Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's assessment of stock market valuations centers around several crucial factors that mitigate concerns about overvaluation. They argue that a balanced view, considering both short-term fluctuations and long-term growth potential, is essential for rational investment decisions.

The Role of Interest Rates in Shaping Valuations

Interest rates significantly impact stock market valuations. They influence the present value of future earnings, a cornerstone of equity valuation models.

- Impact of rising rates: Higher interest rates generally decrease the present value of future earnings, leading to lower stock valuations. Investors might shift funds to higher-yielding bonds, reducing demand for equities.

- Impact of falling rates: Conversely, falling interest rates boost the present value of future earnings, potentially supporting higher stock valuations. Lower borrowing costs can also stimulate economic growth, further benefiting company earnings.

- BofA's forecast for interest rates and its implications for valuations: BofA's forecasts (insert specific data from their reports here, if available) suggest a [insert BofA's prediction, e.g., "gradual increase" or "plateauing"] in interest rates, implying a [insert implication, e.g., "moderate impact" or "limited downside risk"] on current stock market valuations. This prediction is supported by [cite relevant BofA research or reports].

The Importance of Earnings Growth in Assessing Valuation Metrics

Robust earnings growth can justify seemingly high valuations. Simply looking at metrics like the Price-to-Earnings (P/E) ratio without considering earnings growth provides an incomplete picture of market valuation.

- Examples of sectors showing strong earnings growth: [Cite specific sectors and provide data from BofA's research demonstrating strong earnings growth. E.g., "The technology sector, according to BofA, shows robust earnings growth, exceeding expectations..."]

- BofA's projections for future earnings growth: BofA anticipates [insert BofA's projection for future earnings growth, e.g., "continued growth," "moderate expansion," etc.], suggesting that current valuations are sustainable or even undervalued considering the anticipated earnings trajectory.

- Relationship between P/E ratios and earnings growth: High P/E ratios are less concerning when accompanied by strong and sustained earnings growth. BofA’s analysis likely shows a positive correlation between these two factors, indicating that current high P/E ratios in some sectors are justified by future earnings potential. Other valuation metrics, like Price-to-Sales (P/S) ratio and Price-to-Book (P/B) ratio, should also be considered for a comprehensive assessment.

Considering Long-Term Growth Potential Over Short-Term Fluctuations

A long-term investment perspective is crucial. Short-term market volatility is inherent, and reacting to every dip can lead to poor investment decisions.

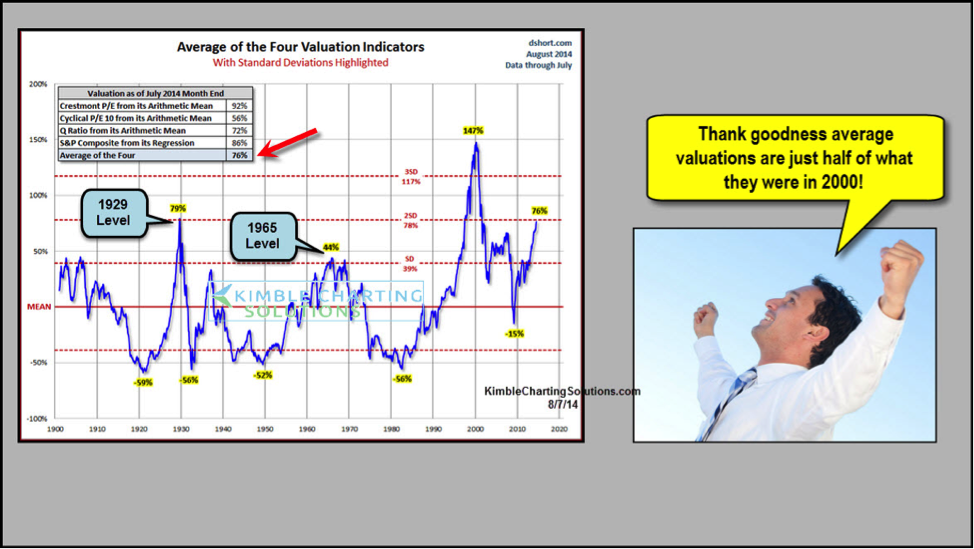

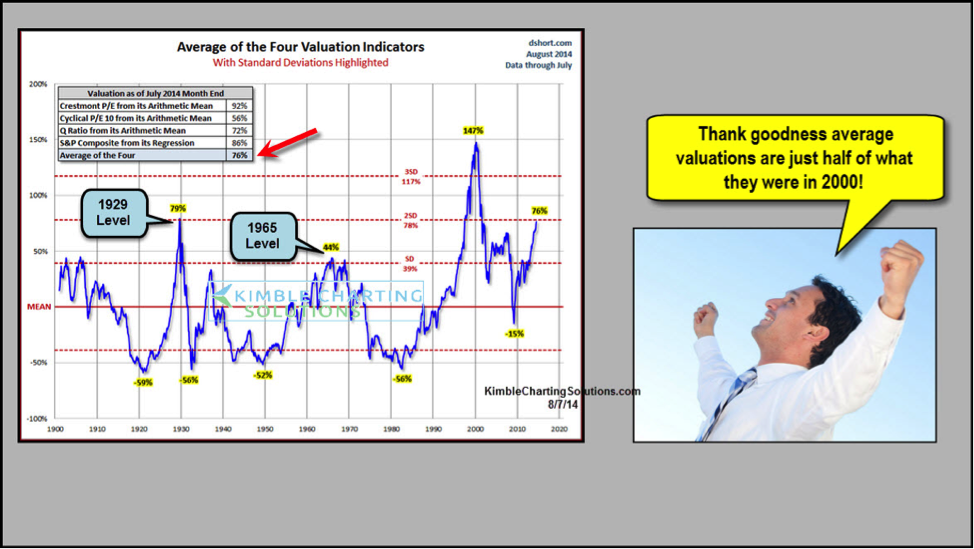

- Historical data showing market recovery after dips: History demonstrates that markets have consistently recovered from previous dips. [Cite relevant historical data supporting this assertion].

- BofA's long-term outlook for the market: BofA maintains a [insert BofA's long-term outlook, e.g., "positive," "bullish," etc.] outlook for the market, emphasizing the potential for long-term growth despite short-term uncertainty.

- Importance of diversification in mitigating risk: Diversification across various asset classes helps mitigate risk and smooth out short-term market fluctuations. BofA likely advocates for a diversified investment strategy.

Addressing Specific Valuation Concerns Raised by Investors

Investors often raise specific concerns about stock market valuations. Let's address some common anxieties using BofA's insights.

High P/E Ratios in Certain Sectors

Some sectors exhibit high P/E ratios, raising overvaluation concerns. However, BofA’s analysis likely suggests that these ratios are justified by exceptional growth prospects or other factors. [Provide specific examples of sectors and BofA's counterarguments, supported by data].

Concerns About Inflation and Its Impact on Valuations

Inflation erodes purchasing power and can impact company profitability. However, BofA likely argues that current inflation levels are already priced into the market, meaning that current valuations already reflect the impact of inflation.

- BofA's inflation predictions: BofA’s forecasts likely include an assessment of inflation's trajectory, indicating whether it's likely to rise further or moderate.

- How inflation affects different sectors differently: The impact of inflation varies across sectors. BofA likely highlights sectors more or less resistant to inflationary pressures.

- How companies are adapting to inflationary pressures: Many companies employ strategies to mitigate the effects of inflation, like raising prices or streamlining operations.

Geopolitical Risks and their Influence on Market Sentiment

Geopolitical risks understandably influence market sentiment. However, BofA likely argues that much of this risk is already priced into current valuations.

- Specific geopolitical risks: [List specific geopolitical events or risks].

- How these risks are reflected in market valuations: Market reactions often precede significant geopolitical events. BofA might argue that current valuations already reflect the anticipated impacts.

- BofA's analysis of the impact of these risks: BofA's assessment likely includes a probability-weighted analysis of the potential impact of these risks.

Conclusion: A Reassuring Outlook on Stock Market Valuations

BofA's analysis suggests that current stock market valuations, while seemingly high in some sectors, are not overly alarming. Their assessment considers interest rate forecasts, strong earnings growth in several sectors, and the historical resilience of the market. They emphasize the importance of long-term investment strategies that account for short-term volatility and the need for diversification.

Key Takeaways:

- Current stock market valuations are not necessarily overinflated when considering earnings growth and interest rate projections.

- A long-term investment perspective is essential, minimizing the impact of short-term market fluctuations.

- Diversification is crucial for managing investment risk.

Call to Action: Don't let short-term market volatility sway your long-term investment strategy. Understand your stock market valuations thoroughly, consider a diversified portfolio, and consult with a financial advisor for personalized advice. Remember, informed decisions based on a comprehensive understanding of stock market valuations are key to achieving your long-term financial goals.

Featured Posts

-

1990s Throwback See If You Made The Cut

Apr 25, 2025

1990s Throwback See If You Made The Cut

Apr 25, 2025 -

Lawsuit Filed Following Accidental Shooting Death Of 4 Year Old In Huntsville

Apr 25, 2025

Lawsuit Filed Following Accidental Shooting Death Of 4 Year Old In Huntsville

Apr 25, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025 -

Spider Man 4 The Sadie Sink Casting Theory Explained

Apr 25, 2025

Spider Man 4 The Sadie Sink Casting Theory Explained

Apr 25, 2025 -

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025

Latest Posts

-

Bbc Radio Reveals Uk Eurovision 2025 Participant

Apr 30, 2025

Bbc Radio Reveals Uk Eurovision 2025 Participant

Apr 30, 2025 -

Will Lars Klingbeil Become Germanys Next Vice Chancellor And Finance Minister

Apr 30, 2025

Will Lars Klingbeil Become Germanys Next Vice Chancellor And Finance Minister

Apr 30, 2025 -

Negotiating A Coalition How Germanys Spd Addresses Youth Concerns

Apr 30, 2025

Negotiating A Coalition How Germanys Spd Addresses Youth Concerns

Apr 30, 2025 -

Uks Eurovision 2025 Act Officially Announced On Bbc Radio

Apr 30, 2025

Uks Eurovision 2025 Act Officially Announced On Bbc Radio

Apr 30, 2025 -

Lars Klingbeil Vice Chancellor And Finance Minister A Realistic Prospect

Apr 30, 2025

Lars Klingbeil Vice Chancellor And Finance Minister A Realistic Prospect

Apr 30, 2025