Stock Market Movers: Rockwell Automation, Angi, BorgWarner, And More See Gains

Table of Contents

Rockwell Automation's Surge

Strong Q1 Earnings Report

Rockwell Automation's stock price saw a significant jump following the release of its impressive Q1 earnings report. The company exceeded analyst expectations across the board, reporting robust revenue growth and a higher-than-anticipated earnings per share (EPS). This positive performance reflects the strength of the industrial automation sector and Rockwell Automation's ability to navigate current economic challenges.

- Exceeded analyst expectations: EPS surpassed projected figures by a considerable margin, signaling strong financial health.

- Positive outlook for future quarters: Management expressed confidence in maintaining this momentum throughout the year, citing increased order backlog and a positive outlook for industrial production.

- Strong industrial automation sector performance: The company benefited from increased demand for automation solutions across various industries, showcasing the growing importance of automation technologies.

- Impact of supply chain improvements: Rockwell Automation successfully mitigated the impact of supply chain disruptions, demonstrating its resilience and operational efficiency.

Increased Investor Confidence

The strong Q1 earnings report significantly boosted investor confidence in Rockwell Automation. This is evident in the substantial increase in the stock price, coupled with a notable rise in trading volume.

- Stock price increase percentage: The stock price experienced a double-digit percentage increase following the earnings announcement.

- Increased trading volume: Trading volume surged, indicating strong investor interest and activity.

- Analyst upgrades: Several financial analysts upgraded their ratings and price targets for Rockwell Automation stock, reflecting a positive outlook.

- Positive media coverage: The positive earnings report generated widespread positive media coverage, further enhancing investor sentiment.

Angi's Positive Momentum

Strategic Initiatives Paying Off

Angi, a leading provider of home services, also saw its stock price climb today. This positive momentum can be attributed to a series of successful strategic initiatives implemented over the past year.

- New marketing campaigns: Angi's targeted marketing campaigns effectively increased brand awareness and customer acquisition.

- Successful acquisitions: Strategic acquisitions expanded Angi's service offerings and market reach, enhancing its competitive position.

- Improved customer engagement: Investments in customer relationship management have led to improved customer satisfaction and loyalty.

- Expansion into new markets: Angi's expansion into new geographical markets further diversified its revenue streams and fueled growth.

Growth in Home Services Sector

Angi's performance is also a reflection of the overall growth in the home services sector. Increased demand for home improvement and repair services, driven by factors such as aging housing stock and rising homeownership rates, has benefited companies like Angi.

- Market trends: The home services market is experiencing robust growth, driven by various factors including demographic shifts and increased disposable income.

- Increased demand for home services: Consumers are increasingly seeking professional help for home maintenance and repair tasks.

- Competitive landscape: Angi's strategic initiatives have helped it maintain a strong competitive position in a growing market.

- Angi's market share: The company continues to expand its market share, demonstrating its leadership position in the home services industry.

BorgWarner's Gains in the Automotive Sector

Electric Vehicle (EV) Transition

BorgWarner's stock price also saw gains, reflecting its strategic position in the rapidly evolving automotive landscape, particularly the transition towards electric vehicles (EVs).

- Investment in EV technology: BorgWarner has made substantial investments in developing cutting-edge EV technologies, positioning itself for future growth.

- Partnerships with major automakers: Collaborations with leading auto manufacturers provide BorgWarner with access to large-scale production and distribution networks.

- Government incentives for EV adoption: Government policies supporting EV adoption are creating a favorable environment for companies like BorgWarner.

- Projected growth in the EV market: The global EV market is expected to experience significant growth in the coming years, creating immense opportunities for companies supplying EV components.

Strong Demand for Automotive Parts

In addition to the EV transition, BorgWarner benefits from the overall strong demand for automotive parts. The recovery in global automotive production, following supply chain disruptions, has positively impacted the company's performance.

- Global automotive production: Global automotive production is rebounding, driving increased demand for automotive parts.

- Supply chain recovery: Improvements in the automotive supply chain are easing production bottlenecks and supporting growth.

- Impact of semiconductor shortage easing: The easing of the semiconductor shortage is contributing to improved production capacity.

Other Notable Stock Market Movers

Several other companies experienced significant gains today. For further details, please refer to [link to relevant news source 1] and [link to relevant news source 2].

Conclusion

This analysis highlights significant gains for several key players in the stock market, including Rockwell Automation, Angi, and BorgWarner. Understanding the factors driving these stock market movers – from strong earnings reports to successful strategic initiatives and the ongoing EV transition – is vital for informed investment decisions. Staying informed on daily stock market trends and analyzing individual company performance allows investors to capitalize on opportunities. Keep monitoring these and other stock market movers to make well-informed investment choices. Continue to check back for updates on the latest stock market gains and analysis of key market trends.

Featured Posts

-

Celtics Vs Hornets Expert Nba Predictions And Tonights Game Odds

May 17, 2025

Celtics Vs Hornets Expert Nba Predictions And Tonights Game Odds

May 17, 2025 -

Dubay Realnost Zhizni Dlya Rossiyan V 2025 Godu

May 17, 2025

Dubay Realnost Zhizni Dlya Rossiyan V 2025 Godu

May 17, 2025 -

Delhi And Mumbai Get Pet Friendly Uber Rides New Partnership With Heads Up For Tails

May 17, 2025

Delhi And Mumbai Get Pet Friendly Uber Rides New Partnership With Heads Up For Tails

May 17, 2025 -

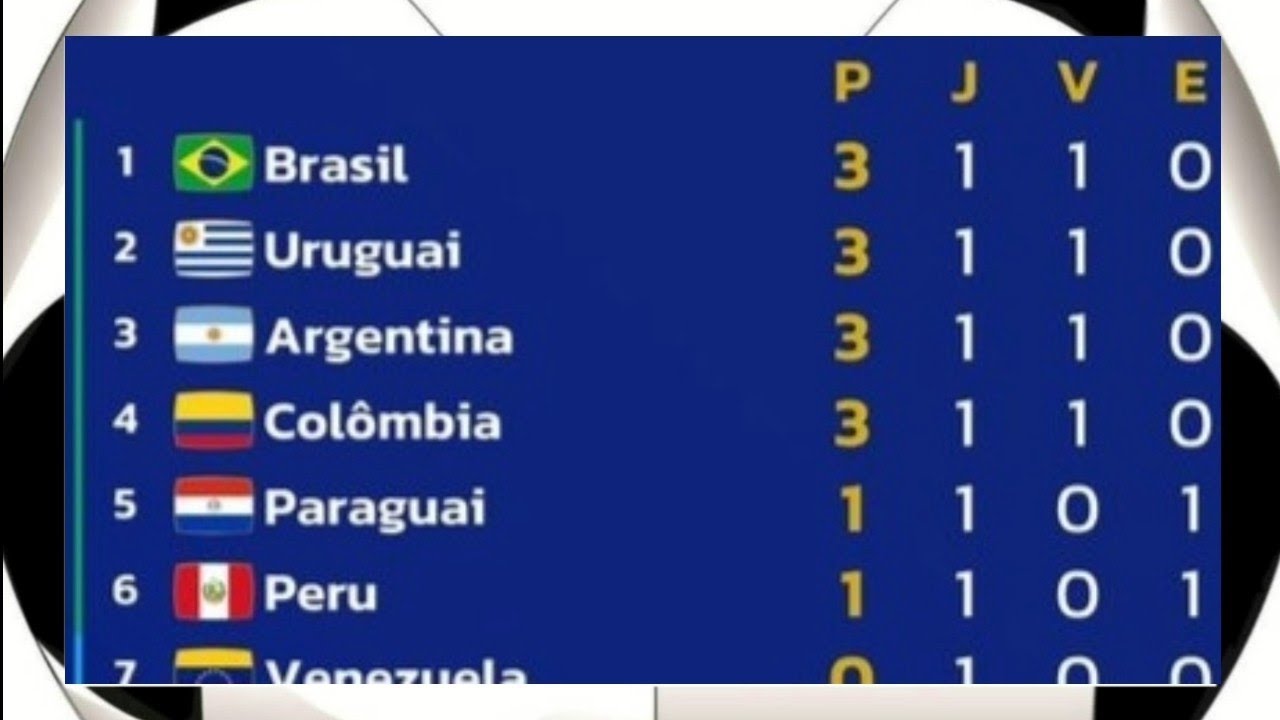

Ex Vasco Brilha Nos Emirados E Sonha Com A Copa Do Mundo De 2026

May 17, 2025

Ex Vasco Brilha Nos Emirados E Sonha Com A Copa Do Mundo De 2026

May 17, 2025 -

1 Thing Holding Back Each Top 10 Nba Contender

May 17, 2025

1 Thing Holding Back Each Top 10 Nba Contender

May 17, 2025