Stock Market Reaction: Trump's Tariff Plan And UK Post-Brexit Trade

Table of Contents

Trump's Tariff Plan and its Impact on the Stock Market

Trump's imposition of tariffs on various goods significantly impacted the stock market. This section examines both the immediate and long-term consequences of these trade policies.

Initial Market Response to Tariff Announcements

The initial market response to tariff announcements was generally negative.

- Sharp Sectoral Drops: Sectors heavily reliant on international trade, such as technology and manufacturing, experienced sharp drops immediately following tariff announcements. Companies like Apple, heavily reliant on Chinese manufacturing, saw immediate stock price declines.

- Increased Volatility: The increased uncertainty surrounding the global trade landscape led to increased market volatility, as reflected in a rise in the VIX index, a key measure of market fear.

- Flight to Safety: Investors sought refuge in safer assets, such as government bonds, reducing their exposure to riskier equity markets.

- Specific Examples: For instance, the announcement of tariffs on steel and aluminum led to immediate declines in the stock prices of companies involved in steel production and manufacturing.

Long-Term Effects of Tariffs on Stock Market Performance

The long-term effects of tariffs are more complex and far-reaching.

- Inflationary Pressures: Tariffs contribute to inflationary pressures by increasing the cost of imported goods. This can lead to higher interest rates as central banks attempt to control inflation, potentially slowing economic growth.

- Impact on Corporate Earnings: Increased input costs due to tariffs reduce corporate profitability, negatively affecting stock prices. Businesses also face reduced consumer spending as prices increase.

- Geopolitical Risks: Tariffs often provoke retaliatory measures from other countries, escalating trade tensions and creating further uncertainty for the stock market.

- Historical Analysis: Historical data reveals that prolonged periods of trade protectionism often correlate with slower economic growth and reduced stock market performance.

UK Post-Brexit Trade Deals and their Influence on Global Stock Markets

The UK's departure from the European Union and subsequent trade negotiations have had a significant impact on global stock markets.

Immediate Market Reaction to Brexit Trade Deal Outcomes

The immediate market reaction to Brexit trade deal outcomes has been highly sensitive.

- Positive Reactions: Positive trade deals, securing access to key markets, generally led to positive reactions in the stock market, signaling investor confidence.

- Negative Reactions: Conversely, unfavorable trade deals or prolonged uncertainty resulted in negative reactions, reflecting market anxieties.

- Index Analysis: The FTSE 100, a leading UK stock market index, experienced significant fluctuations throughout the Brexit process, reflecting the market's sensitivity to trade developments.

- Impacted Sectors: Sectors heavily impacted by Brexit trade deals, such as financial services and agriculture, showed particularly volatile stock market reactions.

Assessing Long-Term Implications for Stock Market Stability

The long-term implications of Brexit for stock market stability remain uncertain.

- Uncertainty: Ongoing uncertainty about future trade relationships contributes significantly to market volatility.

- Market Access: The impact of Brexit on UK companies’ access to international markets and their overall competitiveness significantly influences stock valuations.

- Opportunities and Challenges: Brexit presents both opportunities and challenges for businesses adapting to new trade rules, influencing their stock performance.

- International Comparison: Examining the post-EU membership stock market performance of other countries can provide valuable insights into potential future scenarios for the UK.

Interconnectedness of Trump's Tariffs and UK Post-Brexit Trade on Stock Market Reaction

The effects of Trump's tariffs and UK Brexit are interconnected, creating complex challenges for global markets.

Global Supply Chain Disruptions

Both tariffs and Brexit have disrupted global supply chains, leading to increased costs, delays, and shortages. These disruptions negatively affect the stock market performance of companies reliant on global supply chain efficiency.

Investor Sentiment and Confidence

The cumulative impact of these events significantly impacts investor sentiment and confidence. Negative news surrounding trade policy often leads to reduced investor confidence and a flight to safety.

Currency Fluctuations

Currency exchange rate fluctuations are amplified by both events. Tariffs and Brexit-related uncertainties contribute to volatility in currency markets, further impacting stock market performance. Changes in the value of the pound and the dollar, for instance, directly affect the valuations of internationally traded stocks.

Conclusion

This article has examined the complex interplay between Trump's tariff plans and the UK's post-Brexit trade situation on global stock market reactions. Both events have contributed to significant market volatility and uncertainty, impacting various sectors and creating both opportunities and challenges for investors. Understanding the interconnectedness of these geopolitical factors is crucial for navigating the current market landscape. To stay informed about the ongoing stock market reaction and to make informed investment decisions, continue monitoring global economic and political developments closely. Keep abreast of the latest news and analysis related to stock market reactions to trade policy to make savvy investment choices. Understanding the intricacies of stock market reactions is key to successful investing.

Featured Posts

-

Sylvester Stallone A Visite Mon Atelier Exposition De L Artiste Mondialement Connue

May 11, 2025

Sylvester Stallone A Visite Mon Atelier Exposition De L Artiste Mondialement Connue

May 11, 2025 -

Analyzing Holstein Kiels Relegation From The Bundesliga

May 11, 2025

Analyzing Holstein Kiels Relegation From The Bundesliga

May 11, 2025 -

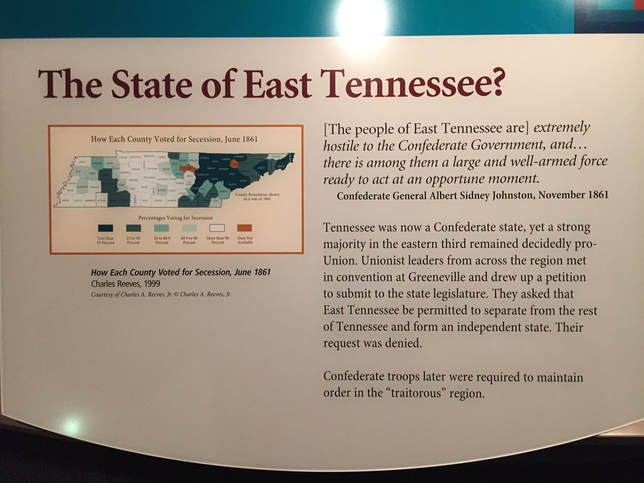

East Tennessee History Center Unveils Baseball Exhibit Before Covenant Health Park Opening

May 11, 2025

East Tennessee History Center Unveils Baseball Exhibit Before Covenant Health Park Opening

May 11, 2025 -

Ufc 315 Belal Muhammad Vs Jack Della Maddalena Full Main Card Announced

May 11, 2025

Ufc 315 Belal Muhammad Vs Jack Della Maddalena Full Main Card Announced

May 11, 2025 -

Faber Criticised For Snubbing Coa Volunteer Honours

May 11, 2025

Faber Criticised For Snubbing Coa Volunteer Honours

May 11, 2025

Latest Posts

-

Ru Pauls Drag Race S17 E13 Preview Drag Baby Mamas A Family Affair

May 12, 2025

Ru Pauls Drag Race S17 E13 Preview Drag Baby Mamas A Family Affair

May 12, 2025 -

Coachella 2025 Tyla Addresses Britney Spears Outfit Inspiration Claims

May 12, 2025

Coachella 2025 Tyla Addresses Britney Spears Outfit Inspiration Claims

May 12, 2025 -

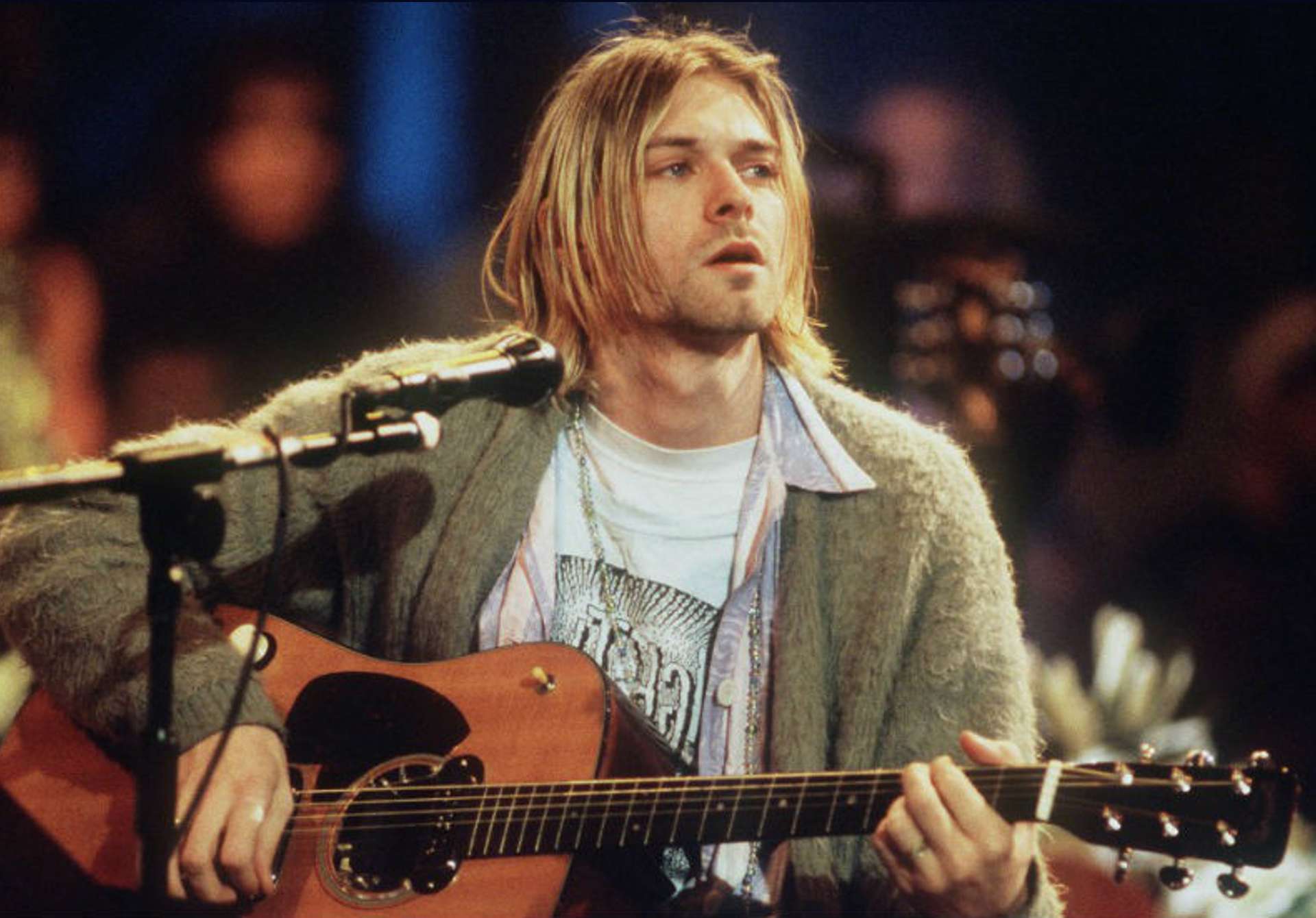

Stream Over 100 Mtv Unplugged Performances The Ultimate Guide

May 12, 2025

Stream Over 100 Mtv Unplugged Performances The Ultimate Guide

May 12, 2025 -

Ru Pauls Drag Race Season 17 Episode 13 Drag Baby Mamas Preview A Family Affair

May 12, 2025

Ru Pauls Drag Race Season 17 Episode 13 Drag Baby Mamas Preview A Family Affair

May 12, 2025 -

Tyla Responds To Britney Spears Coachella Outfit Comparisons

May 12, 2025

Tyla Responds To Britney Spears Coachella Outfit Comparisons

May 12, 2025