Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Perspective on Current Stock Market Valuations

Bank of America, a major player in the financial world, offers valuable insights into current market conditions. Their recent reports suggest a [insert BofA's current stance - bullish, bearish, or neutral] outlook on stock market valuations. While specifics change frequently, it's crucial to consult their latest research for the most up-to-date analysis. (Note: Always reference the most recent official BofA reports for precise data).

- Key Arguments: BofA's analysts might highlight factors such as [insert summary of key arguments from BofA research, e.g., strong corporate earnings growth despite inflation, a resilient consumer base, or long-term growth potential in specific sectors]. Their reasoning often centers around a belief that the market is currently pricing in [insert details about current market pricing based on BofA's research].

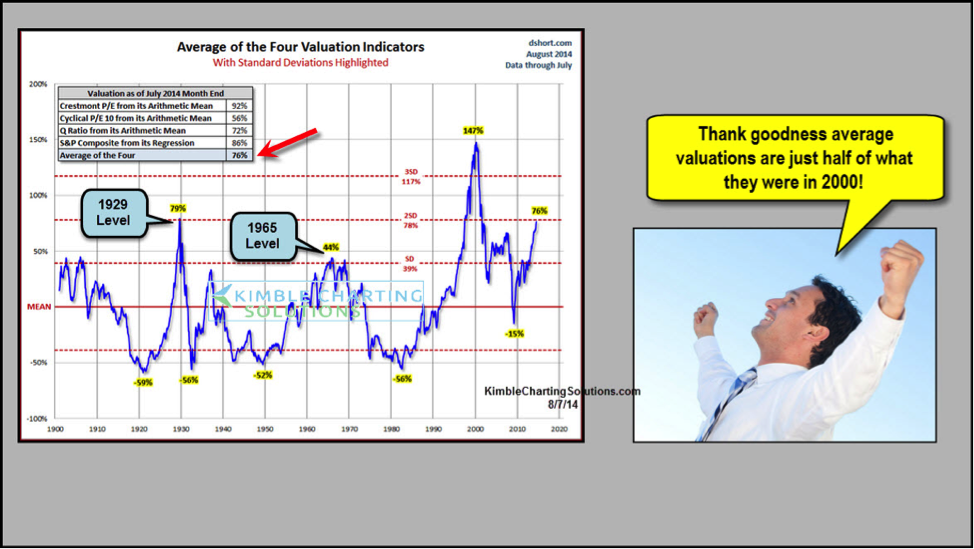

- Valuation Metrics: BofA likely uses a range of metrics to assess valuations, including Price-to-Earnings ratios (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other relevant measures. For example, they might point to a still-elevated Shiller PE ratio suggesting potential overvaluation in some sectors, but counter this with positive projections for future earnings growth.

- Data Points: BofA might project [insert data points, e.g., X% growth in the S&P 500 over the next year, or specific growth forecasts for particular sectors]. These projections, based on their economic models and market analysis, are essential for understanding their overall stance. Remember that these projections are estimates and actual results may vary.

Understanding Market Volatility and its Causes

Current market volatility stems from several interconnected factors:

- Inflation and Interest Rate Hikes: Persistent inflation and the Federal Reserve's response through interest rate hikes create uncertainty for businesses and investors. Higher borrowing costs can slow economic growth and impact company profits.

- Geopolitical Risks: Global events, such as the ongoing war in Ukraine or tensions between major world powers, contribute to uncertainty and market fluctuations. These geopolitical risks can disrupt supply chains and increase investment risks.

- Supply Chain Issues: Lingering supply chain disruptions, exacerbated by geopolitical factors and other unforeseen events, continue to impact production and pricing, adding to economic uncertainty.

- Recessionary Fears: Concerns about a potential recession, fueled by inflation and rising interest rates, often lead to investors taking a more cautious approach, resulting in market volatility.

While these factors are significant and warrant attention, they don't automatically predict a catastrophic market crash. History shows that markets consistently recover from periods of volatility. Effective risk management is key to navigating these periods.

Long-Term Investment Strategies and Risk Mitigation

Successful long-term investing requires a strategic approach that accounts for market fluctuations:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single asset's underperformance.

- Dollar-Cost Averaging: Investing a fixed amount regularly, regardless of market conditions, helps mitigate the risk of buying high and selling low.

- Portfolio Rebalancing: Periodically adjusting your portfolio to maintain your desired asset allocation helps manage risk and capitalize on market opportunities.

- Risk Tolerance Assessment: Understanding your personal risk tolerance is crucial for making informed investment decisions. A financial advisor can assist in determining your appropriate risk profile.

These strategies aren't foolproof, but they significantly enhance your ability to weather market downturns and achieve your long-term financial goals.

Key Indicators Suggesting Cautious Optimism (Counterarguments to Panic)

While acknowledging the challenges, certain indicators suggest a more optimistic outlook than outright panic warrants:

- Strong Corporate Earnings: [Insert details about strong corporate earnings if applicable, citing reliable sources. For example: "Many companies have reported stronger-than-expected earnings in Q[Quarter], indicating resilience despite economic headwinds."]

- Resilient Consumer Spending: [Insert data on consumer spending if applicable. E.g., "Consumer spending remains relatively strong, suggesting a continued level of economic activity."]

- Government Stimulus Measures: [Mention any relevant government stimulus packages or economic support measures if applicable.]

- Technological Advancements: Technological innovation continues to drive growth in various sectors, presenting long-term investment opportunities.

Navigating Stock Market Valuations: A Call to Action

In summary, while BofA's perspective (and other financial analyses) should be carefully considered, current stock market valuations don't automatically signal an impending crash. Understanding the underlying factors driving volatility and employing sound long-term investment strategies is crucial. Remember the importance of diversification, dollar-cost averaging, and regular portfolio rebalancing. Don't let fear dictate your decisions. Take control of your financial future by carefully analyzing stock market valuations and developing a well-informed investment strategy tailored to your risk tolerance and financial goals. Consult with a qualified financial advisor to create a personalized plan for managing stock market valuations effectively. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Analyzing Alan Rodens Style And Themes In The Spectator

May 03, 2025

Analyzing Alan Rodens Style And Themes In The Spectator

May 03, 2025 -

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025 -

Parc De Batteries D Eneco A Au Roeulx Une Infrastructure Energetique De Grande Envergure

May 03, 2025

Parc De Batteries D Eneco A Au Roeulx Une Infrastructure Energetique De Grande Envergure

May 03, 2025 -

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025 -

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025

Joseph Sur Tf 1 Avis Complet Sur La Nouvelle Serie Policiere

May 03, 2025

Latest Posts

-

Alkrh Aljmahyry 30 Shkhsyt Mthyrt Lljdl Fy Ealm Krt Alqdm Mwqe Bkra

May 03, 2025

Alkrh Aljmahyry 30 Shkhsyt Mthyrt Lljdl Fy Ealm Krt Alqdm Mwqe Bkra

May 03, 2025 -

Mwqe Bkra Akthr 30 Ryadya Mkrwhyn Fy Ealm Krt Alqdm

May 03, 2025

Mwqe Bkra Akthr 30 Ryadya Mkrwhyn Fy Ealm Krt Alqdm

May 03, 2025 -

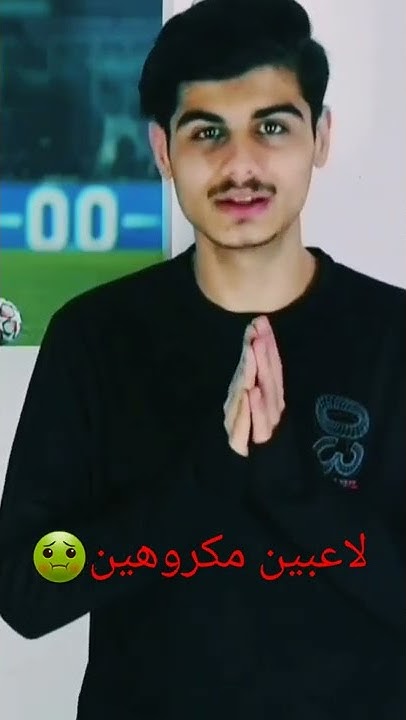

The Internal Fight Within Reform Uk Impact And Analysis

May 03, 2025

The Internal Fight Within Reform Uk Impact And Analysis

May 03, 2025 -

Aedae Aljmahyr Akthr 30 Shkhsyt Ghyr Mhbwbt Fy Tarykh Krt Alqdm Mwqe Bkra

May 03, 2025

Aedae Aljmahyr Akthr 30 Shkhsyt Ghyr Mhbwbt Fy Tarykh Krt Alqdm Mwqe Bkra

May 03, 2025 -

Reform Uk A Look At The Current Internal Conflict

May 03, 2025

Reform Uk A Look At The Current Internal Conflict

May 03, 2025