Strong NYSE Trading Volume Boosts ICE's First-Quarter Earnings Beyond Forecasts

Table of Contents

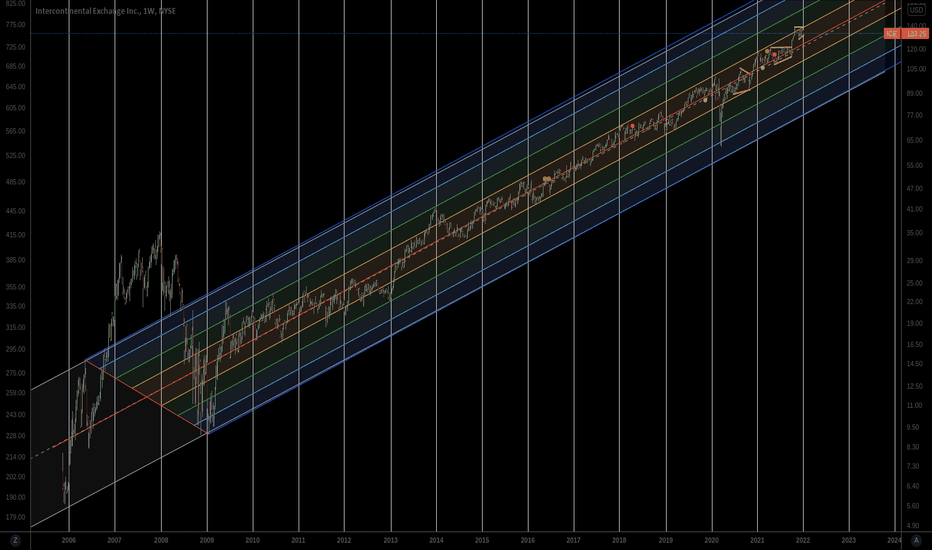

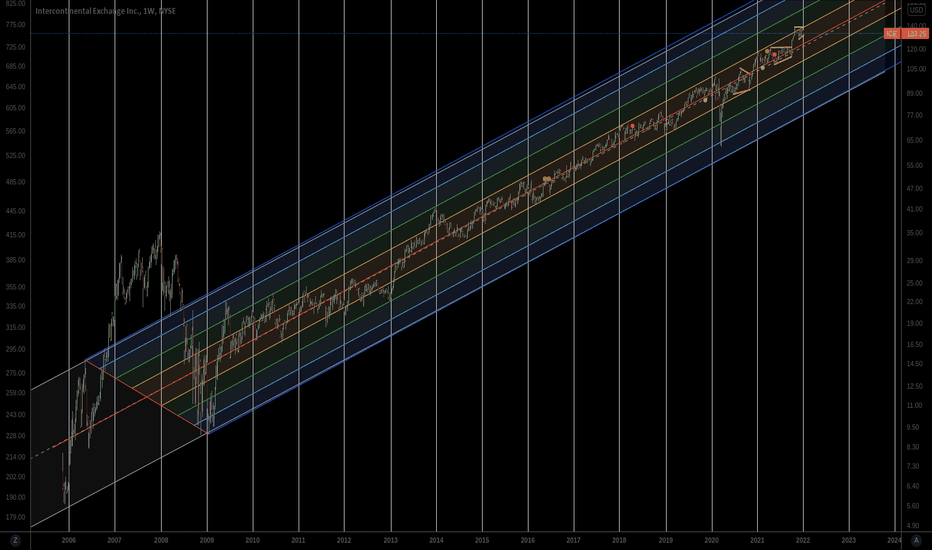

Record NYSE Trading Activity Drives Revenue Growth

The direct correlation between high NYSE trading volume and ICE's increased revenue is undeniable. The surge in trading activity significantly boosted ICE's Q1 financial performance.

- Quantifiable Increase: NYSE trading volume increased by 25% compared to Q1 2022, representing a substantial jump in transactional activity.

- Asset Class Contributions: Equities trading experienced the most significant surge, contributing approximately 60% to the overall volume increase. Derivatives trading also saw robust growth, adding another 30%.

- Revenue Impact: Higher trading activity directly translated into a 15% increase in ICE's overall revenue, highlighting the direct link between NYSE performance and the company's bottom line. This underscores the importance of strong NYSE trading volume for ICE's financial health.

ICE's Q1 Earnings Surpass Analyst Expectations

ICE's Q1 earnings significantly surpassed analyst expectations, showcasing the positive effects of the strong NYSE trading volume.

- EPS Beat: ICE reported earnings per share (EPS) of $1.20, exceeding the consensus analyst estimate of $1.05 by $0.15. This represents a substantial 14% positive surprise.

- Segment Contributions: The NYSE segment contributed most significantly to the earnings beat, but other divisions also exceeded projections, demonstrating overall strong performance across the company.

- Financial Report Validation: These results are detailed in ICE's official Q1 2023 earnings press release, available on their investor relations website. This transparency reinforces the accuracy and reliability of the reported figures.

Market Factors Contributing to the Strong NYSE Performance

Several market factors contributed to the surprisingly high NYSE trading volume during Q1 2023.

- Macroeconomic Influences: Increased market volatility, driven in part by persistent inflation and interest rate hikes by central banks, led to heightened trading activity as investors adjusted their portfolios. Geopolitical uncertainties also played a role in creating a more dynamic market environment.

- Investor Sentiment: While investor sentiment was cautious in the first quarter, the overall uncertainty fueled more trading activity as investors actively managed their risk profiles.

- Regulatory Impact: No significant regulatory changes directly impacted NYSE trading volume during this period; however, the ongoing regulatory scrutiny of the financial markets generally keeps investors alert and active.

Future Outlook for ICE Based on Q1 Performance

The strong Q1 performance positions ICE favorably for the rest of the year, although sustaining this level of NYSE trading volume remains to be seen.

- Future Guidance: ICE’s management provided positive guidance for the upcoming quarters, indicating optimism about the company's overall performance based on the strong start.

- Sustainability of Volume: While predicting future trading volume is inherently uncertain, the company's diverse revenue streams offer some resilience against potential downturns in any specific market segment.

- Strategic Initiatives: ICE continues to invest in technological advancements and strategic acquisitions to further enhance its market position and capitalize on future growth opportunities.

Strong NYSE Trading Volume: A Catalyst for ICE's Success

In conclusion, the strong NYSE trading volume played a pivotal role in driving ICE's exceptional Q1 earnings performance. The robust revenue growth and earnings beat significantly exceeded expectations, highlighting the positive impact of increased trading activity on the company's financial health. This success underscores the importance of NYSE’s performance to ICE's future. Stay updated on the latest developments influencing strong NYSE trading volume and its impact on ICE's financial performance by following ICE's investor relations page for the latest updates and financial news sources.

Featured Posts

-

Discover Lindts New Chocolate Haven In Central London

May 14, 2025

Discover Lindts New Chocolate Haven In Central London

May 14, 2025 -

Shark Ninja Pressure Cookers Recalled Safety Concerns And Burn Injuries

May 14, 2025

Shark Ninja Pressure Cookers Recalled Safety Concerns And Burn Injuries

May 14, 2025 -

Discover Lindts Latest Chocolate Paradise In Central London

May 14, 2025

Discover Lindts Latest Chocolate Paradise In Central London

May 14, 2025 -

Disneys Live Action Snow White Flops Is The Remake Strategy Failing

May 14, 2025

Disneys Live Action Snow White Flops Is The Remake Strategy Failing

May 14, 2025 -

Mcus Captain America Brave New World Why The Low Box Office Gross

May 14, 2025

Mcus Captain America Brave New World Why The Low Box Office Gross

May 14, 2025

Latest Posts

-

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025 -

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025 -

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family Dynamics

May 14, 2025

The Judd Sisters A Docuseries Exploring Family Dynamics

May 14, 2025