Stock Market Valuation Concerns? BofA Offers A Counterargument

Table of Contents

BofA's Counterargument: A Focus on Earnings Growth

BofA's analysis emphasizes the significant role of future earnings growth in justifying current valuations. They argue that projections for robust corporate earnings growth can support current market levels, even in the face of seemingly high price-to-earnings ratios. This perspective shifts the focus from simply looking at current metrics to considering the potential for future profitability.

- Strong corporate profit margins: Many companies are demonstrating impressive profit margins, indicating efficient operations and strong pricing power. This contributes significantly to overall earnings growth projections.

- Increased productivity and efficiency: Advancements in technology and streamlined processes are driving increased productivity, leading to higher profits and bolstering earnings growth.

- Positive economic forecasts impacting earnings: Favorable economic forecasts suggest continued growth, further supporting the projections for strong corporate earnings. This positive outlook is a key factor in BofA's argument.

- Analysis of specific sectors showing high growth potential: BofA's analysis doesn't focus solely on aggregate market data; it dives into specific sectors, identifying those with particularly high growth potential that contribute significantly to the overall positive outlook for earnings. This granular approach strengthens their argument.

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

High P/E ratios are a common concern indicating potentially overvalued stocks. However, BofA counters this by highlighting several factors that put the current P/E ratios into context. Simply looking at the P/E ratio in isolation can be misleading.

- Low interest rates influence higher valuations: Lower interest rates make borrowing cheaper for companies, and investors are willing to pay more for future earnings when the cost of capital is low. This contributes to higher valuations.

- Comparison to historical P/E ratios in similar economic conditions: BofA's analysis likely compares current P/E ratios to those observed during periods with similar economic characteristics. This contextual comparison provides a more nuanced perspective on valuation.

- Focus on forward-looking P/E ratios, reflecting future earnings: Instead of solely relying on trailing P/E ratios, BofA emphasizes forward-looking P/E ratios, which reflect projected future earnings. This provides a more forward-looking view on valuation.

- Sector-specific analysis showing reasonable P/E ratios in certain areas: The analysis acknowledges that P/E ratios vary widely across sectors. Focusing on specific sectors reveals that some exhibit quite reasonable P/E ratios relative to their growth prospects.

The Role of Innovation and Technological Advancements

BofA's perspective acknowledges the significant impact of technological disruption and innovation on future earnings. This is a critical factor often overlooked in simpler valuation models.

- Discussion of the impact of AI and other technologies on corporate earnings: The rise of artificial intelligence (AI) and other advanced technologies is increasing productivity and creating new revenue streams for many businesses, significantly impacting corporate earnings.

- Examples of high-growth technology companies and their influence on overall market valuation: High-growth technology companies often have high valuations, and their success contributes significantly to the overall market's perception of value.

- The potential for technological advancements to drive future earnings beyond current expectations: The rapid pace of innovation suggests that future earnings could significantly exceed current projections, further justifying current valuations.

- Mention of potential risks and opportunities associated with technological disruption: BofA's analysis likely acknowledges the inherent risks and uncertainties related to technological disruption, providing a balanced perspective.

Addressing the Risk of Inflation and Interest Rate Hikes

Acknowledging the potential impact of inflation and interest rate increases on market valuations, BofA suggests that the market may already be pricing in these factors to some degree. This demonstrates a sophisticated understanding of macroeconomic influences.

- Analysis of inflation expectations and their effect on stock prices: BofA's analysis likely incorporates current inflation expectations and their projected impact on corporate earnings and stock prices.

- Discussion of how interest rate hikes could influence corporate borrowing costs: Increased interest rates increase the cost of borrowing for companies, potentially impacting their profitability. This is a key factor considered in their analysis.

- BofA's projected impact of inflation and interest rate increases on earnings: The analysis likely includes projections on how inflation and interest rate hikes could affect corporate earnings.

- Strategies for mitigating risks associated with inflation and rising interest rates: The analysis likely also discusses strategies investors can use to mitigate the risks associated with these macroeconomic factors.

Conclusion

While concerns about stock market valuation are valid, BofA's counterargument presents a nuanced perspective, highlighting the potential for continued growth fueled by strong earnings, innovation, and a considered approach to macroeconomic factors. Understanding the complexities of stock market valuation is crucial for informed investment decisions. To delve deeper into BofA's analysis and refine your understanding of current stock market valuation, consider exploring their research reports and consulting with a financial advisor. Don't let unfounded stock market valuation fears dictate your investment strategy; do your research and make informed decisions based on a comprehensive understanding of the market. Develop a robust stock valuation strategy to navigate the current market conditions effectively.

Featured Posts

-

Ski Lift Snowball Incident Parisian Could Face Imprisonment

May 29, 2025

Ski Lift Snowball Incident Parisian Could Face Imprisonment

May 29, 2025 -

Key Music Lawyers To Know In 2025 The Billboard List

May 29, 2025

Key Music Lawyers To Know In 2025 The Billboard List

May 29, 2025 -

Morgan Wallens The Chair Drink Bar Debut Where He Infamously Tossed A Chair

May 29, 2025

Morgan Wallens The Chair Drink Bar Debut Where He Infamously Tossed A Chair

May 29, 2025 -

France Targets Drug Trade With Phone Seizure Policy

May 29, 2025

France Targets Drug Trade With Phone Seizure Policy

May 29, 2025 -

Jw 24 Alshykh Fysl Alhmwd Yuebr En Mshaerh Tjah Alardn Fy Eyd Alastqlal

May 29, 2025

Jw 24 Alshykh Fysl Alhmwd Yuebr En Mshaerh Tjah Alardn Fy Eyd Alastqlal

May 29, 2025

Latest Posts

-

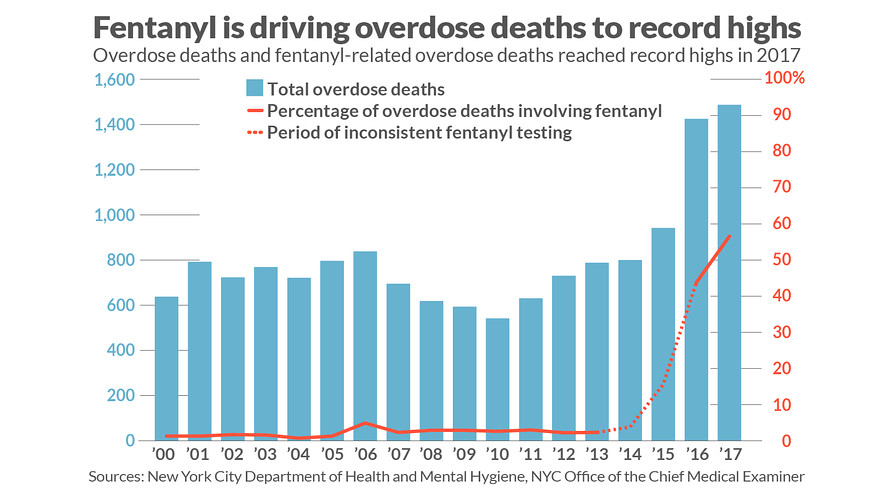

Prince Overdose March 26th Fentanyl Levels In Final Report

May 31, 2025

Prince Overdose March 26th Fentanyl Levels In Final Report

May 31, 2025 -

Local History Key Events And Figures Featured In Kpc News

May 31, 2025

Local History Key Events And Figures Featured In Kpc News

May 31, 2025 -

Critics Choice 30 Best Books For Summer Reading

May 31, 2025

Critics Choice 30 Best Books For Summer Reading

May 31, 2025 -

Understanding Our Past A Look At Kpc News Historical Archives

May 31, 2025

Understanding Our Past A Look At Kpc News Historical Archives

May 31, 2025 -

Summer Reading List 30 Books Recommended By Critics

May 31, 2025

Summer Reading List 30 Books Recommended By Critics

May 31, 2025