Starving For Less: When A Wife Earns Less Than Her A-List Husband

Table of Contents

The Societal Pressure Cooker: Expectations and the Illusion of Wealth

Societal expectations place immense pressure on wives, especially those married to high-earners. The expectation is often to maintain a lifestyle that reflects the husband's income, regardless of the wife's own earnings. This can create a significant financial strain and a disconnect between public perception and private financial realities. The stigma associated with a wife earning less than her husband can also contribute to feelings of inadequacy and pressure to conform to traditional gender roles.

- Examples of societal pressures: Maintaining a luxurious home, funding expensive vacations, covering childcare costs, and contributing to philanthropic endeavors can quickly outpace a wife's income, especially when the husband's career is demanding and unpredictable.

- The disconnect between public perception and private financial realities: Social media often portrays an idealized version of wealth, leading to comparisons and feelings of inadequacy. The reality might be far different, with financial strain impacting daily life.

- The stigma associated with a wife earning less than her husband: Traditional gender roles still influence societal expectations, leading to judgment and pressure on women who prioritize family or personal pursuits over a high-earning career.

Navigating Financial Independence: Strategies for Women in the Spotlight

For women in high-profile relationships where a wife earns less than her husband, achieving financial independence requires proactive financial planning and a clear understanding of their financial situation. Financial literacy is crucial in navigating these complex financial landscapes.

- Creating a realistic household budget: Acknowledging the income disparity is the first step. A budget should reflect both incomes and allocate funds to essential expenses, savings, and personal goals.

- Exploring avenues for personal income generation: Side hustles, freelance work, and investments can supplement income and build financial security, bolstering personal financial independence.

- Seeking professional financial advice: High-net-worth individuals benefit from financial advisors specializing in wealth management and estate planning who can tailor strategies to their unique circumstances.

- Open communication and financial transparency within the marriage: Honest conversations about finances are essential for building a strong and supportive partnership. Transparency avoids misunderstandings and facilitates collaborative financial decision-making.

Beyond the Paycheck: The Importance of Personal Fulfillment

Financial independence is not solely about money; it's also about personal growth and fulfillment. Maintaining personal goals and passions is vital for well-being, regardless of income levels. Focusing on personal growth contributes to a stronger sense of self-worth, independent of financial contribution to the household.

- Pursuing hobbies and interests: Engaging in activities outside of the relationship helps maintain a sense of self and prevents feelings of being defined solely by one's role as a wife.

- The value of volunteer work or community involvement: Contributing to a cause beyond the family unit builds a sense of purpose and connects individuals to a wider community.

- Prioritizing personal well-being and mental health: Self-care is crucial in managing the pressures associated with income disparity and maintaining emotional balance.

- Developing a strong sense of self-worth: Recognizing one's intrinsic value independent of financial contribution is essential for long-term well-being and a fulfilling life.

Legal and Tax Implications: Protecting Your Financial Future

Couples with significant income disparities should understand the legal and tax implications of their financial situation. Proactive legal and financial planning can significantly impact future security. Seeking professional advice is crucial in navigating this complex area.

- The importance of prenuptial agreements: These agreements protect individual assets and ensure financial security in the event of separation or divorce.

- Understanding tax implications for married couples with differing incomes: Tax laws can impact joint filing status, deductions, and overall tax burden, necessitating professional tax advice.

- The role of estate planning: Proper estate planning, including wills and trusts, ensures the distribution of assets according to one's wishes and protects the financial well-being of family members.

Finding Balance When a Wife Earns Less Than Her Husband

Navigating a situation where a wife earns less than her husband presents unique challenges, including societal pressures, financial complexities, and the importance of personal fulfillment. Financial literacy, proactive financial planning, and open communication are crucial for building a strong and balanced partnership. Prioritizing personal well-being and seeking professional financial and legal advice are essential steps toward achieving financial independence and a fulfilling life. Take control of your financial future by exploring resources for financial planning tailored to high-net-worth couples, seeking professional advice on managing household finances, and prioritizing your personal well-being. Remember, financial independence for wives is achievable, even when a wife earns less than her husband.

Featured Posts

-

Get Ready For Nos Alive 2025 Headliners Lineup And Ticket Sales

May 19, 2025

Get Ready For Nos Alive 2025 Headliners Lineup And Ticket Sales

May 19, 2025 -

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025

What Bothered Gilbert Burns More Than His Losses To Chimaev Della Maddalena And Muhammad

May 19, 2025 -

Ufc 313 Results Questioned Fighters Honest Admission

May 19, 2025

Ufc 313 Results Questioned Fighters Honest Admission

May 19, 2025 -

Lipscomb University Ncaa Tournament History A Complete Bracketology Update

May 19, 2025

Lipscomb University Ncaa Tournament History A Complete Bracketology Update

May 19, 2025 -

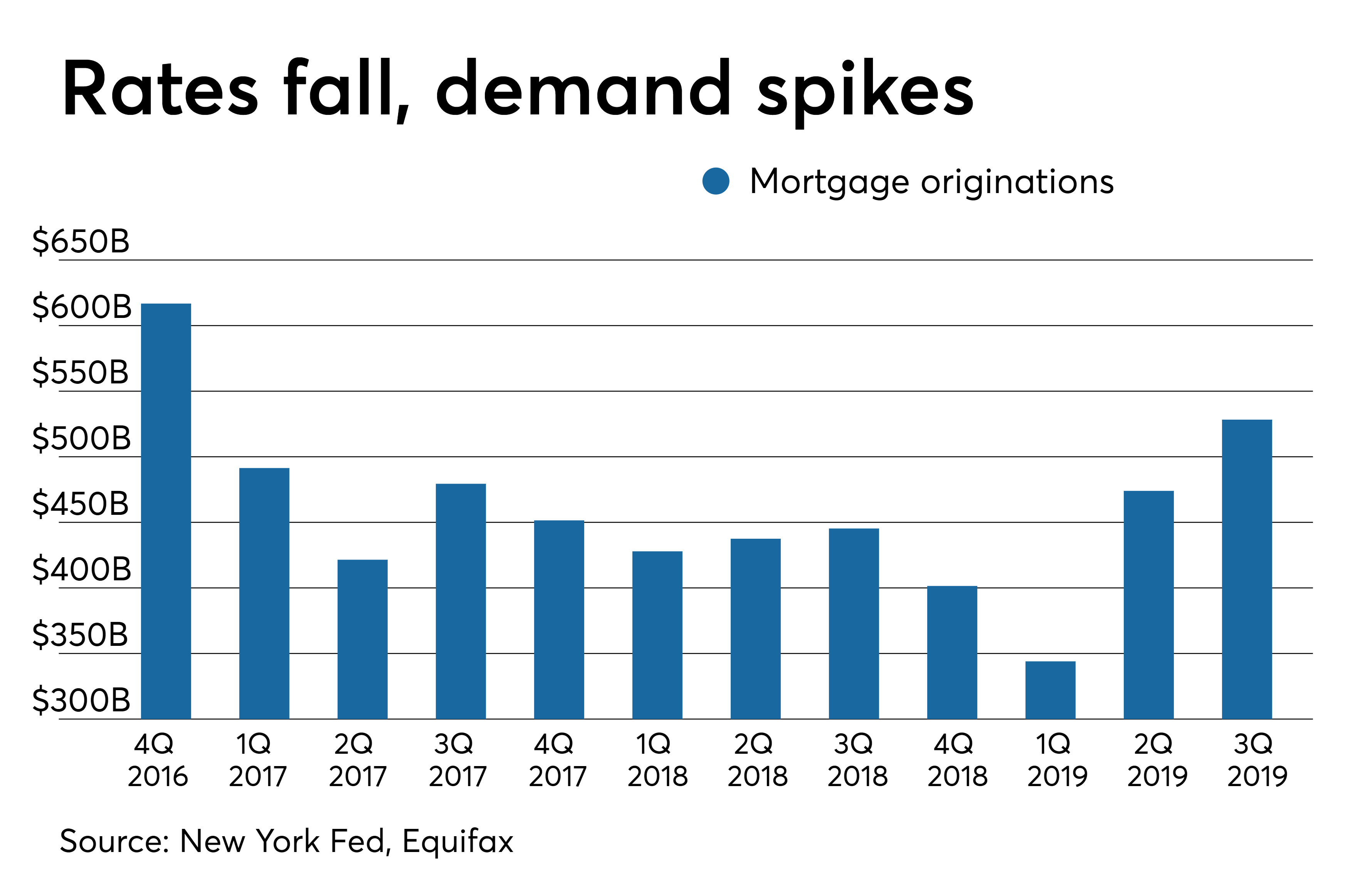

The Impact Of National Debt On Mortgage Interest Rates And Availability

May 19, 2025

The Impact Of National Debt On Mortgage Interest Rates And Availability

May 19, 2025