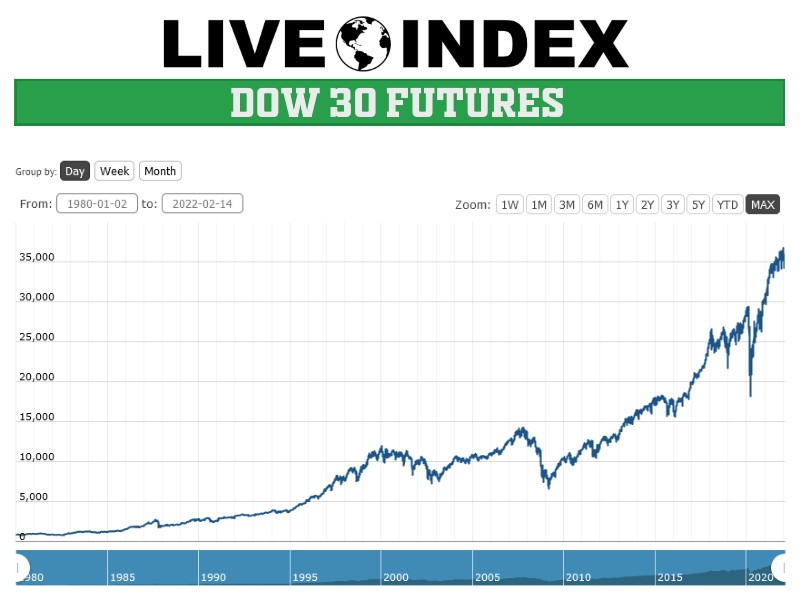

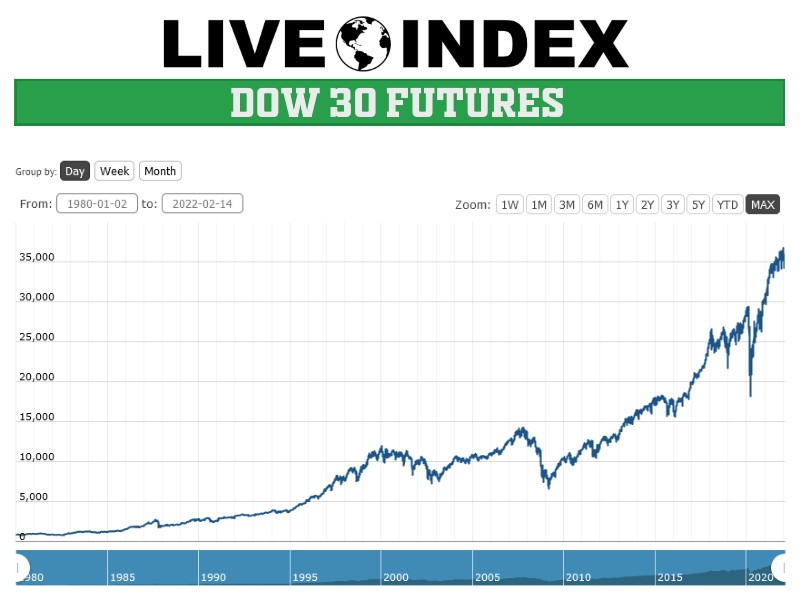

Stock Market Update: Dow Futures Point To Strong Week Finish

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

Dow futures are derivative contracts representing an obligation to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They act as a powerful leading indicator of market sentiment, offering insights into the anticipated direction of the broader stock market before the actual opening bell. The current upward trend in Dow futures suggests a positive outlook for the coming trading sessions.

- Current Dow Futures Price and Percentage Change: [Insert current Dow futures price and percentage change here. This data needs to be updated regularly for accuracy]. For example: "As of [Time], Dow futures are trading at [Price], representing a [Percentage]% increase compared to the previous day's close."

- Comparison to Previous Week's Closing Prices: [Insert comparison to previous week's closing prices here. This data needs to be updated regularly for accuracy]. For example: "This represents a significant increase compared to last week's closing price of [Price]."

- Significant Events Impacting the Futures Market: [Insert any significant news events impacting the futures market, such as earnings reports from major companies, policy announcements, or geopolitical events]. For example: "The recent positive earnings report from [Company Name] has contributed to the bullish sentiment reflected in the Dow futures."

Economic Data Driving Market Performance

Economic data plays a crucial role in shaping market trends and investor sentiment. Positive economic indicators typically boost investor confidence, leading to higher stock prices, while negative data can trigger sell-offs. Analyzing key economic indicators is essential for understanding the current market dynamics.

- Specific Economic Data Points and Their Interpretations: [Insert specific data points like inflation rate, unemployment figures, consumer confidence index, and their interpretations. Examples: "The latest inflation report showed a decline in the Consumer Price Index (CPI), suggesting easing inflationary pressures." or "The unemployment rate remained steady at [percentage], indicating a robust labor market."]

- Impact of Positive/Negative Data on Stock Prices: [Explain how specific data points influence stock prices. For example: "Positive job growth data usually fuels investor optimism, leading to increased demand for stocks." or "Unexpectedly high inflation figures can trigger a market downturn as investors fear higher interest rates."]

- Upcoming Economic Reports and Their Potential Impact: [Mention any anticipated economic reports and their potential market impact. For example: "The upcoming release of the Producer Price Index (PPI) is keenly anticipated, as it could provide further insights into inflationary trends."]

Sector-Specific Performance and Key Movers

Market performance is rarely uniform across all sectors. Some sectors outperform others based on various factors, including economic conditions, technological advancements, and regulatory changes. Analyzing sector-specific performance helps identify investment opportunities and potential risks.

- Top-Performing Sectors and Key Drivers: [Highlight top-performing sectors like technology, energy, or healthcare and explain the drivers behind their success. For example: "The technology sector has seen strong gains driven by advancements in artificial intelligence and increased demand for cloud computing services."]

- Underperforming Sectors and Contributing Factors: [Discuss underperforming sectors and the reasons for their poor performance. For example: "The real estate sector has experienced a slowdown due to rising interest rates and concerns about a potential recession."]

- Specific Stocks Exhibiting Significant Gains or Losses: [Mention specific companies that are showing significant gains or losses and explain the reasons behind their performance. For example: "[Company A] has seen its stock price surge following the announcement of a new groundbreaking product," or "[Company B] experienced a decline due to disappointing quarterly earnings."]

Potential Risks and Considerations for Investors

While Dow futures point to a potentially strong week finish, it’s crucial to acknowledge potential risks and uncertainties that could impact market performance. A balanced approach that considers these risks is essential for successful investing.

- Geopolitical Risks and Their Potential Impact: [Discuss geopolitical events and their potential influence on the market. For example: "The ongoing geopolitical tensions in [Region] could introduce volatility into the market."]

- Inflationary Pressures and Their Influence: [Explain how inflation affects investor behavior and market performance. For example: "Persistent inflationary pressures could lead to higher interest rates, potentially dampening economic growth and impacting stock valuations."]

- Recommendations for Risk Management Strategies: [Offer advice on mitigating risks, such as diversification, hedging strategies, and setting stop-loss orders. For example: "Diversifying your investment portfolio across different asset classes can help reduce overall risk."]

Stock Market Update: Dow Futures and Your Investment Strategy

This Stock Market Update highlights the current positive momentum indicated by Dow futures, driven by encouraging economic data and strong performance in certain sectors. However, it's vital to remember that market conditions are dynamic, and potential risks remain. Understanding the interplay between Dow futures, economic indicators, and sector performance is key to making informed investment decisions.

Remember to analyze the latest data and news before making any investment choices. While Dow futures offer valuable insights, they are not a foolproof predictor of future market movements. The information provided here is for informational purposes only and should not be considered financial advice.

Stay tuned for our next Stock Market Update to get the latest insights on Dow futures and other market trends. Remember to consult with a qualified financial advisor to create an investment strategy that aligns with your risk tolerance.

Featured Posts

-

The End Of Ryujinx Nintendo Contact Leads To Emulator Development Cessation

Apr 26, 2025

The End Of Ryujinx Nintendo Contact Leads To Emulator Development Cessation

Apr 26, 2025 -

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025 -

Interfax Reports Trump Envoy Witkoff In Moscow

Apr 26, 2025

Interfax Reports Trump Envoy Witkoff In Moscow

Apr 26, 2025 -

Chelsea Handler And Drug Use Oscars Afterparty Controversy

Apr 26, 2025

Chelsea Handler And Drug Use Oscars Afterparty Controversy

Apr 26, 2025 -

Why Mission Impossible Dead Reckoning Skips Key Franchise Entries

Apr 26, 2025

Why Mission Impossible Dead Reckoning Skips Key Franchise Entries

Apr 26, 2025

Latest Posts

-

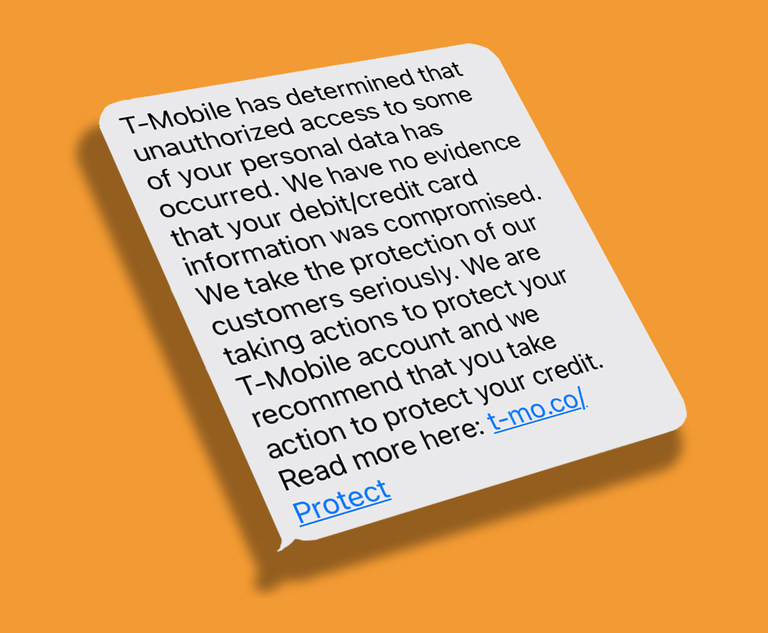

T Mobile Hit With 16 Million Fine Over Three Year Data Breach

Apr 27, 2025

T Mobile Hit With 16 Million Fine Over Three Year Data Breach

Apr 27, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025 -

Repetitive Documents Ai Creates A Compelling Poop Podcast

Apr 27, 2025

Repetitive Documents Ai Creates A Compelling Poop Podcast

Apr 27, 2025 -

Ai Digest How To Create A Podcast From Repetitive Scatological Data

Apr 27, 2025

Ai Digest How To Create A Podcast From Repetitive Scatological Data

Apr 27, 2025 -

From Scatological Documents To Engaging Podcast Ais Role In Content Transformation

Apr 27, 2025

From Scatological Documents To Engaging Podcast Ais Role In Content Transformation

Apr 27, 2025