Sustainability Funding Opportunities For SMEs: A Comprehensive Guide

Table of Contents

The urgency of tackling climate change is undeniable, and for Small and Medium-sized Enterprises (SMEs), embracing sustainability is no longer a choice but a necessity for long-term success. However, navigating the landscape of sustainability funding opportunities for SMEs can be challenging. Securing the necessary capital to implement green initiatives requires understanding various funding avenues, from government grants to private sector investment. This comprehensive guide will illuminate the path, helping you identify and access the best sustainability funding options for your business. We'll explore avenues like green financing, sustainable business grants, ESG investing, and impact investing to help your SME thrive sustainably.

H2: Government Grants and Subsidies for Sustainable Practices

Many governments recognize the crucial role SMEs play in achieving national sustainability goals and offer financial support through various programs. Accessing these funds can significantly reduce the financial burden of implementing eco-friendly practices.

H3: National and Regional Programs:

Numerous national and regional programs offer sustainable business grants and subsidies. These often target specific areas, such as renewable energy adoption, waste reduction strategies, and carbon footprint reduction. For example, in [mention a specific country/region] the [mention specific program name] offers grants for businesses investing in solar panel installations, while the [mention another program name] provides funding for implementing energy-efficient technologies. Always check your country's or region's official government websites for updated information.

- List several examples of national and regional grant programs: [Provide links to relevant government websites for at least 3 different programs, if possible. If not possible, remove the bullet point]

- Eligibility criteria: These programs typically have eligibility criteria based on factors like business size, industry, location, and the type of sustainability project.

- Application process and timelines: Application procedures vary widely, ranging from simple online forms to detailed proposals requiring extensive documentation. Deadlines are crucial to meet.

- Reporting and impact assessment: Successful applicants often need to submit regular reports demonstrating the project's progress and environmental impact.

H2: Private Sector Investment and Venture Capital for Green Businesses

Beyond government support, the private sector is increasingly recognizing the potential of sustainable businesses. ESG investing and impact investing are rapidly gaining traction, with investors actively seeking companies demonstrating strong environmental, social, and governance performance.

H3: Impact Investing and ESG Funds:

Impact investors focus on generating both financial returns and positive social or environmental impact. ESG funds evaluate companies based on their ESG performance, integrating these factors into their investment decisions.

- Investment criteria: These funds typically assess a company's sustainability performance, business model, growth potential, and management team.

- Benefits and drawbacks: Securing funding from private investors offers the potential for significant capital injection and access to valuable expertise. However, it also involves giving up equity and adhering to investor expectations.

- Examples of successful businesses: [Mention a few examples of successful SMEs that secured funding through this route].

H3: Green Bonds and Sustainable Loans:

Green financing is another vital avenue, encompassing green bonds and sustainable loans specifically designed for environmentally friendly projects. These offer favorable interest rates and attract investors keen on supporting sustainable initiatives.

- Application processes and interest rates: The application process usually involves a detailed assessment of the project's environmental impact and financial viability. Interest rates are often competitive.

- Benefits: Green financing enhances a company's reputation, improves access to capital, and demonstrates a commitment to sustainability.

H2: Crowdfunding and Social Impact Platforms

Crowdfunding platforms offer an alternative route to secure sustainability funding. These platforms connect businesses with a wide network of individuals willing to invest in projects aligned with their values.

H3: Utilizing Crowdfunding for Sustainability Initiatives:

Crowdfunding provides a direct avenue to connect with potential investors passionate about your sustainability goals.

- Types of crowdfunding platforms: Reward-based, equity-based, and donation-based platforms cater to different funding needs and investor preferences.

- Strategies for successful campaigns: A compelling narrative highlighting the project's environmental benefits and potential impact is crucial for a successful crowdfunding campaign. Strong visuals and clear communication are essential.

- Benefits and challenges: Crowdfunding offers a flexible way to raise funds, but success depends on effective marketing and community engagement.

H2: Incubators and Accelerators for Sustainable Startups

Incubators and accelerators provide vital support for early-stage sustainable businesses. These programs offer mentorship, networking opportunities, and often seed funding.

H3: Finding the Right Program:

These programs offer comprehensive support to help your business flourish.

- Examples of successful sustainability-focused incubators and accelerators: [Mention examples if possible; otherwise remove the bullet point].

- Benefits: Mentorship, networking, access to resources, and seed funding are key benefits.

- Tips on identifying the right program: Consider the program's focus, stage of funding, mentorship network, and overall fit with your business.

H3: Navigating the Application Process for Sustainability Funding:

Securing funding involves a thorough application process.

- Compelling grant proposals: Clearly articulate your business plan, demonstrate a strong understanding of your target market, and showcase the environmental impact of your project. Highlight the potential return on investment for investors.

- Strong business plan and demonstrable impact: A robust business plan is essential, including detailed financial projections and a clear strategy for measuring and reporting your sustainability achievements.

- Showcasing sustainability aspects: Emphasize your company’s commitment to sustainable practices and clearly demonstrate the environmental benefits of your project. Quantify the positive impact whenever possible.

- Due diligence and understanding terms and conditions: Thoroughly review all terms and conditions before accepting any funding offer. Understand the implications of equity dilution or loan repayments.

Conclusion:

Securing sustainability funding for SMEs requires a strategic approach, exploring various funding opportunities tailored to your business's specific needs. Government grants and subsidies, private sector investment (including impact investing and ESG funds), green financing options, crowdfunding platforms, and incubator/accelerator programs provide a diverse range of avenues. A strong business plan, a clear articulation of your sustainability impact, and meticulous application preparation are crucial factors for success. Explore sustainability funding options, secure your sustainability funding today, and find the best sustainability funding for your SME to build a thriving and responsible business.

Featured Posts

-

Fecha Limite Cne Inscripcion Candidatos Fuera De Primarias

May 19, 2025

Fecha Limite Cne Inscripcion Candidatos Fuera De Primarias

May 19, 2025 -

Cuando Espana Estuvo A Punto De Ganar Eurovision Un Analisis De Sus Resultados

May 19, 2025

Cuando Espana Estuvo A Punto De Ganar Eurovision Un Analisis De Sus Resultados

May 19, 2025 -

Nyt Mini Crossword Solution March 16 2025

May 19, 2025

Nyt Mini Crossword Solution March 16 2025

May 19, 2025 -

Eurowizja 2025 Czy Polska Ma Szanse Na Zwyciestwo Prognozy Sztucznej Inteligencji

May 19, 2025

Eurowizja 2025 Czy Polska Ma Szanse Na Zwyciestwo Prognozy Sztucznej Inteligencji

May 19, 2025 -

Aspirantes A Diputados Del Movimiento Rescate Y Transformacion En Cortes Conoce A Los Candidatos

May 19, 2025

Aspirantes A Diputados Del Movimiento Rescate Y Transformacion En Cortes Conoce A Los Candidatos

May 19, 2025

Latest Posts

-

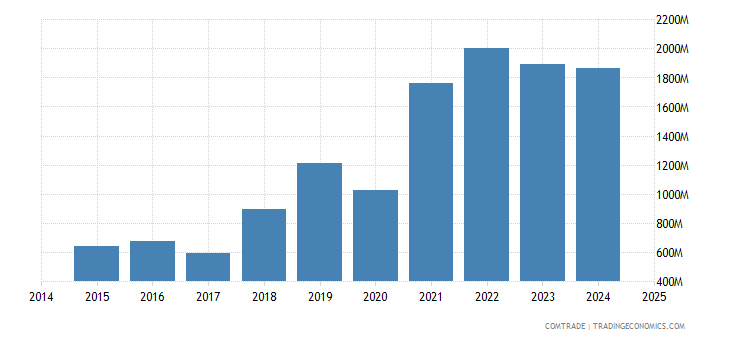

Recent Developments Indias Restrictions On Imports From Bangladesh

May 19, 2025

Recent Developments Indias Restrictions On Imports From Bangladesh

May 19, 2025 -

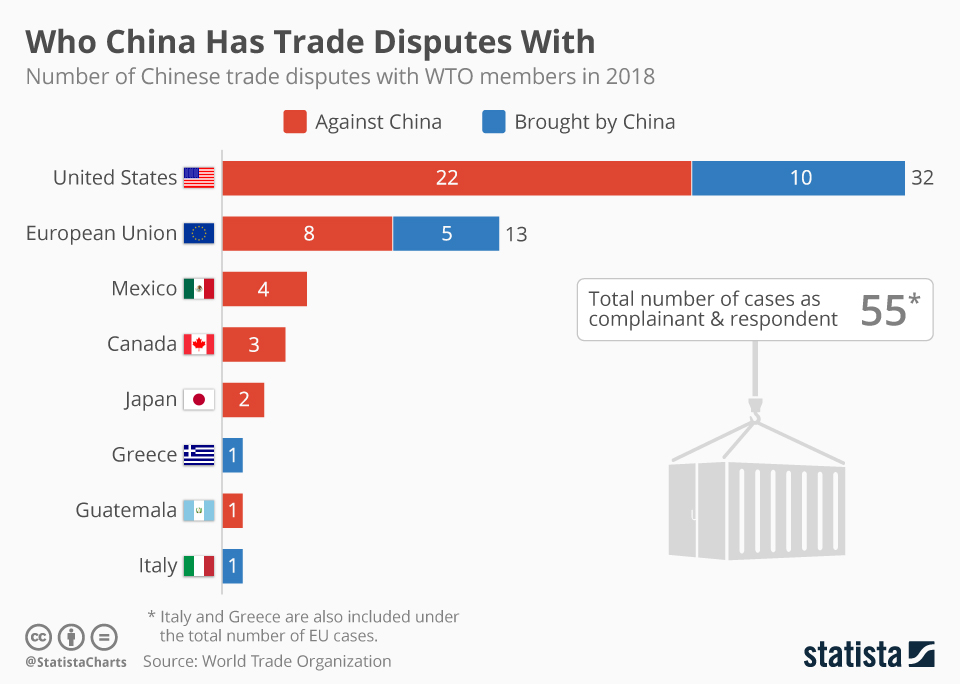

Bilateral Trade Disputes Indias Measures Affecting Bangladesh Imports

May 19, 2025

Bilateral Trade Disputes Indias Measures Affecting Bangladesh Imports

May 19, 2025 -

Rising Trade Barriers Indias New Restrictions On Bangladeshi Goods

May 19, 2025

Rising Trade Barriers Indias New Restrictions On Bangladeshi Goods

May 19, 2025 -

Indias Trade Policy Shift Impact On Imports From Bangladesh

May 19, 2025

Indias Trade Policy Shift Impact On Imports From Bangladesh

May 19, 2025 -

Strained Ties India Imposes New Import Limits On Bangladesh

May 19, 2025

Strained Ties India Imposes New Import Limits On Bangladesh

May 19, 2025