Stock Market Valuations And Investor Concerns: Insights And Analysis From BofA

Table of Contents

BofA's Assessment of Current Stock Market Valuations

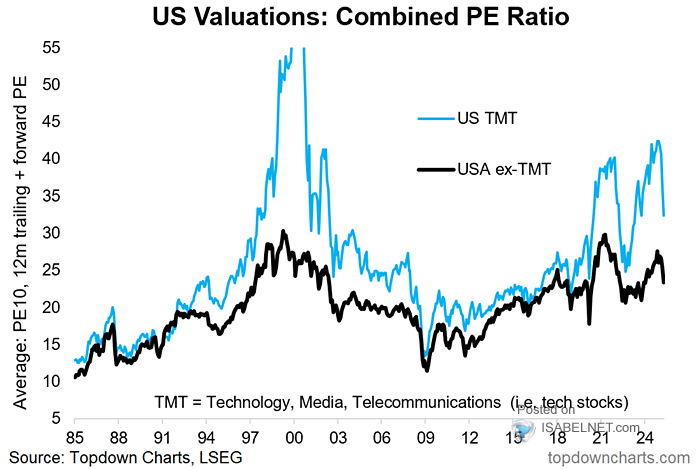

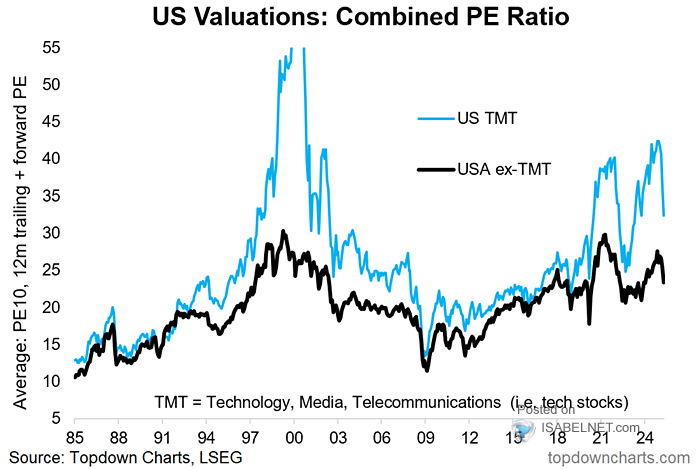

BofA's analysis of stock market valuations employs several key metrics. These include traditional measures like Price-to-Earnings (P/E) ratios, the cyclically adjusted price-to-earnings ratio (Shiller PE), and Price-to-Sales ratios. By comparing these figures to historical averages and sector-specific benchmarks, BofA aims to determine whether the current market is overvalued, undervalued, or fairly valued.

While specific figures from BofA's report are subject to change and should be sought directly from their publication, a hypothetical example might include: a current S&P 500 P/E ratio of 25, compared to a historical average of 15, suggesting a potential overvaluation. The Shiller PE, incorporating inflation-adjusted earnings, might paint a slightly different picture, offering a longer-term perspective. Moreover, sector-specific analyses are crucial; BofA likely highlights differing valuations within sectors like technology (often characterized by high growth and high valuations) and financials (often exhibiting more moderate valuations).

- Specific valuation figures (hypothetical): S&P 500 P/E ratio of 25, Shiller PE of 30, median Price-to-Sales ratio of 2.0.

- Comparison to historical levels: A comparison of current valuations with averages from the past 10, 20, and 50 years.

- Sector-specific analysis: Detailed valuation breakdowns for key sectors like technology, financials, consumer staples, and energy.

Key Investor Concerns Identified by BofA

BofA's report likely identifies several key concerns driving current investor sentiment. These are likely to include:

- Inflation: Persistent inflation erodes purchasing power and impacts corporate earnings, potentially leading to lower stock prices. High inflation forces central banks to increase interest rates, impacting company profitability and investor confidence.

- Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and reducing corporate investment. Higher rates also increase the attractiveness of bonds relative to stocks.

- Geopolitical Risks: Global conflicts, trade wars, and political instability create uncertainty and volatility in the market. These risks can trigger sudden market corrections.

- Recessionary Fears: Concerns about a potential economic recession weigh heavily on investor sentiment, prompting a flight to safety and potentially depressing stock prices.

These factors collectively impact market behavior, leading to increased volatility and potentially influencing investment decisions. Investors become more risk-averse, favoring safer assets like government bonds over riskier equity investments.

BofA's Recommendations and Strategic Implications

Based on their valuation analysis and the identified investor concerns, BofA likely provides specific recommendations for investors. These could include:

- Specific investment recommendations: Sector rotation – shifting investments from overvalued sectors to undervalued ones; favoring defensive stocks (less susceptible to economic downturns) over cyclical stocks.

- Strategies for mitigating risks: Diversification of investment portfolios across different asset classes and geographies; hedging strategies to protect against market downturns.

- Importance of long-term investing: Maintaining a long-term investment horizon, weathering short-term market fluctuations to achieve long-term growth.

Alternative Perspectives and Critical Analysis

It's crucial to consider alternative perspectives and potential limitations in BofA's analysis. Other financial institutions may offer differing valuations or risk assessments. Different methodologies, assumptions about future economic growth, or interpretations of historical data can lead to contrasting conclusions.

- Differing opinions on market valuation: Some analysts might argue that BofA's valuation metrics are too simplistic or fail to account for certain factors.

- Alternative risk assessment methodologies: Other firms might employ different models or focus on different risk factors.

- Potential flaws in BofA's methodology: Any limitations or biases in BofA's data collection or analytical approach should be considered.

Stock Market Valuations and Investor Concerns: A Summary and Call to Action

BofA's report provides valuable insights into current stock market valuations and the key concerns impacting investor sentiment. Understanding these factors is crucial for making informed investment decisions. While BofA's analysis offers a valuable perspective, it’s vital to conduct your own thorough research and consider diverse viewpoints.

To navigate this complex market environment effectively, stay informed about stock market valuations and investor concerns. Consult with a qualified financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. Remember that individual circumstances should always guide investment decisions. Consider reviewing BofA's full report and other reputable market analyses to form a well-rounded understanding of the current investment climate.

Featured Posts

-

Dr Terrors House Of Horrors Is It Worth The Fright A Detailed Look

May 26, 2025

Dr Terrors House Of Horrors Is It Worth The Fright A Detailed Look

May 26, 2025 -

Yom Ha Zikaron 2024 Masa Israels Unprecedented English Ceremony

May 26, 2025

Yom Ha Zikaron 2024 Masa Israels Unprecedented English Ceremony

May 26, 2025 -

Choosing The Right Nike Running Shoes In 2025

May 26, 2025

Choosing The Right Nike Running Shoes In 2025

May 26, 2025 -

Laurence Melys Sur Rtl Son Approche Feminine Du Cyclisme

May 26, 2025

Laurence Melys Sur Rtl Son Approche Feminine Du Cyclisme

May 26, 2025 -

I Mercedes Apomakrynetai Apo Ton Ferstapen

May 26, 2025

I Mercedes Apomakrynetai Apo Ton Ferstapen

May 26, 2025