Strengthening The Euro: Lagarde's EUR/USD Initiatives And Their Global Impact

Table of Contents

Lagarde's Monetary Policy Strategies to Bolster the Euro

Lagarde's approach to strengthening the Euro centers on strategic monetary policy adjustments. These policies directly influence the EUR/USD exchange rate and the broader Eurozone economy.

Interest Rate Hikes and Their Effect on EUR/USD

The ECB's recent interest rate hikes represent a key strategy in strengthening the Euro. By increasing interest rates, the ECB aims to attract foreign investment. Higher interest rates make Euro-denominated assets more appealing to international investors seeking higher returns, increasing demand for the Euro and consequently boosting its value against the USD.

- Rationale: Curbing inflation and encouraging savings while making Eurozone assets more attractive.

- Impact: Since the implementation of the rate hikes, the EUR/USD has seen a noticeable increase, although the exact percentage fluctuates based on market conditions and other influencing factors. (Note: Specific data should be inserted here from a reliable source to reflect current market conditions).

- Downsides: While attracting foreign investment is beneficial, aggressive interest rate hikes can also slow economic growth and potentially exacerbate inflation in the short term. A delicate balance is required.

Quantitative Tightening and Its Influence on the Eurozone Economy

Quantitative tightening (QT), the opposite of quantitative easing, involves reducing the ECB's balance sheet by allowing bonds to mature without replacement. This reduces the money supply, aiming to control inflation.

- Process: The ECB gradually reduces its holdings of government and private bonds, thus removing liquidity from the market.

- Effects: QT aims to curb inflation, but it can also slow down economic growth. The impact on the Euro's value depends on how effectively it manages inflation and maintains investor confidence.

- Pros: Helps control inflation, potentially leading to a more stable and stronger Euro in the long run.

- Cons: Can slow economic growth, potentially impacting employment and investment.

Communication Strategies and Market Confidence

Lagarde's communication strategy is crucial in influencing market sentiment and, therefore, the EUR/USD exchange rate. Clear, consistent messaging builds confidence amongst investors.

The Impact of Lagarde's Public Statements on EUR/USD

Lagarde's public pronouncements on monetary policy and the Eurozone's economic outlook significantly influence market reactions. For instance, (insert example of a specific statement and its market impact here). Her communication style, tone, and clarity directly affect investor confidence.

- Importance of Clear Communication: Transparency and predictability in communication reduce uncertainty and volatility in the foreign exchange market.

- Forward Guidance: Providing clear signals about future monetary policy decisions helps manage market expectations, promoting stability.

Building Confidence through Transparency and Economic Data

Transparency in releasing economic data, such as inflation figures and GDP growth, is vital. Credible economic forecasts, based on solid data analysis, help investors make informed decisions, contributing to a stable exchange rate.

- Benefits of Transparent Communication: Reduced uncertainty, increased investor confidence, and a more stable EUR/USD.

- Credible Forecasts: Accurate projections reinforce trust in the ECB's ability to manage the Eurozone economy effectively.

Geopolitical Factors and Their Influence on the EUR/USD Exchange Rate

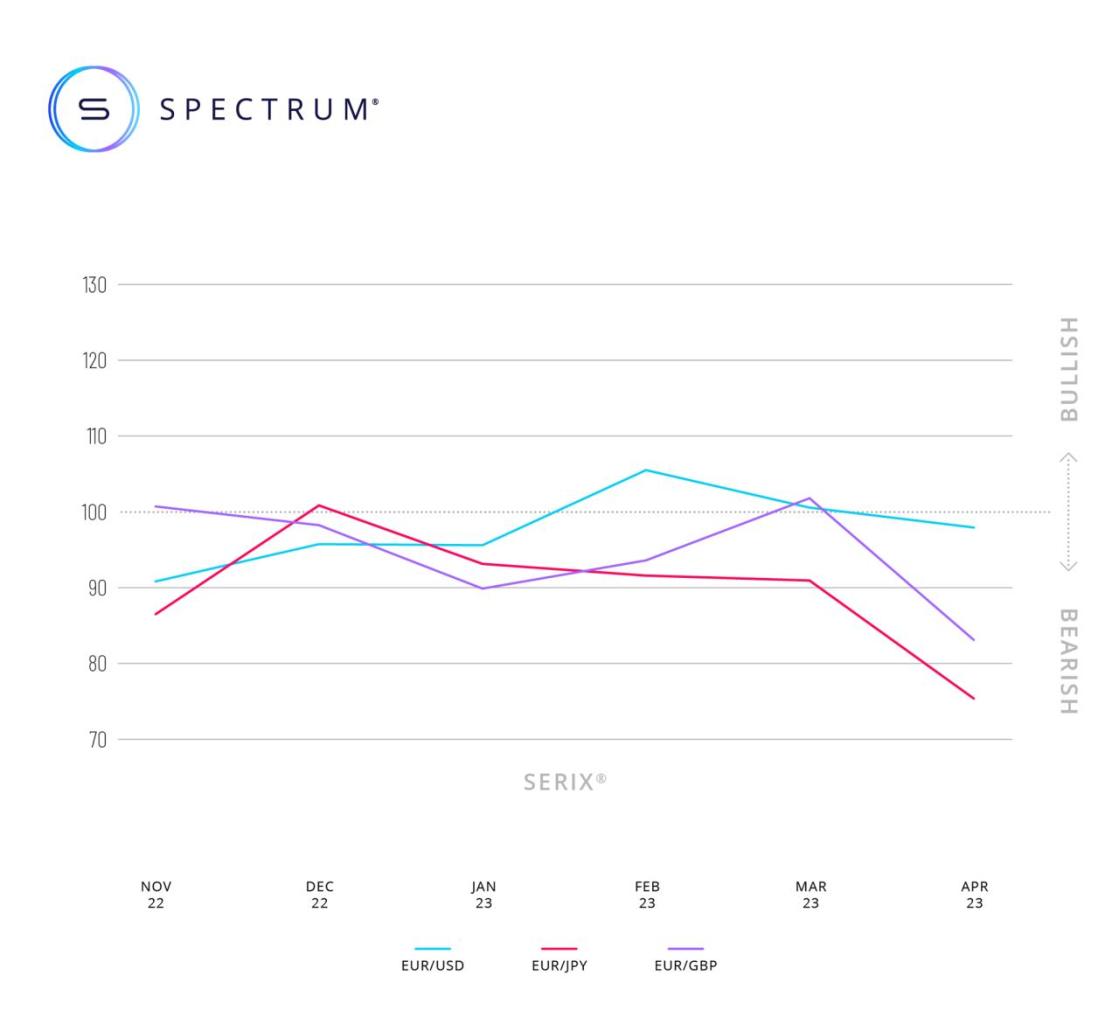

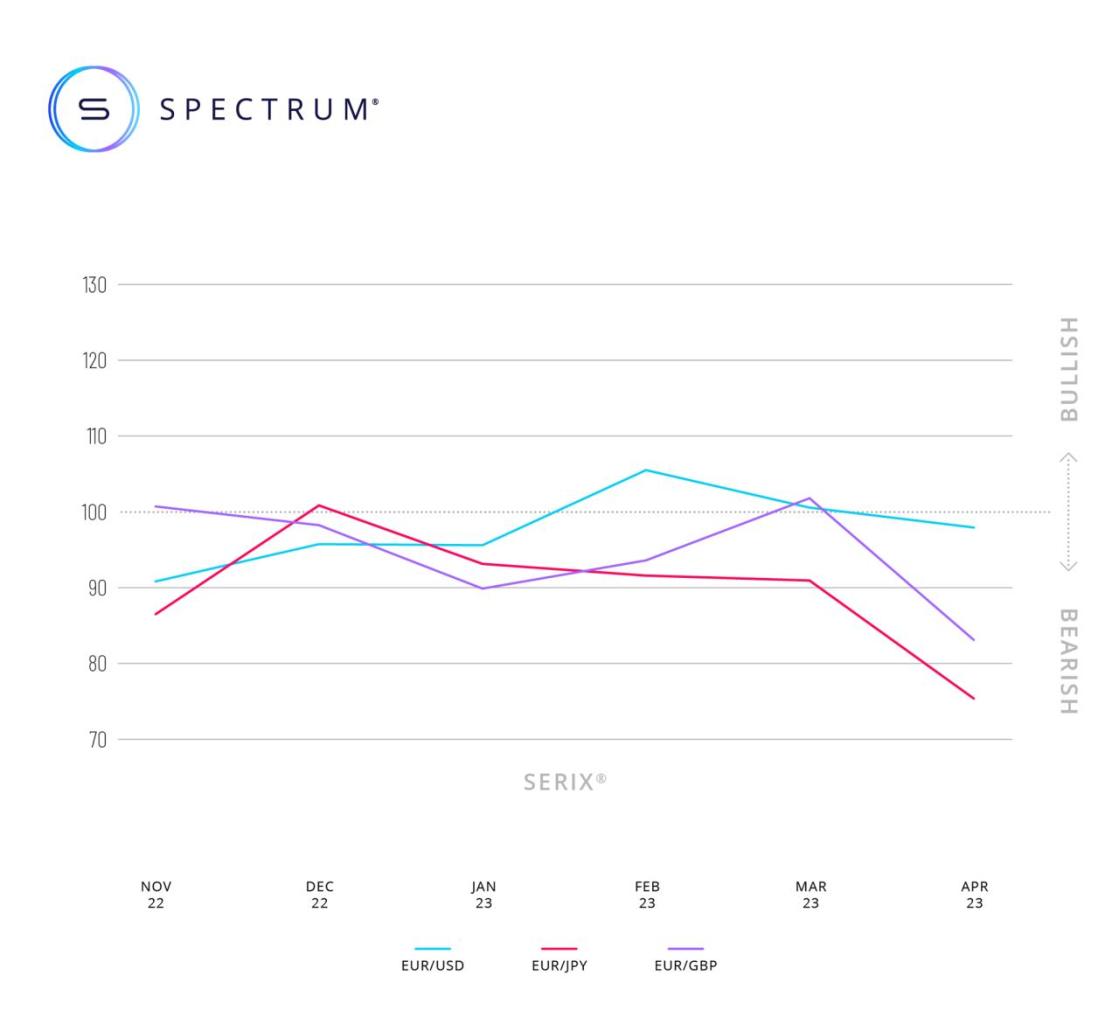

Geopolitical factors play a significant role in influencing the EUR/USD exchange rate, often overshadowing purely economic considerations.

The Role of the Eurozone in Global Geopolitics

The Eurozone's significant role in global trade and its geopolitical standing directly influence the Euro's value. Events like the war in Ukraine and the resulting energy crisis have significantly impacted the Euro's performance against the dollar. (Provide specific data and examples here).

Comparison with the US Dollar's Global Standing

The US dollar's status as a global reserve currency grants it significant strength. Comparing the economic strength and geopolitical influence of the US and the Eurozone reveals key factors driving EUR/USD fluctuations. (Include relevant statistics on GDP growth, trade balances, etc., to support the comparison).

Conclusion: Sustaining the Strength of the Euro

Lagarde's initiatives, encompassing monetary policy adjustments and strategic communication, aim at strengthening the Euro. While interest rate hikes and quantitative tightening play a key role, their effectiveness is intertwined with transparent communication and the unpredictable nature of geopolitical events. Maintaining a strong Euro requires continuous vigilance and adaptation to evolving global economic conditions.

Key Takeaways:

- Interest rate hikes attract foreign investment, bolstering the Euro.

- Quantitative tightening helps manage inflation but can impact economic growth.

- Clear communication and transparency build investor confidence.

- Geopolitical factors significantly influence the EUR/USD exchange rate.

Call to Action: Continue monitoring the EUR/USD exchange rate and follow Lagarde's future policy announcements to stay informed about the ongoing efforts to strengthen the Euro and the complexities of the global economic landscape. Learning more about the strategies for strengthening the Euro is crucial for navigating this dynamic environment.

Featured Posts

-

Wawali Susetyo Taman Kota Baru Di Setiap Kecamatan Balikpapan

May 28, 2025

Wawali Susetyo Taman Kota Baru Di Setiap Kecamatan Balikpapan

May 28, 2025 -

Jannik Sinners Paris Masters Triumph A Close Call

May 28, 2025

Jannik Sinners Paris Masters Triumph A Close Call

May 28, 2025 -

Nas Dem Bali Satu Kursi Di Senayan Proyek Kedai Kopi Ditunda

May 28, 2025

Nas Dem Bali Satu Kursi Di Senayan Proyek Kedai Kopi Ditunda

May 28, 2025 -

Hot Ones Hailee Steinfelds Kansas City Chiefs Shout Out

May 28, 2025

Hot Ones Hailee Steinfelds Kansas City Chiefs Shout Out

May 28, 2025 -

Hasselbaink Ten Ronaldo Ya Emeklilik Cagrisi 2026 Duenya Kupasi Nda Cristiano Ya Ihtiyac Yok Mu

May 28, 2025

Hasselbaink Ten Ronaldo Ya Emeklilik Cagrisi 2026 Duenya Kupasi Nda Cristiano Ya Ihtiyac Yok Mu

May 28, 2025