Stock Market Valuation Concerns? BofA Offers A Different View

Table of Contents

BofA's Counter-Narrative on Stock Market Valuations

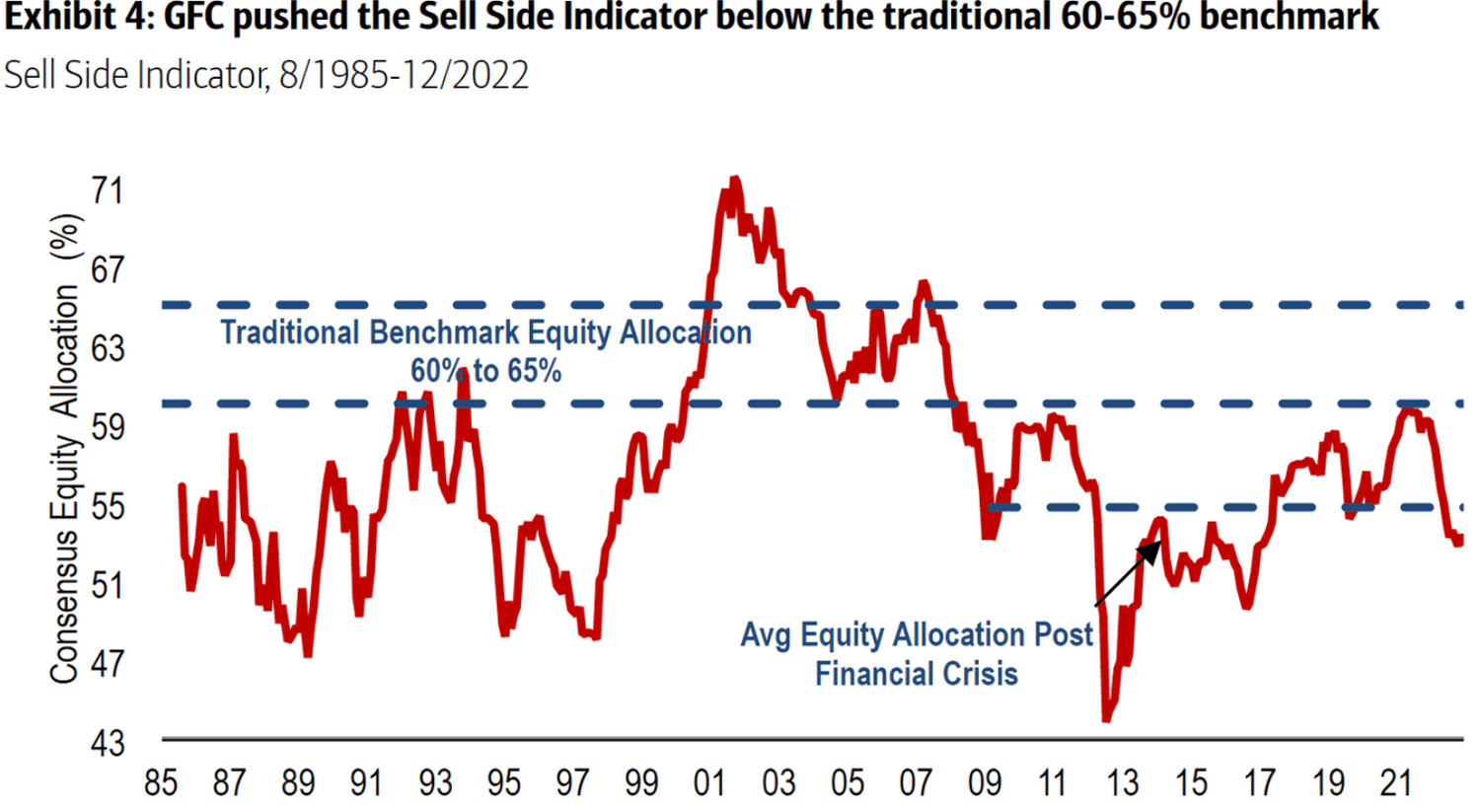

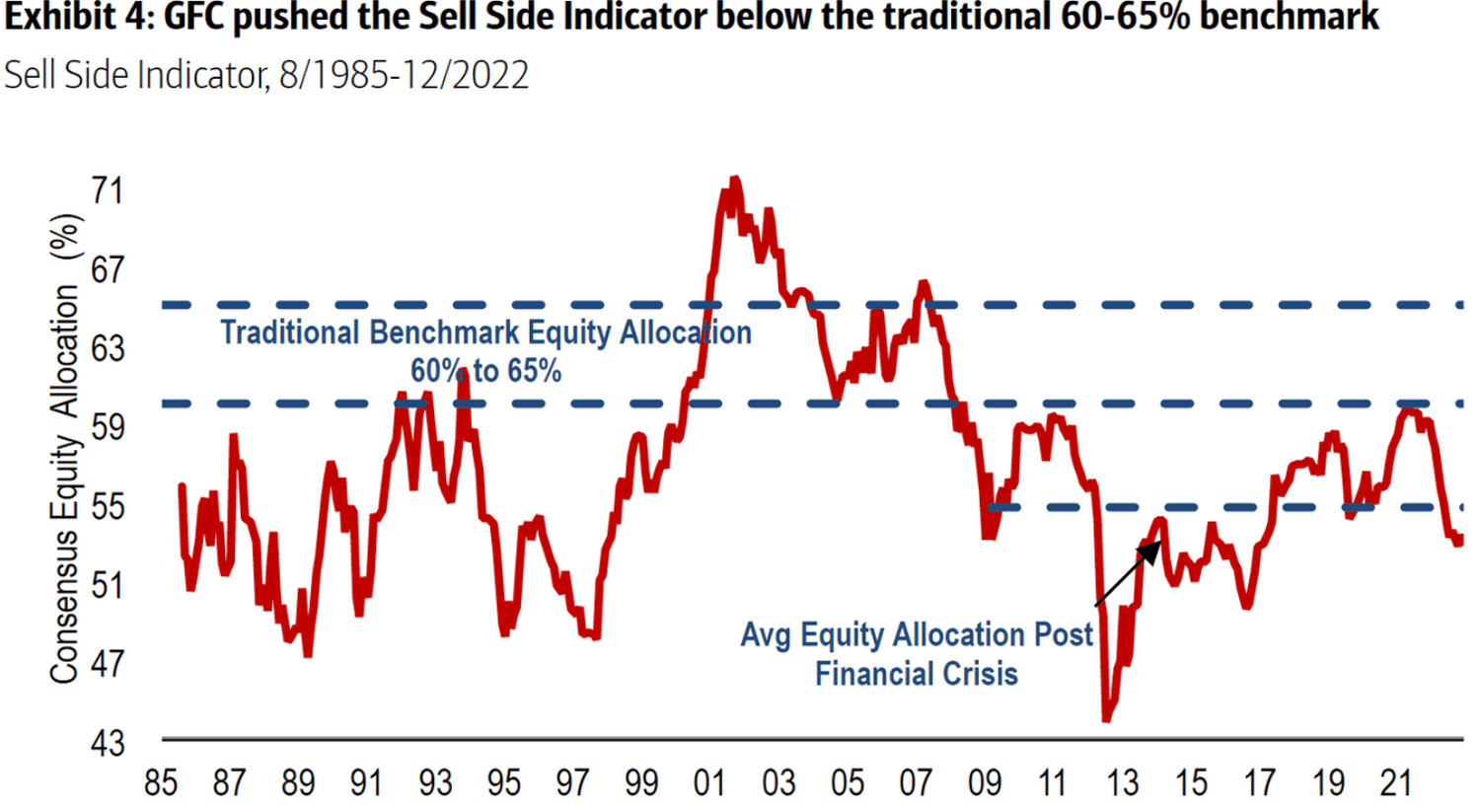

BofA's stance on current stock market valuations can be characterized as cautiously optimistic, rather than outright bullish or bearish. Their key argument centers on the belief that while valuations appear high based on traditional metrics, several crucial factors mitigate these concerns and support the current market levels.

-

BofA's Key Arguments Against Overvaluation: BofA contends that current valuations are justified by strong corporate earnings growth, sustained low interest rates, and a generally positive economic outlook. They argue that focusing solely on traditional valuation metrics like the Price-to-Earnings (P/E) ratio or the cyclically adjusted price-to-earnings ratio (Shiller PE) provides an incomplete picture.

-

Metrics and Indices Used: BofA's analysis incorporates a range of metrics, including P/E ratios, Shiller PE, and forward-looking earnings estimates, along with broader macroeconomic indicators such as inflation rates and interest rate projections. They consider these factors in a holistic framework rather than relying on any single metric.

-

Supportive Economic Factors: BofA highlights the continued strength of corporate earnings, despite economic headwinds. They point to the impact of technological innovation, robust consumer spending in certain sectors, and the ongoing recovery from the pandemic as factors supporting current valuations. Furthermore, they acknowledge the influence of low interest rates in keeping borrowing costs low for businesses and driving investment.

-

Acknowledged Risks: While optimistic, BofA acknowledges potential risks, including rising inflation, geopolitical uncertainties, and potential supply chain disruptions. These are considered in their overall assessment, but they don't see them as immediate threats to significantly derail the market's upward trajectory.

Analyzing BofA's Methodology and Data

Understanding the reliability of BofA's analysis requires examining their methodology and data sources. BofA's research leverages a combination of proprietary data, gathered through their extensive network of analysts and client interactions, and publicly available data from reputable sources like government agencies and financial exchanges.

-

Data Sources: The use of both proprietary and public data strengthens their analysis, offering a more comprehensive perspective. However, the reliance on proprietary data necessitates transparency regarding the data's collection and processing methods.

-

Strengths and Weaknesses of BofA's Approach: A strength is BofA's holistic approach, considering macroeconomic factors alongside traditional valuation metrics. However, a potential weakness could be the inherent subjectivity involved in forecasting future earnings and economic growth, which are key components of their analysis.

-

Comparison with Other Analysts: Comparing BofA's analysis with that of other prominent market analysts like Goldman Sachs or Morgan Stanley reveals some points of convergence and divergence. While there is often a general agreement on macroeconomic trends, variations exist in the specific weight assigned to different factors, and the resulting outlook can vary.

Implications for Investors: Navigating Stock Market Valuation Concerns

BofA's perspective holds significant implications for investors navigating current market conditions and stock market valuation concerns.

-

Portfolio Adjustments: Based on BofA’s analysis, investors might consider a moderate shift in their portfolio allocation. This could involve maintaining exposure to growth stocks, particularly in sectors BofA highlights as promising, while also incorporating defensive assets to mitigate potential risks. Asset class diversification remains crucial.

-

Risk Management Strategies: Given the acknowledged risks, employing robust risk management strategies, including diversification and appropriate asset allocation based on individual risk tolerance, is paramount.

-

Individual Risk Tolerance and Long-Term Goals: Investors should carefully consider their individual risk tolerance and long-term investment goals when making any portfolio adjustments. A long-term perspective is crucial for weathering short-term market fluctuations.

-

Seeking Professional Advice: Given the complexities of market analysis, seeking guidance from a qualified financial advisor is highly recommended. A financial advisor can help tailor an investment strategy aligned with your specific circumstances and risk profile.

Specific Sectors BofA Highlights

BofA's research often points to specific sectors that are particularly well-positioned for growth. While specific recommendations change over time, past analyses frequently highlighted sectors like technology (driven by AI and cloud computing) and healthcare (benefitting from an aging population and technological advancements) as promising areas. These assessments are typically supported by projections of strong earnings growth and market share expansion within those sectors.

Conclusion

BofA's analysis presents a counterpoint to the prevailing anxieties surrounding stock market valuations. While acknowledging potential risks, they highlight factors that support current market levels, emphasizing the need for a holistic approach rather than relying solely on traditional valuation metrics. This perspective suggests a more nuanced view of market conditions and encourages investors to consider a broader range of factors before making investment decisions. Don't let stock market valuation concerns paralyze you; understand your own stock market valuation concerns and explore BofA's insights today!

Featured Posts

-

Trans Australia Run A World Record In Jeopardy

May 21, 2025

Trans Australia Run A World Record In Jeopardy

May 21, 2025 -

Big Bear Ai Stock A Detailed Investment Evaluation

May 21, 2025

Big Bear Ai Stock A Detailed Investment Evaluation

May 21, 2025 -

Coldplay Concert Review Music Lights And Powerful Messages Of Love Captivate No 1 Fans

May 21, 2025

Coldplay Concert Review Music Lights And Powerful Messages Of Love Captivate No 1 Fans

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025 -

Retired Four Star Admiral Convicted Corruption Scandal Details

May 21, 2025

Retired Four Star Admiral Convicted Corruption Scandal Details

May 21, 2025