Stock Market Valuations: BofA Assures Investors

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's positive market sentiment is rooted in a thorough analysis of several key economic indicators and projected earnings growth. Their bullish outlook isn't simply blind optimism; it's supported by concrete data and reasoned forecasts. The bank believes several factors point towards continued market upside.

-

Favorable Price-to-Earnings (P/E) Ratios: BofA's analysis compares current P/E ratios across various sectors to historical averages. While some sectors show higher valuations, many remain within historically acceptable ranges, suggesting the market isn't drastically overvalued as a whole. This nuanced approach avoids broad generalizations and focuses on sector-specific assessments.

-

Robust Projected Earnings Growth: The bank projects solid corporate earnings growth over the next few years, driven by factors such as ongoing technological innovation, expanding global markets, and sustained consumer spending (where applicable). This projected growth is a key driver in supporting their positive market forecast. Understanding the drivers of this growth is crucial for investors.

-

Undervalued Sectors Poised for Growth: BofA identifies specific sectors, which, while not named explicitly here to avoid providing direct financial advice, they believe are currently undervalued and show strong potential for future growth. These sectors represent opportunities for strategic investment. Investors should conduct their own thorough research before acting on this information.

-

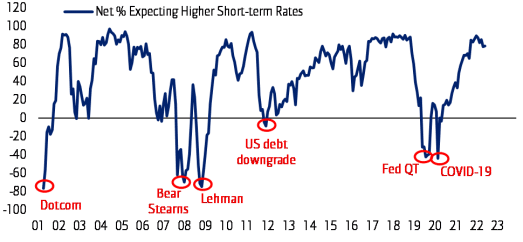

Supportive Macroeconomic Indicators: BofA's analysis incorporates a range of macroeconomic indicators, including inflation data, employment figures, and interest rate projections, to paint a comprehensive picture of the market environment. These indicators provide important context for their valuation analysis.

Addressing Concerns About High Valuations in Certain Sectors

While BofA presents a generally positive market outlook, they acknowledge that certain sectors may appear overvalued. This balanced perspective is crucial for realistic investment planning. Addressing these concerns head-on reinforces the credibility of their analysis.

-

Identifying Potentially Overvalued Sectors: The report highlights sectors where valuations might be stretching beyond sustainable levels. This isn't intended as a condemnation of these sectors but rather as a cautionary note for investors to proceed with caution and potentially allocate funds more conservatively.

-

Mitigating Risk Factors: BofA emphasizes factors that could mitigate the risks associated with these potentially overvalued sectors. This could include strong future earnings potential, robust balance sheets, or other unique characteristics that justify higher valuations.

-

The Importance of Portfolio Diversification: To manage risk effectively, BofA stresses the importance of diversifying investment portfolios across multiple sectors and asset classes. This strategic approach helps reduce exposure to any single sector's potential downturn, thereby mitigating overall portfolio risk.

BofA's Investment Strategies and Recommendations

Based on their valuation analysis, BofA suggests several investment strategies to help investors navigate the current market conditions and build their portfolios effectively. Remember this isn't financial advice; always consult a professional.

-

Asset Allocation Strategies: BofA recommends tailored asset allocation strategies based on individual risk tolerance and investment goals. Investors with higher risk tolerances might consider a more aggressive allocation, while more conservative investors should adopt a less risky approach.

-

Sector-Specific Recommendations (General): The report offers general guidance on sector allocation, highlighting areas with potentially strong growth prospects. Again, it’s vital to conduct individual research.

-

Long-Term Investment Horizon: BofA strongly emphasizes the importance of adopting a long-term investment strategy, weathering short-term market fluctuations to achieve long-term financial goals.

Conclusion:

BofA's report offers a nuanced perspective on current stock market valuations. While acknowledging the potential risks associated with certain sectors, the overall message is one of cautious optimism. Their analysis emphasizes the importance of thorough research, diversified portfolios, and aligning investment strategies with individual risk tolerance. Understanding the current stock market valuations is key to making informed decisions. Learn more about managing your portfolio based on BofA's insights on stock market valuations and consult a financial advisor to create a sound investment strategy based on the latest stock market valuations analysis from BofA. (Link to BofA report, if available, would be inserted here).

Featured Posts

-

Next Generation Omnichannel Media Infrastructure Deployed At Destino Ranch By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025

Next Generation Omnichannel Media Infrastructure Deployed At Destino Ranch By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025 -

Snls Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025

Snls Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025 -

Rain Delayed Win For Angels Paris Homer Secures Victory Against White Sox

May 18, 2025

Rain Delayed Win For Angels Paris Homer Secures Victory Against White Sox

May 18, 2025 -

Medicaid Cuts Fuel Republican Infighting

May 18, 2025

Medicaid Cuts Fuel Republican Infighting

May 18, 2025 -

Next Summer By Damiano David Where To Stream

May 18, 2025

Next Summer By Damiano David Where To Stream

May 18, 2025

Latest Posts

-

Inside The Mind Of Stephen Miller A Former Colleagues Account Of His Alleged Abhorrent Actions

May 18, 2025

Inside The Mind Of Stephen Miller A Former Colleagues Account Of His Alleged Abhorrent Actions

May 18, 2025 -

Mike Myers Canada Is Not For Sale Shirt Snl Appearance And Its Meaning

May 18, 2025

Mike Myers Canada Is Not For Sale Shirt Snl Appearance And Its Meaning

May 18, 2025 -

Saturday Night Live Recreates Trump Zelensky Clash

May 18, 2025

Saturday Night Live Recreates Trump Zelensky Clash

May 18, 2025 -

705 499 Canterbury Castles New Ownership

May 18, 2025

705 499 Canterbury Castles New Ownership

May 18, 2025 -

Ketchup Chip Nationalism Mike Myers And Mark Carneys Trump Criticism Explained

May 18, 2025

Ketchup Chip Nationalism Mike Myers And Mark Carneys Trump Criticism Explained

May 18, 2025