Stock Market Update: Sensex Rebounds, Nifty Above 17950 - Today's Trading

Table of Contents

Sensex Rebound: Analyzing the Key Drivers

The Sensex experienced a robust rebound today, registering a percentage increase of [Insert Percentage Increase Here]%. This positive momentum was fueled by a confluence of factors impacting various sectors.

- Banking Sector Boost: The banking sector played a significant role, with leading banks like [Mention Specific Bank Stocks and their Percentage Increase] witnessing substantial gains. This positive performance can be attributed to [Reasons for Banking Sector Growth, e.g., positive credit growth, improved asset quality].

- IT Sector Recovery: The IT sector also contributed significantly to the Sensex rebound, with companies like [Mention Specific IT Stocks and their Percentage Increase] showing strong performance. Improved global tech sentiment and increased outsourcing are likely contributing factors.

- FMCG Sector Strength: The Fast-Moving Consumer Goods (FMCG) sector demonstrated resilience, with companies like [Mention Specific FMCG Stocks and their Percentage Increase] showcasing steady growth. This indicates continued consumer demand despite inflationary pressures.

- Positive Global Cues: Positive global cues, including [Mention Specific Positive Global News, e.g., easing inflation concerns in the US, positive economic data from major economies], significantly boosted investor sentiment.

- Improved Domestic Economic Indicators: Encouraging domestic economic indicators, such as [Mention Specific Positive Domestic Economic Indicators, e.g., robust industrial production data, healthy services PMI], further fueled the market's positive trajectory.

Nifty Above 17950: Implications and Future Outlook

The Nifty index crossing the 17950 mark is a significant milestone, signaling renewed investor confidence.

- Technical Analysis: [Insert Technical Analysis, if applicable, e.g., The breakout above 17950 suggests a potential move towards the next resistance level at 18100. The RSI is showing [RSI Value], indicating [Overbought/Oversold] conditions.]

- Market Sentiment: The overall market sentiment is currently [Optimistic/Cautious], with investors showing [Increased/Decreased] risk appetite.

- Potential Resistance Levels: While the market has shown strength, potential resistance levels may lie around [Mention Resistance Levels].

- Near-Future Outlook: Based on the current data, the near-term outlook appears [Optimistic/Cautious]. However, investors should remain vigilant and monitor global events and economic indicators.

Top Gainers and Losers: A Detailed Sectoral Analysis

Today's trading witnessed a mixed bag of performances across various sectors.

Top Gainers:

- Sector: [Sector Name, e.g., Banking] – Key drivers: [Reasons for Sectoral Growth] – Example Stocks: [Stock Name 1 (+X%), Stock Name 2 (+Y%)]

- Sector: [Sector Name, e.g., IT] – Key drivers: [Reasons for Sectoral Growth] – Example Stocks: [Stock Name 1 (+X%), Stock Name 2 (+Y%)]

Top Losers:

- Sector: [Sector Name, e.g., Energy] – Key drivers: [Reasons for Sectoral Decline] – Example Stocks: [Stock Name 1 (-X%), Stock Name 2 (-Y%)]

- Sector: [Sector Name, e.g., Pharma] – Key drivers: [Reasons for Sectoral Decline] – Example Stocks: [Stock Name 1 (-X%), Stock Name 2 (-Y%)]

This sectoral analysis provides a comprehensive overview of the day's market performance.

Global Market Influence on Indian Stock Market

Global market dynamics played a significant role in shaping today's Indian stock market performance.

- US Fed Rate Hikes: The impact of recent or anticipated US Fed rate hikes on investor sentiment needs to be considered. [Explain the impact].

- Geopolitical Tensions: Ongoing geopolitical tensions, particularly [Mention Specific Geopolitical Event], may have influenced investor risk appetite. [Explain the impact].

- FII Activity: Foreign Institutional Investor (FII) activity today was [Positive/Negative], with [Net inflow/outflow] impacting market liquidity.

Understanding the global context is critical for interpreting the Indian stock market’s daily movements.

Conclusion: Understanding Today's Stock Market Trading – Your Next Steps

Today's stock market witnessed a significant Sensex rebound and the Nifty index surpassing 17950, driven by a combination of positive global cues, improved domestic economic indicators, and strong performances in key sectors. Analyzing top gainers and losers provides a granular understanding of the day's market dynamics, while acknowledging the influence of global events is crucial for a comprehensive perspective. Staying informed about daily market updates is essential for making sound investment decisions. To stay updated on the latest Sensex and Nifty movements and receive in-depth analysis of today's trading, subscribe to our newsletter or follow us on social media! Don't miss out on future stock market updates and analysis – follow us for continuous insights into Sensex and Nifty performance.

Featured Posts

-

Americas First Nonbinary Person A Life Cut Short

May 10, 2025

Americas First Nonbinary Person A Life Cut Short

May 10, 2025 -

Donner Ses Cheveux A Dijon Informations Pratiques

May 10, 2025

Donner Ses Cheveux A Dijon Informations Pratiques

May 10, 2025 -

Analyzing The Net Worth Of Musk Bezos And Zuckerberg Losses Since Trumps Inauguration

May 10, 2025

Analyzing The Net Worth Of Musk Bezos And Zuckerberg Losses Since Trumps Inauguration

May 10, 2025 -

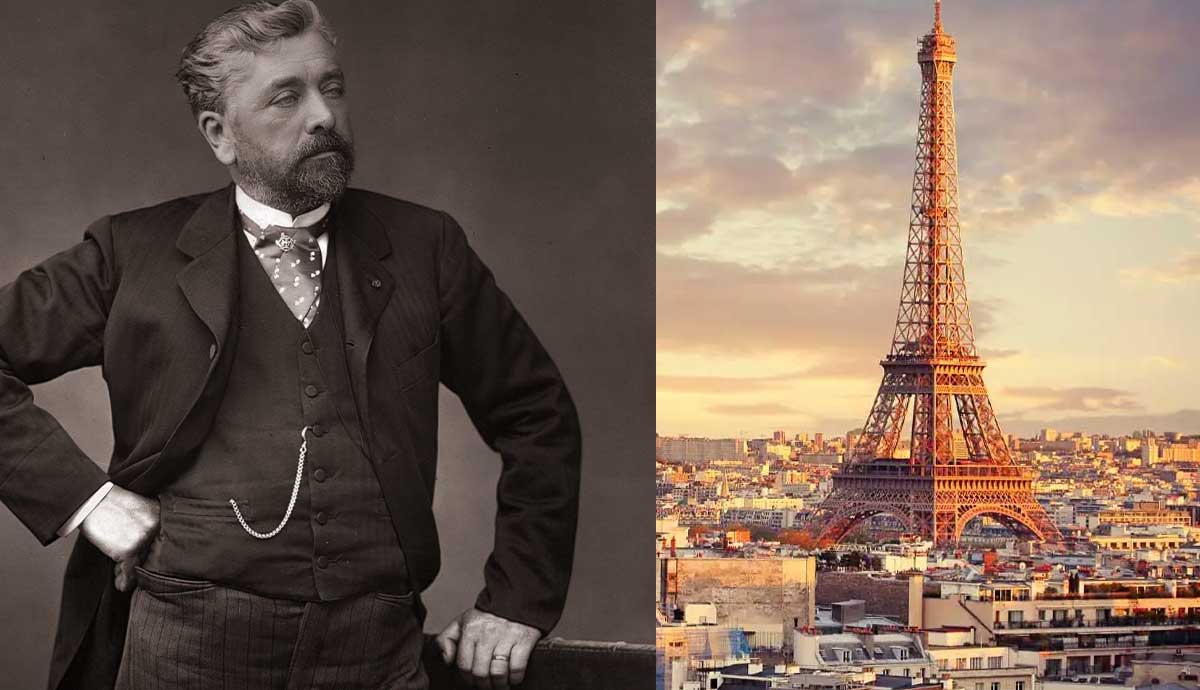

L Ombre De Melanie Comment La Mere De Gustave Eiffel A Influence Son Destin A Dijon

May 10, 2025

L Ombre De Melanie Comment La Mere De Gustave Eiffel A Influence Son Destin A Dijon

May 10, 2025 -

Elon Musks Net Worth Under 300 Billion A Deep Dive Into The Recent Decline

May 10, 2025

Elon Musks Net Worth Under 300 Billion A Deep Dive Into The Recent Decline

May 10, 2025