Sustainable Business Funding: Options For Small And Medium Enterprises

Table of Contents

Traditional Funding Sources with a Sustainable Twist

Many traditional funding sources are adapting to the growing demand for sustainable business funding. Banks, venture capitalists, and angel investors are increasingly recognizing the potential and profitability of environmentally and socially responsible businesses.

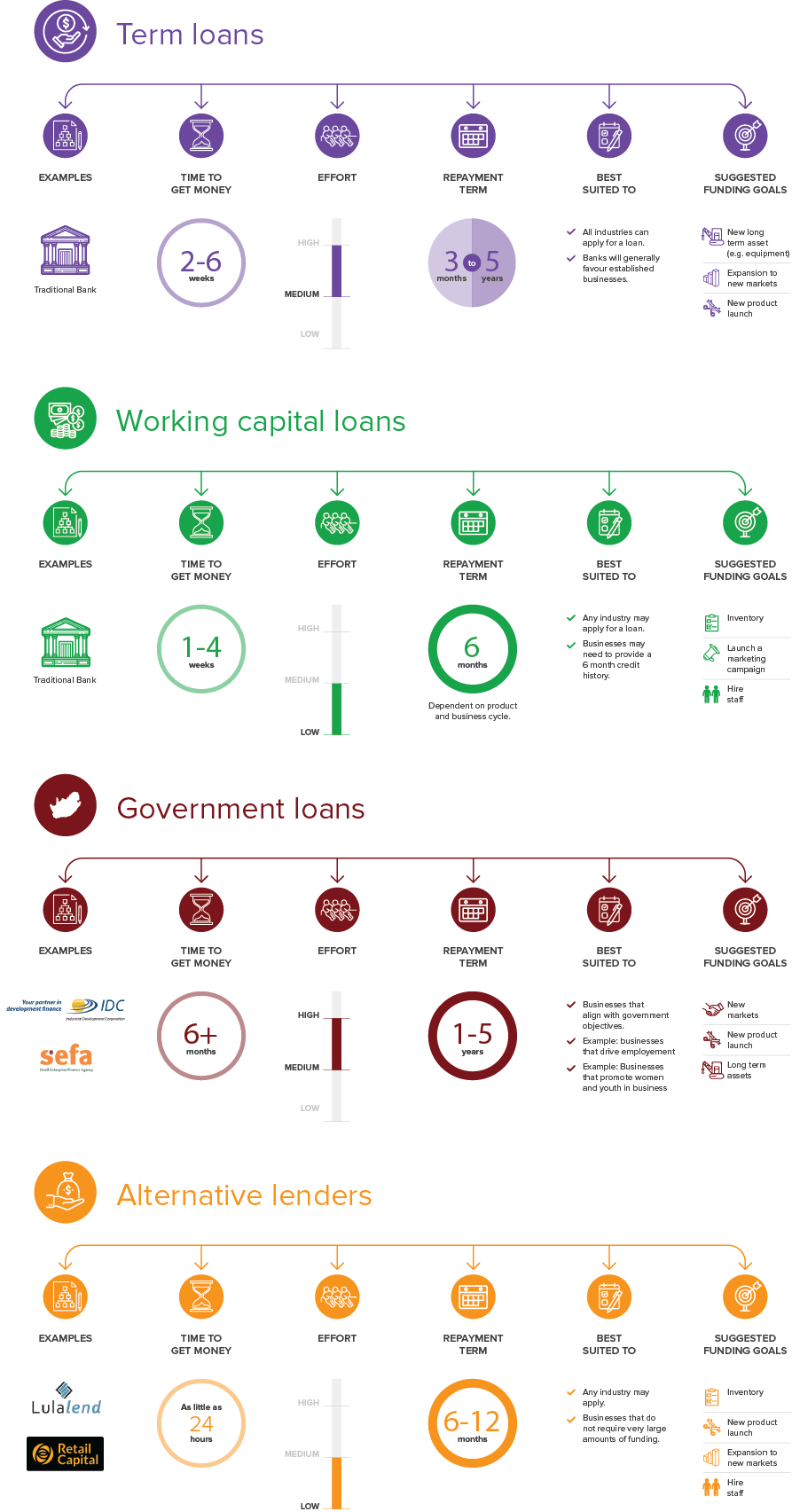

Bank Loans and Lines of Credit

Banks are now offering loans specifically tailored to support sustainable projects. These "green loans" often come with lower interest rates and favorable terms, incentivizing businesses to invest in environmentally friendly technologies and practices. However, securing these loans often requires stringent environmental impact assessments and adherence to specific green loan certifications.

- Lower interest rates for green initiatives: Many banks offer reduced interest rates on loans designated for sustainable projects, making them more financially attractive.

- Government-backed loan programs: Several governments offer loan guarantee programs specifically designed to support SMEs undertaking sustainable business ventures. These programs reduce the risk for lenders, making it easier for businesses to qualify for loans.

- Stringent environmental impact assessments required: Expect a thorough review of your project’s environmental impact before securing a green loan. Banks need to ensure the project aligns with their sustainability criteria.

Venture Capital and Angel Investors

The rise of impact investing has significantly impacted the venture capital and angel investor landscape. Many firms now actively seek out environmentally and socially responsible businesses, focusing on both financial returns and positive social and environmental impact.

- Focus on social and environmental ROI: Impact investors are interested in the overall return on investment (ROI), considering both financial gains and the positive social and environmental impact of your business.

- Higher due diligence on sustainability practices: Be prepared for a thorough review of your company’s sustainability practices and commitment to ESG (Environmental, Social, and Governance) criteria.

- Potential for higher valuations if aligned with ESG criteria: Businesses with strong ESG profiles are often viewed as more attractive investments, potentially leading to higher valuations.

Government Grants and Subsidies for Sustainable Businesses

Governments worldwide are increasingly offering financial support to businesses committed to sustainability. Accessing these grants and subsidies can provide crucial funding for green initiatives.

Identifying Relevant Grants

Finding and applying for suitable government grants requires proactive research. Explore government websites dedicated to business support, utilize online grant databases, and network with organizations specializing in sustainable business development.

- Researching government websites: Check your country's and local government websites for programs supporting sustainable businesses.

- Utilizing grant databases: Several online databases compile information on available grants, making it easier to find relevant opportunities.

- Understanding eligibility criteria: Carefully review the eligibility criteria for each grant to ensure your business qualifies.

- Preparing a strong grant proposal: A well-written and compelling proposal significantly increases your chances of securing funding.

Tax Credits and Incentives

Many governments offer various tax benefits and incentives to businesses that invest in sustainable practices. These incentives can significantly reduce your tax burden and boost your financial resources.

- Tax deductions for renewable energy investments: Investing in solar panels, wind turbines, or other renewable energy sources may qualify for tax deductions.

- Tax credits for energy efficiency upgrades: Improvements that enhance energy efficiency, such as installing energy-efficient lighting or insulation, may be eligible for tax credits.

- Exemptions for certain green technologies: Certain green technologies may be exempt from certain taxes or fees.

Crowdfunding and Community Investment

Crowdfunding platforms provide an alternative avenue for securing sustainable business funding. These platforms allow you to raise capital from a large number of individuals, often engaging your community directly in your business’s success.

Crowdfunding Platforms for Sustainability

Several platforms specialize in supporting sustainable projects. Choosing the right platform, crafting a compelling campaign narrative, and building a strong online community are crucial for a successful campaign.

- Choosing the right platform (Kickstarter, Indiegogo, etc.): Research platforms that align with your project's goals and target audience.

- Crafting a compelling campaign narrative: Tell your story effectively, highlighting your business's mission, sustainability initiatives, and the impact of the funding.

- Building a strong online community: Engage potential investors through social media and other channels to build excitement and support for your campaign.

Community-Based Investment Models

Community-based investment models offer a powerful way to connect with local investors and secure funding. These models foster strong relationships within your community.

- Community development financial institutions (CDFIs): CDFIs provide loans and other financial services to businesses in underserved communities, often prioritizing sustainable initiatives.

- Local investment groups: Many communities have investment groups that focus on supporting local businesses, especially those with a strong commitment to sustainability.

- Cooperative ownership models: Consider structuring your business as a cooperative, allowing community members to become owners and investors.

Innovative Funding Models for Sustainable Enterprises

Beyond traditional methods, innovative funding models are emerging specifically to support sustainable enterprises.

Green Bonds and Sustainability-Linked Loans

Green bonds and sustainability-linked loans offer businesses access to capital while demonstrating a commitment to environmental responsibility.

- Lower borrowing costs: Investors often offer lower interest rates on green bonds and sustainability-linked loans, reflecting the growing demand for sustainable investments.

- Improved brand reputation: Issuing green bonds or securing sustainability-linked loans can enhance your company's reputation and attract customers who value sustainability.

- Access to a wider investor base: These financial instruments can attract a broader range of investors interested in supporting sustainable businesses.

Revenue-Based Financing

Revenue-based financing is a particularly attractive option for early-stage sustainable businesses that may not be ready for traditional equity financing.

- Lower risk for lenders: Repayment is tied to your revenue, reducing the risk for lenders compared to traditional loans.

- Flexible repayment terms: Repayment terms are often more flexible, allowing for adjustments based on your business's performance.

- Avoids dilution of equity: Unlike equity financing, revenue-based financing doesn't require you to give up ownership in your company.

Conclusion

Securing sustainable business funding requires a multifaceted approach. From traditional bank loans and venture capital to innovative crowdfunding and government grants, a variety of options exist to support your green initiatives. Understanding the specific needs of your business and the characteristics of each funding source is key to selecting the most suitable approach. The growing importance of sustainability is transforming the financial landscape, creating exciting opportunities for businesses committed to a greener future. Start securing your sustainable business funding today! Research available grants and loans, and consider alternative funding options like revenue-based financing to fuel your green initiatives and access sustainable funding solutions for your green business finance.

Featured Posts

-

Nyt Mini Crossword February 27 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword February 27 2025 Solutions And Clues

May 19, 2025 -

Nos Alive 2025 Your Guide To Headliners Lineup And Tickets

May 19, 2025

Nos Alive 2025 Your Guide To Headliners Lineup And Tickets

May 19, 2025 -

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025 -

You Tuber Jyoti Malhotra Arrested In Haryana Espionage Charges Following Pakistan Trip

May 19, 2025

You Tuber Jyoti Malhotra Arrested In Haryana Espionage Charges Following Pakistan Trip

May 19, 2025 -

Jon Blir Bonde En Hyllest Til Jon Almaas Og Erling Haaland

May 19, 2025

Jon Blir Bonde En Hyllest Til Jon Almaas Og Erling Haaland

May 19, 2025