Stock Market Prediction: 2 Companies To Eclipse Palantir's Value In 3 Years

Table of Contents

Company 1: [Company Name 1] – A Deep Dive into its Growth Potential

[Company Name 1] is a compelling example of a company perfectly positioned for exponential growth. Its innovative approach and strong financial performance make it a serious contender to outpace Palantir's market capitalization.

Disruptive Technology and Market Domination

[Company Name 1]'s success hinges on its disruptive technology in [Specific Industry]. Their proprietary [Technology Name] offers a significant competitive advantage by [Explain Advantage, e.g., reducing processing time by 50%].

- Patent-protected technology: [Company Name 1] holds several key patents, protecting its intellectual property and creating a high barrier to entry for competitors.

- First-mover advantage: By being one of the first to market with this technology, they’ve already secured a significant portion of the market.

- Market Research Validation: Recent reports from [Source, e.g., Gartner] project [Specific Market Growth Percentage] growth in the [Specific Industry] sector within the next three years, positioning [Company Name 1] for substantial market share gains. This aligns perfectly with their disruptive innovation strategy.

Strong Financial Performance and Future Projections

[Company Name 1] demonstrates impressive financial strength. Their revenue growth has consistently exceeded expectations, with a [Percentage]% increase year-over-year for the past [Number] years.

- Robust Revenue Growth: [Insert specific revenue figures for the last few years].

- Increasing Profitability: [Insert data on profit margins and net income].

- Positive Cash Flow: [Insert data on cash flow from operations].

- Analyst Predictions: Leading financial analysts predict a [Percentage]% compound annual growth rate (CAGR) for the next three years, based on [Mention sources/reasoning].

Risk Assessment and Mitigation Strategies

While [Company Name 1]'s outlook is positive, potential risks exist. Increased competition and dependence on key partnerships are notable concerns.

- Competitive Landscape: The company is actively developing strategies to counteract potential threats from competitors like [Competitor 1] and [Competitor 2].

- Mitigation Strategies: [Company Name 1] is diversifying its product offerings and strengthening its intellectual property portfolio to mitigate these risks. This proactive risk management strategy ensures resilience in a dynamic market.

Company 2: [Company Name 2] – Poised for Exponential Growth

[Company Name 2], operating in the [Specific Industry] sector, represents another strong candidate for surpassing Palantir's valuation. Its strategic partnerships and global expansion plans are key drivers of its growth trajectory.

Strategic Partnerships and Expanding Market Reach

[Company Name 2]'s strategic alliances have been instrumental in accelerating market expansion. Key partnerships with [Partner 1] and [Partner 2] have opened up new markets and distribution channels.

- Synergistic Partnerships: These collaborations leverage each partner's strengths, resulting in enhanced market penetration and increased brand visibility.

- Expanded Market Reach: Access to [Partner 1]'s established customer base and [Partner 2]'s global distribution network has significantly broadened [Company Name 2]'s reach.

Scalability and Global Expansion Plans

[Company Name 2] possesses remarkable scalability, allowing it to efficiently handle increasing demand as it expands globally.

- Robust Infrastructure: Their robust infrastructure and efficient operational model enable them to easily adapt to rising customer needs and international market entry.

- Global Expansion Strategy: [Company Name 2] plans to enter [mention specific regions/countries] within the next three years, capitalizing on untapped market potential.

Innovation Pipeline and Future Product Development

[Company Name 2]'s commitment to research and development fuels its innovation pipeline. Several promising new products are in development.

- Upcoming Product Launches: [Mention specific upcoming products and their potential impact].

- R&D Investments: Significant investments in R&D ensure a continuous stream of innovative products and services, maintaining a competitive edge.

Conclusion: Investing in the Future of the Stock Market

Both [Company Name 1] and [Company Name 2] exhibit compelling characteristics that support our prediction of surpassing Palantir's market capitalization within three years. Their disruptive technologies, strong financials, and strategic growth plans position them for substantial growth. While investing in the stock market inherently involves risk, a careful evaluation of these companies' prospects suggests significant potential rewards. This analysis serves as a starting point. We strongly encourage conducting thorough independent research before making any investment decisions. Remember, stock market prediction is inherently speculative, and past performance is not indicative of future results. Consider these high-growth stocks as part of a diversified investment strategy. Further research into these companies – and exploring other high-growth investment opportunities – could lead to significant returns.

Featured Posts

-

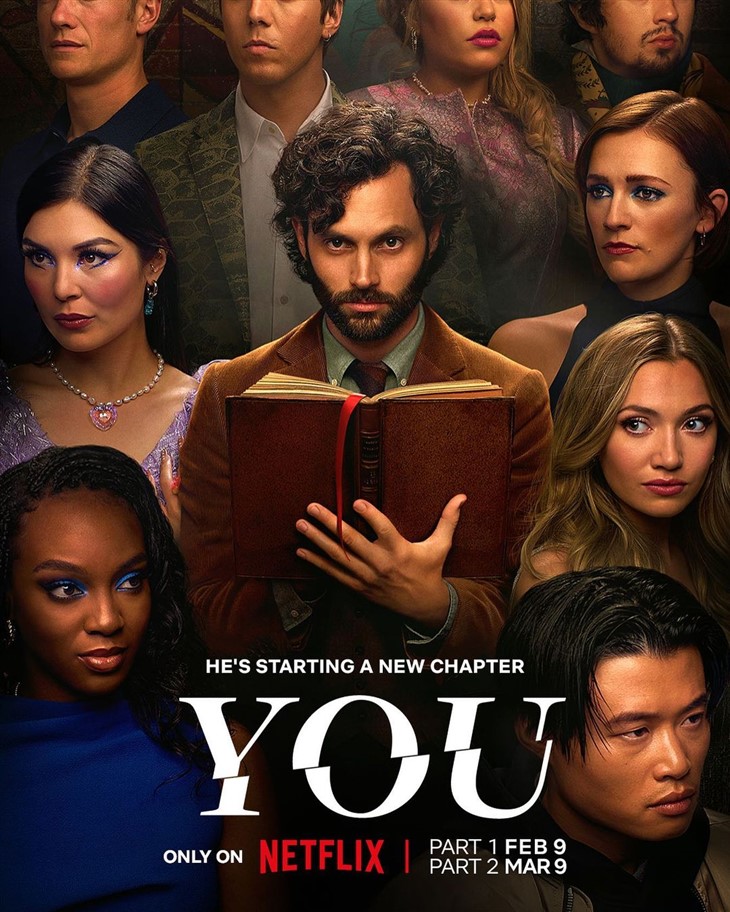

Show Name Season 2 A Potential Spoiler Filled Replacement Show Is Now Streaming

May 10, 2025

Show Name Season 2 A Potential Spoiler Filled Replacement Show Is Now Streaming

May 10, 2025 -

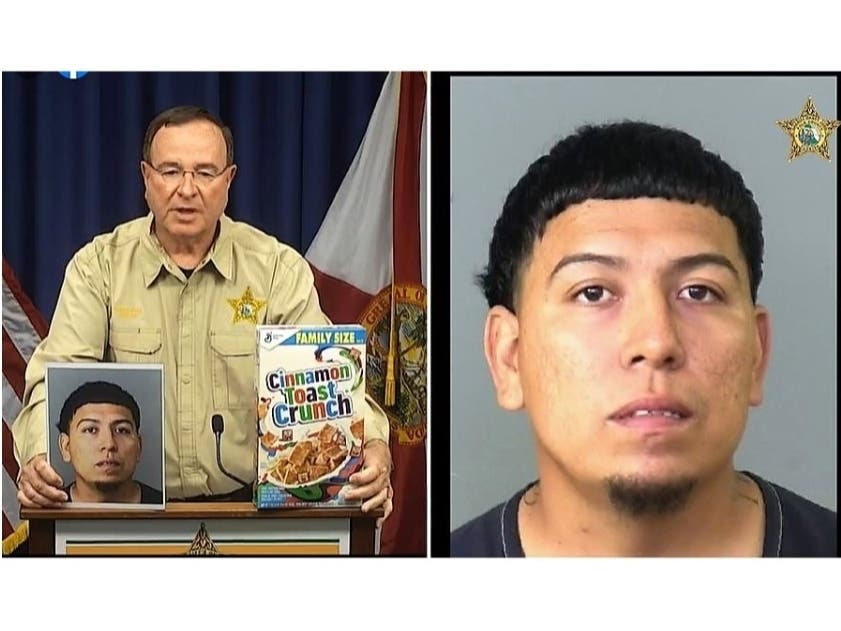

Largest Fentanyl Seizure In Us History Details From Pam Bondi

May 10, 2025

Largest Fentanyl Seizure In Us History Details From Pam Bondi

May 10, 2025 -

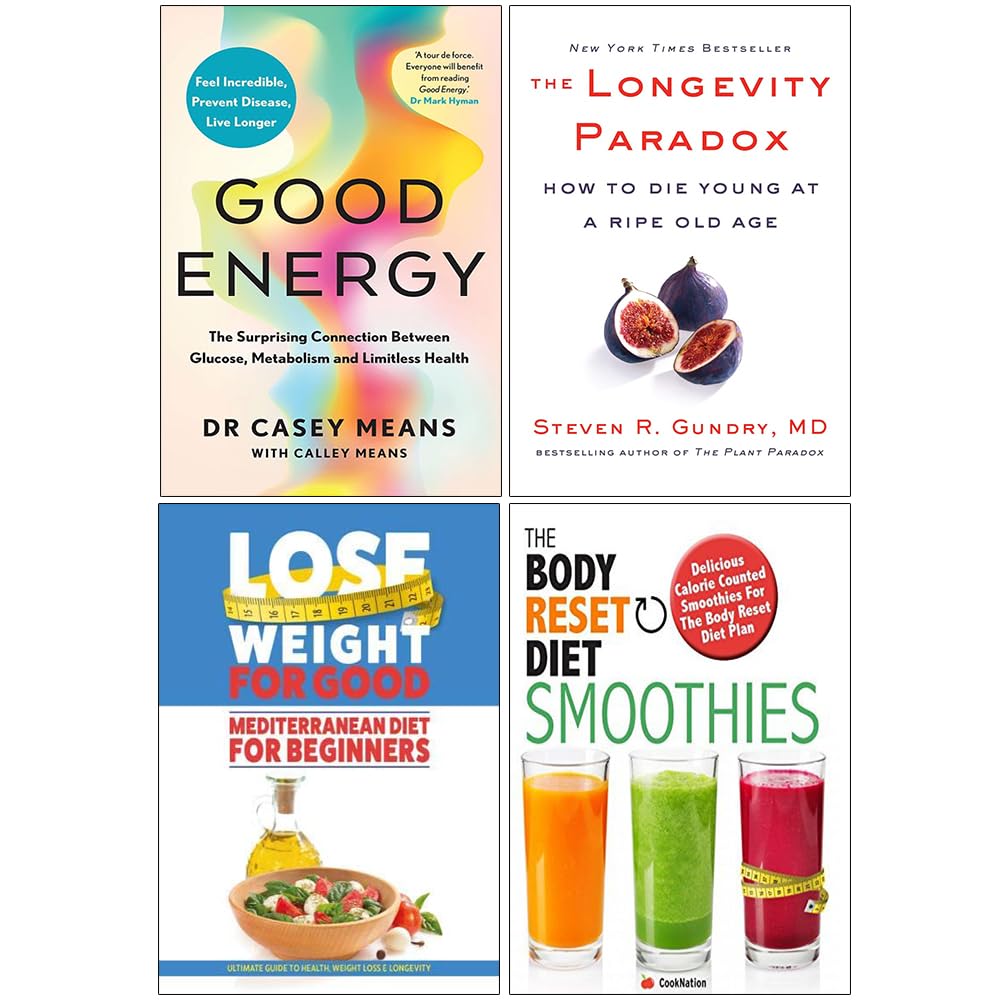

Analyzing Trumps Choice Casey Means And The Future Of Public Health

May 10, 2025

Analyzing Trumps Choice Casey Means And The Future Of Public Health

May 10, 2025 -

Palantir Technologies Stock Current Market Analysis And Investment Advice

May 10, 2025

Palantir Technologies Stock Current Market Analysis And Investment Advice

May 10, 2025 -

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025

Latest Posts

-

Hearing From The Survivors The Nottingham Attacks

May 10, 2025

Hearing From The Survivors The Nottingham Attacks

May 10, 2025 -

Nottingham A And E Data Breach Sparks Outrage Among Families Of Stabbing Victims

May 10, 2025

Nottingham A And E Data Breach Sparks Outrage Among Families Of Stabbing Victims

May 10, 2025 -

Data Protection Failure Nottingham Stabbing Victims Families React To Nhs Breach

May 10, 2025

Data Protection Failure Nottingham Stabbing Victims Families React To Nhs Breach

May 10, 2025 -

Inquiry Into Nottingham Attacks Retired Judge Takes The Helm

May 10, 2025

Inquiry Into Nottingham Attacks Retired Judge Takes The Helm

May 10, 2025 -

Wynne Evans Faces Criticism From Joanna Page On Bbc Programme

May 10, 2025

Wynne Evans Faces Criticism From Joanna Page On Bbc Programme

May 10, 2025