Student Loan Debt: How It Impacts Your Mortgage Application

Table of Contents

Understanding Your Debt-to-Income Ratio (DTI)

What is DTI and why is it important?

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when assessing your mortgage application. It represents the percentage of your gross monthly income that goes towards paying your debts. Student loan payments significantly contribute to your DTI calculation. A higher DTI generally reduces your chances of mortgage approval, or may result in less favorable loan terms.

- Debt-to-Income Ratio (DTI): The percentage of your gross monthly income dedicated to debt repayment.

- DTI Calculation: Lenders calculate DTI by adding up all your monthly debt payments (including student loans, credit cards, car loans, etc.) and dividing by your gross monthly income.

- Typical DTI Requirements: Most lenders prefer a DTI below 43%, with some aiming for even lower ratios (e.g., under 36%). Higher DTIs can lead to loan denial or higher interest rates.

- High Student Loan Payments and DTI: Substantial student loan payments can drastically increase your DTI, making it harder to qualify for a mortgage. Even a seemingly small increase in your student loan debt can significantly impact your approval odds.

For example, let's say your gross monthly income is $5,000, and your total monthly debt payments (excluding your mortgage) are $1,500. Your DTI would be 30% ($1,500/$5,000 = 0.30). If your student loan payment increases by $200, your new DTI would jump to 34%, potentially affecting your mortgage application.

The Impact of Student Loan Payment History on Your Credit Score

Credit Score's Crucial Role in Mortgage Approval

Your credit score is another critical element in the mortgage approval process. Lenders use it to assess your creditworthiness and repayment history. A strong credit score significantly increases your chances of approval and can even secure you a lower interest rate.

- Late or Missed Payments: Late or missed student loan payments negatively impact your credit score, reducing your creditworthiness.

- Collections and Defaults: Student loan defaults or collections significantly damage your credit score, making it very difficult to obtain a mortgage.

- Lower Credit Score = Higher Interest Rates or Denial: A low credit score increases your risk profile for lenders, potentially leading to higher interest rates or outright loan denial.

To improve your credit score before applying for a mortgage, focus on consistently making on-time payments on all your debts, including your student loans. Paying down existing debt and addressing any negative marks on your credit report can also help boost your score.

Strategies to Minimize the Impact of Student Loan Debt on Your Mortgage Application

Exploring Loan Repayment Options

Several student loan repayment options can help you manage your debt and improve your DTI. Choosing the right plan can significantly impact your mortgage application.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size, potentially lowering your monthly payments and improving your DTI.

- Deferment and Forbearance: These options temporarily postpone your student loan payments, but they may not be ideal for long-term solutions as they don't reduce your principal balance and can negatively impact your credit score if not managed carefully.

- Student Loan Refinancing: Refinancing can consolidate your loans into a new loan with a potentially lower interest rate, reducing your monthly payments and boosting your DTI. However, check the terms carefully as refinancing might not always be beneficial.

- Consolidation Options: Consolidating multiple student loans into a single loan can simplify repayment, but be aware of the interest rate implications. A higher interest rate could negate any benefits.

Carefully consider the pros and cons of each option before deciding which best suits your financial situation and long-term mortgage goals. Consulting with a financial advisor can help you make an informed decision.

Seeking Professional Advice: Mortgage Brokers and Financial Advisors

The Value of Expert Guidance

Navigating the complexities of mortgage applications with student loan debt can be challenging. Seeking professional advice can significantly improve your chances of success.

- Mortgage Brokers: Mortgage brokers can help you find the best mortgage options tailored to your specific circumstances, including your student loan debt. They can guide you through the application process and help you overcome potential hurdles.

- Financial Advisors: Financial advisors can offer comprehensive financial planning, assisting with budgeting, debt management strategies, and long-term financial goals, ensuring your student loan debt doesn't derail your homeownership dreams.

Working with a mortgage broker and a financial advisor provides valuable expertise and personalized guidance, significantly increasing your chances of securing a mortgage despite your student loan debt.

Conclusion

Student loan debt significantly impacts your mortgage application through its influence on your DTI and credit score. However, by understanding these factors and exploring available strategies like IDR plans, refinancing, and seeking professional help, you can proactively manage your student loan debt and improve your chances of securing your dream home. Don't let student loan debt derail your homeownership goals – plan ahead! Take control of your student loan debt today to improve your chances of securing your dream home. Start planning your mortgage application effectively by understanding the impact of your student loan debt.

Featured Posts

-

Players Express Disappointment With Latest Fortnite Shop Update

May 17, 2025

Players Express Disappointment With Latest Fortnite Shop Update

May 17, 2025 -

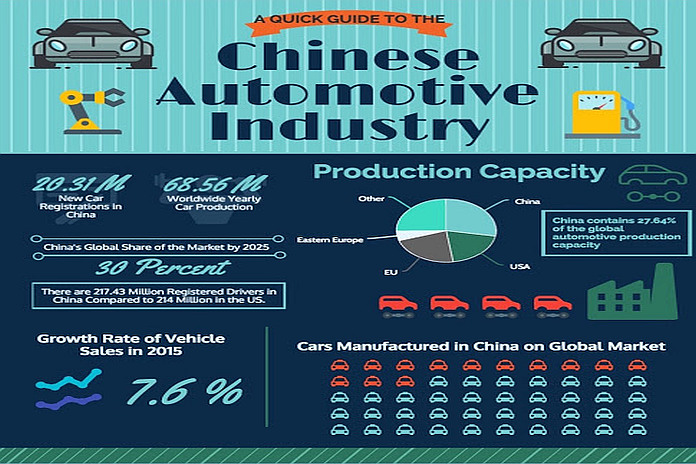

The Chinese Automotive Market Case Studies Of Bmw Porsche And Similar Brands

May 17, 2025

The Chinese Automotive Market Case Studies Of Bmw Porsche And Similar Brands

May 17, 2025 -

New Fortnite Lawsuit Targets Epic Games In Game Store Practices

May 17, 2025

New Fortnite Lawsuit Targets Epic Games In Game Store Practices

May 17, 2025 -

Upad Prosvjednika U Teslin Salon U Berlinu Detalji I Posljedice

May 17, 2025

Upad Prosvjednika U Teslin Salon U Berlinu Detalji I Posljedice

May 17, 2025 -

Kako Srbi Kupuju Stanove U Inostranstvu Iskustva I Saveti

May 17, 2025

Kako Srbi Kupuju Stanove U Inostranstvu Iskustva I Saveti

May 17, 2025