Stock Market Valuation Anxiety? BofA Offers A Calming Perspective

Table of Contents

Understanding Stock Market Valuation Anxiety

Stock market valuation anxiety refers to the emotional distress and worry experienced by investors due to perceived overvaluation or undervaluation of the market. This anxiety manifests in various ways, from sleepless nights spent obsessively checking stock prices to impulsive trading decisions driven by fear or greed. The psychological impact of market fluctuations can be significant, leading to stress, decreased productivity, and even impacting overall well-being.

- Fear of Missing Out (FOMO): The constant bombardment of market news and social media posts can fuel FOMO, pushing investors to make rash decisions based on short-term gains rather than long-term strategies.

- Herd Mentality: The tendency to follow the actions of others, particularly during market downturns, can exacerbate anxiety and lead to panic selling.

- Social Media's Influence: The constant stream of often biased and sensationalized information on social media platforms can amplify negative sentiment and contribute to heightened anxiety levels.

- Past Market Crashes: The memory of previous market downturns, like the 2008 financial crisis, can create a lasting fear and significantly impact how investors react to current market fluctuations. This can lead to a heightened sense of stock market valuation anxiety.

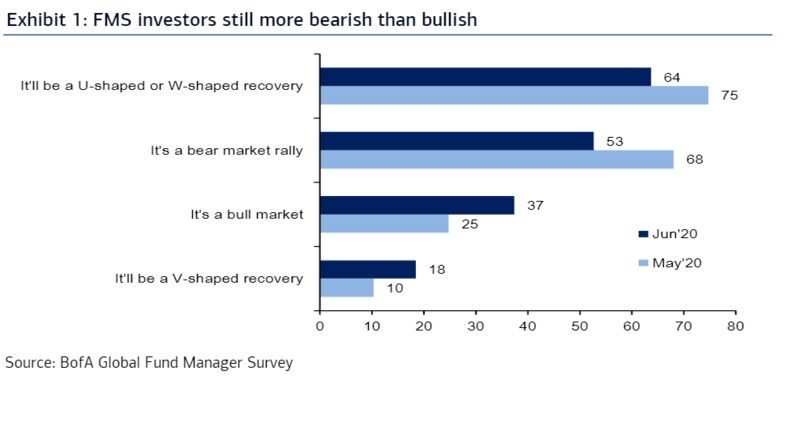

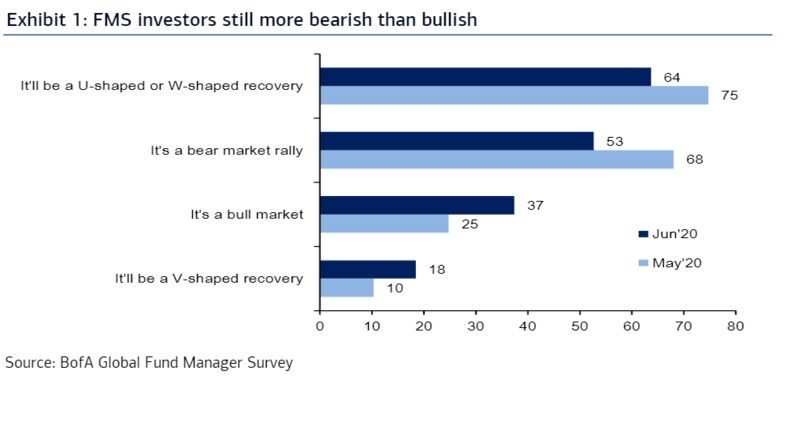

BofA's Perspective on Current Market Valuations

BofA's recent reports offer a more measured outlook on current market valuations. Their analysts have examined various indices, including the S&P 500 and specific sectors like technology and healthcare, to assess overall market health. Their perspective emphasizes several key factors that mitigate anxieties surrounding market valuations:

- Key Findings from BofA's Reports: BofA points to robust corporate earnings in several key sectors, despite macroeconomic challenges. They highlight the resilience of the US economy and the potential for sustained, albeit slower, growth.

- Specific Sectors or Indices BofA Highlights: While acknowledging certain sector-specific risks, BofA emphasizes the long-term growth potential of many established companies and emerging technologies.

- BofA's Predictions and Outlook: BofA's analysts predict moderate market growth in the coming years, acknowledging the possibility of short-term corrections but emphasizing the long-term upward trajectory.

- Comparison to Previous Market Cycles: By comparing current market conditions to previous cycles, BofA analysts show that current valuations, while perhaps elevated in some areas, are not necessarily indicative of an imminent crash. This helps to contextualize the current stock market valuation anxiety.

Strategies to Manage Stock Market Valuation Anxiety

Managing stock market valuation anxiety requires a shift in perspective from short-term market fluctuations to long-term investment goals. BofA's insights support the following strategies:

- Diversification of Portfolio: Spreading investments across different asset classes (stocks, bonds, real estate) reduces risk and mitigates the impact of any single market downturn.

- Importance of a Long-Term Investment Horizon: Focusing on long-term goals, rather than daily price movements, helps to reduce emotional reactions to short-term volatility.

- Regular Portfolio Reviews without Emotional Reactions: Regular portfolio reviews should be objective assessments, not emotionally driven adjustments.

- Seeking Professional Financial Advice: A financial advisor can provide personalized guidance and help create an investment strategy aligned with individual risk tolerance and financial goals.

- Importance of Emotional Detachment from Daily Market Fluctuations: Detaching from the daily ups and downs of the market allows for rational decision-making and prevents impulsive actions driven by anxiety.

- Utilizing Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, reduces the risk of buying high and selling low.

The Importance of Due Diligence and Research

Informed investment decisions are crucial to managing anxiety. Thorough research reduces uncertainty and promotes confidence in your investment strategy.

- Utilizing Reliable Financial News Sources: Stay informed, but be discerning about the sources you rely on. Prioritize reputable financial news outlets and avoid sensationalized or biased reporting.

- Reading Company Financial Reports: Understanding a company's financial health through its reports gives you a clearer picture of its long-term prospects.

- Understanding Key Financial Metrics: Familiarize yourself with key metrics like P/E ratios, debt-to-equity ratios, and revenue growth to better assess a company's value.

Conclusion

BofA's calming perspective, emphasizing long-term growth potential and the importance of reasoned investment strategies, offers a valuable counterpoint to the pervasive stock market valuation anxiety. By focusing on diversification, long-term horizons, and thorough research, investors can mitigate their anxieties and navigate market fluctuations with greater confidence. To further reduce your stock market valuation anxiety, explore BofA's research reports on their website and consider seeking professional financial advice tailored to your specific needs. Remember, a long-term perspective and informed decision-making are key to successful investing. Don't let short-term market volatility dictate your long-term financial future.

Featured Posts

-

Zendayas Space Adventure Prepare For An Unpredictable Journey

May 07, 2025

Zendayas Space Adventure Prepare For An Unpredictable Journey

May 07, 2025 -

Ralph Macchio Provides My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025

Ralph Macchio Provides My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025 -

Nbas Cavaliers Add G League Talent On 10 Day Contract

May 07, 2025

Nbas Cavaliers Add G League Talent On 10 Day Contract

May 07, 2025 -

Wnba Preseason Notre Dame Stars Face Off In South Bend

May 07, 2025

Wnba Preseason Notre Dame Stars Face Off In South Bend

May 07, 2025 -

Jackie Chans Strongest Character A Surprise Hit From An Unexpected Flop

May 07, 2025

Jackie Chans Strongest Character A Surprise Hit From An Unexpected Flop

May 07, 2025

Latest Posts

-

Jalen Brunson And Donovan Mitchell Rising To The Occasion In The Playoffs

May 07, 2025

Jalen Brunson And Donovan Mitchell Rising To The Occasion In The Playoffs

May 07, 2025 -

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025 -

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025 -

Nba Playoffs Smart Bets For The Cavaliers Vs Pacers Series

May 07, 2025

Nba Playoffs Smart Bets For The Cavaliers Vs Pacers Series

May 07, 2025 -

Nba Playoffs Mitchell And Brunson Prove Their Worth

May 07, 2025

Nba Playoffs Mitchell And Brunson Prove Their Worth

May 07, 2025