Stock Market Reaction: Impact Of China's Economic Plans And Dow Futures Volatility

Table of Contents

China's Economic Policies and Their Global Implications

China's economic policies, with their far-reaching consequences, are a major driver of global market trends. Their impact on the stock market reaction, particularly Dow Futures, is undeniable.

The Belt and Road Initiative and its Market Impact

The Belt and Road Initiative (BRI), a massive infrastructure project spanning continents, has profound implications for global trade and investment.

- Increased infrastructure spending: The BRI fuels significant infrastructure investment in participating countries, boosting economic activity and potentially creating new markets.

- Potential for increased trade partnerships: Improved connectivity facilitates increased trade between participating nations, leading to potential economic growth.

- Risks associated with debt sustainability: The large-scale borrowing associated with BRI projects poses risks of debt distress for some participating countries, potentially impacting their economic stability and investor confidence.

- Impact on commodity prices: Increased demand for raw materials and construction materials due to BRI projects can influence commodity prices, impacting related sectors globally.

These factors contribute to Dow Futures volatility. A successful BRI could lead to increased global trade and demand, positively impacting Dow Futures. Conversely, debt crises in BRI-related countries could trigger negative market reactions and increased volatility.

China's Regulatory Crackdowns and Their Ripple Effects

Recent regulatory crackdowns in China, particularly targeting the tech sector and real estate, have sent shockwaves through global markets.

- Impact on specific sectors (tech, real estate): These crackdowns have significantly impacted specific sectors, leading to decreased valuations and uncertainty for investors.

- Decreased investor confidence: The unpredictable nature of these regulatory actions has eroded investor confidence, leading to capital flight and increased risk aversion.

- Capital flight: Investors concerned about further regulatory changes have withdrawn capital from China, impacting global market liquidity and potentially affecting Dow Futures.

- Effects on US-listed Chinese companies: US-listed Chinese companies have faced increased scrutiny and volatility due to these crackdowns, directly impacting Dow Futures performance.

These regulatory actions directly contribute to Dow Futures volatility, often resulting in sharp price swings based on news and speculation surrounding further government interventions.

China's Growth Targets and Their Global Significance

China's ambitious economic growth targets significantly influence global economic expectations and market sentiment.

- Impact on global demand: China's economic growth drives global demand for goods and services, affecting various sectors and influencing stock market performance worldwide.

- Commodity prices: China's demand for raw materials influences commodity prices, impacting companies involved in their production and trade, creating ripples in Dow Futures.

- Inflation: China's economic growth can contribute to global inflation, impacting interest rates and investor behavior, subsequently affecting Dow Futures volatility.

- Interest rates: Changes in China's monetary policy, driven by its growth targets, can have knock-on effects on global interest rates, indirectly impacting Dow Futures.

These targets and their achievement (or shortfall) directly influence prediction models for Dow Futures, often affecting investor sentiment and leading to increased volatility.

Analyzing Dow Futures Volatility in Relation to China's Actions

Understanding the correlation between China's economic actions and the subsequent volatility in Dow Futures is crucial for effective risk management.

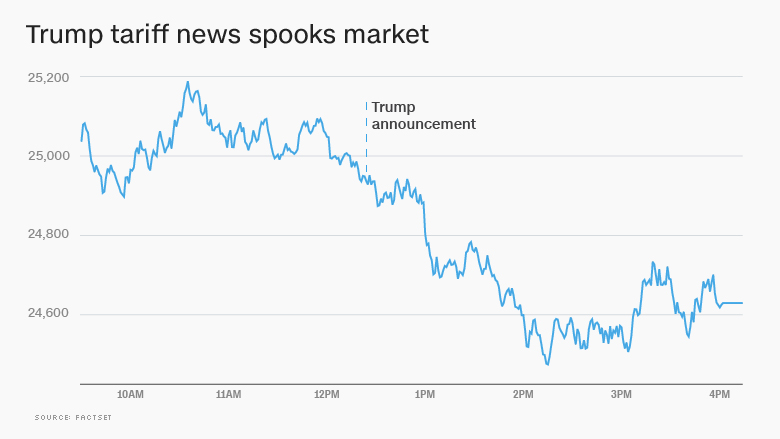

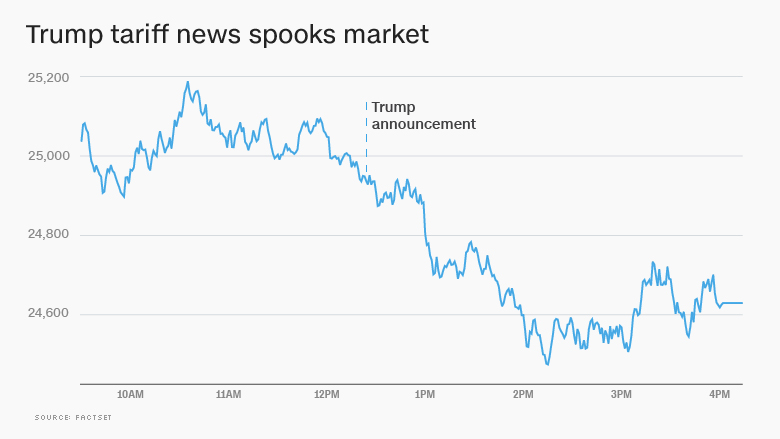

Correlation between China's Economic News and Dow Futures

A strong correlation exists between significant announcements from China and subsequent movements in Dow Futures.

- Examples of specific events and their impact: Analyzing specific events, such as changes in interest rates or regulatory announcements, and their immediate impact on Dow Futures provides valuable insights. (Charts and graphs illustrating correlations would be beneficial here).

- Time lag between Chinese announcements and the Dow Futures reaction: Understanding the time lag allows for better prediction of market reactions and more informed trading strategies.

This analysis reveals the extent to which Dow Futures are influenced by news coming out of China.

The Role of Investor Sentiment and Speculation

Investor psychology plays a significant role in amplifying the impact of China's actions on Dow Futures volatility.

- Fear and uncertainty: Uncertainty surrounding China's economic policies can lead to increased fear and risk aversion among investors, causing market fluctuations.

- Herd behavior: Investors often mimic each other's actions, leading to herd behavior that can exacerbate market swings.

- Short-selling: Short-selling activities can amplify downward pressure on Dow Futures during periods of uncertainty regarding China's economic outlook.

- Market manipulation: In extreme cases, market manipulation can occur, leading to artificial volatility in Dow Futures.

Social media and news coverage can significantly amplify these effects, leading to rapid and sometimes irrational market reactions.

Hedging Strategies and Risk Management in the Face of Uncertainty

Mitigating risks associated with Dow Futures volatility influenced by China’s actions requires proactive risk management strategies.

- Diversification: Diversifying investment portfolios across different asset classes and geographies reduces reliance on any single market, including the US market and its reaction to China's economy.

- Hedging instruments: Using financial derivatives, such as options and futures contracts, can help hedge against potential losses in Dow Futures due to unexpected events in China.

- Options trading: Options trading allows investors to define their risk exposure and limit potential losses.

- Risk assessment models: Sophisticated risk assessment models can help investors better understand the potential impact of China's economic policies on their investments and adjust their strategies accordingly.

These strategies offer investors tools to navigate the complex landscape of Dow Futures volatility influenced by China's actions.

Conclusion

China's economic plans have a significant and often immediate impact on global markets, and Dow Futures volatility is a clear reflection of this interconnectedness. Understanding the implications of the Belt and Road Initiative, regulatory crackdowns, and China's growth targets is essential for navigating the complexities of the global financial landscape. The correlation between Chinese economic news and Dow Futures movements, amplified by investor sentiment and speculation, highlights the importance of informed decision-making. By implementing hedging strategies and practicing effective risk management, investors can better position themselves to handle the volatility stemming from China's economic policies. Stay informed about Stock Market Reaction, China's Economic Plans, and Dow Futures Volatility by continuously monitoring economic indicators and news from China. Further research into global macroeconomic factors and the specific impact on US markets is highly recommended.

Featured Posts

-

De Lente In Woorden Een Gids Voor Lentetaal

Apr 26, 2025

De Lente In Woorden Een Gids Voor Lentetaal

Apr 26, 2025 -

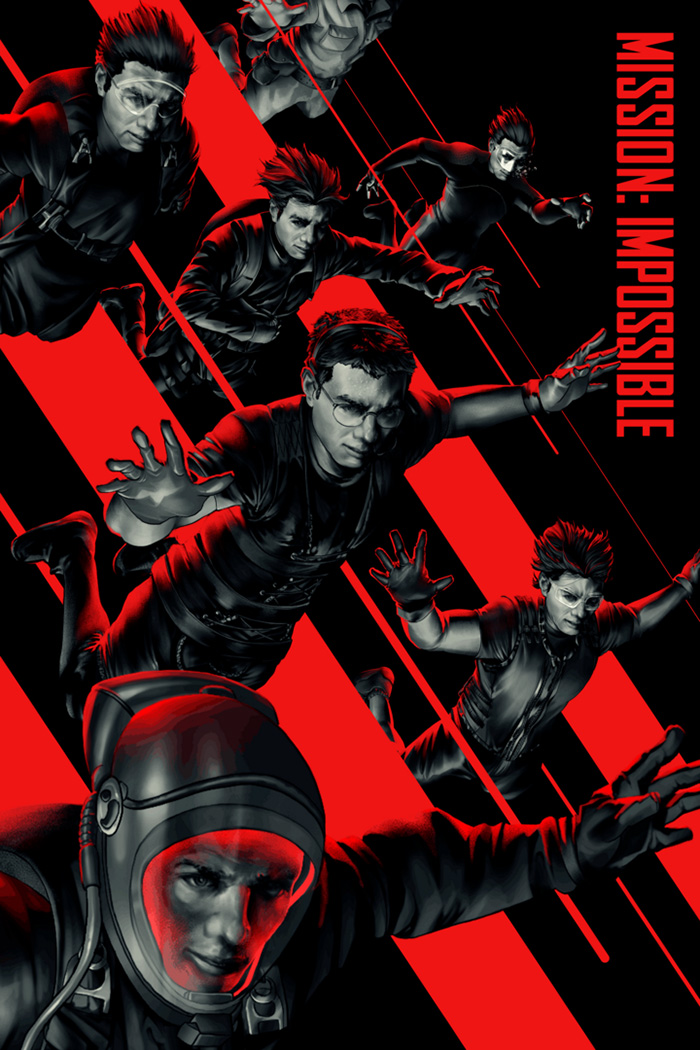

New Mission Impossible Dead Reckoning Part Two Trailer Everything We Know

Apr 26, 2025

New Mission Impossible Dead Reckoning Part Two Trailer Everything We Know

Apr 26, 2025 -

Federal Agency Survey Targets Jewish Employees At Columbia And Barnard

Apr 26, 2025

Federal Agency Survey Targets Jewish Employees At Columbia And Barnard

Apr 26, 2025 -

Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest Your April Events Guide

Apr 26, 2025

Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest Your April Events Guide

Apr 26, 2025 -

Mission Impossible 7 Notable Franchise Omissions

Apr 26, 2025

Mission Impossible 7 Notable Franchise Omissions

Apr 26, 2025

Latest Posts

-

Ariana Grandes Style Overhaul The Professionals Who Helped Create Her New Look

Apr 27, 2025

Ariana Grandes Style Overhaul The Professionals Who Helped Create Her New Look

Apr 27, 2025 -

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025 -

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025 -

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025