SSE's Financial Strategy Shift: £3 Billion Spending Reduction Explained

Table of Contents

Reasons Behind the £3 Billion Spending Reduction

The £3 billion spending reduction reflects a multifaceted response to challenging economic conditions and a strategic reassessment of SSE's investment portfolio. Several key factors contributed to this decision:

-

Increased Inflationary Pressures and Rising Interest Rates: The current economic climate is characterized by significant inflationary pressures and sharply increased interest rates. This has made securing financing for large-scale projects considerably more expensive and significantly impacted the viability of several planned investments. The higher cost of capital makes many projects less attractive from a return-on-investment perspective.

-

Reassessment of Long-Term Return on Investment: SSE has undertaken a thorough review of its planned capital expenditure (CAPEX), focusing on the long-term profitability and strategic alignment of each project. This review resulted in the identification of several projects with lower projected returns, prompting the decision to either delay or cancel them. This rigorous approach to investment prioritization is crucial for maintaining financial stability.

-

Strategic Focus on Core Business Areas: The company is refocusing its efforts on its core competencies and most profitable business areas. This entails prioritizing investments that directly support these core areas and contribute most significantly to the long-term financial health of the company. This prioritization process resulted in the divestment or deferral of certain less strategic projects.

-

Changes in the Regulatory Environment: The regulatory landscape for the energy sector is constantly evolving. Changes in government policies and investment incentives have influenced SSE's investment decisions, affecting the attractiveness of certain projects and prompting a recalibration of its overall strategy.

-

Enhanced Cost Optimization and Efficiency Improvements: Alongside investment cuts, SSE is implementing measures to improve operational efficiency and reduce overall costs. This includes streamlining processes, optimizing resource allocation, and exploring opportunities for technological innovation to reduce expenditures across various departments.

-

Shift Towards More Profitable and Sustainable Energy Ventures: The £3 billion spending reduction also reflects a shift towards more profitable and sustainable energy sources. This includes focusing investment on projects with faster returns and greater long-term sustainability, such as onshore wind and solar power.

Impact on SSE's Investment Portfolio

The £3 billion spending reduction will inevitably impact SSE's investment portfolio. While the company remains committed to its renewable energy goals, some projects will face delays or cancellations:

-

Delays or Cancellations of Less Profitable Renewable Energy Projects: Projects deemed less profitable or strategically less important will be delayed or cancelled outright to free up capital for more promising ventures. This selective approach ensures that resources are directed towards projects with the highest potential for return.

-

Reduced Investment in Network Infrastructure Upgrades (Short-Term): While crucial for long-term reliability, some planned network infrastructure upgrades may be delayed in the short term to reallocate funds to higher-priority projects. This short-term reduction will not compromise the long-term reliability and resilience of the network.

-

Refocusing Investment Towards More Efficient and Profitable Renewable Energy Projects: The company will prioritize investment in more efficient and commercially viable renewable energy sources, such as onshore wind farms and solar power plants, aligning with its commitment to sustainable energy generation.

-

Prioritization of Projects with Quicker Returns on Investment: The focus will be on projects offering quicker returns on investment, enabling a faster recovery of capital and improved financial stability. This pragmatic approach will help the company navigate the current economic uncertainty.

-

Potential Impact on Job Creation (Delayed or Cancelled Projects): The delay or cancellation of projects may have implications for job creation in the short term. However, SSE has committed to managing this transition responsibly and exploring opportunities for retraining and redeployment of affected employees.

Potential Effects on Consumers and Investors

The financial strategy shift will have ramifications for both consumers and investors:

-

Potential Short-Term Impact on Energy Prices: The spending reduction might indirectly influence energy prices in the short term. However, SSE is committed to passing on the benefits of cost savings to consumers wherever possible.

-

Analysis of Potential Changes to Customer Bills: The relationship between this £3 billion spending reduction and customer bills requires close monitoring. The company will likely emphasize its efforts to maintain affordability while navigating the challenges posed by the current economic environment.

-

Impact on Investor Confidence and SSE's Share Price: The announcement has prompted volatility in SSE's share price. Investor confidence will be dependent on the company’s ability to demonstrate the strategic benefits of its decision and its continued progress towards its long-term goals.

-

Potential Adjustments to Dividend Payments: The company may need to adjust dividend payments to shareholders to reflect its revised financial outlook and commitment to maintaining a strong balance sheet.

-

Alignment with Wider Regulatory Objectives: The changes implemented by SSE must align with the broader regulatory objectives for the energy sector, emphasizing sustainable practices and responsible energy production.

SSE's Future Strategy and Long-Term Goals

SSE's revised strategy is focused on long-term sustainability and growth:

-

Alignment with SSE's Long-Term Sustainability Goals and Net-Zero Targets: The £3 billion spending reduction is intrinsically linked to SSE's long-term commitment to net-zero emissions. It allows the company to focus resources on projects that are both commercially viable and contribute to achieving this critical target.

-

Revised Strategic Priorities and Future Business Plans: SSE’s revised strategic priorities centre around maximizing the profitability of its core businesses and making informed investment decisions that create long-term value for its shareholders. Its future business plans will reflect these priorities and leverage the company’s strengths in the energy transition.

-

Positioning for Future Growth and Competitiveness: The company’s strategic restructuring aims to strengthen its financial position and ensure it remains a competitive force within the evolving energy market. The focus on profitable ventures positions SSE for significant future growth.

-

Enhanced Financial Stability: The primary objective of this restructuring is to enhance SSE's financial stability, enabling the company to navigate the current economic uncertainties and continue its pursuit of its long-term strategic goals.

Conclusion

SSE's £3 billion spending reduction represents a significant strategic recalibration, responding to economic pressures and a reassessment of investment priorities. While this decision may lead to short-term impacts, particularly regarding certain projects and potential energy price adjustments, the long-term aim is to improve financial stability, focus resources on high-return ventures, and accelerate the transition towards a sustainable energy future. Understanding this SSE financial strategy shift is crucial for all stakeholders. To stay updated on this evolving situation and the detailed implications of this £3 billion spending reduction, continue to follow SSE's official announcements and relevant financial news outlets.

Featured Posts

-

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 23, 2025

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 23, 2025 -

Co Hosts Comment On Today Show Anchors Extended Leave

May 23, 2025

Co Hosts Comment On Today Show Anchors Extended Leave

May 23, 2025 -

Massive V Mware Price Increase At And T On Broadcoms Proposed 1 050 Jump

May 23, 2025

Massive V Mware Price Increase At And T On Broadcoms Proposed 1 050 Jump

May 23, 2025 -

Hemen Intikam Alan Burclar Ihanete Karsi Gec Kalmayanlar

May 23, 2025

Hemen Intikam Alan Burclar Ihanete Karsi Gec Kalmayanlar

May 23, 2025 -

Inflations Grip How It Affects Auto Theft Prevention In Canada

May 23, 2025

Inflations Grip How It Affects Auto Theft Prevention In Canada

May 23, 2025

Latest Posts

-

Sylvester Stallones Tulsa King Season 3 Neal Mc Donoughs Return And Filming Updates

May 23, 2025

Sylvester Stallones Tulsa King Season 3 Neal Mc Donoughs Return And Filming Updates

May 23, 2025 -

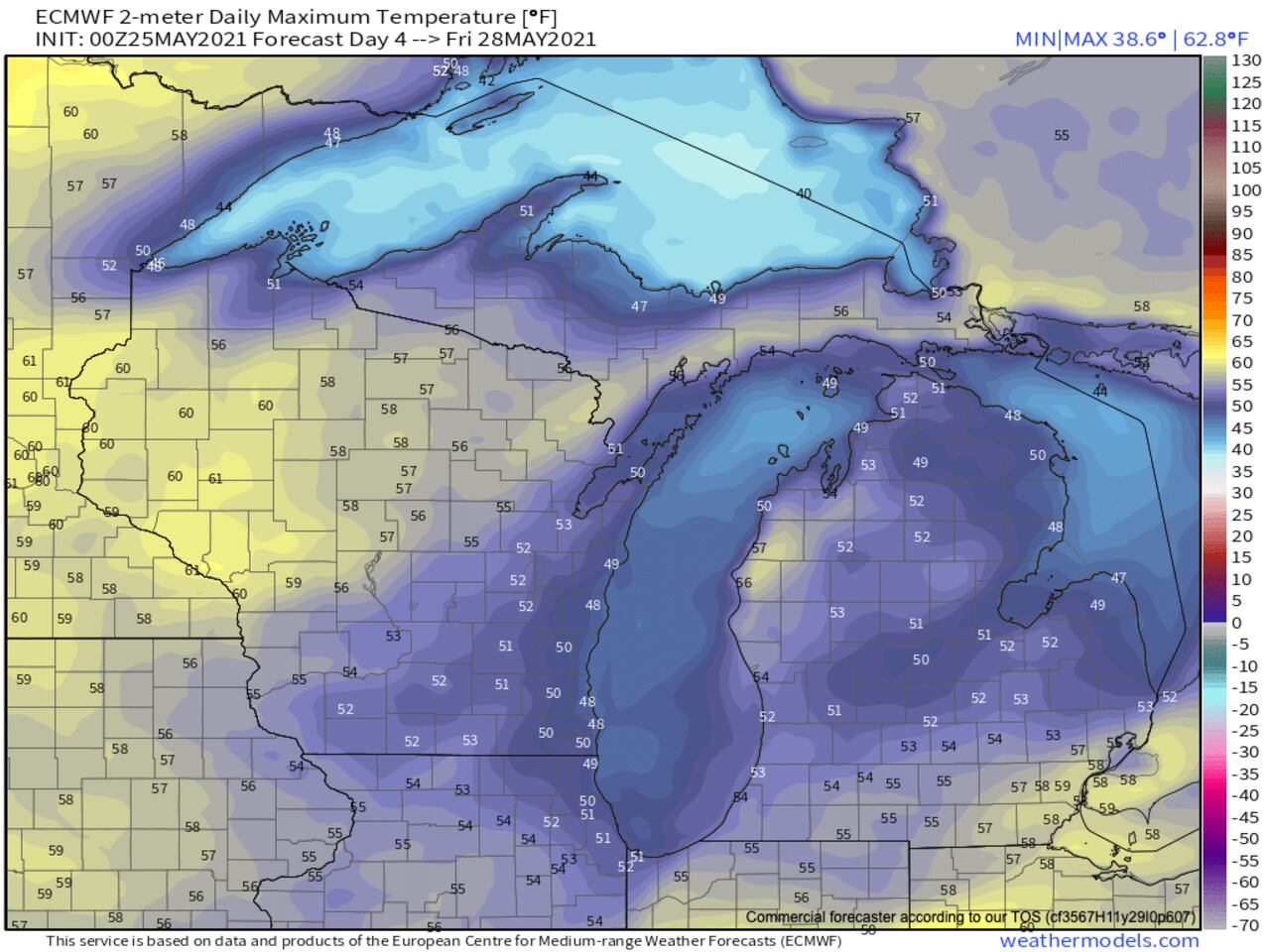

New York City Memorial Day Weekend Weather Forecast And Rain Probability

May 23, 2025

New York City Memorial Day Weekend Weather Forecast And Rain Probability

May 23, 2025 -

Gas Prices Plunge Memorial Day Weekend Savings

May 23, 2025

Gas Prices Plunge Memorial Day Weekend Savings

May 23, 2025 -

Gas Prices To Plunge For Memorial Day Weekend

May 23, 2025

Gas Prices To Plunge For Memorial Day Weekend

May 23, 2025 -

Memorial Day Travel Gas Prices At Their Lowest

May 23, 2025

Memorial Day Travel Gas Prices At Their Lowest

May 23, 2025