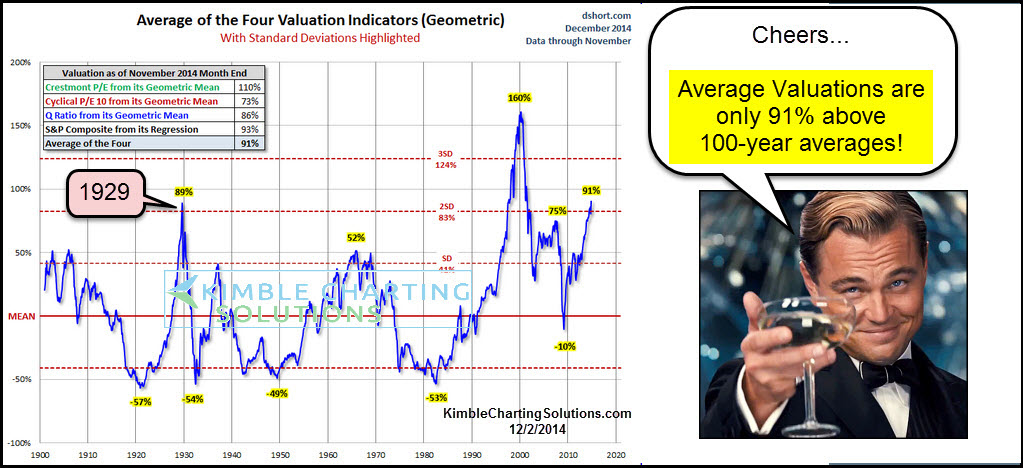

Stock Market Valuations: BofA's Reassuring Take For Investors

Table of Contents

BofA's Methodology: How They Assess Market Valuations

BofA employs a robust methodology to assess market valuations, utilizing a combination of quantitative and qualitative factors. Their analysis isn't a simplistic snapshot; it's a deep dive into various financial metrics and market trends. They leverage sophisticated valuation models, including:

-

Price-to-Earnings (P/E) Ratio: This classic metric compares a company's stock price to its earnings per share. A lower P/E ratio generally suggests a potentially undervalued stock. However, it's crucial to understand that the P/E ratio can be influenced by factors like accounting practices and industry-specific conditions.

-

Price-to-Sales (P/S) Ratio: This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings or those in high-growth sectors. The P/S ratio provides a broader perspective than the P/E ratio alone.

-

Discounted Cash Flow (DCF) Analysis: This more complex method projects a company's future cash flows and discounts them back to their present value. It provides a comprehensive valuation, incorporating growth projections and the time value of money. BofA's DCF models are sophisticated and incorporate various assumptions about future growth and risk.

BofA's analysis goes beyond individual stocks. Their research incorporates data from a wide range of sources, covering various sectors, geographies, and asset classes. This breadth provides a comprehensive overview of the overall market valuation landscape. Their valuation process incorporates forward-looking estimates, attempting to predict future performance rather than solely relying on historical data.

Key Findings: Why BofA Sees Opportunity in the Current Market

BofA's recent analysis suggests that despite market volatility, opportunities exist for investors. Their key conclusions highlight a more positive outlook than many anticipate. They believe that current market prices reflect a degree of pessimism that may not fully account for future growth prospects.

Specifically, BofA points to certain sectors as potentially undervalued:

-

Technology: While some technology stocks experienced significant corrections, BofA sees potential for long-term growth in specific segments, particularly those focused on artificial intelligence and cloud computing.

-

Energy: The ongoing global energy transition presents both challenges and opportunities. BofA believes certain energy companies are undervalued considering their role in a mixed energy landscape.

BofA's positive outlook is rooted in their predictions for future market growth. They anticipate sustained, albeit slower, economic expansion, driving corporate earnings and stock prices upwards over the long term. While they acknowledge the impact of interest rate hikes on valuations, they believe these factors are already largely priced into the market. They stress the importance of a long-term investment strategy to weather short-term market fluctuations.

Addressing Investor Concerns: Counterarguments to Bearish Sentiment

Many investors harbor legitimate concerns about the current market environment. Inflation, recessionary fears, and geopolitical risks all contribute to bearish sentiment. However, BofA's analysis addresses these concerns directly:

-

Inflation: While inflation erodes purchasing power, BofA argues that its impact on corporate earnings is not as severe as some predict. Many companies have successfully passed on increased costs to consumers.

-

Recession: BofA acknowledges the risk of a recession but points to indicators that suggest a mild, rather than severe, downturn. Their models incorporate various recession scenarios and assess their potential impact on stock prices.

-

Geopolitical Risks: Geopolitical uncertainties are always a factor, but BofA's models integrate these risks to produce a balanced assessment. They acknowledge the potential for disruption but maintain that the overall impact on market valuations might be less dramatic than many fear. Their comprehensive analysis considers diverse geopolitical scenarios.

Practical Implications for Investors: How to Utilize BofA's Insights

BofA's findings offer actionable insights for investors:

-

Sector Allocation: Consider overweighting undervalued sectors like technology (specific segments) and energy (selected companies) based on BofA's analysis.

-

Stock Selection: Use BofA's research as a starting point to identify undervalued stocks within promising sectors. Perform thorough due diligence before making any investment decisions.

-

Long-Term Horizon: Maintain a long-term investment horizon to ride out short-term market fluctuations and benefit from long-term growth.

-

Risk Management: Diversify your portfolio across various asset classes and sectors to mitigate risks.

Conclusion

BofA's analysis of stock market valuations offers a surprisingly positive outlook, suggesting that current market prices may present opportunities for investors. While acknowledging legitimate concerns about inflation, recession, and geopolitical risks, their research indicates that these factors might be less impactful than widely believed. By using a combination of valuation models and considering a wide range of factors, BofA provides a comprehensive assessment. While BofA's analysis offers a positive outlook on stock market valuations, it is crucial to conduct your own thorough research and consider your individual risk tolerance. Learn more about understanding and utilizing stock market valuations to make informed investment decisions. Don't hesitate to consult a financial advisor for personalized guidance. Start planning your investment strategy based on these insights into current stock market valuations today!

Featured Posts

-

The Dnieper River Prospects For Peace And Regional Cooperation

Apr 25, 2025

The Dnieper River Prospects For Peace And Regional Cooperation

Apr 25, 2025 -

Nfl Mock Draft 2024 Saints Target Alvin Kamaras Replacement In Top 10

Apr 25, 2025

Nfl Mock Draft 2024 Saints Target Alvin Kamaras Replacement In Top 10

Apr 25, 2025 -

Stuttgart Vs Bayern Munich Comeback Win Extends Bayerns Bundesliga Dominance

Apr 25, 2025

Stuttgart Vs Bayern Munich Comeback Win Extends Bayerns Bundesliga Dominance

Apr 25, 2025 -

Carnaval Jorge Mateus E Felipe Amorim Garantem Festa No Primeiro Dia

Apr 25, 2025

Carnaval Jorge Mateus E Felipe Amorim Garantem Festa No Primeiro Dia

Apr 25, 2025 -

5 Reasons Ridley Scotts New Apple Tv Show Has Promising Reviews

Apr 25, 2025

5 Reasons Ridley Scotts New Apple Tv Show Has Promising Reviews

Apr 25, 2025

Latest Posts

-

Louisville Launches Storm Debris Removal Program What You Need To Know

Apr 30, 2025

Louisville Launches Storm Debris Removal Program What You Need To Know

Apr 30, 2025 -

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025 -

The Kamala Harris Political Comeback What We Know So Far

Apr 30, 2025

The Kamala Harris Political Comeback What We Know So Far

Apr 30, 2025 -

Road Construction Cripples Louisville Restaurants A Call To Action

Apr 30, 2025

Road Construction Cripples Louisville Restaurants A Call To Action

Apr 30, 2025 -

Is Kamala Harris Returning To Politics A Timeline Of Her Plans

Apr 30, 2025

Is Kamala Harris Returning To Politics A Timeline Of Her Plans

Apr 30, 2025