Stock Market Dip: Rising US Fiscal Uncertainty Creates Investor Anxiety

Table of Contents

The Debt Ceiling Debate and its Market Impact

The ongoing debate surrounding the US debt ceiling is a major factor driving the current stock market dip. Simply put, the debt ceiling is the legal limit on how much the US government can borrow. Reaching this limit without raising it could lead to a catastrophic financial crisis, impacting the entire global economy. This uncertainty creates significant anxiety amongst investors.

Potential Government Shutdown

The potential for a government shutdown further exacerbates the situation. A shutdown would mean:

- Reduced government spending on crucial programs: This could stifle economic growth and negatively impact various sectors.

- Potential credit rating downgrade: A failure to address the debt ceiling could lead to a downgrade of the US credit rating, increasing borrowing costs and signaling a lack of fiscal responsibility.

- Increased market volatility: The uncertainty surrounding a shutdown drastically increases market volatility, making it difficult to predict market movements and creating significant risk for investors.

Impact on Treasury Yields

The debt ceiling debate also significantly influences Treasury yields. As investors perceive increased risk, they demand higher yields on US Treasury bonds. This means:

- Rising yields reflect increased risk perception: Higher yields indicate investors are demanding a greater return to compensate for the perceived risk.

- Impact on borrowing costs for businesses and consumers: Increased Treasury yields translate to higher borrowing costs for businesses and consumers, potentially slowing economic activity.

- Effect on investment strategies: Investors may adjust their investment strategies, shifting away from riskier assets and towards safer havens like government bonds, further impacting the stock market.

Inflation and Interest Rate Hikes

Persistent inflation remains another significant factor contributing to the stock market dip. The Federal Reserve's response to combat inflation through interest rate hikes has created further economic uncertainty.

Fed's Tightening Monetary Policy

The Fed's tightening monetary policy, aimed at curbing inflation, has several negative consequences for the stock market:

- Higher borrowing costs reduce corporate investment: Increased interest rates make it more expensive for companies to borrow money, potentially hindering investment and expansion.

- Effect on company valuations: Higher interest rates also impact company valuations, as future earnings are discounted at a higher rate.

- Potential for recessionary pressures: Aggressive interest rate hikes increase the risk of a recession, further depressing market sentiment.

Inflation's Erosive Effect on Investments

High inflation erodes the purchasing power of investments, leading to:

- Reduced purchasing power: The real value of investments declines as prices rise faster than investment returns.

- Impact on investor confidence: Persistent inflation erodes investor confidence, leading to reduced risk appetite.

- Search for inflation-hedged investments: Investors actively seek assets that can protect against inflation, such as commodities or inflation-protected securities, diverting funds from equities.

Geopolitical Risks and Market Volatility

Ongoing geopolitical tensions add another layer of complexity to the current market environment. Global instability contributes significantly to market anxiety and volatility.

Global Uncertainty and its Ripple Effect

International events have a direct impact on the stock market, creating uncertainty and volatility:

- Supply chain disruptions: Geopolitical events can disrupt global supply chains, leading to shortages and price increases.

- Energy price volatility: Geopolitical instability often impacts energy prices, leading to increased inflation and economic uncertainty.

- Increased market uncertainty: The overall unpredictability associated with geopolitical risks creates heightened market uncertainty, making investors hesitant to commit capital.

Investor Flight to Safety

In times of geopolitical uncertainty, investors often seek safer havens:

- Increased demand for government bonds: Investors flock to government bonds, considered safe-haven assets, driving up demand and potentially lowering yields.

- Reduced equity investments: Investors reduce their exposure to equities, opting for less risky assets.

- Impact on portfolio diversification strategies: Investors may need to reassess their portfolio diversification strategies to navigate these heightened risks.

Conclusion

The current stock market dip is a result of a confluence of factors: the US debt ceiling debate, persistent inflation and subsequent interest rate hikes, and escalating geopolitical risks. These elements collectively create significant uncertainty, impacting investor confidence and market stability. Understanding the interplay of these factors is crucial for navigating the current market environment. Stay informed about the evolving situation and consider diversifying your investment portfolio to mitigate the risks associated with a stock market dip. Learn more about managing your investments during times of stock market dips and consult with a financial advisor for personalized guidance to better understand how to protect your investments during periods of high volatility.

Featured Posts

-

Steal Cat Deeleys Look Denim Midi Dress And Cowboy Style

May 23, 2025

Steal Cat Deeleys Look Denim Midi Dress And Cowboy Style

May 23, 2025 -

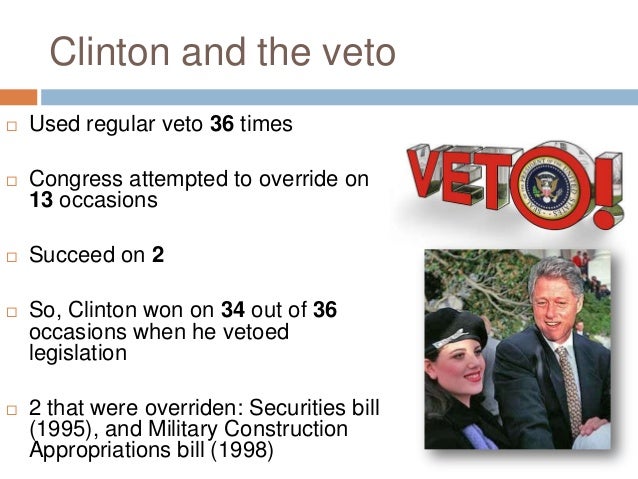

The 1990s Budget Crisis Understanding Clintons Veto Power

May 23, 2025

The 1990s Budget Crisis Understanding Clintons Veto Power

May 23, 2025 -

Cobra Kais Continuity How The Show Expands The Karate Kid Universe

May 23, 2025

Cobra Kais Continuity How The Show Expands The Karate Kid Universe

May 23, 2025 -

The Culkin Familys Financial Situation Mothers Reported Struggle Amidst Sons Wealth

May 23, 2025

The Culkin Familys Financial Situation Mothers Reported Struggle Amidst Sons Wealth

May 23, 2025 -

Cedric Klapischs Colours Of Time Studiocanal Secures Distribution Deal At Cannes

May 23, 2025

Cedric Klapischs Colours Of Time Studiocanal Secures Distribution Deal At Cannes

May 23, 2025

Latest Posts

-

Nicolas Tagliafico Criticizes Man United Players Amidst Ten Hags Difficulties

May 23, 2025

Nicolas Tagliafico Criticizes Man United Players Amidst Ten Hags Difficulties

May 23, 2025 -

Tagliafico Blames Man United Players For Ten Hags Struggles

May 23, 2025

Tagliafico Blames Man United Players For Ten Hags Struggles

May 23, 2025 -

Prediccion Meteorologica Detallada Lluvias Moderadas

May 23, 2025

Prediccion Meteorologica Detallada Lluvias Moderadas

May 23, 2025 -

Lluvias Moderadas La Prevision Meteorologica Te Lo Cuenta

May 23, 2025

Lluvias Moderadas La Prevision Meteorologica Te Lo Cuenta

May 23, 2025 -

Meteorologia Lluvias Moderadas Y Su Impacto

May 23, 2025

Meteorologia Lluvias Moderadas Y Su Impacto

May 23, 2025