Stock Market Valuation Concerns? BofA Offers Reassurance To Investors

Table of Contents

BofA's Key Arguments for a More Positive Market Outlook

BofA's analysis challenges the prevailing narrative of an overvalued market, presenting a more nuanced and optimistic outlook. Their report directly addresses investor concerns by incorporating various economic factors into their valuation models.

Addressing Overvaluation Concerns

Many analysts point to high market capitalization and elevated price-to-earnings ratios (P/E) as indicators of an overvalued market. BofA acknowledges these concerns but argues that a simplistic view of valuation multiples ignores crucial contextual factors.

- Specific Metrics: BofA employs a multi-faceted approach, considering not just P/E ratios but also other valuation metrics such as Price-to-Sales ratios, dividend yields, and discounted cash flow (DCF) models. They adjust these metrics based on their projections for future earnings growth and interest rate environments.

- Differing Analysis: Unlike some bearish predictions that focus solely on historical comparisons and current market multiples, BofA integrates forward-looking economic indicators and company-specific fundamentals into their analysis. This provides a more dynamic and comprehensive assessment of market valuation.

- Undervalued Sectors: The report identifies specific sectors, such as certain segments of the technology and healthcare industries, as potentially undervalued based on their growth prospects and current market pricing. This suggests opportunities for discerning investors willing to perform due diligence.

The Role of Interest Rates and Inflation

Interest rate hikes and persistent inflationary pressures significantly influence stock market valuations. BofA incorporates these factors into their models, recognizing their impact on discount rates and future earnings expectations.

- Interest Rate and Inflation Projections: BofA's projections suggest that while interest rates will likely remain elevated for some time, the pace of increases might slow down. Similarly, they forecast a gradual decline in inflation, although the timing and extent remain uncertain.

- Impact on Valuation: Higher interest rates generally lead to lower valuations, as they increase the discount rate applied to future cash flows. However, BofA's analysis suggests that the impact of projected interest rate increases might be offset by sustained corporate earnings growth.

- Potential Risks: The report acknowledges potential risks associated with these projections. Unforeseen economic shocks or a more persistent inflationary environment could negatively impact market valuations.

The Impact of Corporate Earnings and Growth Prospects

BofA's analysis places significant emphasis on corporate earnings and growth prospects as key drivers of market valuations. Their optimistic outlook rests on projections of continued, albeit moderated, earnings growth.

- Earnings Forecasts: BofA forecasts moderate but sustained growth in corporate profits over the coming quarters and years. This projection is based on their assessment of macroeconomic conditions and industry-specific trends.

- Supporting Valuation: These positive earnings projections directly support their less pessimistic view of market valuations. Strong corporate earnings can justify higher price-to-earnings ratios and support market capitalization.

- Outperforming Industries: BofA highlights specific industries, such as energy and certain technology sub-sectors, that they expect to outperform the broader market based on robust earnings growth and positive industry dynamics.

BofA's Recommended Investment Strategies

Based on their valuation analysis, BofA recommends a balanced approach to investing, emphasizing diversification and risk management.

- Asset Allocation: BofA suggests a diversified portfolio, incorporating a mix of stocks, bonds, and potentially alternative assets, depending on individual risk tolerance and investment goals.

- Risk Management: The report stresses the importance of a well-defined risk management strategy tailored to individual investor profiles. This involves carefully considering both upside potential and downside risks.

- Long-Term Horizon: BofA emphasizes the importance of maintaining a long-term investment horizon, recognizing that short-term market fluctuations are normal and should not unduly influence long-term investment strategies.

Conclusion

BofA's analysis presents a counterpoint to the prevailing narrative of a significantly overvalued stock market. By considering a broader range of factors, including interest rate projections, inflation forecasts, and corporate earnings growth, they offer a more nuanced and optimistic outlook. Their recommendations emphasize a balanced approach to investing, prioritizing diversification and risk management. Don't let stock market valuation concerns paralyze you. Learn more about BofA's perspective and make informed investment decisions. [Link to relevant BofA resources, if available]. Remember, this information is for general knowledge and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Featured Posts

-

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 22, 2025

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 22, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times An Analysis

May 22, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times An Analysis

May 22, 2025 -

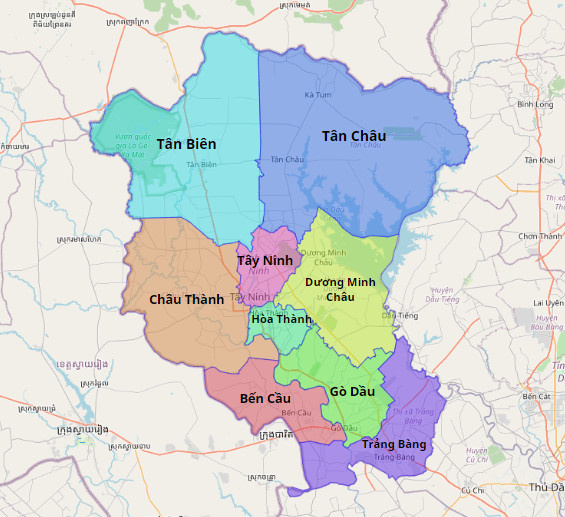

He Thong Giao Thong Lien Ket Binh Duong Tay Ninh Cau And Duong

May 22, 2025

He Thong Giao Thong Lien Ket Binh Duong Tay Ninh Cau And Duong

May 22, 2025 -

Complete Sandylands U Tv Guide Uk Air Dates And Channels

May 22, 2025

Complete Sandylands U Tv Guide Uk Air Dates And Channels

May 22, 2025 -

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025

Tory Wifes Jail Sentence Stands Following Southport Migrant Comments

May 22, 2025