SSE's £3 Billion Spending Cut: A Response To Economic Slowdown

Table of Contents

Reasons Behind the SSE Spending Cut

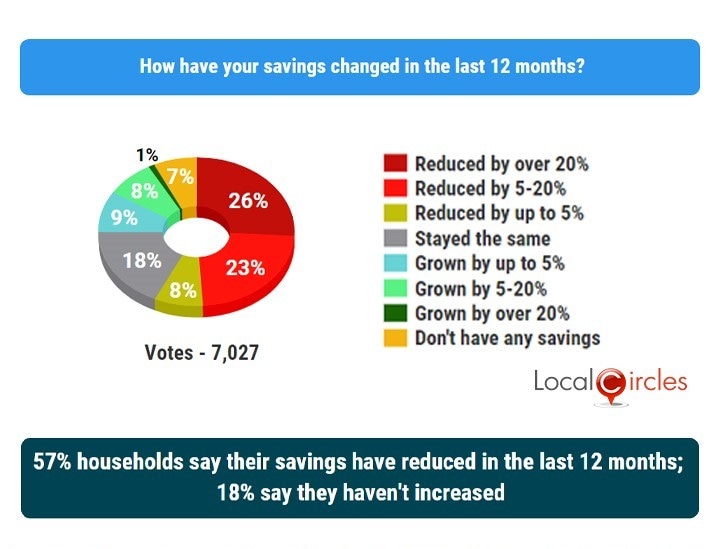

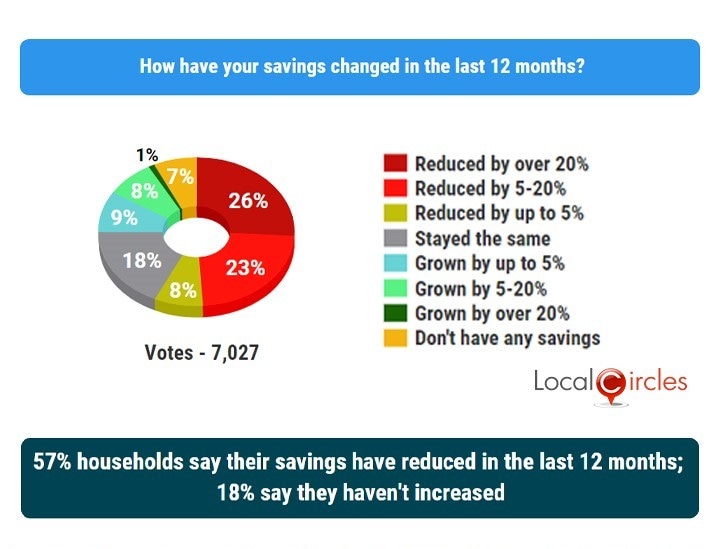

Several factors have contributed to SSE's decision to implement this significant £3 billion spending cut. The current economic uncertainty, characterized by high inflation, rising interest rates, and volatile energy prices, presents a formidable challenge for businesses across all sectors, but particularly those with large capital expenditure plans like SSE. These macroeconomic headwinds have directly impacted SSE's ability to confidently proceed with planned investments.

- Increased cost of borrowing: Higher interest rates make borrowing money for large-scale projects considerably more expensive, increasing the overall cost and potentially reducing profitability. This directly impacts SSE's ability to finance ambitious renewable energy projects and infrastructure upgrades.

- Uncertainty in energy markets: Fluctuations in energy prices and demand create significant uncertainty in revenue projections, making long-term investment decisions riskier. Predicting future returns on investment has become increasingly difficult in this volatile market.

- Government regulations and potential changes: The regulatory landscape for the energy sector is constantly evolving. Changes in government policy and regulations can significantly impact the viability of existing and planned projects, adding another layer of uncertainty for SSE. This uncertainty compels a more cautious approach to investment.

- Need to prioritize existing projects and maintain financial stability: In the face of economic headwinds, SSE needs to prioritize its existing projects and ensure its own financial stability. This necessitates a strategic reassessment of planned investments to focus on core operations and mitigate financial risks.

Impact on SSE's Future Projects and Investments

The £3 billion spending cut will inevitably impact SSE's future projects and investments. While the specific details of which projects will be affected remain to be seen, it's likely that some initiatives will be delayed, scaled back, or even cancelled altogether. This will particularly affect SSE's ambitious plans for renewable energy expansion and network infrastructure upgrades.

- Potential delays in renewable energy projects: Projects involving wind, solar, and other renewable energy sources are likely to experience delays or reduced investment. This could slow the UK's progress towards its net-zero targets.

- Reduced investment in grid infrastructure modernization: Modernizing the UK's energy grid is crucial for integrating renewable energy sources and ensuring energy security. The spending cut may lead to slower progress in upgrading the national grid infrastructure.

- Impact on job creation and employment: Reduced investment can translate to fewer job opportunities within SSE and related industries, potentially impacting employment across the supply chain. This has implications for local economies reliant on SSE's activities.

- Revised timelines for key infrastructure developments: Projects already underway may experience extended timelines, affecting the overall delivery schedule of crucial energy infrastructure projects across the UK.

Wider Implications for the Energy Sector and UK Economy

SSE's decision has broader implications for the UK energy sector and the wider economy. The reduced investment could impact the overall investment climate, potentially discouraging further investment in crucial energy infrastructure and hindering the transition to a cleaner energy system.

- Reduced investment in crucial energy infrastructure impacting long-term energy security: A slowdown in investment in energy infrastructure could compromise the UK's long-term energy security and resilience. This is especially pertinent given the ongoing energy crisis.

- Potential slowdown in the transition to renewable energy sources: Delays in renewable energy projects could slow the UK's progress toward its climate change goals and its commitment to net-zero emissions.

- Impact on economic growth and job creation within the energy sector: Reduced investment will have a ripple effect, impacting economic growth and job creation within the energy sector and related industries. This can exacerbate existing economic challenges.

- Potential for government intervention to stimulate investment: The government might need to intervene with policy measures to stimulate investment in the energy sector and mitigate the negative consequences of reduced private investment.

Conclusion

SSE's £3 billion spending cut represents a significant response to the current economic slowdown. The decision highlights the considerable challenges facing the energy sector, driven by economic uncertainty, rising costs, and regulatory considerations. This reduction in planned investment has significant implications for SSE's future projects, the UK's energy transition, and the broader economic outlook. The impact on job creation, energy security, and the achievement of net-zero targets remains a significant concern. Stay tuned for further updates on SSE's response to the economic slowdown and the impact of this significant £3 billion spending cut. Learn more about the challenges facing the UK energy sector and the implications of reduced investment in crucial infrastructure by following industry news and government reports.

Featured Posts

-

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 24, 2025 -

Dax Vs Wall Street Analyzing The Potential For A Market Shift

May 24, 2025

Dax Vs Wall Street Analyzing The Potential For A Market Shift

May 24, 2025 -

Process Orchestration At Camunda Con 2025 Amsterdam Driving Ai And Automation Success

May 24, 2025

Process Orchestration At Camunda Con 2025 Amsterdam Driving Ai And Automation Success

May 24, 2025 -

Ferraris 10 Fastest Production Models Fiorano Track Times

May 24, 2025

Ferraris 10 Fastest Production Models Fiorano Track Times

May 24, 2025 -

The Woody Allen Controversy Sean Penns Support And The Publics Reaction

May 24, 2025

The Woody Allen Controversy Sean Penns Support And The Publics Reaction

May 24, 2025

Latest Posts

-

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025 -

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025