Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Methodology: How They Assess Market Valuation

Bank of America employs a robust methodology to assess stock market valuations, incorporating various established metrics to provide a comprehensive view. Their approach isn't solely reliant on a single indicator but rather a combination of factors offering a more nuanced understanding.

-

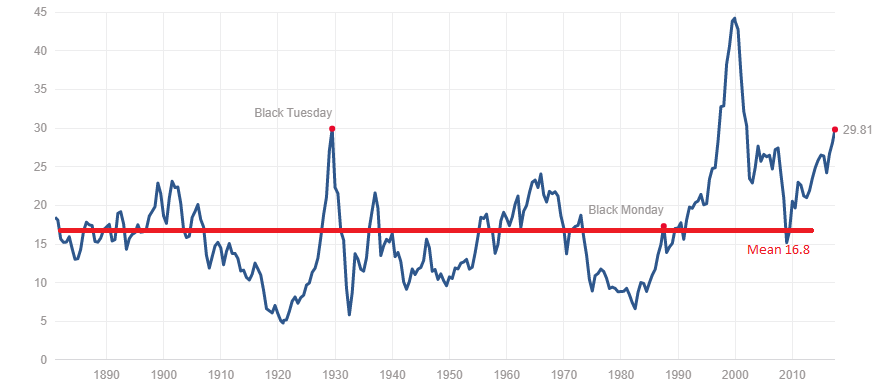

Specific Valuation Metrics: BofA utilizes a range of metrics, including the widely used price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE), and other forward-looking measures that consider projected earnings growth. They also incorporate sector-specific analyses and consider historical trends to contextualize current valuations.

-

Unique Aspects of BofA's Methodology: While the core metrics are standard, BofA's methodology distinguishes itself by incorporating detailed macroeconomic forecasts into its valuation models. This allows them to account for potential shifts in interest rates, inflation, and economic growth, providing a more dynamic assessment than many simpler models.

-

Differences from Other Methods: Unlike some simpler valuation methods that focus solely on historical data, BofA's approach integrates both historical data and forward-looking projections. This dynamic approach aims to provide a more accurate and relevant picture of current market conditions and potential future performance.

-

Supporting Sources: [Link to BofA's research reports (if publicly available)]. [Link to reputable financial news source discussing BofA's methodology].

Key Findings: Why BofA Remains Relatively Optimistic

BofA's recent analysis suggests that while stock market valuations are not dramatically undervalued, they are also not excessively overvalued, offering a relatively reassuring picture for long-term investors.

-

Data Supporting Optimism: BofA's findings indicate that the market is currently trading at a level slightly above its historical average, considering various valuation metrics. They point to strong corporate earnings growth in certain sectors as a key supporting factor. [Incorporate relevant chart/graph visualizing this data, if available].

-

Addressing Potential Counterarguments and Risks: BofA acknowledges the inherent risks associated with investing, particularly the impact of rising interest rates and persistent inflation. However, their analysis suggests that these risks are largely factored into current market prices.

-

Favorable Sectors and Asset Classes: BofA's analysis suggests that certain sectors, such as [mention specific sectors if mentioned in BofA's report], may offer relatively attractive valuations compared to others. This highlights the importance of diversified investing strategies.

Considering Inflation and Interest Rates

BofA’s valuation model explicitly considers the significant impact of inflation and interest rates on stock valuations.

-

Impact of Higher Interest Rates: Higher interest rates generally increase the discount rate used in valuation models, leading to lower present values of future earnings and consequently lower stock valuations. BofA's analysis incorporates projected interest rate changes into their forecasts.

-

Inflation's Effect on Corporate Earnings: Inflation can impact corporate earnings both positively and negatively. Increased prices can boost revenues but also increase input costs. BofA's analysts carefully assess these opposing forces to arrive at a net impact on corporate profitability.

-

Risks Associated with Economic Shifts: Unexpected changes in inflation or interest rates could significantly impact stock valuations. BofA emphasizes the need to monitor these macroeconomic factors closely and adjust investment strategies accordingly.

Implications for Investors: Actionable Advice Based on BofA's Analysis

BofA's relatively reassuring view on stock market valuations doesn't signal a guaranteed path to riches, but it does offer some valuable insights for investors.

-

Investment Strategies: Based on BofA's analysis, a long-term investment strategy focused on diversification across various sectors and asset classes remains a prudent approach. Considering sector-specific opportunities identified by BofA's research may also be beneficial.

-

Risk Management: Despite the relatively optimistic outlook, investors should maintain a healthy level of risk awareness. Diversification, regular portfolio reviews, and a well-defined risk tolerance are crucial aspects of a successful investment strategy.

-

Further Research and Due Diligence: Investors should conduct thorough research before making any investment decisions. BofA's analysis provides valuable context, but it's not a substitute for individual due diligence.

-

Disclaimer: Investing in the stock market inherently carries risks, including the potential for loss of principal. This article should not be considered financial advice.

Conclusion

BofA's analysis suggests that current stock market valuations, while not exceptionally low, are not alarmingly high either, offering a relatively reassuring perspective despite market volatility. This implies that a long-term investment approach, incorporating diversification and careful risk management, remains a viable strategy. However, while BofA offers a reassuring perspective on stock market valuations, conducting your own thorough research and seeking professional financial advice is crucial before making any investment decisions. Stay informed about evolving stock market valuations and adapt your strategy accordingly. Understanding stock market valuation and its nuances is key to making sound investment choices.

Featured Posts

-

M Ivaskeviciaus Isvarymas Gilesnis Zvilgsnis I Spektakli Filma Ir Konteksta

Apr 30, 2025

M Ivaskeviciaus Isvarymas Gilesnis Zvilgsnis I Spektakli Filma Ir Konteksta

Apr 30, 2025 -

Bibee Guardians Defeat Judge Yankees In Thrilling 3 2 Game

Apr 30, 2025

Bibee Guardians Defeat Judge Yankees In Thrilling 3 2 Game

Apr 30, 2025 -

Planning A Southern Cruise In 2025 Heres What You Need To Know

Apr 30, 2025

Planning A Southern Cruise In 2025 Heres What You Need To Know

Apr 30, 2025 -

Mexican Human Rights Activist And Spouse Found Dead Questions Remain

Apr 30, 2025

Mexican Human Rights Activist And Spouse Found Dead Questions Remain

Apr 30, 2025 -

Beyonces Butt Flashing Levis Ad Sparks Frenzy Among Fans

Apr 30, 2025

Beyonces Butt Flashing Levis Ad Sparks Frenzy Among Fans

Apr 30, 2025

Latest Posts

-

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025 -

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025 -

Warriors Vs Rockets Bet Mgms 150 Bonus With Code Rotobg 150

Apr 30, 2025

Warriors Vs Rockets Bet Mgms 150 Bonus With Code Rotobg 150

Apr 30, 2025 -

37

Apr 30, 2025

37

Apr 30, 2025 -

Vilniaus Savu Vardu Turnyras Mato Buzelio Netiketa Tyla

Apr 30, 2025

Vilniaus Savu Vardu Turnyras Mato Buzelio Netiketa Tyla

Apr 30, 2025