government's targets for emissions reduction and how the budget contributes to achieving them.

- Policies to promote sustainability: Explain the specific policies and measures designed to promote sustainability.

Conclusion

The Spring Budget update addresses several key public concerns, including the cost of living crisis, taxation changes, and funding for healthcare and public services. The government's response includes a range of measures, but their long-term effectiveness and impact remain to be seen. Further analysis and public discourse are needed to fully evaluate the implications of this budget.

Call to Action: Stay informed about the implications of the Spring Budget update and its impact on your finances. Continue to research and engage in discussions regarding the Spring Budget to ensure your voice is heard. Further research on the specifics of the Spring Budget is crucial to understanding its full impact.

Featured Posts

-

Canada Post Daily Home Delivery A Commission Report Recommends Change

May 19, 2025

Canada Post Daily Home Delivery A Commission Report Recommends Change

May 19, 2025 -

Red Carpet Etiquette Why Guests Ignore The Rules Cnn

May 19, 2025

Red Carpet Etiquette Why Guests Ignore The Rules Cnn

May 19, 2025 -

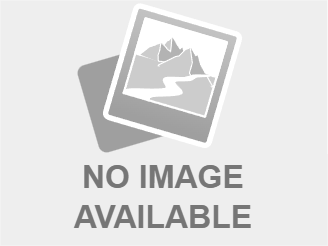

Sustainable Business Funding Options For Small And Medium Enterprises

May 19, 2025

Sustainable Business Funding Options For Small And Medium Enterprises

May 19, 2025 -

Harnessing The Power Of Mobile Marketing For E Commerce Growth

May 19, 2025

Harnessing The Power Of Mobile Marketing For E Commerce Growth

May 19, 2025 -

Luca Haenni And Eurovision 2025 Whats His Involvement

May 19, 2025

Luca Haenni And Eurovision 2025 Whats His Involvement

May 19, 2025