Successfully Buying A House Despite Student Loan Repayments

Table of Contents

The dream of homeownership often clashes with the reality of student loan debt. Many young adults find themselves burdened by significant student loan repayments, making the prospect of buying a house seem daunting, even impossible. But don't despair! Successfully navigating this challenge is achievable with careful planning, a realistic budget, and a proactive approach to managing your finances. This guide provides practical strategies and advice to help you buy a house despite your student loan repayments. The number of people facing this dual financial commitment is increasing, but it's a hurdle you can overcome.

Assessing Your Financial Situation & Creating a Realistic Budget

Before even starting your house hunt, a thorough understanding of your financial situation is paramount. This involves carefully assessing your debt-to-income ratio (DTI) and crafting a comprehensive budget that accommodates both your student loan payments and homeownership aspirations.

Understanding Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when evaluating your mortgage application. It represents the percentage of your gross monthly income that goes towards debt repayment. A lower DTI generally signifies lower risk to lenders, increasing your chances of approval.

-

Calculating your DTI:

- Add up all your monthly debt payments (student loans, credit cards, car loans, etc.).

- Divide this total by your gross monthly income (before taxes).

- Multiply the result by 100 to express it as a percentage.

-

Lenders and DTI: Lenders typically prefer a DTI below 43%, although this can vary. A lower DTI often results in more favorable mortgage terms.

-

Improving your DTI:

- Reduce your debt: Pay down high-interest debt aggressively.

- Increase your income: Explore opportunities for promotions, raises, or part-time jobs.

- Refinance your student loans: Lower monthly payments can improve your DTI. (See section below for more information).

Several online calculators can help you determine your DTI. Using these tools provides a clearer picture of your financial standing.

Creating a Comprehensive Budget

Creating a detailed budget is essential for successfully buying a house while managing student loan repayments. This budget needs to account for all your expenses, including:

-

Rent or mortgage payments (if applicable)

-

Student loan payments

-

Utilities

-

Groceries

-

Transportation

-

Entertainment

-

Savings for a down payment and closing costs

-

Budgeting Tools: Utilize budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital to track your spending and ensure you stay on track.

-

Accurate Budgeting: Track your spending for several months to gain an accurate understanding of your expenses before creating your budget.

-

Down Payment and Closing Costs: Remember to allocate a significant portion of your budget to saving for the down payment and closing costs associated with buying a home. These costs can be substantial and significantly impact your budget.

Exploring Government Assistance Programs

Several government programs offer assistance to first-time homebuyers, potentially making homeownership more attainable. These programs may provide down payment assistance, reduced interest rates, or other benefits.

-

FHA Loans: The Federal Housing Administration (FHA) insures mortgages, allowing lenders to offer loans to borrowers with lower credit scores and down payments.

-

VA Loans: The Department of Veterans Affairs (VA) guarantees home loans for eligible veterans, active-duty military personnel, and surviving spouses. These often require no down payment.

-

State and Local Programs: Many states and local municipalities offer down payment assistance programs specific to their region. Research your area for potential assistance.

Always check the eligibility requirements for each program to determine if you qualify. You can find more information on the official websites of these agencies.

Improving Your Credit Score & Managing Student Loan Debt

A strong credit score is crucial for securing a favorable mortgage interest rate. Simultaneously, managing your student loan debt effectively is also critical for improving your overall financial picture.

The Importance of a Good Credit Score

Your credit score significantly impacts the interest rate you'll receive on your mortgage. A higher credit score usually translates to lower interest rates, saving you thousands of dollars over the life of your loan.

-

Credit Score Factors: Your credit score is calculated based on several factors including payment history, amounts owed, length of credit history, new credit, and credit mix.

-

Improving Your Credit Score:

- Pay all bills on time. This is the single most important factor.

- Keep credit utilization low (the percentage of available credit you are using). Aim for under 30%.

- Maintain a mix of credit accounts (credit cards, installment loans).

- Avoid opening numerous new credit accounts in a short period.

- Use credit monitoring services to track your credit score and identify potential issues.

Strategies for Managing Student Loan Debt

Strategically managing your student loan debt can significantly impact your ability to qualify for a mortgage.

-

Student Loan Refinancing: Refinancing your student loans could potentially lower your monthly payments, freeing up more funds for your down payment and other expenses. However, carefully weigh the pros and cons as some refinancing options may lead to a higher overall interest paid.

-

Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size. They can help manage your cash flow, but may result in higher total repayment costs over the life of the loans.

-

Loan Forgiveness Programs: Some professions and situations might qualify for loan forgiveness programs, which can substantially reduce your student loan debt. Research these possibilities thoroughly.

Finding the Right Mortgage & Home

With your financial situation assessed and your budget in place, you can begin the exciting process of searching for your new home. The right mortgage and the right home are equally important in this equation.

Shopping for the Best Mortgage Rates

Once you know your budget and have a realistic idea of how much you can borrow, comparing mortgage rates from different lenders is crucial.

-

Online Mortgage Calculators: Use online mortgage calculators to estimate your monthly payments based on different loan amounts, interest rates, and loan terms.

-

Fixed-Rate vs. Adjustable-Rate Mortgages: Understand the differences between fixed-rate mortgages (consistent monthly payments) and adjustable-rate mortgages (payments can fluctuate). Choose the option that best suits your financial situation and risk tolerance.

-

Mortgage Pre-Approval: Getting pre-approved for a mortgage gives you a significant advantage when making offers on homes. It demonstrates to sellers that you're a serious buyer with financing in place.

Searching for a Home Within Your Budget

Focus your home search on properties that align with your budget and financial capabilities. Avoid overspending, even if you feel pressured to do so.

-

Real Estate Agent: Working with a qualified real estate agent can significantly streamline the process and help you find properties that meet your needs and budget.

-

Needs vs. Wants: Prioritize your needs when searching for a home and be willing to compromise on wants if necessary.

-

Thorough Home Inspections: Always conduct thorough home inspections before finalizing the purchase to identify any potential issues and avoid costly surprises later.

Conclusion

Buying a house while paying off student loans is a challenging but achievable goal. By carefully assessing your financial situation, improving your credit score, managing your student loan debt effectively, and finding the right mortgage and home, you can successfully navigate this process. Remember to prioritize creating a realistic budget, exploring government assistance programs, and seeking professional advice when needed.

Start your journey towards successfully buying a house despite student loan repayments today! Begin by assessing your financial situation and exploring your mortgage options. Don't let student loan debt derail your dream of homeownership. With careful planning and smart strategies, you can achieve your goal of owning a home.

Featured Posts

-

Resultado Palmeiras Bolivar 2 0 Goles Y Reporte Del Partido

May 17, 2025

Resultado Palmeiras Bolivar 2 0 Goles Y Reporte Del Partido

May 17, 2025 -

Doctor Who Season 2 Trailer The Fifteenth Doctor And His New Companion Face Killer Cartoons

May 17, 2025

Doctor Who Season 2 Trailer The Fifteenth Doctor And His New Companion Face Killer Cartoons

May 17, 2025 -

Trumps Humiliation O Donnell Show Captures Defining Moment

May 17, 2025

Trumps Humiliation O Donnell Show Captures Defining Moment

May 17, 2025 -

City To Honor Paige Bueckers With Day Of Recognition For Wnba Entry

May 17, 2025

City To Honor Paige Bueckers With Day Of Recognition For Wnba Entry

May 17, 2025 -

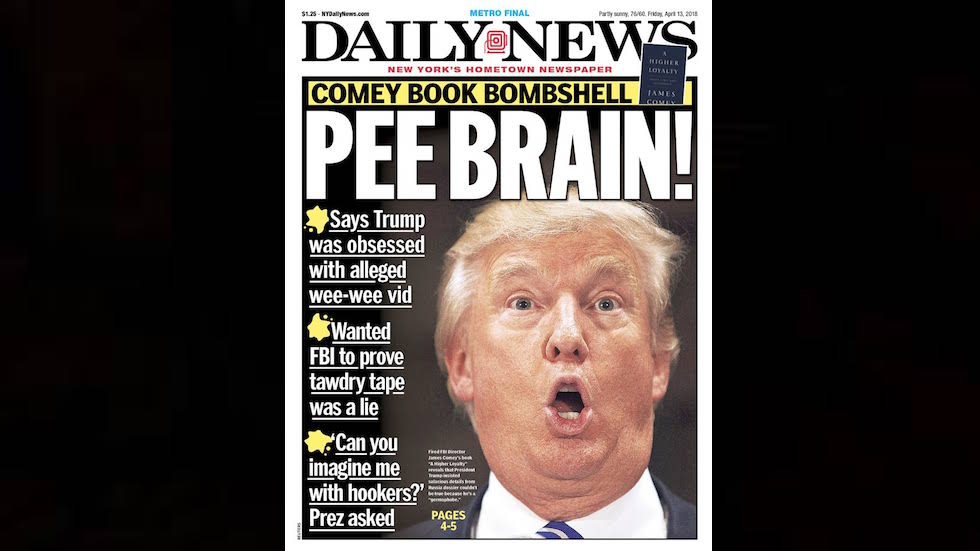

New York Daily News Back Pages May 2025 Archives

May 17, 2025

New York Daily News Back Pages May 2025 Archives

May 17, 2025