Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's overall assessment suggests that while stock market valuations are not historically low, they are not excessively high either. The analysis points to a more balanced picture, acknowledging elevated valuations in some sectors while highlighting factors that mitigate overall risk. BofA's assessment incorporates a range of valuation metrics, providing a comprehensive view.

- Price-to-Earnings (P/E) Ratios: While P/E ratios are slightly above historical averages for the broad market, BofA notes significant variation across sectors. Certain sectors show robust earnings growth that justifies their higher valuations.

- Price-to-Sales (P/S) Ratios: Similar to P/E ratios, P/S ratios show sector-specific differences. High-growth technology companies, for example, often command higher P/S multiples due to anticipated future revenue growth. BofA's analysis adjusts for these sector-specific variations.

- Earnings Growth Projections: BofA analysts predict a 10-15% increase in corporate earnings over the next year, a significant factor in their positive outlook. This projected growth offsets concerns about relatively high valuations in many sectors.

Factors Contributing to BofA's Positive Outlook

BofA's positive outlook on current stock market valuations is underpinned by several significant macroeconomic factors. These factors contribute to a supportive environment for continued growth and justify, to some extent, the current levels of stock prices.

- Strong Economic Growth Projections: Global economic growth forecasts remain positive, supporting corporate profitability and bolstering investor confidence.

- Continued Low Interest Rates: Low interest rates reduce the cost of borrowing for businesses and stimulate investment, further promoting economic expansion.

- Positive Corporate Earnings Momentum: Strong corporate earnings reports continue to outpace expectations, contributing to higher valuations and investor optimism.

- Technological Advancements Driving Innovation: Technological innovation drives productivity gains and fuels growth in numerous sectors, creating new investment opportunities.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA recommends a cautiously optimistic approach to stock market investment. This isn't a full-throttle "bullish" recommendation, but rather a balanced strategy acknowledging both opportunities and risks.

- Focus on Undervalued Sectors: BofA suggests focusing on sectors with robust earnings growth and relatively lower valuations compared to their historical averages or industry peers. Energy and certain cyclical sectors are mentioned as potential candidates.

- Consider Diversifying Your Portfolio Across Asset Classes: Diversification is crucial to mitigating risk. BofA advises including a mix of stocks, bonds, and potentially other asset classes like real estate to balance portfolio exposure.

- Rebalance Your Portfolio Regularly: Regular portfolio rebalancing ensures that the investor maintains their desired asset allocation, thereby controlling risk and capitalizing on market fluctuations.

- Maintain a Long-Term Investment Horizon: BofA emphasizes the importance of a long-term investment strategy to weather short-term market volatility and capture long-term growth potential.

Addressing Potential Risks and Concerns

While BofA's analysis paints a generally positive picture, it's crucial to acknowledge potential risks and uncertainties. A balanced perspective is essential for responsible investing.

- Inflationary Pressures: Rising inflation could erode corporate profit margins and impact consumer spending, potentially dampening economic growth. BofA's models incorporate inflation forecasts to assess potential impacts.

- Geopolitical Uncertainties: Geopolitical instability can create market uncertainty and volatility. BofA monitors these factors and adjusts their projections as needed.

- Potential for Interest Rate Hikes: Future interest rate increases by central banks could impact borrowing costs and potentially slow economic growth. BofA is carefully monitoring interest rate policy decisions.

- BofA's Contingency Plans: BofA's analysis includes various scenarios and contingency plans to address potential negative outcomes, ensuring a robust and adaptable investment strategy.

Conclusion: Navigating Stock Market Valuations with Confidence

BofA's analysis offers a reassuring perspective on current stock market valuations, highlighting a balanced picture with opportunities for growth despite some elevated metrics. While acknowledging potential risks, the firm points to strong economic growth projections, positive corporate earnings, and technological advancements as supportive factors. Investors should carefully consider BofA's recommendations, including diversification and a long-term investment horizon, but also conduct their own thorough research and seek professional advice before making any investment decisions. Understand the nuances of stock market valuations by exploring BofA's comprehensive reports and make informed investment decisions today!

Featured Posts

-

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025 -

Neighbours A Shocking Return After 38 Years

Apr 26, 2025

Neighbours A Shocking Return After 38 Years

Apr 26, 2025 -

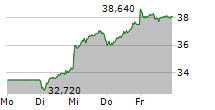

Dow Futures Up Positive Stock Market Outlook For Today

Apr 26, 2025

Dow Futures Up Positive Stock Market Outlook For Today

Apr 26, 2025 -

Deion Sanders Speaks Out Shedeurs Recruitment And Nfl Implications

Apr 26, 2025

Deion Sanders Speaks Out Shedeurs Recruitment And Nfl Implications

Apr 26, 2025 -

Chelsea Handler Netflix Comedy Special Trailer Get Ready To Laugh

Apr 26, 2025

Chelsea Handler Netflix Comedy Special Trailer Get Ready To Laugh

Apr 26, 2025

Latest Posts

-

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025 -

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025 -

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025