Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Key Arguments for Current Stock Market Valuations

BofA's analysis of stock market valuations doesn't solely rely on traditional metrics. Their analysts highlight a more nuanced approach, emphasizing the crucial interplay between various factors to arrive at a comprehensive assessment of market risk.

-

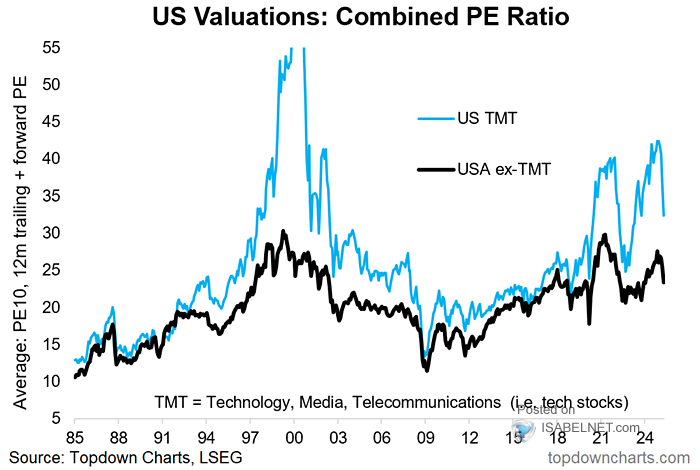

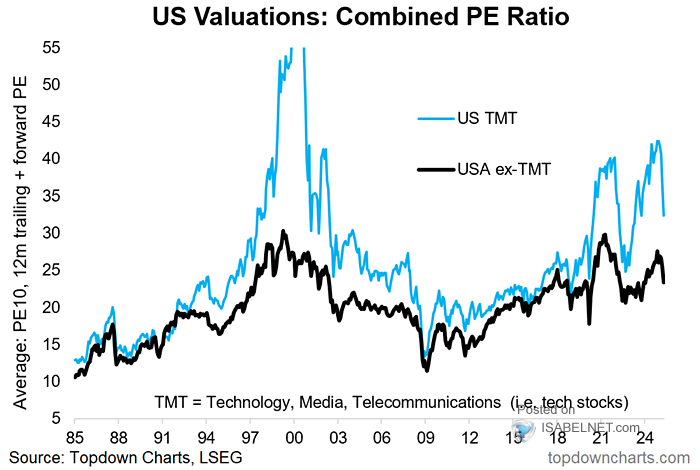

Beyond the P/E Ratio: While the price-to-earnings ratio (P/E) remains a significant valuation metric, BofA stresses that it shouldn't be considered in isolation. They emphasize the importance of considering earnings growth alongside P/E, creating a more holistic view of a company's value and future potential. A high P/E ratio might be justified if the company demonstrates robust and sustainable earnings growth.

-

Strong Corporate Earnings as Support: BofA's research points to strong corporate earnings as a key pillar supporting current valuations. Healthy profit margins and consistent revenue growth across several sectors provide a foundation for a positive outlook. This isn't to say all sectors are equally strong; their analysis likely includes a granular look at individual performances.

-

Macroeconomic Factors in Play: The analysis incorporates macroeconomic factors, including interest rate movements and inflation expectations. Understanding these external pressures is critical for a complete picture of market valuations. BofA likely models various scenarios, considering different inflation and interest rate trajectories.

-

Growth Trajectory: BofA's research points to a continued, albeit potentially slower, growth trajectory for the economy. This moderated growth forecast might temper some anxieties around overvaluation, suggesting that the market isn't wildly detached from fundamental economic realities.

-

Sector-Specific Insights: BofA's research likely highlights specific sectors or individual stocks that they consider particularly well-valued. These insights offer actionable intelligence for investors looking to refine their portfolio allocation based on a detailed, data-driven perspective.

Addressing Concerns About Overvaluation and Market Corrections

BofA acknowledges the inherent risks associated with potentially high valuations and the ever-present possibility of market corrections. However, they offer counterarguments emphasizing long-term growth prospects and mitigating factors.

-

Long-Term Perspective: BofA likely advocates for a long-term investment strategy, emphasizing the historical tendency of markets to recover from corrections. Looking at long-term charts can provide perspective, diminishing the impact of short-term fluctuations.

-

Historical Context: Their analysis likely incorporates historical market data to contextualize current valuations and potential corrections. Comparing current P/E ratios to historical averages can help determine whether valuations are truly extreme or within a reasonable range.

-

Mitigating Factors: BofA might identify factors that could mitigate the risk of a severe market downturn, such as robust corporate balance sheets or resilient consumer spending. These factors could provide a buffer against significant market volatility.

-

Economic Indicator Impact: The analysis likely explores the potential impact of various economic indicators, such as employment data and consumer confidence, on stock market performance. Understanding these correlations helps refine risk assessment and investment strategy.

-

Portfolio Diversification: As part of their risk management strategy, BofA likely emphasizes the importance of portfolio diversification. Spreading investments across different asset classes and sectors can significantly reduce the impact of market corrections on an individual portfolio.

The Role of Interest Rates and Inflation

Interest rates and inflation are critical factors influencing stock market valuations. BofA's analysis likely explores their intricate interplay.

-

Interest Rate Influence: Higher interest rates generally increase the cost of borrowing for companies, impacting their profitability and potentially depressing stock prices. Conversely, lower rates can stimulate economic activity and boost corporate investments. BofA's analysis would likely model these impacts under different interest rate scenarios.

-

Inflationary Pressures: Inflation erodes the purchasing power of future earnings, impacting the present value of investments. BofA’s analysis likely assesses the current inflationary environment and its potential influence on corporate earnings and subsequently, stock prices.

-

Federal Reserve's Role: The Federal Reserve's monetary policy plays a vital role in shaping interest rates and inflation. BofA's analysis would consider the Fed's actions and their potential effects on the broader stock market.

-

Historical Comparisons: Comparing the current interest rate environment to past periods allows for a more contextualized understanding of its potential impact on stock valuations. This historical perspective aids in risk assessment and informed decision-making.

BofA's Investment Recommendations Based on Valuation Analysis

Based on their valuation analysis, BofA likely offers specific investment recommendations.

-

Investment Strategies: Their suggested strategies would likely depend on individual investor risk tolerance and time horizons. This could involve a blend of active and passive management approaches.

-

Asset Allocation: BofA's recommendations on asset allocation would factor in current market conditions, aiming for a diversified portfolio that aligns with individual risk profiles.

-

Sector Allocation: The analysis might suggest overweighting or underweighting specific sectors based on their valuation and growth prospects. This sector allocation strategy helps optimize portfolio returns while mitigating risk.

-

Diversification Emphasis: They will reinforce the importance of diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors, reducing overall portfolio volatility.

-

Long-Term Focus: BofA likely emphasizes the importance of long-term investing, encouraging investors to avoid knee-jerk reactions to short-term market fluctuations.

Conclusion

BofA's analysis of stock market valuations provides a reassuring perspective for investors, emphasizing the importance of considering earnings growth and long-term prospects alongside traditional valuation metrics like the price-to-earnings ratio. While acknowledging inherent market risks and the possibility of market corrections, BofA's research suggests a more optimistic outlook than some might anticipate. Understanding their reasoning, particularly regarding the impact of interest rates and inflation on stock market valuations, allows investors to make more informed decisions. Don't let uncertainty about stock market valuations deter you from investing. Learn more about BofA's comprehensive analysis and develop a well-informed investment strategy tailored to your risk tolerance. Explore various resources to understand stock market valuations better and make confident investment decisions.

Featured Posts

-

R3 2

May 09, 2025

R3 2

May 09, 2025 -

Analysis Pam Bondis Reaction To Congressman Comers Epstein Claims

May 09, 2025

Analysis Pam Bondis Reaction To Congressman Comers Epstein Claims

May 09, 2025 -

The Next Warren Buffett A Canadian Billionaires Unconventional Path

May 09, 2025

The Next Warren Buffett A Canadian Billionaires Unconventional Path

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

Wynne Evans On Strictly Come Dancing Return His Official Statement

May 09, 2025

Wynne Evans On Strictly Come Dancing Return His Official Statement

May 09, 2025