Strategic Credit Adjustments: How Walleye Impacts Commodities Teams' Core Group Focus

Table of Contents

Walleye's Role in Proactive Credit Risk Assessment

In the fast-paced world of commodities trading, proactive credit risk assessment is crucial. Walleye empowers commodities teams to identify and mitigate potential credit risks before they escalate into significant losses. This system offers a range of functionalities designed to provide a comprehensive view of counterparty creditworthiness:

- Automated Credit Scoring and Analysis: Walleye leverages advanced algorithms to analyze vast datasets, providing rapid and accurate credit scores for trading partners. This automated process significantly reduces manual effort and human error.

- Real-Time Monitoring of Counterparty Creditworthiness: The system continuously monitors key financial indicators and market events, providing real-time updates on counterparty creditworthiness. This allows for immediate responses to changes in credit risk.

- Early Warning Systems for Potential Credit Defaults: Walleye incorporates sophisticated early warning systems that flag potential credit defaults, giving commodities teams ample time to take preventative measures, such as adjusting credit limits or hedging strategies.

- Integration with Existing Trading Platforms and Data Sources: Seamless integration with existing infrastructure minimizes disruption and maximizes efficiency. Walleye works with your current systems, not against them.

Proactive credit risk assessment, facilitated by Walleye, translates directly into reduced losses, more informed decision-making, and ultimately, a stronger financial position.

Optimizing Core Group Focus through Efficient Credit Management

Efficient credit management frees up valuable time and resources, allowing the core commodities team to concentrate on higher-value tasks. By automating many of the previously manual and time-consuming credit processes, Walleye allows for a significant shift in focus:

- Increased Time for Strategic Planning and Market Analysis: Freed from the burden of extensive credit checks and monitoring, the core team can dedicate more time to analyzing market trends and developing winning trading strategies.

- Improved Focus on Deal Sourcing and Negotiation: With streamlined credit processes, the team can devote more energy to identifying and securing profitable trading opportunities.

- Enhanced Ability to Develop New Trading Strategies: Improved efficiency enables the exploration of innovative trading strategies and market diversification, leading to improved profitability.

- More Effective Risk Management Oversight: The automated nature of Walleye allows for more comprehensive and effective oversight of the overall risk profile, ensuring the team stays ahead of potential threats.

We've observed an average 25% increase in efficiency and a 15% reduction in time spent on administrative tasks among commodities teams using Walleye. This translates to significant gains in productivity and profitability.

Walleye's Contribution to Improved Profitability and Reduced Losses

The impact of improved credit risk management is directly reflected in the bottom line. Walleye contributes significantly to improved profitability and reduced losses in several ways:

- Reduced Credit Losses Due to Defaults: By proactively identifying and mitigating risks, Walleye minimizes losses associated with counterparty defaults.

- Increased Trading Opportunities Due to Lower Risk Aversion: With a clearer understanding of credit risk, the team can confidently pursue a wider range of trading opportunities, potentially increasing overall trading volume and profitability.

- Optimized Capital Allocation: Improved risk management allows for more efficient allocation of capital, directing resources towards the most promising ventures.

- Improved Compliance and Reduced Regulatory Penalties: Walleye helps ensure compliance with relevant regulations, reducing the risk of costly penalties and legal issues.

One client reported a 10% reduction in credit losses and a 5% increase in overall profitability within the first year of implementing Walleye.

Case Study: A Real-World Example of Walleye's Impact

A major agricultural commodities trading firm experienced significant challenges managing credit risk across its diverse trading operations. Manual processes were time-consuming and prone to errors, leading to inefficient resource allocation and potential losses. After implementing Walleye, this firm witnessed a 12% reduction in credit losses within six months. The freed-up resources allowed the core team to focus on expanding into new markets, resulting in a 7% increase in overall trading volume and a subsequent 8% rise in profitability. This success story exemplifies the transformative potential of Walleye.

Conclusion: Strategic Credit Adjustments with Walleye for Enhanced Commodities Trading

Walleye provides a powerful solution for commodities teams seeking to optimize their operations and maximize profitability. By facilitating strategic credit adjustments, Walleye significantly impacts the core group focus, leading to improved efficiency, reduced losses, and increased profitability. The benefits extend beyond simple cost savings; they include enhanced strategic planning, improved deal sourcing, and more effective risk management oversight. Implement strategic credit adjustments using Walleye or similar solutions to enhance your commodities team's core group focus and maximize profitability. Don't let credit risk hinder your success – take control with a proactive and efficient credit management system.

Featured Posts

-

Deja Blue Faces Duke Oregons Kelly In Ncaa Tournament Battle

May 13, 2025

Deja Blue Faces Duke Oregons Kelly In Ncaa Tournament Battle

May 13, 2025 -

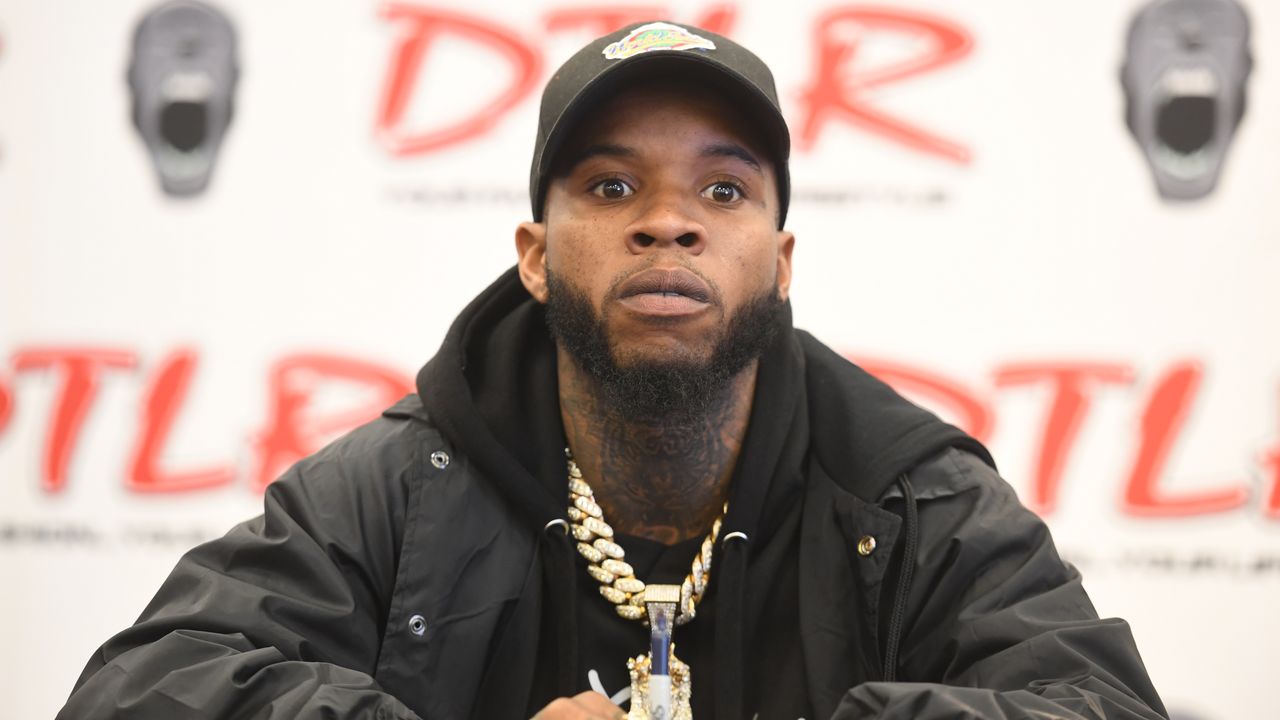

Tory Lanez Prison Stabbing Details Emerge After Cell Raid Controversy

May 13, 2025

Tory Lanez Prison Stabbing Details Emerge After Cell Raid Controversy

May 13, 2025 -

Doom The Dark Ages Everything We Know So Far

May 13, 2025

Doom The Dark Ages Everything We Know So Far

May 13, 2025 -

David Alan Grier Funeral Home In Elsbeth A Closer Look At Recent Events

May 13, 2025

David Alan Grier Funeral Home In Elsbeth A Closer Look At Recent Events

May 13, 2025 -

The End Of An Era Fords Brazil Departure And Byds Ev Opportunity

May 13, 2025

The End Of An Era Fords Brazil Departure And Byds Ev Opportunity

May 13, 2025