Strategy's $555.8 Million Bitcoin Acquisition: A Comprehensive Overview

Table of Contents

The Rationale Behind Strategy's Bitcoin Purchase

Strategy's decision to allocate a significant portion of its capital towards Bitcoin wasn't arbitrary. Several factors likely contributed to this strategic move, demonstrating a forward-thinking approach to investment diversification and a belief in Bitcoin's long-term potential.

-

Diversification of Investment Portfolio: By adding Bitcoin to its portfolio, Strategy likely aimed to reduce reliance on traditional asset classes and mitigate risks associated with market volatility. Diversification is a cornerstone of sound investment strategy, and Bitcoin, with its distinct characteristics, offers a unique diversification opportunity.

-

Long-Term Belief in Bitcoin's Value Proposition: Strategy's investment reflects a strong belief in Bitcoin's underlying value proposition. This could stem from a conviction in Bitcoin's decentralized nature, its limited supply, and its growing adoption as a store of value and a medium of exchange.

-

Capitalizing on Bitcoin's Growth Potential: Bitcoin's price has historically demonstrated periods of significant growth, presenting considerable potential for substantial returns on investment. Strategy’s acquisition may reflect a strategic decision to capitalize on this growth potential.

-

Positioning for Future Adoption of Bitcoin as a Mainstream Asset: Many believe Bitcoin is on a trajectory to become a more widely accepted mainstream asset. Strategy's investment could be a strategic move to position itself favorably within this evolving financial ecosystem.

-

Hedge against Inflation or Traditional Market Volatility: Bitcoin, often considered a hedge against inflation, could serve as a safeguard against potential devaluation of traditional fiat currencies and the fluctuations of traditional markets.

Strategy’s previous investment strategies suggest a [describe Strategy’s past investment approach, e.g., conservative, aggressive, risk-averse, etc.] approach. This Bitcoin purchase, however, signifies a notable shift towards embracing digital assets as a significant component of their investment strategy. [Insert any official statements released by Strategy regarding this Bitcoin purchase].

Market Reaction to the $555.8 Million Bitcoin Acquisition

The announcement of Strategy's $555.8 million Bitcoin acquisition triggered a notable reaction within the cryptocurrency market.

-

Price Fluctuations of Bitcoin following the Announcement: The news likely caused short-term price fluctuations in Bitcoin, with the exact impact depending on the prevailing market sentiment and trading volume at the time. [Insert chart showing Bitcoin's price movement around the announcement date].

-

Analysis of Market Sentiment (positive, negative, or neutral): The market's overall reaction likely ranged from positive (reflecting increased institutional confidence in Bitcoin) to neutral (if investors were already anticipating such a move), while some might have expressed negative sentiment, perhaps citing concerns about market manipulation.

-

Impact on Other Cryptocurrencies: The acquisition could have influenced the price movements of other cryptocurrencies, either positively (by association) or negatively (due to potential capital flow shifts).

-

Reactions from Financial Analysts and Industry Experts: Financial analysts and experts likely offered diverse interpretations of the acquisition's implications, considering factors such as Strategy's financial health, the potential risks involved, and the broader implications for the crypto market.

-

Significant Changes in Bitcoin's Market Capitalization: A large-scale acquisition like this could slightly influence Bitcoin's overall market capitalization, although the effect might be relatively small in comparison to the overall market size. [Insert chart showing Bitcoin's market cap around the announcement date].

Potential Future Implications of Strategy's Bitcoin Holdings

Strategy's substantial Bitcoin holdings have significant implications for both the company and the broader crypto landscape.

-

Potential ROI (Return on Investment) for Strategy: The ultimate success of Strategy's investment will depend largely on Bitcoin's future price performance. A significant price increase would yield a substantial ROI, while a decrease could result in losses.

-

Strategy's Future Plans Regarding its Bitcoin Holdings (holding, selling, etc.): Strategy’s long-term intentions regarding its Bitcoin holdings remain to be seen. Will they hold onto the investment long-term, or will they look to sell at opportune moments to capitalize on profits?

-

Impact on Institutional Adoption of Bitcoin: Strategy's bold move could encourage other institutional investors to consider Bitcoin as a viable asset, accelerating the broader adoption of cryptocurrencies.

-

Potential Influence on Bitcoin's Regulatory Environment: Large-scale institutional investments could influence the regulatory landscape surrounding Bitcoin, potentially prompting regulatory bodies to further clarify their stance on digital assets.

-

The Role of this Acquisition in Shaping Future Corporate Investment in Cryptocurrencies: Strategy's action could act as a catalyst, inspiring other corporations to explore incorporating crypto assets into their investment strategies.

Comparison with Other Large Bitcoin Acquisitions

To better understand the context of Strategy's $555.8 million Bitcoin acquisition, it's essential to compare it with other significant Bitcoin purchases by corporations or institutional investors. [Insert a table comparing several large Bitcoin acquisitions, including the date, amount invested, company, and subsequent performance]. This comparison will highlight similarities and differences in investment strategies, timing, and the rationale behind these decisions.

Conclusion: Understanding Strategy's $555.8 Million Bitcoin Acquisition

Strategy's $555.8 million Bitcoin acquisition represents a significant milestone in the integration of cryptocurrencies into mainstream finance. The decision reflects a multifaceted strategy involving portfolio diversification, a long-term belief in Bitcoin's value, and a forward-looking approach to capitalizing on growth potential within the digital asset space. The market's reaction, while varied, highlighted the significant attention this acquisition commanded, influencing both Bitcoin's price and broader market sentiment. The long-term implications are significant, potentially accelerating institutional adoption, shaping regulatory landscapes, and further solidifying Bitcoin's place within the global financial ecosystem.

Stay updated on the latest developments in the world of Bitcoin investment and learn more about how major players are shaping the future of digital assets. Follow our blog for more insights on Strategy's $555.8 million Bitcoin acquisition and other significant cryptocurrency investments.

Featured Posts

-

Beyonces Tour Why Sir Carter Remains Out Of The Spotlight While Rumi And Blue Shine

Apr 30, 2025

Beyonces Tour Why Sir Carter Remains Out Of The Spotlight While Rumi And Blue Shine

Apr 30, 2025 -

Okreme Sidinnya Trampa Ta Zelenskogo Poyasnennya Podiyi

Apr 30, 2025

Okreme Sidinnya Trampa Ta Zelenskogo Poyasnennya Podiyi

Apr 30, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 30, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 11 Unleashing The Ducks A Preview

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 11 Unleashing The Ducks A Preview

Apr 30, 2025 -

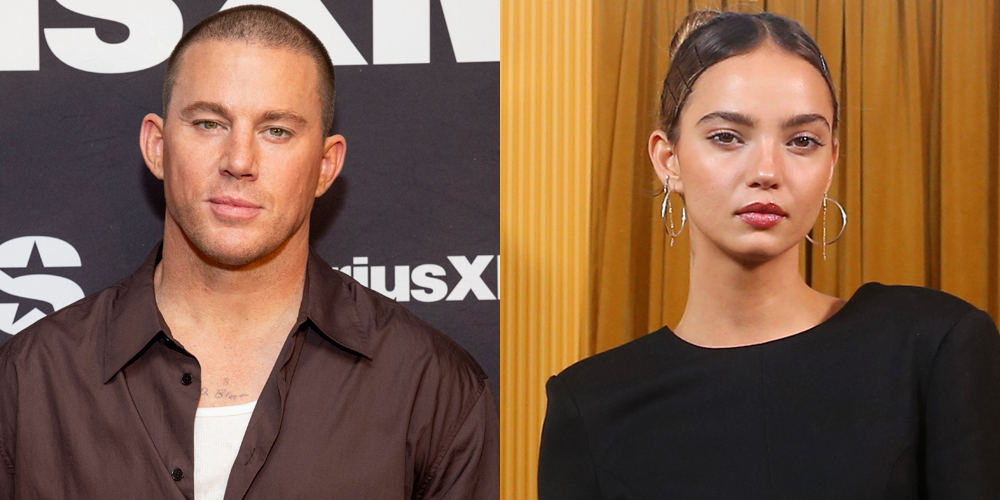

Inka Williams Channing Tatums Girlfriend Makes A Statement At The Australian Grand Prix

Apr 30, 2025

Inka Williams Channing Tatums Girlfriend Makes A Statement At The Australian Grand Prix

Apr 30, 2025

Latest Posts

-

The Countrys Hottest New Business Locations A Comprehensive Map

Apr 30, 2025

The Countrys Hottest New Business Locations A Comprehensive Map

Apr 30, 2025 -

Landlord Price Gouging Allegations Surface After La Fires Selling Sunset Star Weighs In

Apr 30, 2025

Landlord Price Gouging Allegations Surface After La Fires Selling Sunset Star Weighs In

Apr 30, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 30, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 30, 2025 -

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025 -

Volatility Ahead Secure Your S And P 500 Investments With Downside Insurance

Apr 30, 2025

Volatility Ahead Secure Your S And P 500 Investments With Downside Insurance

Apr 30, 2025