Stock Market Update: Sensex Jumps 700 Points, Nifty At 18800+

Table of Contents

Key Drivers Behind the Sensex and Nifty Surge

The remarkable rise in the Sensex and Nifty can be attributed to a confluence of positive global and domestic factors. Understanding these drivers is crucial for investors navigating the current market landscape.

Positive Global Cues

Positive global economic indicators played a significant role in today's market rally. Easing inflation concerns in major economies like the US and Europe boosted investor confidence, leading to increased risk appetite.

- Stronger-than-expected earnings reports from global companies: Positive corporate earnings demonstrate robust global economic activity, reassuring investors about future growth prospects.

- Positive investor sentiment: A general feeling of optimism in global markets spills over into the Indian stock market, attracting both domestic and foreign investment.

- Easing inflation concerns in major economies: Reduced inflation pressures lessen the likelihood of aggressive interest rate hikes, creating a more favorable environment for stock market growth.

Domestic Economic Factors

Positive developments within the Indian economy also contributed significantly to the market's upward trajectory. Strong domestic consumption and robust corporate earnings paint a picture of economic resilience.

- Strong domestic consumption: Increased consumer spending indicates a healthy and growing domestic economy, bolstering business confidence and driving stock prices higher.

- Robust corporate earnings: Strong performance by Indian companies showcases the effectiveness of their business models and reinforces investor faith in the long-term prospects of the Indian economy.

- Positive government policy announcements stimulating investment: Government initiatives aimed at boosting infrastructure, promoting manufacturing, and encouraging foreign direct investment (FDI) create a favorable environment for growth.

Sector-Specific Performance

The surge wasn't uniform across all sectors. Certain sectors displayed exceptional strength, driving the overall market rally.

- Strong IT sector performance driven by increased demand: The IT sector benefited from increased global demand for technology services, leading to strong revenue growth and higher stock valuations.

- Banking sector boosted by positive credit growth: Healthy credit growth in the banking sector signals increased economic activity and positive prospects for the financial sector.

- FMCG sector resilient despite inflation: The fast-moving consumer goods (FMCG) sector demonstrated resilience despite inflationary pressures, showcasing the strength of consumer demand for essential goods.

Analyzing the Market Rally: Short-Term and Long-Term Implications

While today's gains are impressive, investors need to consider both short-term and long-term implications.

Short-Term Outlook

While the current rally is encouraging, investors should remain cautious about potential short-term volatility.

- Potential for short-term corrections: Market corrections are a normal part of the market cycle. Investors should be prepared for potential dips and manage their risk accordingly.

- Factors that could influence continued market growth: Sustained market growth will depend on continued positive global and domestic cues, as well as stability in macroeconomic indicators.

- Expert opinions on the sustainability of the rally: Market analysts offer varied opinions on the sustainability of the current rally, emphasizing the need for cautious optimism.

Long-Term Investment Strategies

The current market conditions offer opportunities for long-term investors to build wealth.

- Importance of diversification across sectors: Diversifying investment across various sectors minimizes risk and maximizes potential returns.

- Managing investment risk: Employing appropriate risk management strategies is vital for protecting capital and achieving long-term goals.

- Identifying long-term growth opportunities: The current rally presents opportunities to identify promising sectors poised for long-term growth.

- Considering long-term investment horizons: Long-term investing, with a focus on fundamental analysis and value investing, remains a key strategy to ride out market fluctuations.

Expert Opinions and Market Sentiment

Leading market analysts express a cautiously optimistic outlook, viewing the current rally as a positive sign but cautioning against excessive exuberance. The overall market sentiment can be characterized as cautiously bullish.

- Quotes from market analysts: Prominent analysts highlight the positive factors contributing to the market's strength while acknowledging the need for monitoring global economic developments and potential risks.

- Overall market sentiment: The prevailing sentiment is a mix of optimism and caution, with investors taking a wait-and-see approach.

- Expert predictions for the coming weeks and months: Predictions for the coming period are diverse, ranging from further moderate gains to the possibility of consolidation or minor corrections.

Conclusion

This Stock Market Update highlighted the significant 700-point jump in the Sensex and the Nifty crossing 18800, driven by positive global and domestic factors, strong sector performance, and positive market sentiment. While short-term volatility remains a possibility, the overall outlook presents attractive long-term investment opportunities. Understanding the nuances of the Indian Stock Market is crucial for smart investment decisions.

Call to Action: Stay informed on the latest developments in the Indian stock market. Follow our regular Stock Market Updates to make well-informed investment decisions based on the latest Sensex and Nifty movements and trends. Subscribe to our newsletter for timely insights and expert analysis. Invest wisely!

Featured Posts

-

Police Make Arrest In Elizabeth City Shooting Investigation

May 10, 2025

Police Make Arrest In Elizabeth City Shooting Investigation

May 10, 2025 -

A First Look The Renovated Queen Elizabeth 2 Cruise Ship

May 10, 2025

A First Look The Renovated Queen Elizabeth 2 Cruise Ship

May 10, 2025 -

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025 -

The China Factor Analyzing The Struggles Of Premium Automakers

May 10, 2025

The China Factor Analyzing The Struggles Of Premium Automakers

May 10, 2025 -

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025

Latest Posts

-

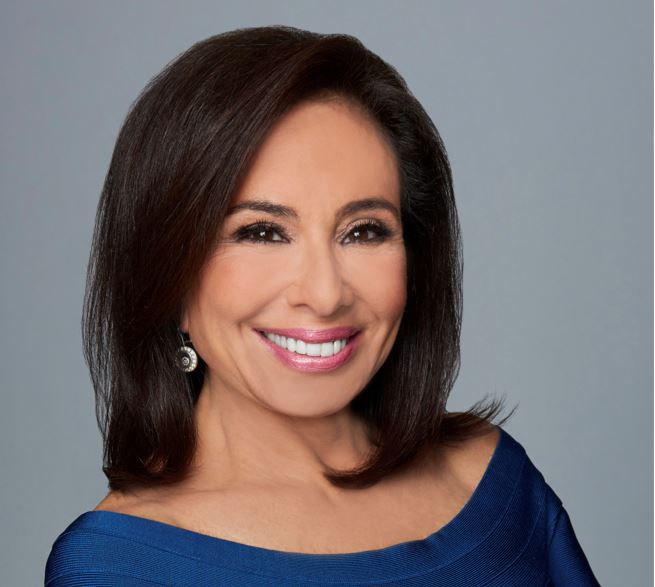

Did Past Controversies Prevent Jeanine Pirros Appointment As Us Attorney For Dc

May 10, 2025

Did Past Controversies Prevent Jeanine Pirros Appointment As Us Attorney For Dc

May 10, 2025 -

Jeanine Pirros Dc Attorney Nomination The Impact Of Past Allegations

May 10, 2025

Jeanine Pirros Dc Attorney Nomination The Impact Of Past Allegations

May 10, 2025 -

An Unfiltered Look At Judge Jeanine Pirro Behind The Scenes At Fox News

May 10, 2025

An Unfiltered Look At Judge Jeanine Pirro Behind The Scenes At Fox News

May 10, 2025 -

A Candid Conversation Judge Jeanine Pirro On Life Fears And Love At Fox News

May 10, 2025

A Candid Conversation Judge Jeanine Pirro On Life Fears And Love At Fox News

May 10, 2025 -

Jeanine Pirros Stock Market Prediction A Few Weeks Of Caution

May 10, 2025

Jeanine Pirros Stock Market Prediction A Few Weeks Of Caution

May 10, 2025