Stock Market Valuation Anxiety: BofA Offers Reassurance

Table of Contents

BofA's Key Arguments for a Less-Anxious Market Outlook

BofA's recent report presents a compelling case for a less pessimistic view of current stock market valuations. Their analysis suggests that while challenges exist, several factors point towards a more positive long-term outlook.

-

Strong Corporate Earnings Despite Economic Headwinds: BofA highlights that despite inflationary pressures and rising interest rates, many corporations have demonstrated resilience, reporting strong earnings. This suggests underlying economic strength and the capacity of businesses to adapt to challenging environments. This resilience is a key factor in their market analysis.

-

Resilience of the Consumer: Despite economic uncertainty, consumer spending remains relatively robust in many sectors. This continued consumer demand supports corporate profitability and indicates a degree of economic stability. This is a crucial element in their assessment of market valuation.

-

Positive Long-Term Growth Projections: BofA's analysts project continued, albeit moderate, economic growth in the coming years. This forecast underpins their belief that current valuations, while potentially elevated in some sectors, are not necessarily unsustainable in the long term. This market outlook is vital for investors making long-term plans.

-

Impact of Interest Rate Hikes on Valuations: While interest rate hikes impact valuations by increasing borrowing costs, BofA's analysis suggests that the effect is already largely priced into the market. They argue that further rate increases are unlikely to cause a dramatic market downturn, especially given the underlying strength of corporate earnings. This perspective directly addresses concerns about stock market valuation.

-

Sector-Specific Analysis: BofA identifies specific sectors that they believe are potentially undervalued (e.g., certain segments of the technology sector showing strong growth potential) and others that may be overvalued (e.g., certain real estate sectors potentially facing interest rate pressures). This granular BofA analysis enables investors to make more informed decisions.

Their report supports these arguments with detailed financial data and projections, offering a comprehensive perspective on the current stock market outlook.

Understanding the Drivers of Stock Market Valuation Anxiety

Market valuation anxiety stems from several interconnected factors that can significantly impact investor sentiment. Understanding these drivers is crucial for managing your own anxieties.

-

Inflation Concerns: Persistent inflation erodes purchasing power and raises concerns about future economic growth, impacting both corporate profits and investor confidence. This leads to volatility in stock market valuation.

-

Recession Fears: Concerns about a potential recession fuel anxiety, as recessions typically lead to decreased corporate earnings and increased market volatility. These recession fears directly contribute to investor anxiety.

-

Geopolitical Uncertainties: Global events, such as conflicts or political instability, inject uncertainty into the market, leading to increased volatility and affecting market valuation. This geopolitical risk is a major contributor to overall market volatility.

-

High Interest Rates: Higher interest rates increase borrowing costs for businesses and consumers, impacting economic growth and potentially leading to a decrease in corporate profits. This is a crucial component of the current stock market valuation debate.

-

Market Volatility: Periods of heightened market volatility naturally increase anxiety among investors, as unpredictable price swings can lead to significant short-term losses. This market volatility amplifies investor sentiment.

These factors influence market valuations by affecting investor sentiment, leading to price fluctuations and contributing to widespread investor anxiety.

Addressing Specific Investor Concerns

Many investors grapple with specific questions about market valuation:

-

Is the market overvalued? While some sectors may appear overvalued, BofA argues that the overall market is not necessarily in a bubble, particularly given the strength of corporate earnings and the resilience of the consumer.

-

Should I sell my stocks? BofA generally advocates against panic selling. A long-term investment strategy, aligned with your risk tolerance, is recommended over knee-jerk reactions.

-

What should I invest in now? BofA suggests focusing on diversification and identifying potentially undervalued sectors based on their analysis.

It's crucial to acknowledge that BofA's perspective is not without potential counterarguments. There are inherent risks in any investment, and unexpected events could negatively impact market valuations. Thorough risk management is key.

BofA's Recommendations for Investors

BofA emphasizes a strategic and measured approach to navigating the current market conditions:

-

Diversification Strategies: Diversifying your portfolio across different asset classes and sectors reduces risk and helps mitigate the impact of any single market downturn. This diversification is key for long-term investment strategies.

-

Long-Term Investment Approach: Focus on long-term goals and avoid making rash decisions based on short-term market fluctuations. This long-term investment perspective is crucial for managing stock market valuation anxiety.

-

Risk Tolerance Assessment: Understand your own risk tolerance and invest accordingly. Seek professional advice if needed to ensure your investment strategy aligns with your financial goals and comfort level. Understanding your risk tolerance is fundamental in creating a robust investment strategy.

-

Professional Financial Advice: Consider consulting with a qualified financial advisor for personalized guidance tailored to your specific circumstances. Professional advice helps create a suitable financial plan.

Managing Your Stock Market Valuation Anxiety: A Path Forward

BofA’s reassurances highlight the importance of focusing on the underlying strength of the economy and corporate earnings, rather than succumbing to short-term market volatility. Understanding the drivers of market valuation anxiety – inflation, recession fears, geopolitical uncertainty, interest rates, and market volatility – is vital. A well-informed investment strategy based on long-term goals, risk tolerance, and diversification is crucial.

Don't let stock market valuation anxiety paralyze you. Take control of your investments by conducting thorough research, seeking professional financial planning advice if needed, and developing a robust investment strategy tailored to your specific goals and risk tolerance. Remember, a long-term perspective is key to navigating the ups and downs of the market successfully.

Featured Posts

-

Nba Draft Lottery Celebrate With A Free Party Hosted By The Charlotte Hornets

May 13, 2025

Nba Draft Lottery Celebrate With A Free Party Hosted By The Charlotte Hornets

May 13, 2025 -

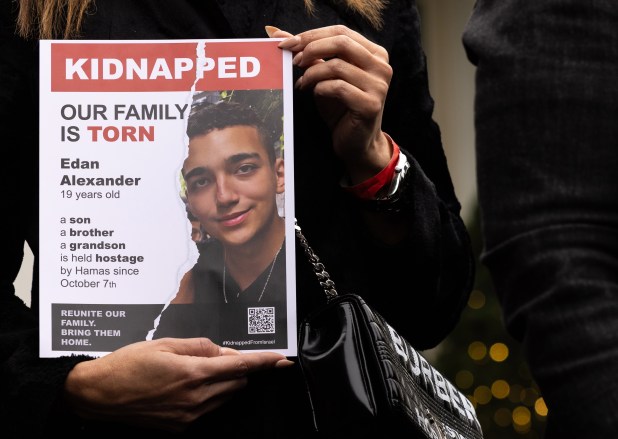

Us Urged To Engage Hamas In Talks Father Of Gaza Hostage Edan Alexander Remains Hopeful

May 13, 2025

Us Urged To Engage Hamas In Talks Father Of Gaza Hostage Edan Alexander Remains Hopeful

May 13, 2025 -

Ian Mc Kellens Coronation Street Appearance A Pivotal Moment In His Career

May 13, 2025

Ian Mc Kellens Coronation Street Appearance A Pivotal Moment In His Career

May 13, 2025 -

Mc Kellen On Closeted Actors Its Silly

May 13, 2025

Mc Kellen On Closeted Actors Its Silly

May 13, 2025 -

Black Widow Kleinei Oristika To Kefalaio Tis Skarlet Gioxanson

May 13, 2025

Black Widow Kleinei Oristika To Kefalaio Tis Skarlet Gioxanson

May 13, 2025