Stock Market Defies Recession Fears: Investors Anticipate Continued Growth

Table of Contents

Strong Corporate Earnings Fuel Market Growth

Robust corporate earnings reports are a primary driver of the market's resilience. Stronger-than-expected profit announcements from numerous companies are bolstering investor confidence and fueling further growth. This surge in corporate profits is not just a fleeting trend; it reflects a broader picture of economic health. Keywords like "corporate profits," "earnings growth," "revenue increase," and "profit margins" highlight the positive financial performance that's underpinning this market strength.

- Examples of companies exceeding earnings expectations: Many tech giants, alongside established players in various sectors, have significantly exceeded analysts' earnings expectations, showing continued innovation and adaptability.

- Analysis of key sectors driving profit growth: The technology, healthcare, and consumer staples sectors, among others, are showing particularly strong earnings growth, indicating diverse economic strength.

- Impact of strong earnings on stock valuations: These positive earnings reports are directly translating into higher stock valuations, further enhancing investor sentiment and attracting new investment.

Easing Inflation and Interest Rate Expectations

The easing of inflation and the anticipation of interest rate stabilization are significantly impacting investor sentiment. The relationship between inflation, interest rates, and stock market performance is complex, but the current trend is positive. As inflation cools, pressure on the Federal Reserve to continue aggressive interest rate hikes diminishes. This creates a more predictable and stable economic environment, encouraging investment. Keywords like "inflation rate," "interest rate hikes," "Federal Reserve policy," and "monetary policy" are crucial for understanding this dynamic.

- Recent inflation data and its market implications: Recent data shows a slowing inflation rate, suggesting the aggressive measures taken by central banks are starting to have an effect, leading to greater investor confidence.

- Predictions for future interest rate adjustments: Experts predict that interest rate hikes will slow or even pause, reducing the risk of a significant economic slowdown induced by high borrowing costs.

- Impact of easing inflation on consumer spending and business investment: Lower inflation boosts consumer spending power and reduces uncertainty for businesses, leading to increased investment and economic activity.

Resilient Consumer Spending and Economic Indicators

Despite recessionary predictions, consumer spending remains remarkably resilient, providing further support to the market's growth. This, coupled with positive economic indicators, is countering the narrative of an impending downturn. Analyzing keywords like "consumer confidence," "GDP growth," "unemployment rate," "economic outlook," and "recession indicators" provides a comprehensive picture.

- Key economic indicators showing resilience: Several key economic indicators, such as GDP growth and unemployment rates, are showing more strength than anticipated, suggesting underlying economic health.

- Data on consumer spending patterns: Data indicates consumers continue to spend, albeit perhaps more cautiously, suggesting that the economy isn't as weak as some forecasts predicted.

- Analysis of the current employment situation: A robust employment market, with low unemployment rates, supports consumer spending and overall economic strength, contradicting typical recessionary indicators.

Long-Term Investor Optimism and Strategic Positioning

Long-term investors are demonstrating remarkable optimism, employing strategic positioning to navigate the current market conditions and capitalize on potential growth opportunities. They are focused on long-term investment horizons and are less reactive to short-term market fluctuations. Understanding keywords like "long-term investment," "portfolio diversification," "risk management," "investment strategy," and "market volatility" is essential to grasping their perspective.

- Common investment strategies employed by long-term investors: Diversification, value investing, and growth investing are some prominent strategies being employed to mitigate risk and maximize returns.

- Analysis of sector-specific investments: Investors are strategically allocating capital to sectors they believe are poised for continued growth despite economic headwinds.

- Discussion of risk mitigation strategies: Long-term investors are employing various risk management techniques to protect their portfolios from potential market volatility.

Conclusion: Navigating the Market's Unexpected Strength

In summary, the stock market's resilience in the face of recessionary fears is a complex phenomenon driven by a confluence of factors: strong corporate earnings, easing inflation, resilient consumer spending, and the strategic optimism of long-term investors. The unexpected strength of the market underscores the importance of understanding these underlying economic trends when making investment decisions. To further navigate the nuances of "Stock Market Defies Recession Fears," explore reputable financial resources and consider consulting with a financial professional to make informed investment choices tailored to your risk tolerance and financial goals.

Featured Posts

-

Ariana Grande And Jeff Goldblum Release I Dont Know Why Details Inside

May 06, 2025

Ariana Grande And Jeff Goldblum Release I Dont Know Why Details Inside

May 06, 2025 -

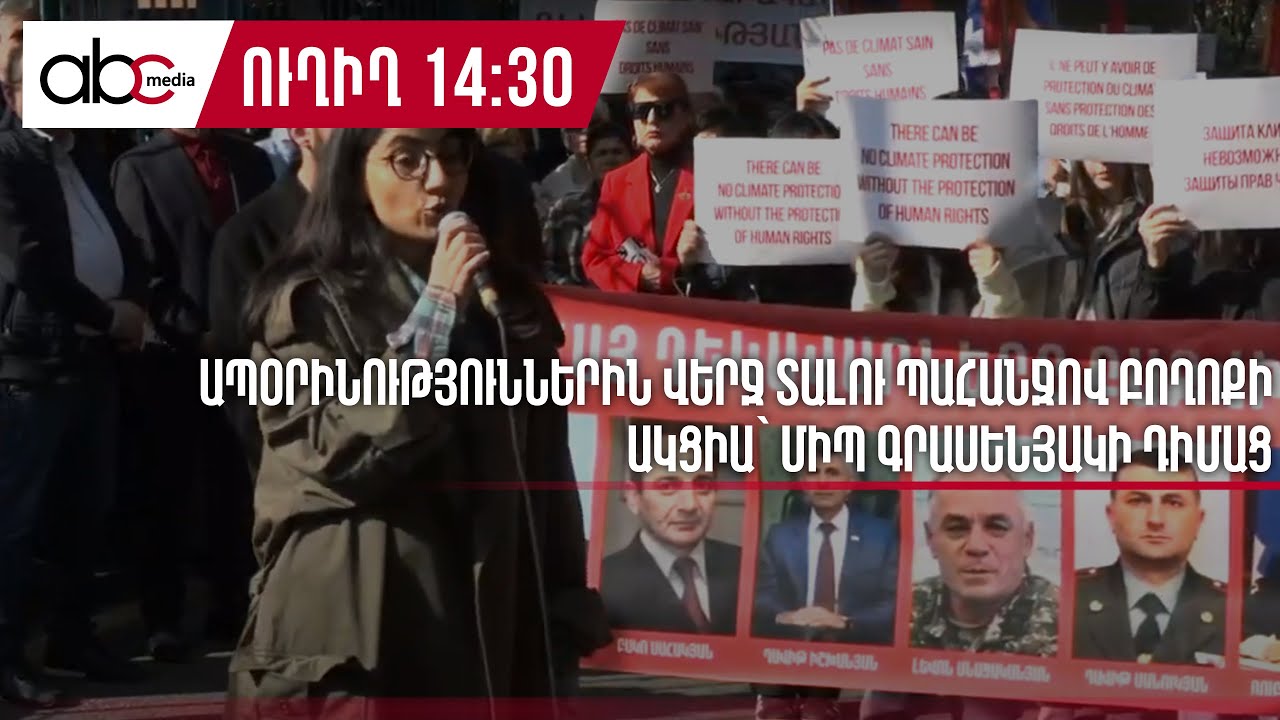

Bbs N Pakvo M E Ir Grasyenyaky Adrbyejanvo M Baqvi Pahanjvov

May 06, 2025

Bbs N Pakvo M E Ir Grasyenyaky Adrbyejanvo M Baqvi Pahanjvov

May 06, 2025 -

Smart Shopping On A Budget Affordable Quality Products That Dont Disappoint

May 06, 2025

Smart Shopping On A Budget Affordable Quality Products That Dont Disappoint

May 06, 2025 -

Oscar Nominee Sing Sing Debuts On Max This Week

May 06, 2025

Oscar Nominee Sing Sing Debuts On Max This Week

May 06, 2025 -

King Protiv Maska Pisatel Vernulsya V X I Ne Sderzhal Emotsiy

May 06, 2025

King Protiv Maska Pisatel Vernulsya V X I Ne Sderzhal Emotsiy

May 06, 2025