SSE Cuts £3 Billion Spending: Impact On Growth And Future Plans

Table of Contents

SSE's dramatic £3 billion reduction in capital expenditure sends shockwaves through the energy sector, raising crucial questions about its future growth trajectory. This significant announcement by the energy giant has far-reaching implications for its operations, its commitment to renewable energy, and the broader UK energy market. This article will analyze the impact of this £3 billion spending cut on SSE's growth and future plans.

<h2>The Reasons Behind the £3 Billion Spending Reduction</h2>

Several factors have contributed to SSE's decision to slash its capital expenditure by £3 billion. This substantial reduction reflects a complex interplay of economic challenges, regulatory changes, and a strategic re-evaluation of the company's investment priorities.

<h3>Economic Headwinds and Inflationary Pressures</h3>

Soaring inflation and rising interest rates have significantly impacted SSE's investment decisions. The increased cost of borrowing, coupled with higher material and labor costs, has made many projects financially less viable.

- Increased material costs: The price of essential materials, such as steel and copper, has risen dramatically, increasing the overall cost of energy projects. Estimates suggest a 20-30% increase in material costs in the last year alone.

- Labor shortages: A skills shortage within the energy sector is further driving up labor costs and potentially delaying project timelines.

- Supply chain disruptions: Ongoing global supply chain disruptions continue to impact project delivery, adding delays and increasing costs.

<h3>Shifting Regulatory Landscape and Policy Changes</h3>

The evolving regulatory environment and policy changes within the UK energy sector have also played a crucial role. SSE's investment strategy is being reshaped in response to these evolving parameters.

- New renewable energy targets: The UK government's ambitious renewable energy targets require significant investment, but the current economic climate has likely made achieving these targets more challenging for SSE.

- Changes in carbon emission regulations: Stricter carbon emission regulations are forcing energy companies to reassess their investment portfolios and prioritize projects that align with sustainability goals. This may have influenced the decision to cut spending on certain fossil fuel-related projects.

<h3>Strategic Re-evaluation and Prioritization of Projects</h3>

SSE is likely re-evaluating its project portfolio to focus on projects that offer the highest returns and strategic importance. This involves a careful prioritization process.

- Postponed or cancelled projects: The £3 billion cut suggests that several projects, potentially some less profitable or higher-risk ventures, have been delayed or cancelled altogether.

- Long-term strategic goals: This strategic shift reflects SSE's commitment to adapting to the changing energy landscape and ensuring long-term financial stability. The focus is now likely on projects that directly support the transition to a low-carbon future.

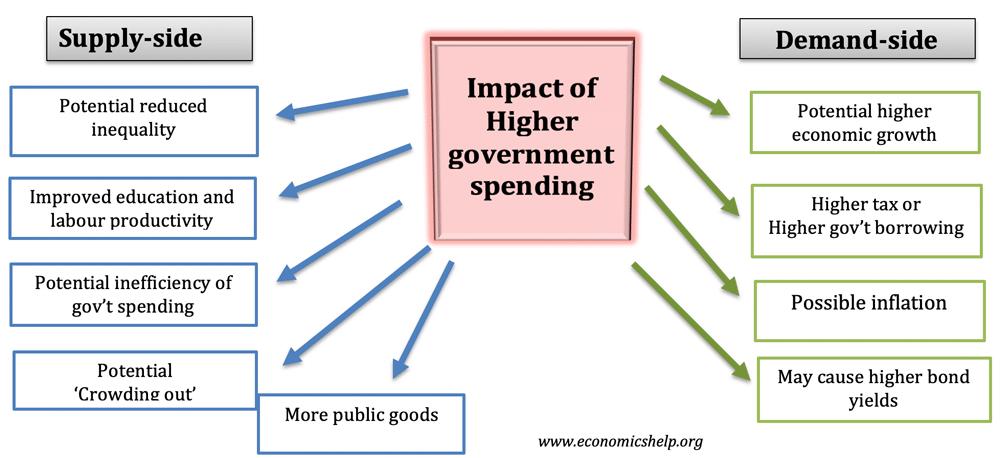

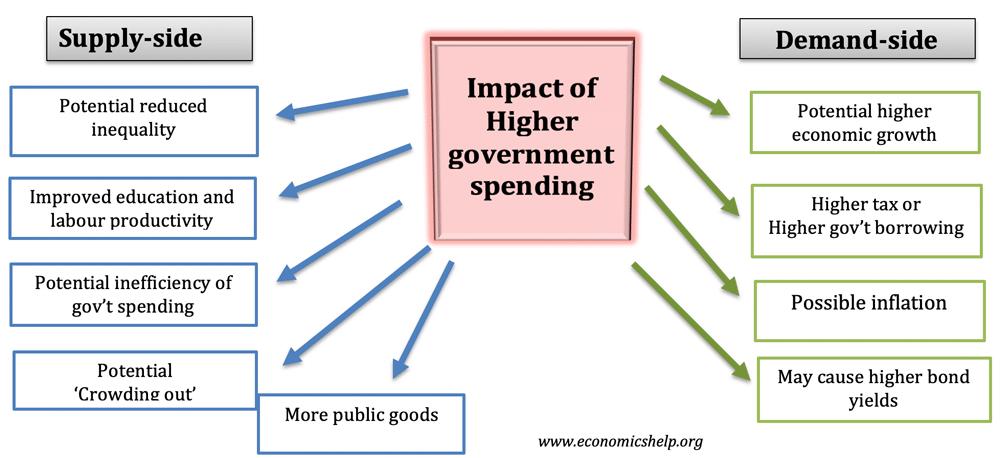

<h2>Impact on SSE's Growth and Investment in Renewables</h2>

The £3 billion spending reduction will undoubtedly have significant impacts on SSE's growth and its investment in renewable energy projects, both in the short and long term.

<h3>Short-Term Effects on Revenue and Profitability</h3>

The immediate consequence of the spending cuts will likely be a reduction in short-term growth and potential impact on shareholder returns.

- Potential reduction in short-term growth: Reduced capital expenditure directly translates to fewer projects underway, resulting in a slowdown of revenue generation in the near future.

- Impact on shareholder returns: Investors may experience reduced returns in the short term due to the decrease in investment and potentially slower profit growth.

- CAPEX reduction: The significant reduction in capital expenditure (CAPEX) will impact immediate growth figures.

<h3>Long-Term Implications for Renewable Energy Investments</h3>

While the immediate impact may appear negative, the long-term implications for renewable energy investments remain uncertain.

- Potential delays in renewable energy projects: The spending cuts could lead to delays or cancellations of some renewable energy projects, potentially hindering SSE's progress toward its sustainability targets.

- Impact on meeting sustainability targets: The delay or cancellation of renewable energy projects could impact SSE's ability to meet its own sustainability goals and contribute to the UK's overall renewable energy targets.

- Impact on job creation and the UK's energy transition: Reduced investment in renewable energy could negatively impact job creation within the green energy sector and potentially slow down the UK's transition to cleaner energy sources.

<h3>Competitive Landscape and Market Share</h3>

SSE's position in the competitive energy market will be significantly affected by this decision.

- Comparison with competitor strategies: SSE's competitors might capitalize on this situation, potentially expanding their market share by aggressively pursuing new projects.

- Potential loss of market share: The reduced investment could potentially lead to a loss of market share in certain sectors.

- Impact on consumer energy prices: The long-term impact on consumer energy prices is uncertain but could be influenced by SSE's reduced investment capacity and its impact on energy supply.

<h2>SSE's Future Plans and Adaptability</h2>

Despite the challenges, SSE needs to demonstrate adaptability and develop effective strategies to navigate this period of reduced spending.

<h3>Revised Investment Strategy and Portfolio Optimization</h3>

SSE will likely focus on optimizing its existing assets and implementing cost-reduction measures.

- Focus on operational efficiency: SSE might prioritize measures to improve operational efficiency in its existing infrastructure to maximize returns.

- Asset optimization: A thorough review and optimization of existing assets will be crucial to maximizing returns from current investments.

- Cost reduction measures: Implementing robust cost-reduction strategies across all departments will be crucial for maintaining financial stability.

<h3>Exploration of Alternative Funding Sources</h3>

Exploring alternative funding sources will be crucial for SSE to secure capital for future projects.

- Potential partnerships: Strategic partnerships with other companies in the energy sector could provide access to additional funding and expertise.

- Joint ventures: Joint ventures could allow SSE to share the financial risks and rewards of major projects.

- Private equity investment: Seeking investment from private equity firms could provide access to substantial capital for future development.

<h3>Communication with Stakeholders and Investor Relations</h3>

Maintaining transparent communication with investors and the public is paramount.

- Importance of maintaining investor confidence: Clear and consistent communication is vital for maintaining investor confidence during this period of adjustment.

- Strategies for communicating the changes: SSE needs to effectively communicate the reasons behind the spending cuts and outline its future plans to reassure stakeholders.

<h2>Conclusion: Analyzing the Future of SSE After its £3 Billion Spending Cut</h2>

SSE's £3 billion spending cut is a significant event with potential short and long-term consequences. The decision was driven by a combination of economic headwinds, regulatory changes, and a strategic reassessment of its investment portfolio. While this may lead to short-term challenges regarding growth and profitability, the company's long-term adaptability and its focus on exploring alternative funding mechanisms will be key determinants of its future success. The impact on renewable energy investments and the UK's energy transition remains to be seen. The competitive landscape will also be significantly reshaped. Stay updated on the evolving situation by following our future articles on SSE and its strategic responses to the changing energy landscape.

Featured Posts

-

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025 -

Memorial Day 2025 Air Travel When To Expect The Most Crowds

May 24, 2025

Memorial Day 2025 Air Travel When To Expect The Most Crowds

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Savannah Guthries Replacement Co Host A Mid Week Shake Up

May 24, 2025

Savannah Guthries Replacement Co Host A Mid Week Shake Up

May 24, 2025 -

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025

Latest Posts

-

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025 -

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025