Stealth Wealth: Uncovering The Methods Of The Quietly Rich

Table of Contents

Strategic Investing Beyond the Spotlight

The quietly rich understand that building substantial wealth requires a sophisticated investment strategy that goes beyond simply buying individual stocks. It's about carefully managing risk and ensuring long-term growth.

Diversification and Risk Management

The foundation of stealth wealth is diversification. Putting all your eggs in one basket is a recipe for disaster. The quietly rich utilize a variety of asset classes to mitigate risk and maximize returns.

- Diversification across asset classes: This includes stocks, bonds, real estate, private equity, and alternative investments. A well-diversified portfolio spreads risk across different market sectors, reducing the impact of any single investment's underperformance.

- Hedging against inflation: Inflation erodes purchasing power over time. The wealthy often invest in assets that tend to perform well during inflationary periods, such as real estate and commodities.

- Utilizing professional financial advisors: Seeking advice from experienced financial planners provides a personalized strategy tailored to individual financial goals and risk tolerance.

A long-term investment horizon is crucial. Market fluctuations are inevitable, but a patient approach allows investors to weather the storms and benefit from the power of compounding. A well-balanced portfolio, designed to withstand market volatility, is essential for building and protecting stealth wealth.

Understanding Passive Income Streams

Passive income is the cornerstone of building wealth silently. It's about generating income without requiring constant active involvement. This allows for continued wealth accumulation even while pursuing other interests or engaging in other income-generating activities.

- Real Estate Investment Trusts (REITs): REITs offer exposure to the real estate market without the direct responsibilities of property management.

- Dividend-paying stocks: These stocks provide a regular stream of income, supplementing other investment returns.

- Royalties: Creating and licensing intellectual property, such as books, music, or software, generates ongoing income.

- Creating and selling digital products: Ebooks, online courses, and software applications can provide passive income streams.

- Affiliate marketing: Promoting other companies' products or services and earning a commission on sales.

Each of these passive income streams contributes to wealth generation without demanding constant active management, allowing for a more relaxed and less public approach to wealth building.

Mindful Spending and Debt Avoidance

Stealth wealth isn't about deprivation; it's about conscious spending. It's about prioritizing long-term financial security over immediate gratification.

The Power of Frugal Living

Frugal living isn't about sacrificing happiness; it's about making informed choices.

- Avoiding unnecessary luxury purchases: Focusing on needs over wants frees up capital for investment.

- Prioritizing needs over wants: Differentiating between essential and non-essential spending is key.

- Focusing on value rather than brand names: Quality doesn't always come with a premium price tag.

- Practicing mindful consumption: Making conscious purchasing decisions reduces impulsive spending.

Conscious spending habits free up significant capital for investment and accelerate wealth accumulation.

Eliminating High-Interest Debt

High-interest debt is a major obstacle to wealth building. It consumes a significant portion of income, hindering the ability to save and invest.

- Prioritizing high-interest debt repayment: Focus on paying off debts with the highest interest rates first.

- Creating a structured debt repayment plan: Developing a budget and sticking to it.

- Seeking professional financial advice for debt consolidation: Consolidating multiple debts into a single loan can simplify repayment.

The snowball and avalanche methods are popular techniques for debt repayment. The snowball method focuses on paying off the smallest debts first for motivation, while the avalanche method prioritizes debts with the highest interest rates to minimize overall interest paid. Debt freedom is a critical step toward building stealth wealth.

Protecting and Growing Your Stealth Wealth

Protecting and growing your assets is as crucial as building them in the first place.

Tax Optimization Strategies

Minimizing tax liabilities is essential for maximizing investment returns and preserving your wealth.

- Utilizing tax-advantaged accounts (IRAs, 401(k)s): These accounts offer tax benefits for retirement savings.

- Understanding tax deductions and credits: Taking advantage of all applicable tax deductions and credits.

- Consulting with a tax advisor: A tax professional can help you develop a tax-efficient investment strategy.

Tax optimization strategies vary depending on income level and investment structure, so seeking professional advice is essential.

Estate Planning and Legacy Building

Estate planning is crucial for protecting your family's financial future.

- Creating a will: Ensuring your assets are distributed according to your wishes.

- Establishing trusts: Protecting assets from creditors and taxes.

- Designating beneficiaries: Clearly outlining who will inherit your assets.

- Working with an estate planning attorney: An estate attorney can guide you through the process and ensure your plan is legally sound.

Effective estate planning safeguards your wealth and minimizes estate taxes, ensuring a smooth transfer of assets to your heirs.

Conclusion

Stealth wealth isn't about hiding money; it's about building it strategically and wisely. By focusing on diversification, mindful spending, passive income, and smart tax planning, you can accumulate significant wealth without drawing unnecessary attention. Remember, the path to stealth wealth involves long-term planning, discipline, and a focus on sustainable financial growth. Start building your stealth wealth today by implementing these strategies and consulting with financial professionals to create a personalized plan that aligns with your goals. Unlock the secrets of stealth wealth and build a secure financial future.

Featured Posts

-

Cashback Rewards And Increased Orders Uber Kenyas New Incentive Program

May 19, 2025

Cashback Rewards And Increased Orders Uber Kenyas New Incentive Program

May 19, 2025 -

Florida State University Shooting Victim Identified As Employee Father A Former Cia Operative

May 19, 2025

Florida State University Shooting Victim Identified As Employee Father A Former Cia Operative

May 19, 2025 -

Complete Guide To The Nyt Mini Crossword April 18 2025

May 19, 2025

Complete Guide To The Nyt Mini Crossword April 18 2025

May 19, 2025 -

Kuzey Kibris Gastronomisi Itb Berlin De Bueyuek Basari Kazandi

May 19, 2025

Kuzey Kibris Gastronomisi Itb Berlin De Bueyuek Basari Kazandi

May 19, 2025 -

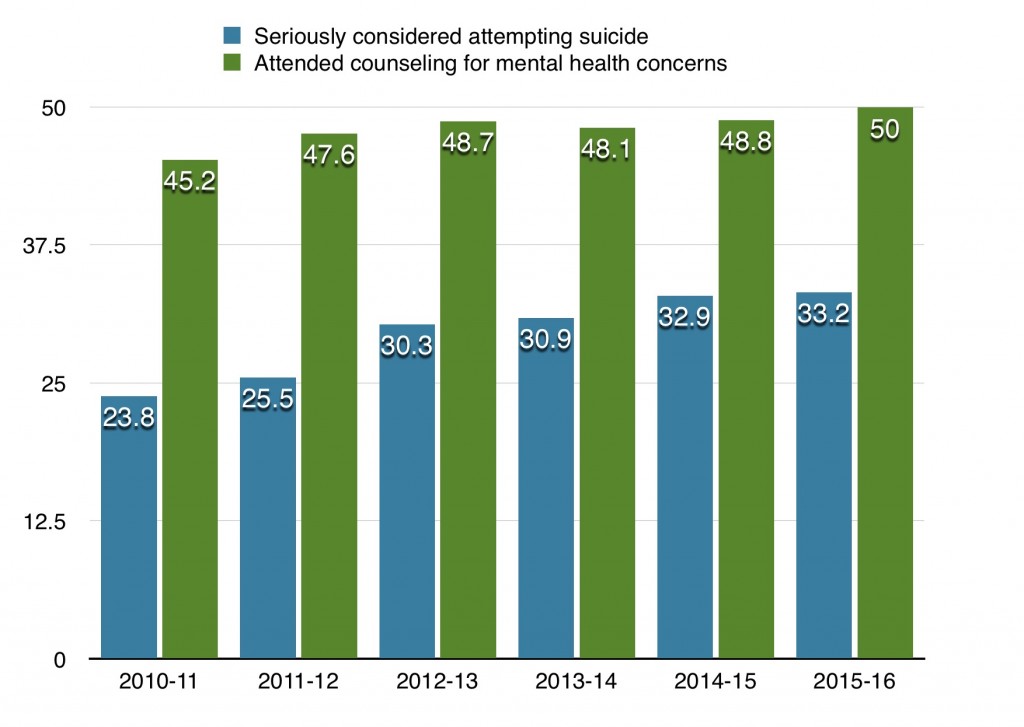

Suncoast Searchlight Exploring The Impact Of Rising Mental Health Needs

May 19, 2025

Suncoast Searchlight Exploring The Impact Of Rising Mental Health Needs

May 19, 2025

Latest Posts

-

Man United Transfer News Journalists Report On Matheus Cunha Raises Questions

May 20, 2025

Man United Transfer News Journalists Report On Matheus Cunha Raises Questions

May 20, 2025 -

Matheus Cunha To Man Utd Journalist Shares Worrying News

May 20, 2025

Matheus Cunha To Man Utd Journalist Shares Worrying News

May 20, 2025 -

Man United News Matheus Cunha Transfer Update Causes Concern

May 20, 2025

Man United News Matheus Cunha Transfer Update Causes Concern

May 20, 2025 -

Travels With Agatha Christie And Sir David Suchet A Comprehensive Review

May 20, 2025

Travels With Agatha Christie And Sir David Suchet A Comprehensive Review

May 20, 2025 -

The Complete Guide To The Nyt Mini Crossword April 25th

May 20, 2025

The Complete Guide To The Nyt Mini Crossword April 25th

May 20, 2025