Stock Market Today: Bonds Tumble, Dow Futures Uncertain, Bitcoin Rises — Live Updates

Table of Contents

Bond Market Rout: Rising Yields Send Shockwaves

The bond market is experiencing a significant downturn today, with rising yields sending shockwaves across the fixed-income landscape. This sell-off reflects growing concerns about inflation and the potential for aggressive interest rate hikes by central banks. Rising interest rates make existing bonds less attractive, driving down their prices and pushing yields higher.

- Yield Curve Steepening: The yield curve, which illustrates the difference in yields between bonds of varying maturities, is steepening, indicating a growing expectation of future rate increases.

- Treasury Bond Decline: Treasury bond prices have fallen sharply, with the 10-year Treasury yield climbing to [Insert Current Yield Percentage]%, a notable increase from yesterday's [Insert Yesterday's Yield Percentage]%.

- Impact on Fixed-Income Investors: This decline poses significant challenges for fixed-income investors, who are now facing lower returns and potential capital losses on their bond holdings.

- Future Trend Predictions: Analysts predict further upward pressure on bond yields in the short-term, although the long-term trajectory remains uncertain and depends heavily on inflation data and central bank policy decisions.

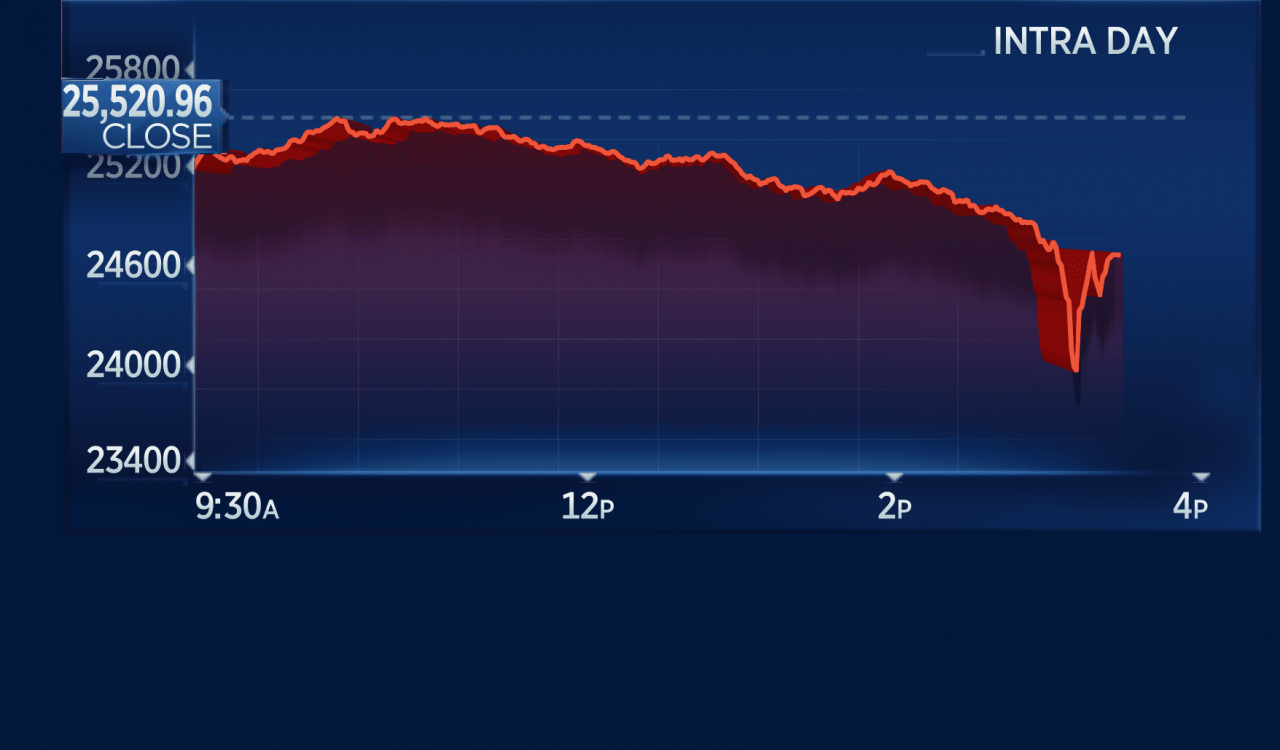

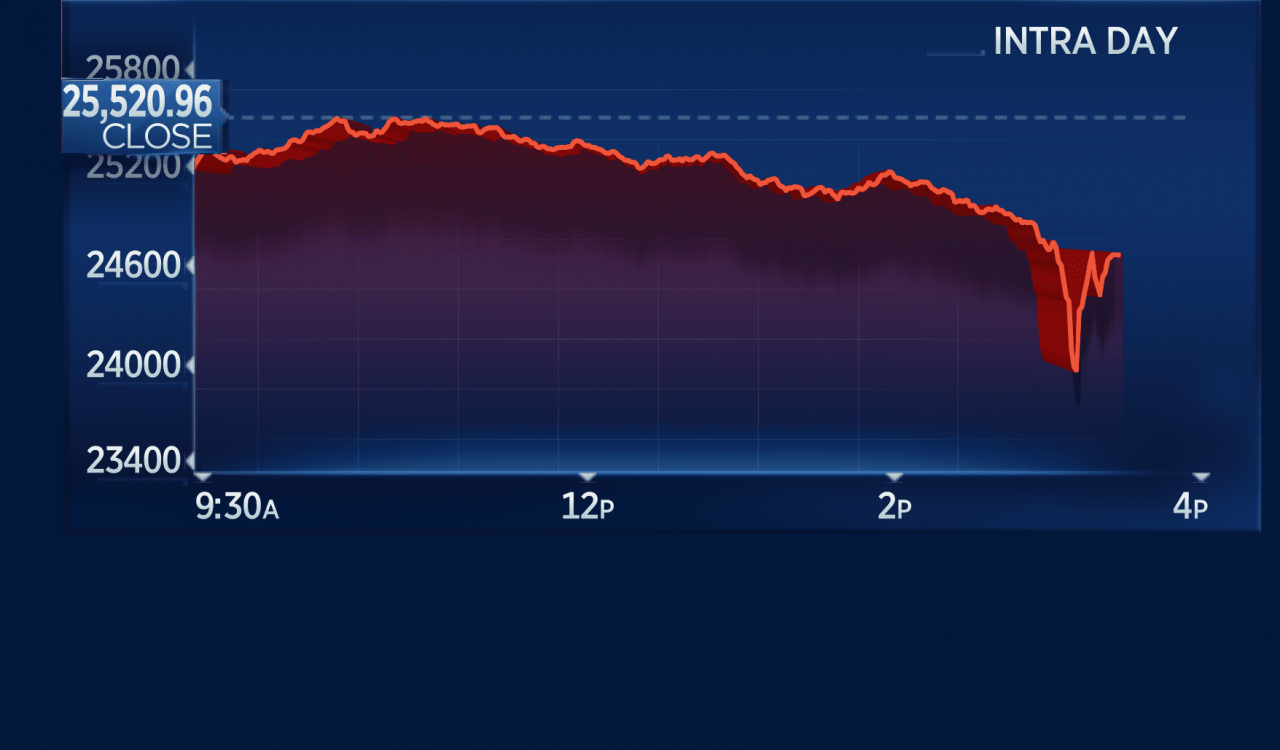

Dow Futures Indicate Uncertain Trading Day

Pre-market trading for the Dow Jones Industrial Average reveals a picture of considerable uncertainty. Dow futures are currently [Insert Current Dow Futures Percentage Change]%, indicating a potentially volatile day ahead for equities. This uncertainty stems from a confluence of factors, including the bond market sell-off, ongoing geopolitical tensions, and lingering concerns about inflation.

- Early Indicators: The current Dow futures movement suggests [interpret the meaning of the percentage change – e.g., a potential opening gap down/up].

- News Impact: Recent news regarding [mention specific news affecting the market - e.g., earnings reports, economic data] is likely contributing to this uncertainty.

- Analyst Predictions: Analysts are divided on the Dow's short-term outlook, with some predicting further declines while others anticipate a potential rebound based on [mention supporting factors, if applicable].

- Investor Sentiment: Investor sentiment remains cautious, reflected in the muted pre-market activity and the volatility seen in other asset classes.

Bitcoin's Ascent Amidst Market Uncertainty

While traditional markets grapple with uncertainty, Bitcoin is defying the trend, experiencing a notable price increase. The cryptocurrency has surged to [Insert Current Bitcoin Price], representing a [Insert Percentage Change] increase in the last [Time Period]. This counter-cyclical movement is attributed to several factors.

- Institutional Adoption: Increased institutional investment and adoption of Bitcoin as a hedge against inflation is a key driver.

- Regulatory Developments: Positive regulatory developments or announcements in key jurisdictions could be fueling the price increase.

- Crypto Market Performance: While Bitcoin leads the charge, other cryptocurrencies are also showing varying degrees of positive performance, boosting the overall crypto market sentiment.

- Decoupling from Traditional Markets: Bitcoin's recent price action highlights a potential decoupling from traditional markets, suggesting that it may be acting as a safe haven asset for some investors amidst broader economic uncertainty.

Understanding the Interconnectedness of Markets

The events of today underscore the intricate interconnectedness of global markets. The bond market rout is impacting equity markets, as evidenced by the uncertain Dow futures. Yet, Bitcoin is showing signs of independence from these traditional asset classes. Understanding these relationships is crucial for effective risk management.

- Market Correlation: While not always perfectly correlated, the bond market and equity markets often exhibit a degree of inverse correlation. Rising bond yields can often signal a flight to safety, impacting equity prices.

- Risk Management Strategies: Diversification across asset classes is a critical risk management strategy in a volatile market environment.

- Portfolio Diversification: Investors may consider diversifying their portfolios to include both traditional and alternative assets, such as cryptocurrencies, to mitigate risks.

- Investment Opportunities: Market volatility can present both risks and opportunities for savvy investors. Careful analysis and strategic decision-making are essential.

Conclusion

Today's market highlights significant drops in the bond market, uncertainty in equity futures (Dow futures), and the contrasting rise of Bitcoin. This interconnectedness underscores the need for careful analysis and diversified investment strategies. Stay informed on the latest developments in the stock market today to make sound investment decisions.

Call to Action: Stay informed on the latest developments in the stock market today by checking back for frequent updates. Understand the live market updates and make informed decisions about your investment strategies by following our comprehensive coverage of stock market news. We provide in-depth analysis on Dow futures, bond yields, and the ever-evolving Bitcoin price to help you navigate the current market volatility.

Featured Posts

-

Deadly Attack Israeli Embassy Staffers Die In Washington Museum Shooting

May 23, 2025

Deadly Attack Israeli Embassy Staffers Die In Washington Museum Shooting

May 23, 2025 -

Canada Vs Mexico Recopilacion De Los Mejores Memes De La Liga De Naciones Concacaf

May 23, 2025

Canada Vs Mexico Recopilacion De Los Mejores Memes De La Liga De Naciones Concacaf

May 23, 2025 -

Cat Deeleys Black Swimsuit Holiday Style Inspiration

May 23, 2025

Cat Deeleys Black Swimsuit Holiday Style Inspiration

May 23, 2025 -

Englands Team Selection For Zimbabwe Test Revealed

May 23, 2025

Englands Team Selection For Zimbabwe Test Revealed

May 23, 2025 -

Increased Bt Profitability A Result Of Johnson Mattheys Strategic Move

May 23, 2025

Increased Bt Profitability A Result Of Johnson Mattheys Strategic Move

May 23, 2025

Latest Posts

-

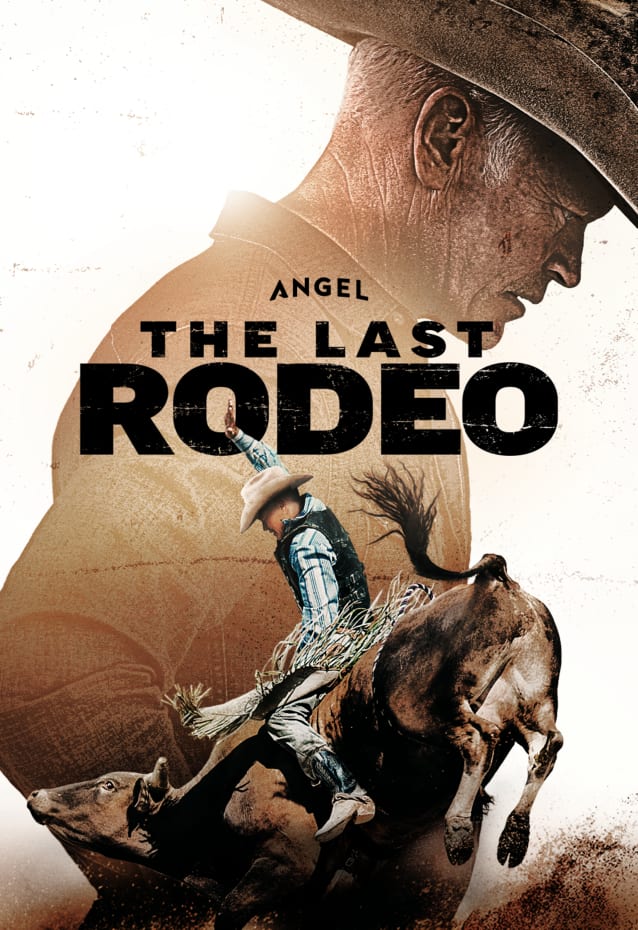

The Last Rodeo Movie Review A Critical Analysis

May 23, 2025

The Last Rodeo Movie Review A Critical Analysis

May 23, 2025 -

The Last Rodeo Film Review Is It Worth Watching

May 23, 2025

The Last Rodeo Film Review Is It Worth Watching

May 23, 2025 -

The Last Rodeo A Heartfelt Look At A Familiar Story

May 23, 2025

The Last Rodeo A Heartfelt Look At A Familiar Story

May 23, 2025 -

The Last Rodeo Review A Powerful Bull Riding Drama

May 23, 2025

The Last Rodeo Review A Powerful Bull Riding Drama

May 23, 2025 -

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 23, 2025

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 23, 2025