Stock Market News: Dow, S&P 500 - Real-time Updates May 5

Table of Contents

Dow Jones Industrial Average (Dow) Performance

The Dow Jones Industrial Average concluded October 26th with a substantial drop, closing at [Insert Closing Value] after opening at [Insert Opening Value]. The index reached a high of [Insert High Value] and a low of [Insert Low Value] throughout the trading day. This represents a [Insert Percentage Change]% decrease from the previous day's closing value.

- Contributing Factors: The Dow's decline was largely attributed to [Insert Specific Reason 1, e.g., disappointing earnings reports from major tech companies]. Concerns regarding [Insert Specific Reason 2, e.g., rising interest rates and their impact on corporate profits] also weighed heavily on investor sentiment. Increased geopolitical uncertainty stemming from [Insert Geopolitical Event, if applicable] further exacerbated the negative trend.

- Key Companies: Companies like [Insert Company Name 1, e.g., Apple], [Insert Company Name 2, e.g., Microsoft], and [Insert Company Name 3, e.g., Boeing] experienced significant share price declines, contributing considerably to the Dow's overall performance. Their individual stock performance can be further investigated through links to [Link to relevant financial news source 1] and [Link to relevant financial news source 2].

- Percentage Change: As mentioned, the Dow closed down [Insert Percentage Change]% on October 26th compared to the previous day's close. This signifies a notable reversal from the recent [Mention any recent positive trends, if applicable].

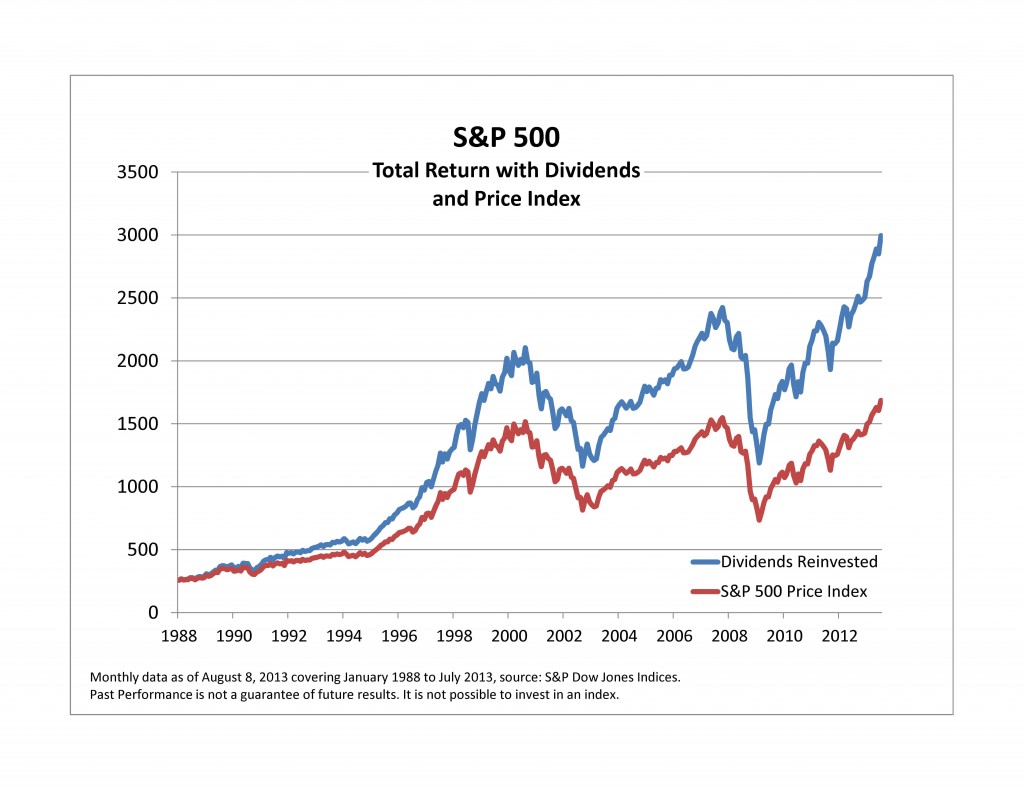

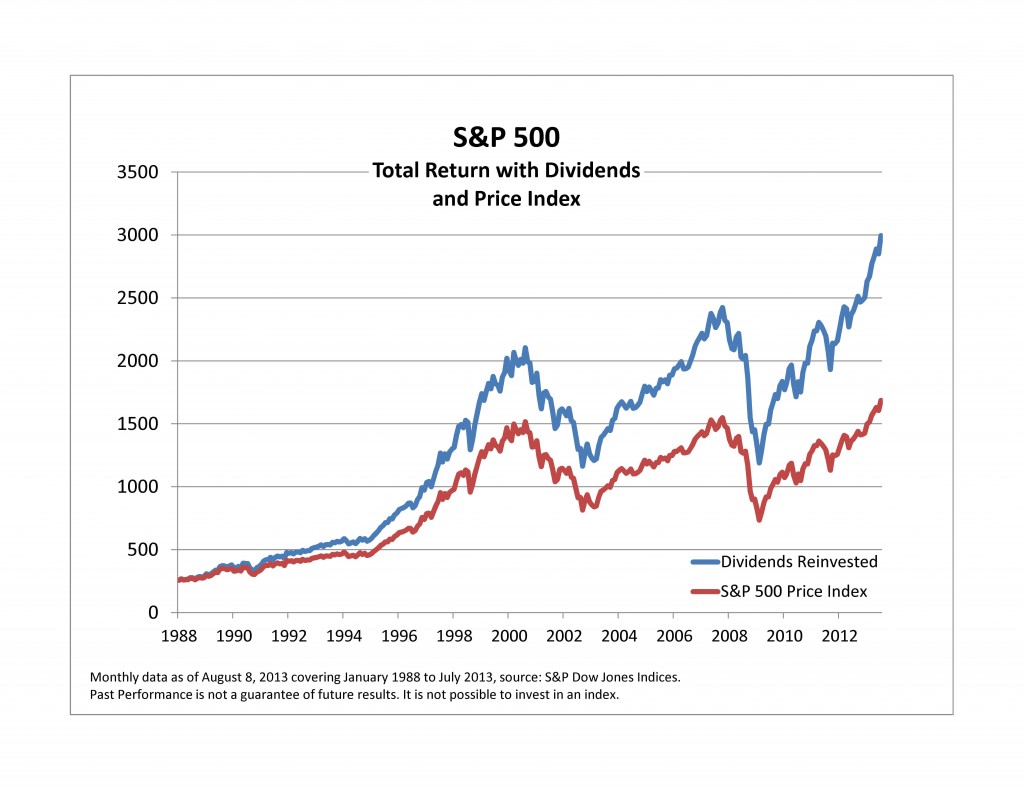

S&P 500 Index Performance

The S&P 500 index mirrored the Dow's negative trajectory on October 26th, closing at [Insert Closing Value] after opening at [Insert Opening Value]. The index saw a high of [Insert High Value] and a low of [Insert Low Value] during the day's trading. This represents a [Insert Percentage Change]% decrease compared to the previous day's close.

- Correlation with Dow: The S&P 500's movement closely tracked that of the Dow, indicating a broad-based market sell-off rather than sector-specific issues. Both indices were heavily influenced by the same macroeconomic factors.

- Sector-Specific Trends: The technology sector, in particular, experienced a significant decline, contributing substantially to the S&P 500's losses. [Insert other affected sectors, e.g., Energy and Financial sectors also saw negative performance].

- Significant Company News: Negative news surrounding [Insert Company Name, if applicable] significantly impacted investor sentiment and contributed to the overall market downturn. For more detailed information consult [Link to relevant financial news source 3].

- Percentage Change: The S&P 500 concluded the day with a [Insert Percentage Change]% decrease, reinforcing the overall bearish sentiment in the market.

Market Volatility and Analysis

Market volatility was significantly elevated on October 26th, reflecting the uncertainty surrounding various economic and geopolitical factors.

- Trading Volume: Trading volume was [Insert Description of Trading Volume, e.g., significantly higher than average], suggesting heightened investor anxiety and active participation in the market sell-off.

- Market Indicators: The VIX volatility index, a key measure of market fear, [Insert Description of VIX Movement, e.g., spiked considerably], further confirming the heightened volatility.

- Analysis: The market's reaction on October 26th can be interpreted as a correction in response to recent [Mention recent market trends]. However, it is crucial to avoid making definitive predictions about future market movements based on a single day's performance.

- Broader Market Trends: The day's events underscore the ongoing challenges faced by the market, including [mention overarching challenges, e.g., inflation and supply chain disruptions].

Impact on Investors and Future Outlook

The market downturn on October 26th presents both challenges and opportunities for investors.

- Investment Strategies: Investors may consider diversifying their portfolios and adopting a more cautious approach in the near term.

- Cautious Outlook: While the market's future trajectory is uncertain, it's prudent to remain informed and adapt investment strategies accordingly.

- Upcoming Economic Events: Upcoming economic data releases, such as [Mention upcoming economic events], will likely influence market sentiment in the coming days and weeks.

Conclusion

October 26th witnessed a significant decline in both the Dow and S&P 500 indices, reflecting increased market volatility and uncertainty. The day's events highlight the importance of staying informed about real-time stock market news. Understanding the interplay between various economic factors and their impact on major indices like the Dow and S&P 500 is crucial for making well-informed investment decisions. Stay informed on the latest Dow and S&P 500 updates by following us for real-time stock market news and analysis. Check back tomorrow for more stock market news, including Dow and S&P 500 updates.

Featured Posts

-

Jurassic Parks Jeff Goldblum London Appearance Draws Huge Crowds

May 06, 2025

Jurassic Parks Jeff Goldblum London Appearance Draws Huge Crowds

May 06, 2025 -

Independence Day A Comprehensive Guide

May 06, 2025

Independence Day A Comprehensive Guide

May 06, 2025 -

Smart Spending Affordable Products You Ll Love

May 06, 2025

Smart Spending Affordable Products You Ll Love

May 06, 2025 -

White Lotus Patrick Schwarzenegger Responds To Nepotism Claims

May 06, 2025

White Lotus Patrick Schwarzenegger Responds To Nepotism Claims

May 06, 2025 -

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Sasirtiyor Mine Tugay In Tepkisi

May 06, 2025

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Sasirtiyor Mine Tugay In Tepkisi

May 06, 2025