Stock Market Valuations: BofA's Argument For Why Investors Shouldn't Panic

Table of Contents

BofA's Perspective on Current Stock Market Valuations

BofA's assessment of current stock market valuations is nuanced. They don't paint a picture of impending doom, but neither do they suggest a market ripe for aggressive buying. Instead, their analysis suggests a more moderate stance.

Moderately Expensive, Not Dangerously Overvalued

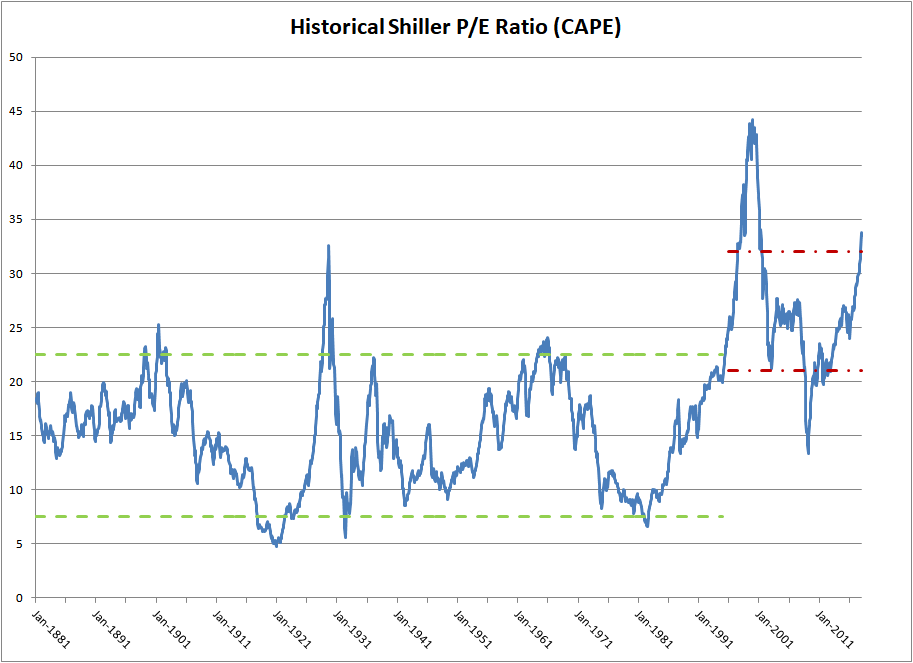

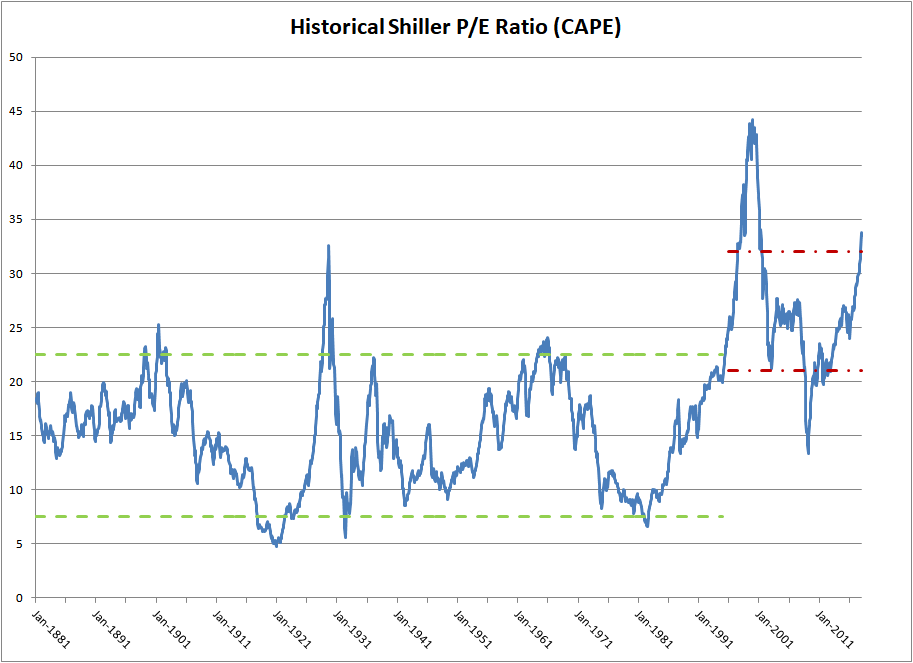

BofA doesn't view current valuations as drastically inflated. While prices are moderately high compared to historical averages, they argue that they aren't at bubble levels, the kind that precede a significant market crash.

- Price-to-Earnings (P/E) Ratios: BofA analysts likely compare current P/E ratios across various sectors to historical averages and those of comparable global markets. A high P/E ratio generally indicates that investors are willing to pay a premium for a company's earnings, suggesting potentially higher expectations for future growth. However, BofA’s analysis likely factors in adjustments for interest rates and inflation, producing a more tempered view.

- Other Valuation Multiples: Beyond P/E ratios, BofA likely considers other key valuation metrics such as Price-to-Sales (P/S), Price-to-Book (P/B), and Dividend Yield to gain a holistic understanding of market valuations.

- Sector-Specific Valuations: Different sectors exhibit varying levels of valuation. BofA’s analysis probably highlights sectors that appear relatively overvalued versus those that seem undervalued, providing a more granular perspective. The tech sector, for example, may show higher valuations than more established sectors like utilities or consumer staples.

The Importance of Long-Term Investment Horizons

BofA emphasizes that market fluctuations are a normal part of the investment cycle. Short-term volatility, while unnerving, shouldn't dictate long-term investment strategies.

- "Time in the Market" vs. "Timing the Market": BofA likely stresses the importance of remaining invested over the long term ("time in the market") rather than attempting to time the market's highs and lows ("timing the market"), which is notoriously difficult and often unsuccessful.

- Past Market Corrections: Historical data shows numerous market corrections and bear markets followed by significant recoveries. BofA's analysis probably draws on this data to emphasize the cyclical nature of the market.

- Dollar-Cost Averaging: BofA likely advocates for strategies like dollar-cost averaging, a method of investing where regular investments are made regardless of market price, smoothing out the impact of volatility.

Factors Supporting BofA's Optimism

BofA's relatively optimistic outlook is underpinned by several key factors.

Strong Corporate Earnings and Profitability

BofA points to healthy corporate earnings as a major support for current valuations. Robust profits suggest underlying strength in the economy and the capacity of businesses to generate returns for shareholders.

- Recent Earnings Reports: Analysis of recent earnings reports across various sectors would likely be central to BofA's argument. Strong revenue growth and profit margins indicate business health.

- Supply Chain Improvements: The easing of supply chain disruptions, a major factor in recent years, contributes to increased corporate profitability.

- Consumer Spending: Sustained consumer spending, although potentially slowing, provides a fundamental underpinning for business growth and earnings.

Continued Economic Growth (with caveats)

While acknowledging potential economic headwinds, BofA likely anticipates continued, albeit possibly slower, economic growth.

- Government Policies: Government fiscal and monetary policies, particularly central bank actions, play a significant role in influencing economic growth.

- Inflation and Interest Rates: Inflation and rising interest rates pose potential risks, impacting borrowing costs and consumer spending. BofA's analysis would likely discuss these challenges.

- GDP Growth Forecasts: BofA's outlook will be informed by its forecasts for GDP growth and other leading economic indicators.

Technological Innovation and Long-Term Growth Potential

BofA acknowledges the transformative potential of technological advancements to drive future growth and support stock market valuations.

- Impact of AI and Renewable Energy: The rapid advancement of artificial intelligence (AI), renewable energy technologies, and other innovations creates long-term growth opportunities.

- Growth in Tech Sectors: Specific technology-related sectors are poised for significant long-term growth.

- Productivity Improvements: Technological innovation often translates into increased productivity and efficiency, boosting corporate profitability.

Addressing Concerns About Inflation and Interest Rates

Inflation and rising interest rates are legitimate concerns affecting stock market valuations. BofA's analysis would likely address these concerns directly, offering a counter-argument based on their projections.

- Inflation Predictions: BofA's predictions regarding inflation's trajectory and peak are crucial to their overall assessment.

- Interest Rate Impact on Sectors: Different sectors are impacted differently by interest rate changes. BofA's analysis would delve into these sector-specific implications.

- Risk Mitigation Strategies: BofA would likely outline strategies for mitigating the risks associated with inflation and rising interest rates, potentially including diversification and selective stock picking.

Conclusion

BofA's analysis suggests that while current stock market valuations aren't exceptionally cheap, they aren't cause for widespread panic selling. Focusing on long-term investment horizons, understanding the strength of corporate earnings, and acknowledging the influence of technological innovation empowers investors to navigate market volatility more effectively. Remember, carefully considering your own risk tolerance and investment goals is crucial. Don't let short-term market fluctuations dictate your long-term stock market valuations strategy. Instead, conduct thorough research and consider consulting a financial advisor to develop a sound investment plan tailored to your needs. Consider the arguments presented by BofA, but always make informed decisions based on your individual circumstances. Remember to diversify your portfolio and manage your risk accordingly.

Featured Posts

-

Xrp Price Jump Trumps Post Impacts Ripple

May 01, 2025

Xrp Price Jump Trumps Post Impacts Ripple

May 01, 2025 -

Optimaal Gebruik Van Enexis Auto Opladen Buiten Piektijden In Noord Nederland

May 01, 2025

Optimaal Gebruik Van Enexis Auto Opladen Buiten Piektijden In Noord Nederland

May 01, 2025 -

A Look At Ongoing Nuclear Litigation Key Cases And Legal Battles

May 01, 2025

A Look At Ongoing Nuclear Litigation Key Cases And Legal Battles

May 01, 2025 -

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Shdyd Rdeml

May 01, 2025

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Shdyd Rdeml

May 01, 2025 -

Michael Sheens 1 Million Giveaway How To Participate

May 01, 2025

Michael Sheens 1 Million Giveaway How To Participate

May 01, 2025

Latest Posts

-

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025 -

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025 -

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Win Against Portland

May 01, 2025

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Win Against Portland

May 01, 2025 -

Celtics Defeat Cavaliers 4 Important Observations From Derrick Whites Performance

May 01, 2025

Celtics Defeat Cavaliers 4 Important Observations From Derrick Whites Performance

May 01, 2025 -

Hunters Strong Performance Fuels Cavaliers 10 Game Winning Streak

May 01, 2025

Hunters Strong Performance Fuels Cavaliers 10 Game Winning Streak

May 01, 2025