Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

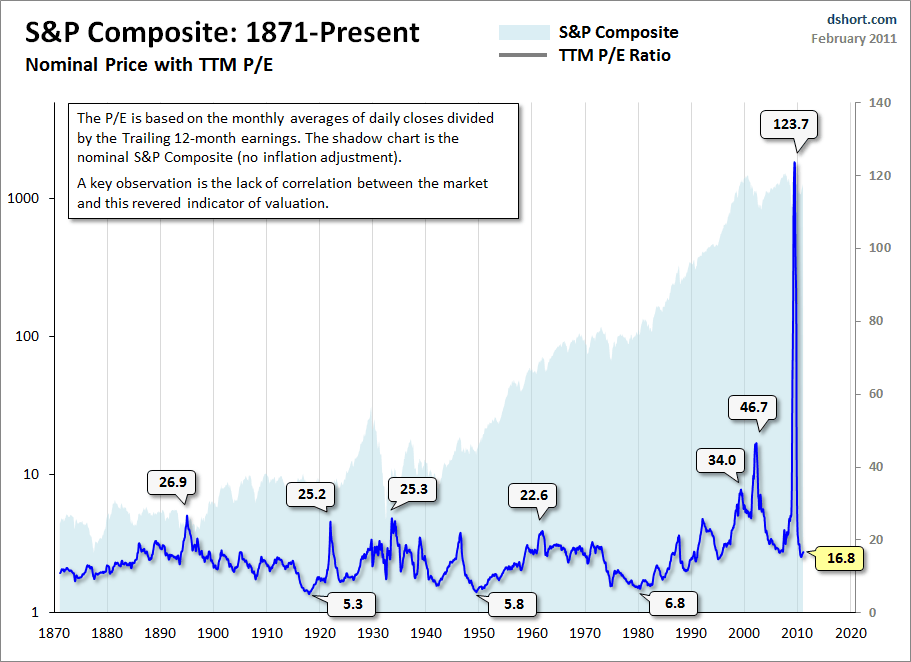

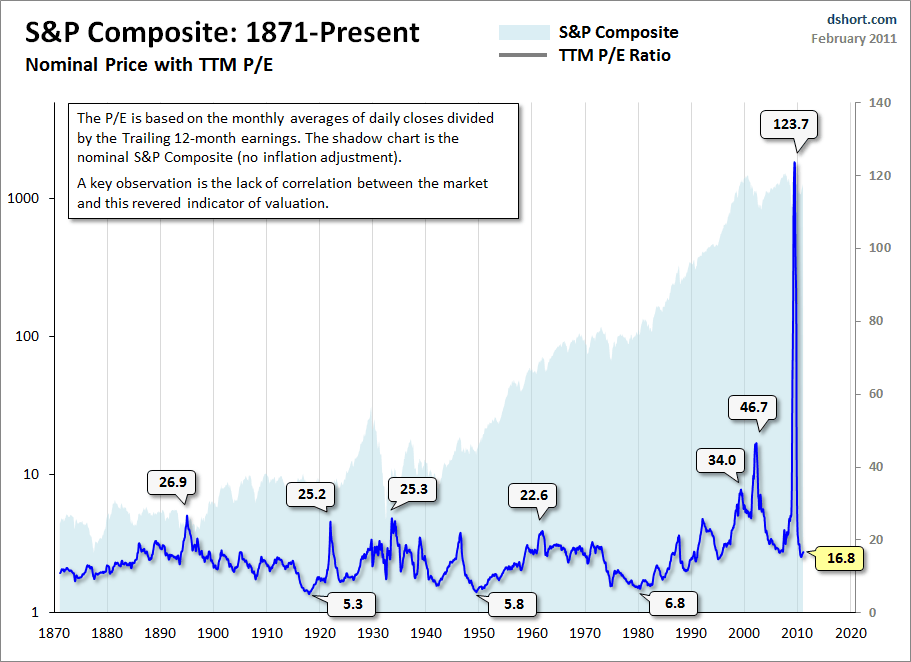

BofA's core thesis centers on a cautiously optimistic outlook for the stock market. While acknowledging the challenges, they argue that current stock valuations, while not necessarily cheap, are not excessively overvalued either. Their analysis suggests that a combination of factors, including resilient corporate earnings and a still-growing global economy, supports continued, albeit moderate, growth.

BofA supports this argument with specific data points:

- P/E Ratios: They point to a forward P/E ratio that, while elevated compared to historical averages, is still within reasonable bounds considering the current low-interest-rate environment and strong corporate profitability.

- Dividend Yields: The report highlights attractive dividend yields in certain sectors, offering a compelling income stream for investors seeking stability.

- Market Capitalization: BofA's analysis considers the overall market capitalization relative to GDP, finding it to be in line with historical norms, suggesting no significant overvaluation at a macroeconomic level.

Specific sectors BofA considers favorably valued include:

- Technology (driven by AI advancements)

- Healthcare (benefiting from aging populations and ongoing innovation)

- Energy (experiencing robust growth amidst the global energy transition).

Keywords: BofA market analysis, stock valuation metrics, P/E ratio, dividend yield, market capitalization.

Addressing Concerns About High Inflation and Interest Rates

BofA acknowledges the significant impact of high inflation and rising interest rates on stock valuations. They predict further interest rate hikes in the near term but suggest that the pace of increases will likely slow as inflation begins to moderate. Their analysis argues that the market has largely priced in much of the anticipated rate increases, and therefore, further hikes may have a less dramatic effect than previously feared.

BofA offers several strategies for navigating inflationary environments:

- Diversification: Spreading investments across different asset classes and sectors to reduce risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals.

- Inflation-Hedged Assets: Considering investments in commodities or real estate to protect against inflation's eroding effects.

Keywords: inflation impact on stocks, interest rate hikes, monetary policy, risk management, stock market volatility.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA recommends a balanced and diversified investment strategy. They suggest maintaining a core portfolio of high-quality stocks, focusing on companies with strong earnings growth potential and robust balance sheets. While they don't explicitly endorse specific stock picks (disclaimer: This article does not constitute financial advice; always conduct thorough due diligence before making any investment decisions), their recommendations suggest a focus on sectors mentioned earlier, favoring companies that demonstrate resilience in the face of economic uncertainty.

Actionable steps investors can take based on BofA's advice include:

- Reviewing and adjusting portfolio allocation to align with their risk tolerance.

- Conducting thorough due diligence on potential investments.

- Considering the incorporation of inflation-hedged assets.

Keywords: investment strategy, portfolio allocation, stock picking, diversification, risk tolerance.

Considering Alternative Investment Strategies

While BofA's primary focus is on traditional stock market valuations, they also touch upon alternative investment strategies. They suggest that investors, depending on their risk profiles and investment goals, might explore diversifying into:

- Bonds: Offering a lower-risk, fixed-income component to a portfolio.

- Real Estate: A potential hedge against inflation.

- Commodities: Providing diversification and exposure to underlying raw materials.

Keywords: alternative investments, bonds, real estate, commodities.

Conclusion: Making Informed Decisions on Stock Market Valuations Based on BofA's Insights

BofA's analysis presents a cautiously optimistic outlook on stock market valuations. While acknowledging the challenges posed by inflation and interest rate hikes, their assessment suggests that current valuations are not excessively high and that opportunities for growth remain. However, it's crucial to remember that this is just one perspective, and investors should always consider their individual risk tolerance and conduct thorough due diligence before making any investment decisions. The key takeaway is the importance of a well-diversified investment strategy tailored to your specific circumstances and financial goals. To develop a robust stock market valuation strategy, delve deeper into BofA's full report and conduct further research on your own. Learn more about effective stock market valuation strategies and make informed decisions for your financial future.

Keywords: stock market valuation strategies.

Featured Posts

-

Investigation Reveals Disturbing Truths About The D C Blackhawk Crash

Apr 29, 2025

Investigation Reveals Disturbing Truths About The D C Blackhawk Crash

Apr 29, 2025 -

Mets Rotation Has Pitchers Name Earned A Spot

Apr 29, 2025

Mets Rotation Has Pitchers Name Earned A Spot

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Ryan Reynolds Wrexham Investment Reaps Rewards Promotion Secured

Apr 29, 2025

Ryan Reynolds Wrexham Investment Reaps Rewards Promotion Secured

Apr 29, 2025 -

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 29, 2025

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 29, 2025

Latest Posts

-

Trump Backs Pete Rose Pardon And Hall Of Fame Induction Call

Apr 29, 2025

Trump Backs Pete Rose Pardon And Hall Of Fame Induction Call

Apr 29, 2025 -

Donald Trump On Pete Rose Mlb Criticism And Pardon Promise

Apr 29, 2025

Donald Trump On Pete Rose Mlb Criticism And Pardon Promise

Apr 29, 2025 -

Pete Rose Pardon Trumps Plea To Mlb For Hall Of Fame Induction

Apr 29, 2025

Pete Rose Pardon Trumps Plea To Mlb For Hall Of Fame Induction

Apr 29, 2025 -

Pete Rose Pardon Donald Trumps Gamble Pays Off

Apr 29, 2025

Pete Rose Pardon Donald Trumps Gamble Pays Off

Apr 29, 2025 -

Will Pete Rose Get A Presidential Pardon Trumps Hof Campaign

Apr 29, 2025

Will Pete Rose Get A Presidential Pardon Trumps Hof Campaign

Apr 29, 2025