Stock Market Valuation Concerns: BofA Offers Perspective

Table of Contents

BofA's Key Valuation Concerns

BofA's primary concerns regarding current stock market valuations center around several key metrics indicating potentially inflated prices. They highlight the elevated Price-to-Earnings (P/E) ratios across numerous sectors, suggesting that stocks may be priced higher than their fundamental earnings justify. Furthermore, they point to an elevated market capitalization relative to the Gross Domestic Product (GDP), a classic indicator of potential overvaluation. This suggests the market's overall value may be out of sync with the underlying economic strength.

-

Specific examples of overvalued sectors identified by BofA: BofA's analysis often points towards technology and certain consumer discretionary sectors as potentially exhibiting higher-than-average valuations, based on their chosen metrics. The specifics may vary depending on the report.

-

Mention of any specific metrics BofA used to assess valuation: BofA utilizes a variety of valuation metrics, including the Cyclically Adjusted Price-to-Earnings ratio (CAPE ratio), also known as the Shiller PE, which smooths out earnings fluctuations over a longer period, providing a potentially more accurate long-term valuation picture. They also analyze traditional P/E ratios and other relative valuation metrics.

-

Discussion of BofA's assessment of potential risks associated with high valuations: BofA's analysts warn that high valuations increase the susceptibility of the market to significant corrections or even a bear market. A sudden shift in investor sentiment, a rise in interest rates, or unexpected economic downturn could trigger a sharp decline in stock prices if valuations remain elevated.

Factors Contributing to High Valuations

Several macroeconomic factors contribute to the current high stock market valuations. One key driver is the prolonged period of low interest rates. These low rates make borrowing cheaper for companies and investors, stimulating investment and driving up asset prices, including stocks. Quantitative easing (QE) policies implemented by central banks further fueled this trend by injecting liquidity into the market.

-

Detail on the impact of low interest rates on stock valuations: Low interest rates make bonds less attractive relative to stocks, pushing investors towards equities in search of higher returns. This increased demand drives up stock prices.

-

Analysis of the role of quantitative easing in inflating asset prices: QE programs increase the money supply, lowering interest rates and increasing the availability of capital for investment, thus contributing to inflated asset prices across various markets, including stocks.

-

Explanation of how strong corporate earnings in specific sectors influence overall market valuation: While some sectors have reported strong earnings, this strength is not uniform across the board. The strong performance of certain sectors can disproportionately influence overall market valuation, potentially masking underlying weaknesses in other areas.

BofA's Recommendations and Predictions

Based on their valuation concerns, BofA generally recommends a cautious approach for investors. This might involve diversification across different asset classes to reduce risk, selective stock picking focusing on fundamentally sound companies with reasonable valuations, and the potential use of hedging strategies to protect against market downturns.

-

Specific sectors BofA suggests investors consider (or avoid): BofA's specific recommendations vary depending on the report, but generally, they advocate for a more selective approach, favoring undervalued sectors or companies with strong fundamentals over those in potentially overvalued sectors.

-

BofA's predicted market trajectory: BofA's predictions often lean towards a more neutral or cautiously optimistic outlook, acknowledging the risks associated with current valuations while also acknowledging the potential for continued growth in specific sectors. Specific timeframes provided in their reports should always be considered in context.

-

Discussion of risk mitigation strategies recommended by BofA: Risk mitigation strategies recommended by BofA frequently include diversification across different asset classes, careful stock selection, and potentially hedging against market risk through instruments like options or other derivative products.

Alternative Perspectives on Stock Market Valuation

It's important to acknowledge that not all analysts share BofA's concerns about stock market valuation. Some argue that technological advancements, increased productivity, and sustained low inflation could justify higher valuations than those suggested by traditional metrics. Others point to the potential for continued earnings growth as a reason for optimism.

-

Mention of any dissenting opinions from other financial analysts or economists: Various financial institutions and economists offer different perspectives, some emphasizing the potential for continued growth and others highlighting potential risks.

-

Discussion of potential counterarguments to BofA's concerns: Counterarguments often center on the limitations of traditional valuation metrics in capturing the impact of technological disruption or long-term growth potential.

-

Explanation of different valuation metrics and their implications: Different valuation metrics, such as the Price-to-Sales ratio (P/S) or Price-to-Book ratio (P/B), can paint a different picture of market valuation, highlighting the importance of considering multiple perspectives.

Conclusion

BofA's analysis of stock market valuation concerns highlights the risks associated with currently elevated valuations, emphasizing the importance of a cautious and diversified investment approach. Factors like low interest rates and quantitative easing have contributed to these high valuations, but the potential for market corrections remains. Alternative perspectives exist, but understanding the risks associated with high valuations is crucial for informed investing.

Call to Action: Understanding stock market valuation is crucial for informed investing. Stay informed about market trends and consult with a financial advisor to develop a personalized investment strategy that addresses your risk tolerance and financial goals. Further research into stock market valuation metrics and BofA's reports can help you navigate this complex landscape.

Featured Posts

-

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025 -

Investing In Ai Reddits 12 Best Stock Picks

May 20, 2025

Investing In Ai Reddits 12 Best Stock Picks

May 20, 2025 -

Hegseth Confirms Further Us Missile Deployment To The Philippines

May 20, 2025

Hegseth Confirms Further Us Missile Deployment To The Philippines

May 20, 2025 -

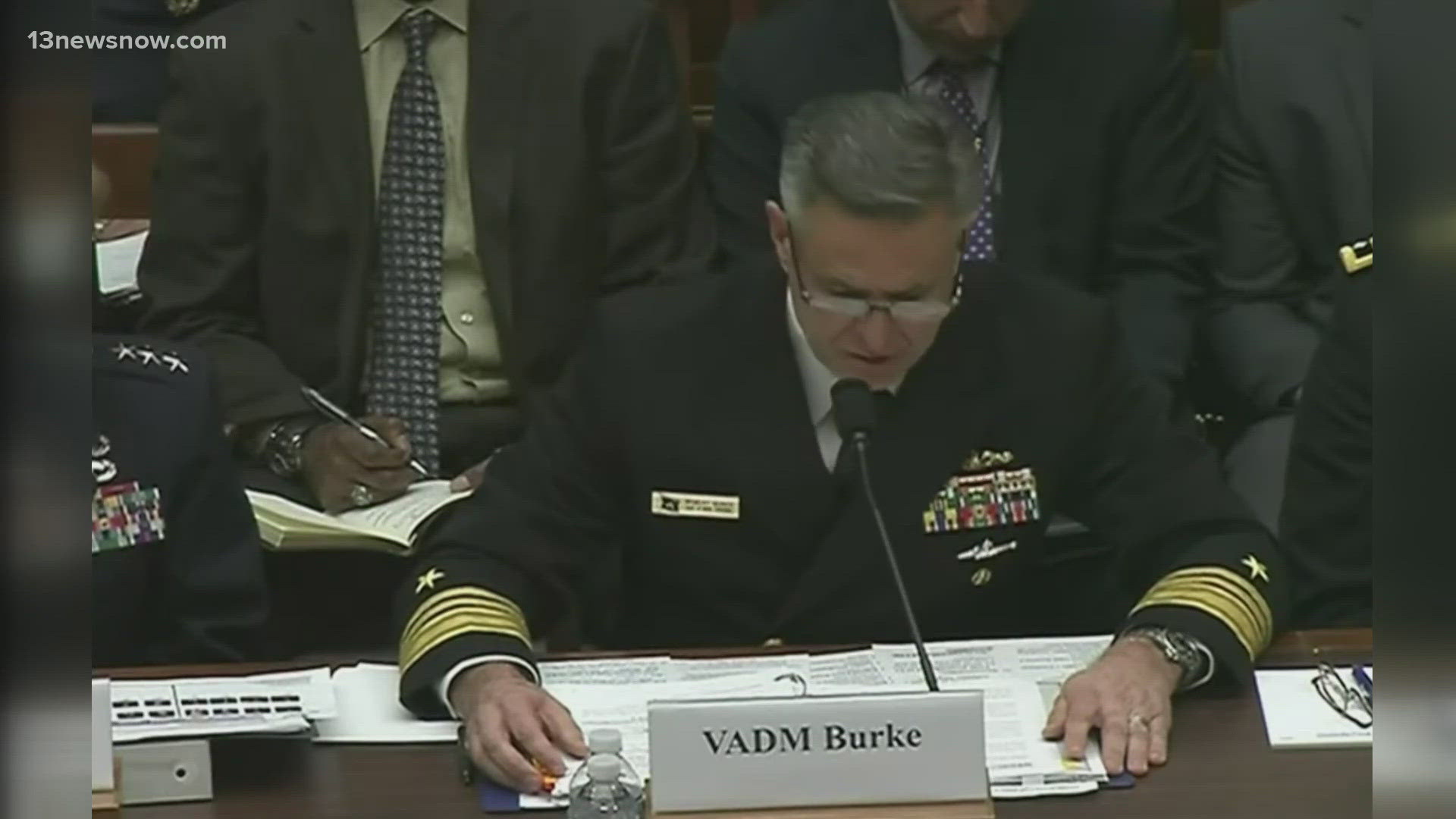

Four Star Admiral Burke Found Guilty Bribery Charges

May 20, 2025

Four Star Admiral Burke Found Guilty Bribery Charges

May 20, 2025 -

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Latest Posts

-

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 20, 2025

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 20, 2025 -

Kaellmanin Ja Hoskosen Aika Puolalaisessa Seurassa Paeaettynyt

May 20, 2025

Kaellmanin Ja Hoskosen Aika Puolalaisessa Seurassa Paeaettynyt

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025 -

Kaellman Ja Hoskonen Laehtoe Puolalaisseurasta

May 20, 2025

Kaellman Ja Hoskonen Laehtoe Puolalaisseurasta

May 20, 2025